Q4: Sentiment falls into deep negative territory amid growing tax and regulatory concerns.

The latest national Business Confidence Monitor (BCM) shows that business sentiment slipped deeper into negative territory amid uncertainty about the Budget and rising concern about both the tax burden and regulations. However, companies are optimistic that domestic sales and exports growth will improve over the next 12 months.

The survey results are based on 1,000 telephone interviews among ICAEW Chartered Accountants covering a range of UK sectors, regions and company sizes, ensuring a representative picture of the UK economy. The latest quarterly findings are based on the period 8 October to 11 December 2025.

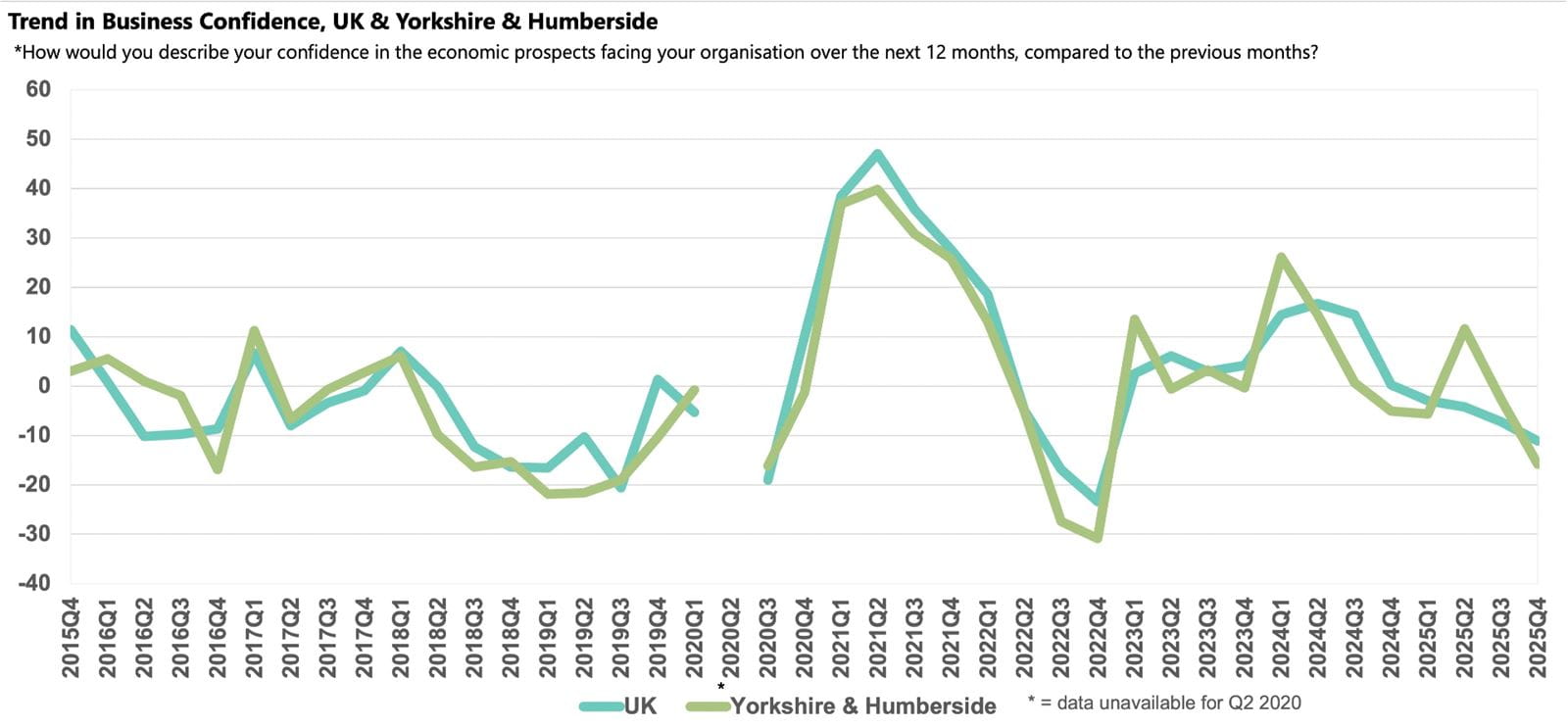

- Business confidence in Yorkshire & Humberside declined further in Q4 2025, dropping deeper into negative territory, to -15.8.

- The tax burden remained the main rising challenge for companies in the region while regulations also reached its highest rate since Q2 2018.

- Both domestic sales and exports growth underperformed the national average in the year to Q4 2025, a trend expected to continue over the coming year.

- A rise in annual input cost inflation and weak sales underpinned sluggish profits growth in the quarter. Businesses anticipate an uplift in profits growth, but the outlook is among the weakest in the UK.

- Businesses reduced their staff count and further declines are expected over the next 12 months.

- Capital investment and R&D budget growth both deteriorated and the outlook for the year ahead is weak, with businesses planning to cut R&D budgets.

Business confidence in Yorkshire & Humberside

Business sentiment in Yorkshire fell deeper into negative territory in Q4 2025 as concerns over the tax burden and regulation continue to intensify alongside below-par sales and profits growth. The Business Confidence Index for the region fell to -15.8 from -2.8 in the previous quarter. This was the region’s lowest score since Q4 2022, significantly down on its historical average (+4.7) and showing that businesses in the region are more downbeat than the national average (-11.1).

