On 18 July 2019, the Office for Budget Responsibility (OBR) published its second fiscal risks report. The fiscal risks report provides an analysis of the economic and policy risks facing the public finances, including a ‘fiscal stress test’, setting out how the fiscal numbers might react to a no-deal Brexit.

The report covers risks to the economy, the financial sector, revenue, spending, the balance sheet and debt interest, as well as policy risks and the potential implications of climate change for the public finances.

Martin Wheatcroft FCA, advisor to ICAEW on public finances, said:

“The OBR highlights the continuing vulnerability of the UK public finances to economic headwinds and policy risks. Both revenue and spending are under increasing pressure as the population grows older and productivity stubbornly refuses to improve.

“The report stresses the short-term risks to the public finances arising from Brexit or a potential global recession, with the ‘mild’ no-deal scenario presented by the OBR suggesting a significant hit to the public finances in the order of £30bn a year, before considering potential policy responses that could cost even more.

“Perhaps more concerning is the OBR’s observation that austerity fatigue is leading to a fiscal loosening and less ambitious objectives for the management of the public finances. With the public finances already on an unsustainable path in the longer-term, the temptation to defer necessary decisions even further into the future appears to be proving too difficult to resist.”

According to the OBR, there is a similar risk profile to two years ago

- Most risks remain from first fiscal risks report

- The UK Government has improved monitoring, management and reporting of fiscal risks

- The fiscal deficit has reduced and the debt to GDP ratio has started to fall

But, policy risks are increasing

- Balanced budget objective appears to have been abandoned

- Unfunded commitment to increase NHS spending by £27bn a year

- Conservative leadership candidates uncosted proposals for tax cuts and spending increases

- All signs are for a fiscal loosening and less ambitious objectives for the management of the public finances

- There is no war chest

Economic headwinds and a potential recession

- Fiscal stress based on ‘mild’ no-deal Brexit would trigger a recession

- Borrowing up by £30bn a year from 2020-21

- Public sector net debt 12 per cent higher in 2023-24

- Additional to the Brexit impact already in forecasts

- Assumes no policy response such as tax cuts or more spending, which would involve more borrowing

- A more disruptive Brexit would hit public finances harder

- Recessions occur roughly every decade

- Policy responses can mitigate, but government accepts the need to reduce debt to provide capacity to absorb shocks

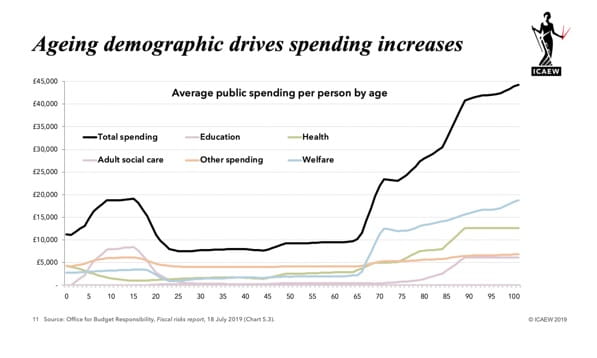

Public finances remain unsustainable in long-term

- Upward pressures on public spending

- Ageing population and other cost pressures on health and social care budgets

- Pensions triple-lock unaffordable in long-term term

- Climate change risks could be severe

The OBR concludes:

- Many potential shocks and risks taken on by choice are much as they were two years ago

- But ‘no deal’ Brexit risks more prominent

- ‘Austerity fatigue’ risk partly crystallised

- But still apparent in leadership shopping lists and open discussion of looser fiscal objective

ICAEW perspective:

- The strength of the fiscal risks report is that it is produced by the OBR, a body independent of government

- Some minor fiscal risks have been addressed, but Brexit and policy risks have increased

- Important decisions on issues such as social care have been deferred; these will be more costly if not dealt with

- The UK needs a long-term fiscal strategy to address the serious financial challenges facing the public finances

Better Government Series

Our Better Government Series is a series of thought leadership, policy insights, toolkits and best practice special reports on topical public sector financial management issues.