This accounting apprenticeship will help you to develop knowledge, skills and behaviours needed within an entry-level role in accountancy and will enable you to qualify as a Level 4 Accounting Technician. You will develop your knowledge, skills and behaviours, required by the apprenticeship standard, through a combination of off-the-job training and practical experience in the workplace. Your apprenticeship will involve completing the six ICAEW CFAB exams with additional apprenticeship-specific requirements over 18-24 months. Here is all the information you need.

If you are studying the Level 4 apprenticeship through the ACA, view the student guide.

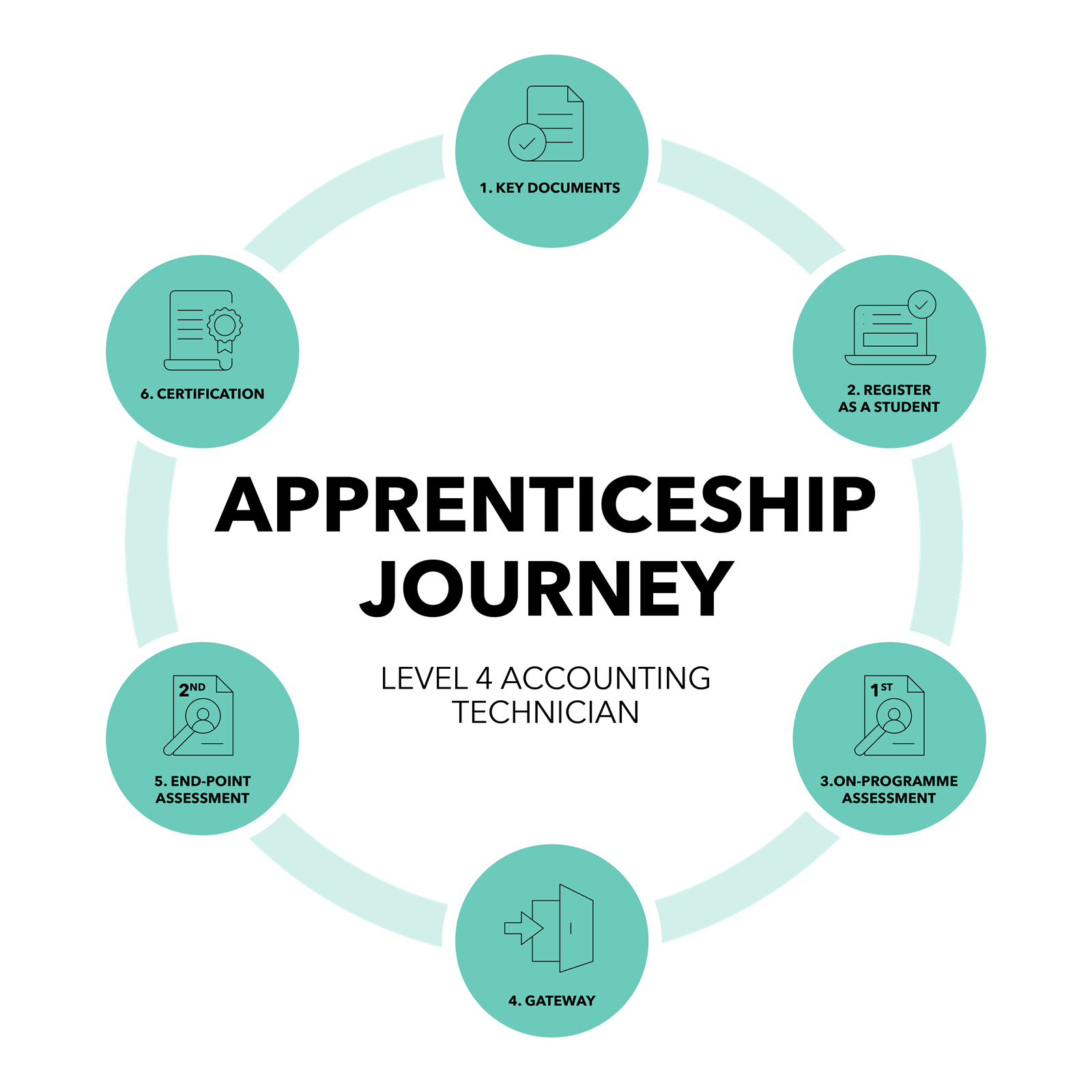

Your journey

The Level 4 Accounting Technician Apprenticeship involves progressing through and completing six stages.

1. Key documents

You will be given the following documents:

- employment contract; and

- commitment statement and apprenticeship agreement.