Domestic sales and exports growth

Annual domestic sales growth picked up marginally in Q4 2025, reaching 2.1% over the year, however they underperformed compared to the region’s historical average and the rise observed across the UK (both 2.9%). This subdued sales growth is likely linked to the weak expansion trend recorded in the locally important Manufacturing & Engineering sector over the past 12 months. While businesses in Yorkshire & Humberside anticipate a further uplift in domestic sales growth in the year ahead, the projected increase of 3.6% is lower than the 4.2% rise expected nationally.

Following successive uplifts in the previous two quarters, businesses in Yorkshire & Humberside reported that annual exports growth eased to 1.2% in Q4 2025, less than half the national average (2.5%). Only Scotland (0.0%) and the North East (-0.1%) recorded weaker rates. However, following the disruption caused by US tariffs in the early part of the year, the uncertainty in the global trading environment is gradually dissipating and businesses in Yorkshire & Humberside have strengthened their exports outlook for the year ahead, anticipating a rise of 2.3% over the coming year. Despite this uptick, the projected growth is lower than the region’s historical norm (2.6%) and just over half the UK forecast rate (4.1%).

Labour market

Due to the comparatively large dependence on typically lower-paid roles, Yorkshire & Humberside’s labour market was particularly exposed to the impacts of April’s rise in National Insurance Contributions and the National Living Wage. Businesses in the region reduced their employment levels by 0.9% in the 12 months to Q4 2025, the weakest outturn of any UK region and the first annual decline recorded since Q2 2021. Unlike most regions, companies expect further job losses over the coming year, projecting a marginal decline of 0.2%, below both the region’s historical norm (1.0%) and the national average projection (1.3%).

Despite a reduction in staffing levels in the region, concerns over the availability of skills ticked up. However, while the availability of management and non-management skills were more prevalent among Yorkshire and Humberside businesses compared to the national average and above their respective historical averages, they are far from the peak rates observed in late 2022 and could be evidence of long-term vacancies that businesses are struggling to fill.

Despite the drop in employment, annual wage inflation edged up in the year to Q4 2025 to 2.9%, matching the UK average. Companies in the region anticipate a similar increase of 2.8% over the next 12 months, still markedly above the region’s historical average (2.2%) and equaling the national projection.

Input and selling prices, and profits growth

Annual input price inflation ticked up slightly to 3.5% in Q4 2025 but was the softest rise of any UK region, below the UK average (4.1%). Over the next year, businesses in the region anticipate input cost inflation will ease to 3.2% but remain above the region’s historical norm (2.7%) and marginally exceed the 3.0% rise anticipated nationally.

Companies in Yorkshire & Humberside raised their selling prices by 2.9% in the year to Q4 2025, up significantly from the previous quarter. This increase was nearly double the region’s historical norm (1.5%) and was sharper than reported in any other UK region. The planned increase of 2.6% for the coming year is among the largest increases in the UK, surpassing the UK average projection of 2.2%.

Subdued domestic sales and exports growth alongside elevated input cost inflation resulted in Yorkshire & Humberside recording the lowest annual profits growth of any UK region in the year to Q4 2025. Reported growth of 0.7% was an improvement on the previous quarter but nearly four-times below the national average increase of 2.7%. Companies are optimistic that as input cost inflation dissipates and sales growth improves, profits growth will accelerate to 3.5% next year, above the historical average (2.8%) but lower than the national projection of 4.3%.

Business challenges

Elevated pre-Budget uncertainty likely compounded businesses’ tax concerns following April’s rise in National Insurance Contributions. As a result, the share of companies reporting the tax burden as a growing challenge increased for the third consecutive quarter in Q4 2025, reaching a new survey record high at 69%. This proportion was nearly four times the region’s historical norm (18%) and was a more widespread growing challenge in Yorkshire & Humberside compared to the UK average (64%). Meanwhile, regulatory requirements also spiked, with 54% of businesses citing the issue as a rising challenge, a seven year high and again a more prominent concern for businesses in the region compared to the UK (51%).

Mediocre sales growth over the past year is reflected in the proportion of companies citing competition in the marketplace and customer demand (both 47%) as growing challenges. Both issues were significantly more prevalent compared to both their respective historical norms and exceeded UK averages, with reports for competition in the marketplace at their highest level since Q1 2015. In addition, the issue of late payments was reported by 27% of businesses, the joint highest proportion of UK regions alongside the East of England.

Investment

Capital expenditure growth in Yorkshire & Humberside edged down in Q4 2025, with an increase of just 0.8% year-on-year. This increase was less than half the historical average (2.0%) and among the lowest expansions recorded in the UK. Companies in Yorkshire & Humberside expect a modest uplift in the coming year, with growth set to rise to 1.2%, though this is still below the UK average projection of 1.6%.

Businesses in the region also reported a slowdown in the growth of R&D budgets, with a rise of just 0.5% in the year to Q4 2025, more than three times lower than both the region’s historical (1.7%) and national averages (1.6%). The outlook for the year ahead is also fragile, with companies in the region planning to cut their R&D budgets by 0.6% over the next 12 months, the weakest expected outturn of any UK region.