April 2022 sees a new tax regime for ‘qualifying asset holding companies’ (QAHCs). Richard Jones, Business Tax Manager, Tax Faculty, explains what QAHCs are and how they are taxed differently to other UK companies.

The QAHC regime forms part of a wider review of the UK funds regime in a bid to enhance the UK’s competitiveness as a location for asset management and investment funds.

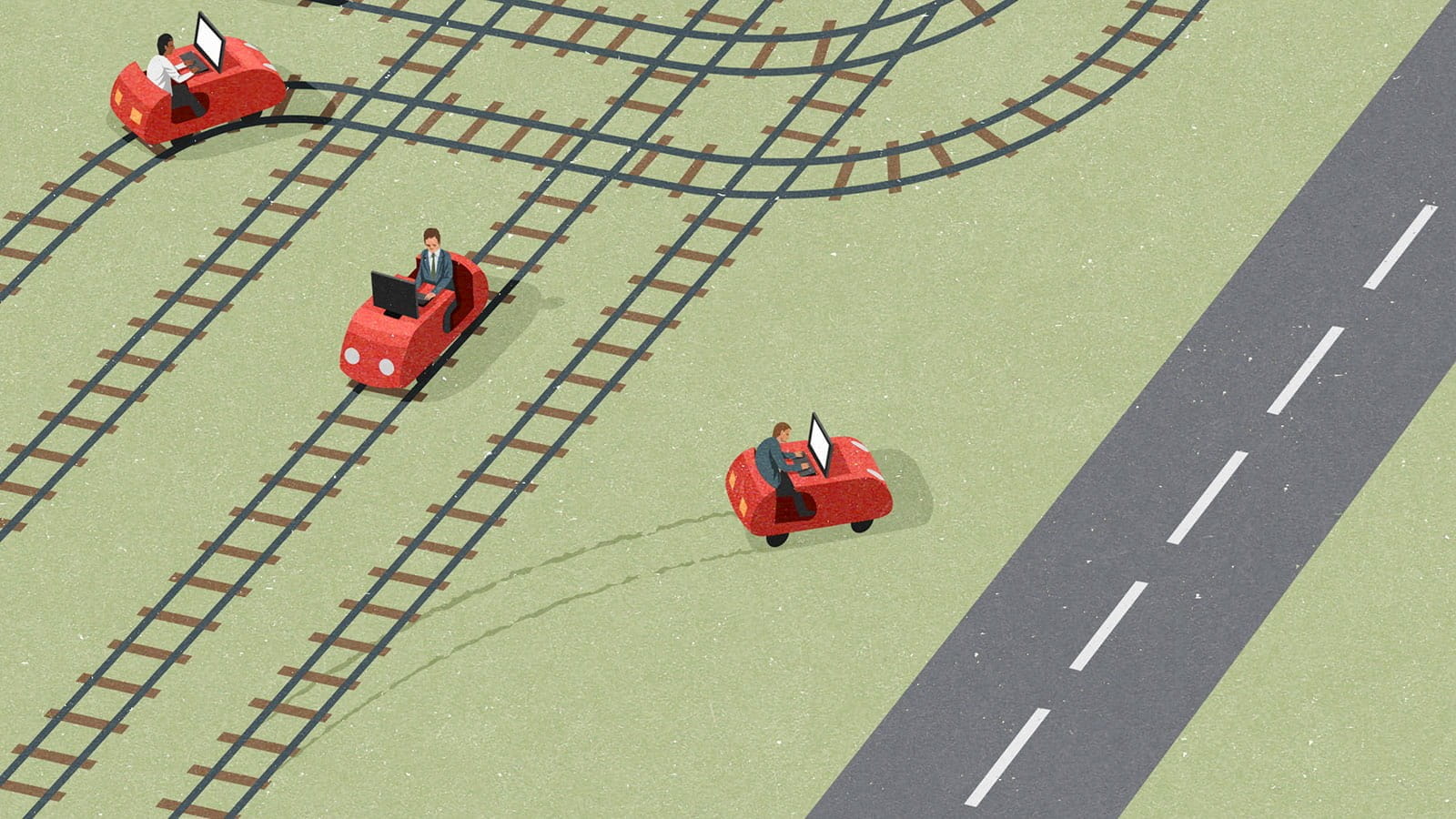

The intention behind the new regime is:

- to identify circumstances where intermediate holding companies are being used to facilitate the flow of capital, income and gains between investors and underlying investments;

- to ensure that investors in those companies are taxed broadly as if they had invested in the underlying assets rather than through the company; and

- that such companies are taxed in way that is proportionate to the activities they perform.

The rationale is that, due to the standard corporation tax rules, the UK could be seen as a less attractive place in which to base investment holding companies than other territories. One example is Luxembourg, perceived to be attractive due to the participation exemption and other aspects of its corporate tax regime.