Once you, your employer and training provider have signed the commitment statement and apprenticeship agreement, your training provider will register you as an apprentice with the education and skills funding agency (ESFA).

| SUPPORT FROM YOUR EMPLOYER | SUPPORT FROM YOUR TRAINING PROVIDER | SUPPORT FROM US |

|---|---|---|

| Your employer will provide financial support and cover the costs for your training throughout your apprenticeship. Studying for the apprenticeship means your employer will support you professionally, helping you to develop the skills needed to become an Accounting Technician. | Your training provider will support and guide you in developing the knowledge, skills and behaviours necessary for achieving the Level 4 Accounting Technician Apprenticeship. They should be your first port of call for any apprenticeship-specific queries. | We provide a variety of resources as you progress through your apprenticeship journey, including exam resources, student benefits, how to guides, webinars and more. Our dedicated student support team is also on hand to help you with your ICAEW CFAB-specific enquiries, call +44 (0)1908 248 250 or email student support. |

2. Register as a student

It’s really important that you register with us as a student and correctly select the type of student you’re registering as. This means we can provide you with the relevant information that you’ll need during your apprenticeship and ensures that you are awarded your apprenticeship certificate.

To register as a student, go to the student registration page, log in and select your qualification and student category, before adding your details within the registration process. You will first select ‘ICAEW CFAB, or ICAEW CFAB apprenticeship’. Click on ‘View qualifications’ and then select ‘Level 4 apprenticeship’. If you select ICAEW CFAB standard by mistake, don’t worry, just log back into icaew.com/studentregistration and re-register. Select ‘Level 4 apprenticeship’ and follow the instructions on screen.

Please note it is a government requirement that before you attempt your end-point assessment, you will be asked to demonstrate that you have achieved Level 2 or above GCSE Maths and English (or equivalent). You may need to take an additional Functional Skills assessment, if you have not met this requirement. Your tuition provider will arrange this for you.

Apprenticeship-specific information

Remember to have your 10-digit unique learner number (ULN) to hand before you register. Your training provider will give you this number. This is apprenticeship-specific and you will be asked to provide these details during the registration process. You may also locate your ULN on certificates issued by other exam or qualification-awarding bodies. If your employer has an employer reference number (ERN) you can also enter it here but this is optional, this is different to your employer’s ICAEW authorised training employer number. If you don’t provide these numbers when you register, that’s okay, just remember to tell us before applying for your end-point assessment. You will be able to do this via the apprenticeship portal within your ICAEW online training file.

3. On-programme assessment

During the on-programme assessment, you will need to study for the six ICAEW CFAB exams. You will also have quarterly progress review meetings with your employer or training provider to discuss your skills development progress, any further training you need and whether you’re ready to move on to the end-point assessment. They will confirm when these meetings are to take place. The duration of the on-programme assessment stage of the apprenticeship is flexible and depends on your progress.

Throughout this time, you will also develop knowledge, skills and behaviours, important for any finance or business role, undertake off-the-job training and update your ICAEW online training file to record your professional development skills progress.

Your employer will confirm when you’re ready to move on to the end-point assessment; this is known as the gateway review.

When you apply for the end-point assessment, you will need to enter your unique learner number (ULN), if you have not entered it into your training file. We recommend entering your ULN via your training file. If your employer has an employer reference number (ERN) you can also enter this.

The ULN can be obtained from your tuition provider.

4. End-point assessment

If you started after 9 June 2025, you will be on the V1.2 end-point assessment, more information about this will be available soon.

The end-point assessment consists of two parts:

Portfolio and reflective statement

The portfolio and reflective statement demonstrates your competence in the knowledge, skills and behaviours required to be an ICAEW Accounting Technician. It is an opportunity for you to show how you have developed competence throughout your apprenticeship and to think about anything you would have done differently, as well as what you have learned through the process.

Role simulation exam

This is a 2.5 hour long, invigilated exam which will test the knowledge, skills and behaviours you have developed during your apprenticeship. This exam can be sat via remote invigilation and we have a limited number of exam centre spaces available.

If you sit this exam via remote invigilation please ensure your device meetings the technical specifications and read all the relevant information.

5. Certification

Once you have successfully completed both elements of the end-point assessment, we will notify ESFA. You will then receive your apprenticeship certificate from the Institute for Apprenticeships (IfA).

At the end of your apprenticeship

Your apprenticeship will provide a variety of options open to you to progress your career. In addition to achieving the Level 4 Accounting Technician Apprenticeship, you have also achieved the ICAEW CFAB qualification which is internationally recognised and respected by employers around the world. The skills that you have developed will not only boost your CV, they will help you to progress further in your career and demonstrate that you have the knowledge, understanding and ambition to succeed.

Gain professional recognition

As an ICAEW Accounting Technician, you can take yourself further by becoming an ICAEW Business and Finance Professional (BFP). By becoming a BFP you will gain recognition from ICAEW, a world-leading professional membership organisation, and have the right to use the BFP designatory letters. You will also have access to professional development resources and continued support from us, such as our invaluable helplines.

Continue your journey onto becoming an ICAEW Chartered Accountant

By achieving the Level 4 Accounting Technician Apprenticeship, you have already taken your first steps to qualifying as an ICAEW Chartered Accountant. Achieving ICAEW CFAB as a qualification as part of your apprenticeship, means you have also passed the six Certificate Level exams of the ACA. Once you have completed your Level 4 apprenticeship, you can register as an ACA student, either as a standard ACA student or as a Level 7 Accountancy Professional Apprenticeship student. Your employer or training provider can guide you on this.

Student support

Our dedicated student support team is on hand to help and advise you throughout your training.