As freeports begin to open in the UK, Joseph Eloi explores the trade-related opportunities, including tax relief, tax exemptions and streamlined customs clearance, as well as the implications for businesses.

The UK government announced in March 2021 the location of eight freeports across England, with more to be announced in Scotland, Wales and Northern Ireland. Typically, freeports are designated areas around a seaport or airport that are free from certain taxes and obligations. While the latest freeport zones are a recent introduction in the UK, freeports have existed for centuries, with 3,500 freeports or special economic zones (SEZs) currently operating worldwide. Freeports also operated in the UK between 1984 and 2012.

Freeports are a type of SEZ that traditionally focus on encouraging imports and exports. Other SEZs often include additional incentives to encourage regeneration and drive economic growth. There is a clear levelling up focus in their introduction in the UK, given their locations, initial oversight by the newly named Department for Levelling Up, Housing and Communities, and the three stated [government] objectives of:

- establishing national hubs for global trade and investment;

- regeneration and levelling up; and

- creating hotbeds of innovation.

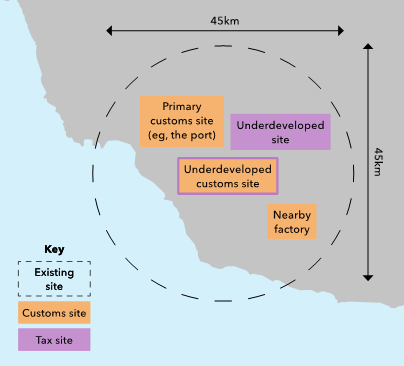

The new English freeports are defined as multi-site, digitally connected zones, linking ports with existing manufacturing sites and enterprise zones, all within a 45km boundary. The English model includes controlled customs sites where customs levers can be applied, and controlled tax sites where other tax levers can be applied. These tax and customs sites can overlap (see diagram below).

Trade benefits for a business operating from a freeport

The English model is more aligned with the broader definition of an SEZ, as it includes additional incentives such as enhanced relief for capital expenditure (both buildings and plant), business rate and stamp duty land tax exemptions, and national insurance relief. Much has been written on these incentives and the contribution freeports could make to levelling up, but duty-related opportunities are a key feature of the policy design, explored further below.

- Duty deferral is available for importers. Duty payments are deferred when goods enter a freeport customs site until they enter UK free circulation.

- Duty exemption occurs when products enter a freeport customs site and then are re-exported or remain in the freeport indefinitely. No duty payments are due, as the goods never enter free circulation in the UK.

- Duty flexibility helps manufacturers in freeport customs sites to choose an optimal duty rate for goods imported into the UK. For example, they can use so-called duty inversion when importing components with a higher duty rate than the final product. In this circumstance, an importer can choose to move the components into the freeport customs site duty free before manufacturing/assembling the components and importing them as part of a lower duty-rated final product (with a different tariff classification) within the freeport customs site. Even where finished products have a lower rate than the components, as the final product often has a higher customs valuation, the duty paid on the components may still be less. In practice, these benefits may be limited in the UK, as duty rates on component materials are rarely higher than the final product under the new UK Global Tariff. Duty inversion benefits are more common in higher-duty regimes such as the US.

Businesses must carefully assess how these duty-related benefits apply to their specific activities. Freeports were initially proposed prior to the UK agreeing a trade agreement with the EU; the benefits would have been greater under a no-deal Brexit, as this would have resulted in tariffs on UK- and EU-originating goods.

Free trade agreements (FTAs) reduce duty benefits by reducing the scope for duty to be charged in the first place, but they can go further and exclude duty benefits altogether. Some recent UK FTAs, including those with Canada, Norway and Singapore, include provisions prohibiting UK exporters from utilising agreed preferential rates where imported duties were not paid or refunded to business (duty drawback). In effect, businesses will have to choose between benefiting from freeport special procedures and availing themselves of preferential rate benefits agreed under some UK FTAs.

Even where trading with countries without preferential rates agreed under an FTA, average global tariffs have been falling since the mid-1990s, reducing the potential duty benefits. But despite the apparent reduction in trade volatility over the past 20 years, protectionist measures have increased in recent years, with trade disputes between various countries and trading blocs, and trade restrictions imposed in response to the pandemic.

Freeports present an opportunity for businesses to safeguard against recent and future trade volatility. Protecting against these risks should be considered along with other commercial considerations when deciding whether to operate within a freeport.

There are also trade-related benefits beyond duty benefits.

