IPSASB's new revenue standard, IPSAS 47, combines three revenue standards into one. It consolidates IPSAS 9 - 'Revenue from Exchange Transactions', IPSAS 23 - 'Revenue from Non-exchange Transactions' and IPSAS 11 - 'Construction Contracts'.

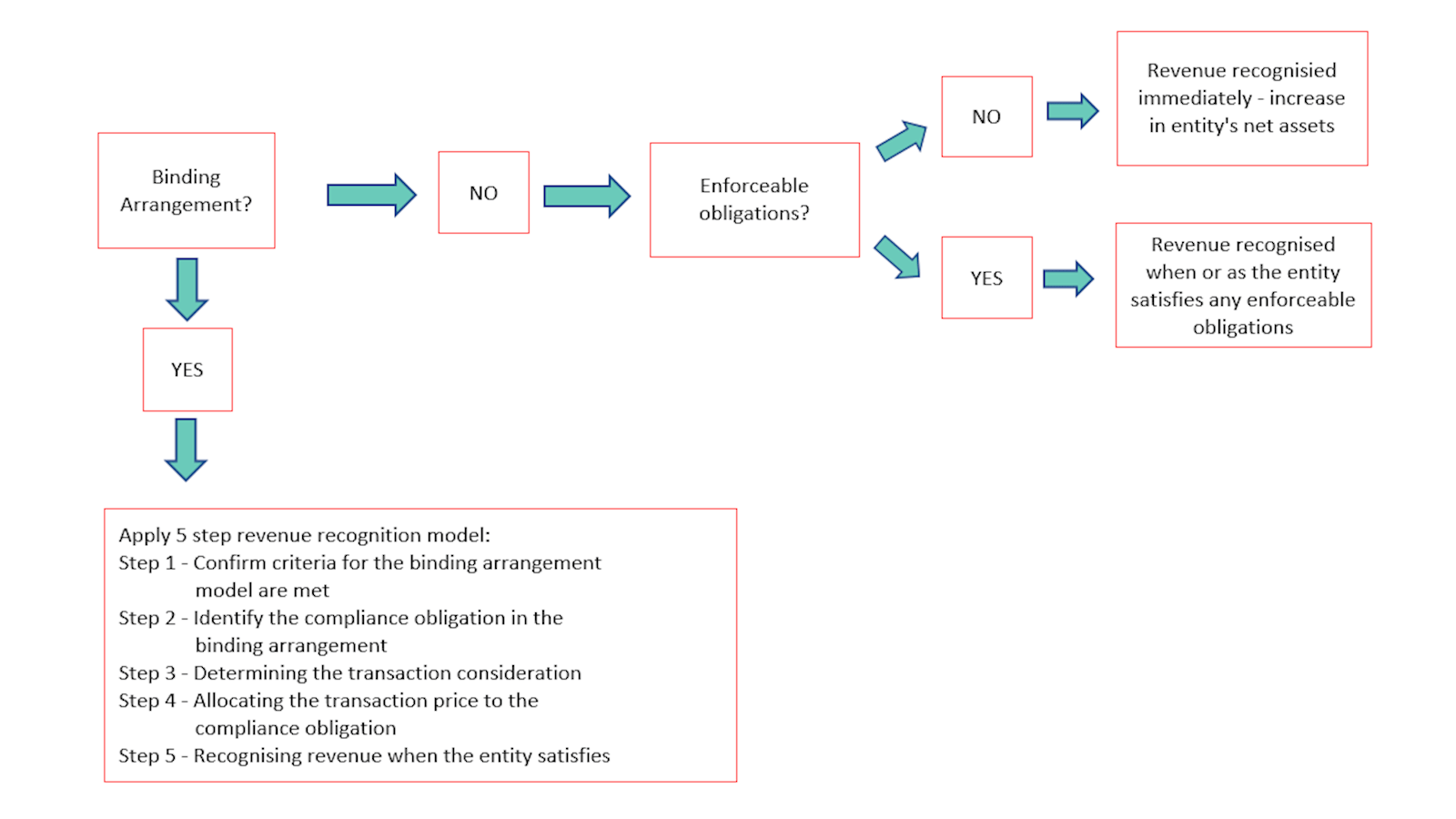

The new revenue standard introduces two accounting models based on the existence of a binding arrangement.

Revenue transactions without binding arrangements

Revenue transactions without binding arrangements are expected to be high in volume as they include taxes. In these circumstances an entity will not have both an enforceable right and an enforceable obligation. Nevertheless, in some circumstances an entity may have either enforceable rights or enforceable obligations which would impact the timing of revenue recognition.

Revenue without binding arrangements is recognised when (or as) the entity satisfies any enforceable obligations associated with the inflow of resource that meet the definition of a liability or immediately, if there are no enforceable obligations associated with the inflow.

The revenue is measured at the amount of the increase in the entity's net assets (eg the consideration received or receivable).

We would expect most grants to fall into the 'transactions without binding arrangements' model since whilst the recipient of grants may well have enforceable obligations it is unlikely to be able to compel the grant giving body to make payments.

Revenue transactions with binding arrangements

However, some transfers may well be underpinned by a binding arrangement in which the recipient is obliged to provide goods and services to third parties or to use the resource internally. In this scenario, IPSAS 47 has adapted the IFRS 15 five-step model to account for revenue principally by allocating expected consideration to each compliance obligation.

There are two key adaptations, one is the widening of the scope of IFRS 15's use of the term "contract" to "binding arrangement" and the other is to use the concept of compliance obligations instead of performance obligations.

Binding arrangements can include contracts but are broader since they are enforceable not just through legal but equivalent means, such as statutory mechanisms, legislative or executive authority or even ministerial directives. This is to allow for jurisdictions where government and public sector entities cannot enter into legal contracts but do enter into contracts that are in substance the same as contracts (with enforceability through equivalent means). A binding arrangement confers both rights and obligations and must be enforceable by either party to the transaction.

A compliance obligation not only includes a promise in a binding arrangement to provide goods and services to a purchaser (customer in IFRS 15) but is expanded to also include the possibility that the entity will use the resources internally or to provide goods and services to a third party.

Revenue is subsequently recognised as per the five-step model:

- Confirm binding arrangement model criteria are met;

- Identify compliance obligations

- Determine the transaction consideration

- Allocate the transaction consideration

- Recognise revenue

Revenue is recognised at the amount allocated to a compliance obligation when (or as) the entity satisfies that compliance obligation. The amount recognised depends on how much the entity expects to be compensated for each compliance obligation.

Overview of grant income accounting under IPSAS:

As per the diagram above, the existence of a binding arrangement is key. If there is no binding arrangement, then the grant recipient will recognise revenue immediately if there are no enforceable obligations. This may arise under a different kind of arrangement that is not a binding arrangement as it may not contain enforceable rights and obligations by all parties.

For example, a transaction may not contain an unenforceable right but an enforceable obligation, for example an education grant where a university is not able to enforce payment from the resource provider (eg department for education) but is required to provide the grant to students who meet the predetermined eligibility criteria.

An entity determines if any of its rights in the arrangement meet the definition and recognition criteria of an asset, and whether any of its obligations meet the definition and recognition criteria of a liability.

Similarities regarding grant income accounting

IAS 20 allows the preparer a number of options in how to account for grant income and depending on what options are selected, the resulting accounting for grant income in IFRS and IPSAS is very similar. |

Find out more

Follow these links for a detailed look at other areas of Government Grants: