This report considers who is involved in the preparation of financial statements for UK companies, how they are involved and the role of auditors in challenging those responsible.

This background paper is intended to help directors, politicians, and policymakers understand the complex relationships between boards, auditors, shareholders and others, and the regulatory regime within which those relationships operate. It is the first in a series of succinct, high-level essays on the future of audit, which will help to inform the various independent reviews of audit and regulation currently in progress. These reviews need to be as well informed as they can be; the issues are not straightforward.

Financial statements: at the heart of the financial reporting system

Financial reporting needs to improve, and everyone involved – preparers, auditors, audit committees, shareholders – needs to do more. This is no mere exhortation: all of these players are required by law, regulation and various codes to play an active part in ensuing that the financial statements, which sit at the heart of the system, pass the test required of them by law, which is that they give a ‘true and fair’ view. All of the players in the system, including shareholders, are responsible in different ways for ensuring that the financial statements pass this test.

This overview is necessary because the way that these players interact is less straightforward than it might be. To say that directors prepare financial statements for the benefit of shareholders, and that auditors report on those financial statements to shareholders may be true, but such statements need unpacking, and putting into context if we are to properly understand the dynamics of the relationships in the system and the pressures that lead to dysfunction. Among many other things, such simple statements suggest that shareholders are passive recipients of financial information and that their interests alone are relevant. Neither of those assertions are true.

The financial reporting system has emerged over time. Bolt-ons, periodic re-organisations and changes in the business environment have resulted in a system characterised by a certain amount of duplication, internal inconsistency, omission, redundancy and misalignment. The system is less effective than it can or should be.

It is not simply a case of preparers and auditors needing to serve investors better. Preparers and auditors undoubtedly need to do that, but investors and audit committees need to step up their engagement with auditors and preparers, and investors should not rely on audit committees to do that for them. Audit committees need to be more willing than they are now to challenge management, and standard-setters, regulators and government all need to acknowledge and address the inefficiencies and dysfunction in the system arising from decades of ad hoc maintenance.

In the last 50 years, the financial statements of listed companies have grown significantly, as have the annual reports within which they are published as a result of successive waves of legislation, regulation and corporate governance reform, as well as globalisation. Many assume that all of the ‘front end’ information in annual reports, especially the financial highlights and key performance indicators, is subject to much greater scrutiny than it actually is. It is a common misconception the ‘front end’ of the annual report is audited in the same way as the ‘back end’ financial statements. The only procedures auditors are currently required to perform on the full annual report is to ‘read’ it for consistency with the ‘back end’ financial statements, the auditor’s knowledge of the business, and obvious misstatements.

It is no exaggeration to say that the legislation and regulation governing the preparation of financial statements is a bewildering mess. ICAEW has periodically called for rationalisation in a number of areas, and while we recognise that company law is rarely a political priority, we will continue to press for reform in this area.

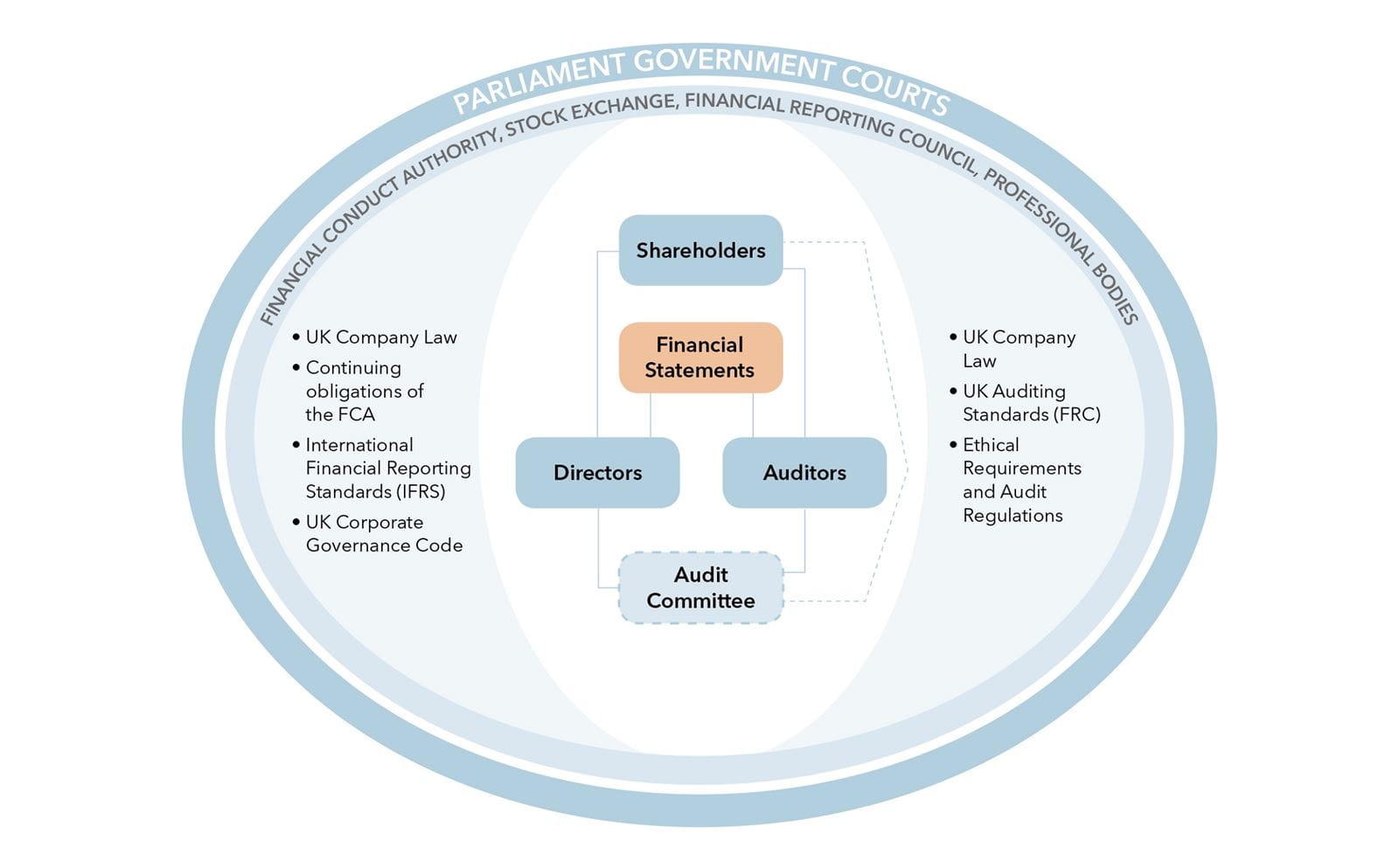

The diagram below sets out how the various players within the financial reporting system interact.

How the players interact

- Shareholders appoint directors to serve on the board, the board appoints members of the audit committee.

- The audit committee conducts a tendering process and makes recommendations to the board about the appointment of auditors.

- Directors propose the appointment of auditors to shareholders, shareholders vote on whether to approve the appointment.

- Directors prepare financial statements, audit committees monitor the integrity of financial information.

- Auditors audit the financial statements and perform other procedures on other parts of the annual report.

- Auditors report various matters to the audit committee.

- Auditors report on the financial statements to shareholders.

Shareholders range from private individual investors to large institutional investors. They ‘own’ the company. Shareholders appoint directors to run the company on their behalf. Directors are often also shareholders. The audit committee, comprised of non-executive directors, liaises between auditors and the main board of directors. It is required to act independently to ensure that the interests of shareholders are properly protected in relation to financial reporting and internal control.

To find out more about how these players interact in practice, and to understand some of the shortcomings in the system, read the full paper.

Who does what in the financial reporting system

PDF (893kb)

Read this background paper to ICAEW's thought leadership series The future of audit.

Download