Technical helpsheet issued to help ICAEW members understand the International Standards on Auditing (UK) (ISAs (UK)) requirements in relation to going concern and the impact the various different situations have on the auditor’s report.

Introduction

This helpsheet has been issued by ICAEW’s Technical Advisory Service to help ICAEW members understand the International Standards on Auditing (UK) (ISAs (UK)) requirements in relation to going concern and the impact the various different situations have on the auditor’s report.

Members may also wish to refer to the following related helpsheets and guidance:

- Audit reports - overview

- Audit reports – modified opinions, emphasis of matter and other matter paragraphs

- Auditing micro-entities

- FRC's Compendium of illustrative auditor’s reports (for periods commencing before 15 December 2019)

- FRC’s Illustrative Auditor’s Reports (for periods commencing on or after 15 December 2019)

- Audit and Assurance Faculty guides

Going concern

ISA (UK) 570 Going Concern makes it clear that, in the UK, those charged with governance are responsible for the preparation of the financial statements and the assessment of the entity’s ability to continue as a going concern.

The auditor is responsible for obtaining sufficient appropriate audit evidence regarding, and concluding on, the appropriateness of management’s use of the going concern basis of accounting and whether a material uncertainty exists about the entity’s ability to continue as a going concern. The auditor must evaluate management’s assessment of the entity’s ability to continue as a going concern.

ISA (UK) 570 explains that a material uncertainty related to going concern exists when the magnitude of the potential impact of the events or conditions and the likelihood of occurrence is such that appropriate disclosure is necessary for the fair presentation of the financial statements or for the financial statements not to be misleading.

