Effective finance business partners have been around for over 50 years. The involvement of finance professionals in business decision making, strategy development and driving performance is nothing new. However, we are still asked for guidance on how finance can make a greater contribution to organisational performance.

Our report, Finance business partnering: a guide provides practical advice for those considering business partnering initiatives and those looking to improve their approach. Here we provide a brief summary of some of the ideas covered – even shorter than the executive summary.

Understanding the business is a fundamental pre-requisite for effective business partnering. Such understanding is gained through ongoing conversations, observation, research and action – action is required to gain feedback and test understanding.

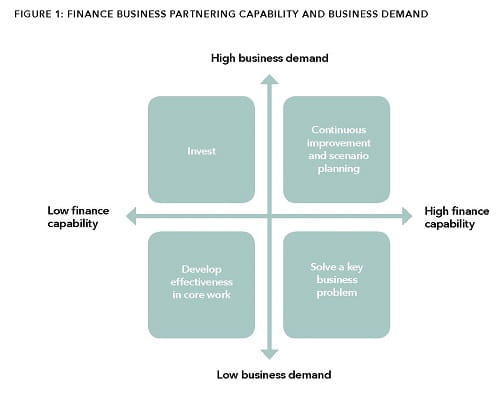

Based on sound business understanding, an objective assessment of finance’s capabilities and the level of demand for business partnering services, a high-level strategy for developing the finance department can be developed, (see Figure 1).

While it may be obvious, it needs to be emphasised that finance’s capability depends on people, organisational structures, systems and processes. The report discusses how key business partnering knowledge, skills and attitudes can be developed, including commerciality and communication skills. We argue that decentralised approaches to finance business partnering better enable business support but increase the risks of finance losing its objectivity. We also argue that finance needs to be actively involved in system and process developments across the organisation.

Finance business partnering is not necessarily right for all organisations and demand for such services is not a given. The best way of generating demand is for finance to solve an important business issue but we also discuss some other helpful approaches.

Concerns that finance business partners may get too close to the business remain and need to be guarded against. Personal integrity, senior management support, culture, enforced value statements, whistleblowing and effective controls all have a part to play.

Successful business partners will need both perseverance and adaptability to build and maintain their influence. Perseverance to cope with inherent tensions in the role and to overcome inevitable setbacks. And adaptability to deal with increasing demands for organisational sustainability, new approaches to outsourcing and developments in big data and analytics.

Our report is based on discussions with members and experts, reviewing practitioner and academic research and our own experience. As well as advice and food for thought it also includes a number of case studies. We hope you find it useful. If you would like to comment on this report or discuss the content further, please email business@icaew.com.

Can't find what you're looking for?

The ICAEW Library can give you the right information from trustworthy, professional sources that aren't freely available online. Contact us for expert help with your enquiries and research.