- Streamlined customs formalities are available for businesses moving goods into a freeport. A reduced amount of data will be required on form C21 requesting customs clearance for goods, and a further declaration will be made in the business’s records – although a business will still need to provide evidence to freeport operators that adequate information can be kept and security can be maintained. These record-keeping and security requirements can be expensive and challenging to meet. Businesses looking to operate from a freeport should consider undertaking a feasibility assessment to assess the duty benefits against the cost of meeting freeport obligations.

- Import VAT relief and zero-rating are available on goods moved into a freeport and goods and services supplied within a freeport. VAT is mentioned just once in the 50-page Freeport Bidding Prospectus, suggesting that VAT was not a significant policy lever when designing the freeport regime. Despite this, the ability to zero-rate supplies represents a cash-flow benefit for businesses operating within freeports.

Supplies of goods can be zero-rated provided:

- the goods are declared to the freeport customs procedure;

- they are sold from one authorised freeport business to another; and

- both businesses are VAT registered (or exempt from registration).

Services can be zero-rated provided they:

- are related to goods declared to the freeport customs procedure;

- would otherwise be taxable; and

- are performed by an authorised freeport business.

The Making Tax Digital (MTD) VAT rules state that transactions should be recorded digitally and an electronic audit trail must exist from source through to submission. Freeport businesses making zero-rated transactions may require a new tax code for supplies of goods within a freeport and zero-rated services. Invoices must also contain the word ‘freezone’.

Both these changes may require amendments to IT systems. Any business seeking to operate in a freeport may consider the extent of any reconfiguration of IT systems required to ensure systems are compliant with the invoicing and MTD rules. These administrative challenges should not be an issue where businesses exclusively make zero-rated supplies, as these businesses could request exemption from registration altogether.

Comparison with existing reliefs

Many trade and indirect tax benefits can already be achieved under existing UK regimes. For example, customs warehouses enable an importer to postpone duty and import VAT, and inward processing relief (IPR) allows duty relief on goods imported for processing that are subsequently exported or imported to the UK at the duty rate of the final product. There are key differences between existing procedures and freeports.

- A single authorisation is required for freeports, with existing reliefs requiring different applications for different measures.

- Combined benefits are also available under the freeports’ regime. For example, goods can be processed and kept in a freeport indefinitely, where there is typically a time limit on goods under IPR. Another person is also responsible for operating a freeport, while IPR should be operated by the person receiving the relief.

- Clustering benefits are also available within freeports. For example, the location and shape of freeport customs sites can be more flexible than customs warehouses, and businesses can benefit from economies of agglomeration (costs savings associated with businesses being located nearby), while customs warehouses are often restricted in size. From a customs perspective, particular clustering benefits can be seen as duty suspension is available across multiple instances of processing in a customs site, unlike under inward processing, where authorisations are needed for each instance of processing. Meanwhile, the VAT cash-flow benefits are more apparent under a freeport special customs procedure than in a customs warehouse, as transactions are more likely to occur under a freeport special customs procedure as only simple processing is available in a customs warehouse.

The clustering benefits become more obvious where a greater proportion of the supply chain is located in a freeport – something likely to be the case if a freeport is focused on particular industries. The VAT-clustering benefits would be further strengthened were the UK to follow the lead of some countries in the Gulf and introduce zero-rate corridors between different freeports.

With digital technology being used to link sites within freeports, the same technology could be used to monitor zero-rate corridors between freeports. This may be considered for Scottish, Welsh and Northern Irish freeports, too.

Next steps for businesses considering operating from a freeport

Although some of the potential trade risks envisaged when freeports were announced have been addressed more generally through the post-Brexit FTAs that the UK has agreed, there are still trade opportunities for businesses operating in a freeport.

Understanding the benefits

Businesses considering setting up in a freeport should explore the options. Each freeport offers slightly different incentives and industry focuses in line with local economic development plans and levelling-up objectives. Businesses may wish to seek advice and engage with freeport governing bodies and local authorities. A detailed feasibility assessment could be considered to assess both the trade and non-trade related benefits available and the costs of meeting the obligations and locating within the freeport.

Where a business concludes operating in a freeport would be preferable

Businesses should engage with the freeport to explore the strategic alignment between the business and the economic development plans that form the basis of the underlying business case for the specific freeport zone. To begin operating within a freeport, a business should then enter into an agreement with the site operator, apply online to operate within it, and, if accepted, physically relocate there (if not there already).

About the author

Joseph Eloi, Tax Policy and Trade Strategy, EY