As a result of the changes introduced in the Finance Bill, from 1 April 2022 various forms of income and gains of the company will be exempt from corporation tax and there will be amended rules relating to distributions and other types of payments made by QAHCs.

The introduction of the regime follows a two-stage consultation process and is introduced alongside targeted changes to the tax regime for real estate investment trusts (REITs).

What is a QAHC?

For a company to qualify as a QAHC, it must be no more than 30% owned by non-‘category A’ investors. Ownership is determined using rules that are closely modelled on those used in the context of group relief (in Ch 5, Corporation Tax Act 2010 (CTA 2010)), but with some differences and complications.

One of the key differences is that when applying the various tests (voting rights, entitlement to profits and to assets on a winding up) each relevant investor is treated as holding the highest percentage derived by any of those tests. Percentage ownership of nominal share capital is not a relevant test for these purposes.

Category A investors are as follows:

- other QAHCs;

- qualifying funds;

- relevant qualifying investors;

- intermediate companies; and

- various public bodies.

A qualifying fund is broadly one in which there is diversity of ownership. There are various routes through which this test can be met, such as by being a non-close fund or a collective investment scheme that meets the genuine diversity of ownership rules in the Offshore Funds (Tax) Regulations 2009, SI 2009/3001 (with some modifications).

- Relevant qualifying investors include:

- those operating in the long-term insurance business market;

- UK REITs and companies subject to equivalent overseas tax rules;

- collective investment vehicles;

- pension schemes; and

- certain charities.

As well as meeting the ownership condition, the company must not have any trading activity other than a non-substantial amount that must also be ancillary to its investment business. The company’s investment strategy must, broadly speaking, also not involve the acquisition of listed or traded securities or other interests deriving their value from such securities.

There are detailed rules in the legislation setting out the procedures companies will apply in order to enter into and exit from the QAHC regime.

How will QAHCs be taxed differently from other companies?

The main tax implications of a company being classified as a QAHC are set out below. There are also minor modifications to the corporation tax rules for such companies, such as switching off the late paid interest and deeply discounted securities rules in relation to debits arising on debtor relationships entered into by the QAHC for the purpose of its ring-fenced business.

Capital gains

QAHC’s gains are exempt from corporation tax on the disposal of overseas land and shares in UK or non-UK companies that do not derive at least 75% of their value from UK land. There is no maximum or minimum level of shareholding the QAHC needs to have in such companies.

Overseas property income

Income arising from an overseas property business (within the meaning of Ch 3, Pt 4, Corporation Tax Act 2009 (CTA 2009)) is tax exempt if it is subject to a tax equivalent to UK corporation tax or income tax in an overseas jurisdiction and is not exempt or subject to a nil rate in that jurisdiction.

In addition, any profits arising from loan relationships or derivative contracts entered into for the purposes of such a business are not taxable.

There are no special rules for the taxation of dividends received by QAHCs, but they can take advantage of the exemption regime in Pt 9A, CTA 2009.

Treatment of certain payments made by QAHCs

Certain payments to shareholders that the QAHC is party to for the purpose of its ‘ring-fenced’ business (broadly, that on which it is exempt from tax) are not to be treated as distributions and therefore are not subject to dividend tax rates.

Those payments are amounts normally treated as distributions under condition B, C or D of s1015, CTA 2020 or as non-commercial securities under s1005, CTA 2010. Furthermore, these payments are tax-deductible for the QAHC, even where another jurisdiction treats the receipt of those payments as dividends.

In most cases, any premium paid by a QAHC when it buys back its own shares will be treated as a repayment of capital rather than an income distribution in the hands of a UK investor. There are exceptions such as where the shares constitute ‘qualifying employment-related securities’ or the investor is a non-category A investor acquiring shares that bring the total relevant interests held by such investors above the 30% threshold.

Repurchases of shares and loan capital by a QAHC will also be exempt from all stamp duties where the repurchase does not form part of a ‘disqualifying arrangement’ or take place at a time when there is an arrangement for the disposal of at least 90% of relevant interests in the QAHC. This broadly prevents the exemption from being used to avoid the stamp duty that would have been payable had the repurchased shares been transferred to another party.

Interest income, distributions and gains realised on the disposal of shares in a QAHC by non-UK domiciled individuals will be treated as relevant foreign income or gains. This is to the extent that these amounts are made out of foreign income or gains of the QAHC (determined on a just and reasonable basis). The individual must also have provided investment management services in connection with the QAHC’s investment arrangements (for income) or in relation to disposal arrangements (for gains).

Income tax will not need to be withheld at source on payments of yearly interest under s874, Income Tax Act 2007 by a QAHC, however the interest arises. This means, in particular, that shareholders in a QAHC will be able to receive gross interest payments from the company.

Conclusion

By reducing the level of tax leakage that can occur, commentators agree that these changes should make a positive impact on the attractiveness of the UK as a location for intermediate holding companies for institutional investors.

About the author

Richard Jones, Business Tax Manager, Tax Faculty