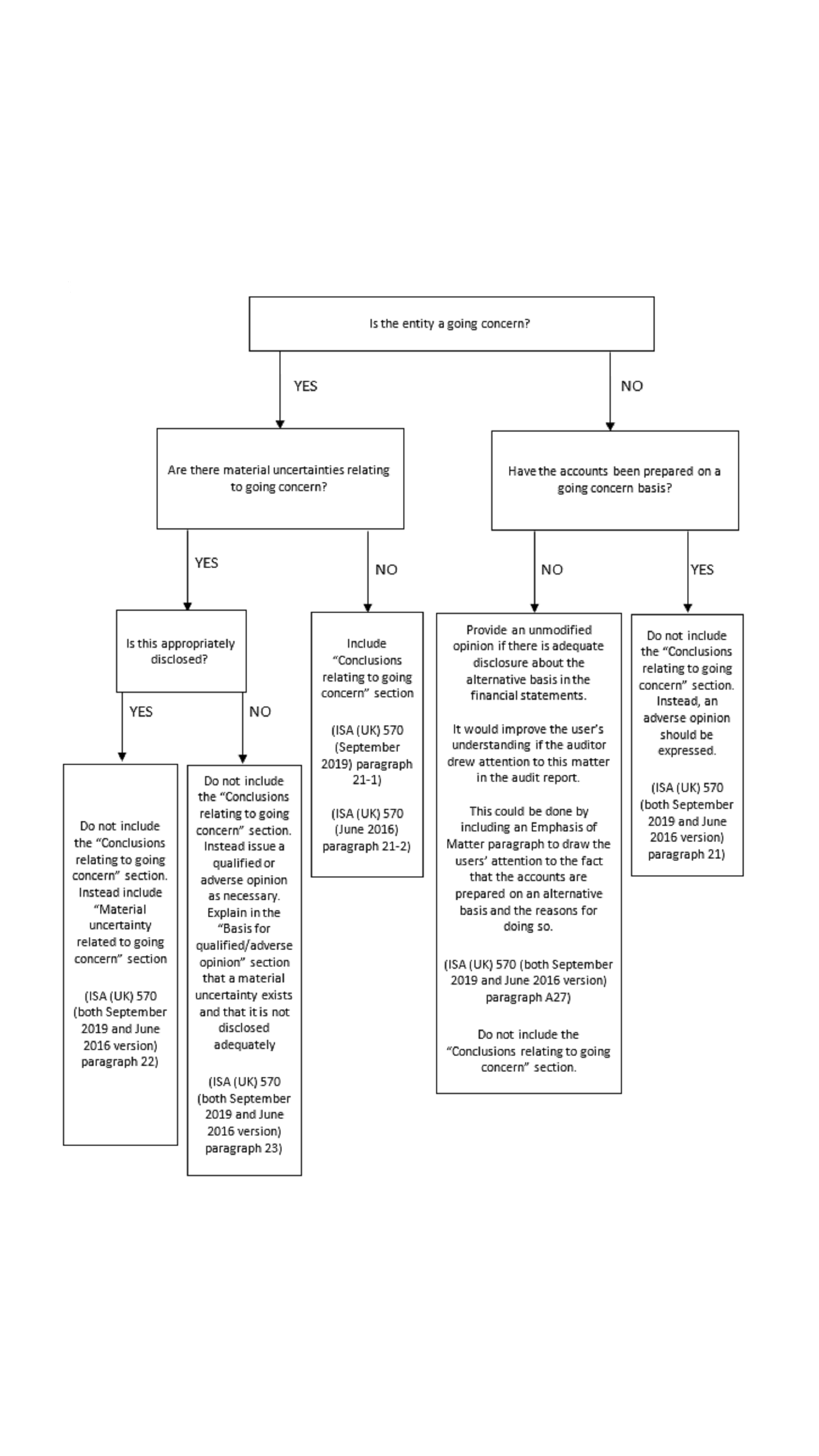

The implications for the audit report depend not only on the audit evidence obtained, but also on the disclosures made by management in the accounts. The various circumstances that can arise (assuming the auditor obtains sufficient evidence to conclude on whether the use of the going concern basis of accounting is appropriate), together with the impact on the audit report, are set out in the following flow chart.

For guidance on drafting an audit report requiring a “material uncertainty related to going concern” section, see Audit and Assurance Faculty guide Going concern – material uncertainty related to going concern. Where the accounts are prepared on a basis other than going concern and this has been appropriately disclosed, the change required to the audit report are explained in Audit and Assurance Faculty guide Going concern – basis other than going concern.

For audits conducted in accordance with ISA (UK) 570 (Revised September 2019), which is effective for periods commencing on or after 15 December 2019, the wording of the ‘conclusions relating to going concern’ or ‘material uncertainty related to going concern’ section (if appropriate) has changed. The FRC’s Illustrative Auditor’s Reports (for periods commencing on or after 15 December 2019) include a range of examples.

If in doubt seek advice

ICAEW members, affiliates, ICAEW students and staff in eligible firms with member firm access can discuss their specific situation with the Technical Advisory Service on +44 (0)1908 248 250 or via webchat.

© ICAEW 2026 All rights reserved.

ICAEW cannot accept responsibility for any person acting or refraining to act as a result of any material contained in this helpsheet. This helpsheet is designed to alert members to an important issue of general application. It is not intended to be a definitive statement covering all aspects but is a brief comment on a specific point.

ICAEW members have permission to use and reproduce this helpsheet on the following conditions:

- This permission is strictly limited to ICAEW members only who are using the helpsheet for guidance only.

- The helpsheet is to be reproduced for personal, non-commercial use only and is not for re-distribution.

For further details members are invited to telephone the Technical Advisory Service T +44 (0)1908 248250. The Technical Advisory Service comprises the technical enquiries, ethics advice, anti-money laundering and fraud helplines. For further details visit icaew.com/tas.

Download this helpsheet

PDF (228kb)

Access a PDF version of this helpsheet to print or save.

Download-

Update History

- 24 Sep 2018 (12: 00 AM BST)

- First published

- 27 Jan 2021 (12: 00 AM GMT)

- Changelog created, helpsheet converted to new template

- 27 Jan 2021 (12: 01 AM GMT)

- Updated for new draft CCAB guidance. Addition of links to government website for info about Lasting Power of Attorney.