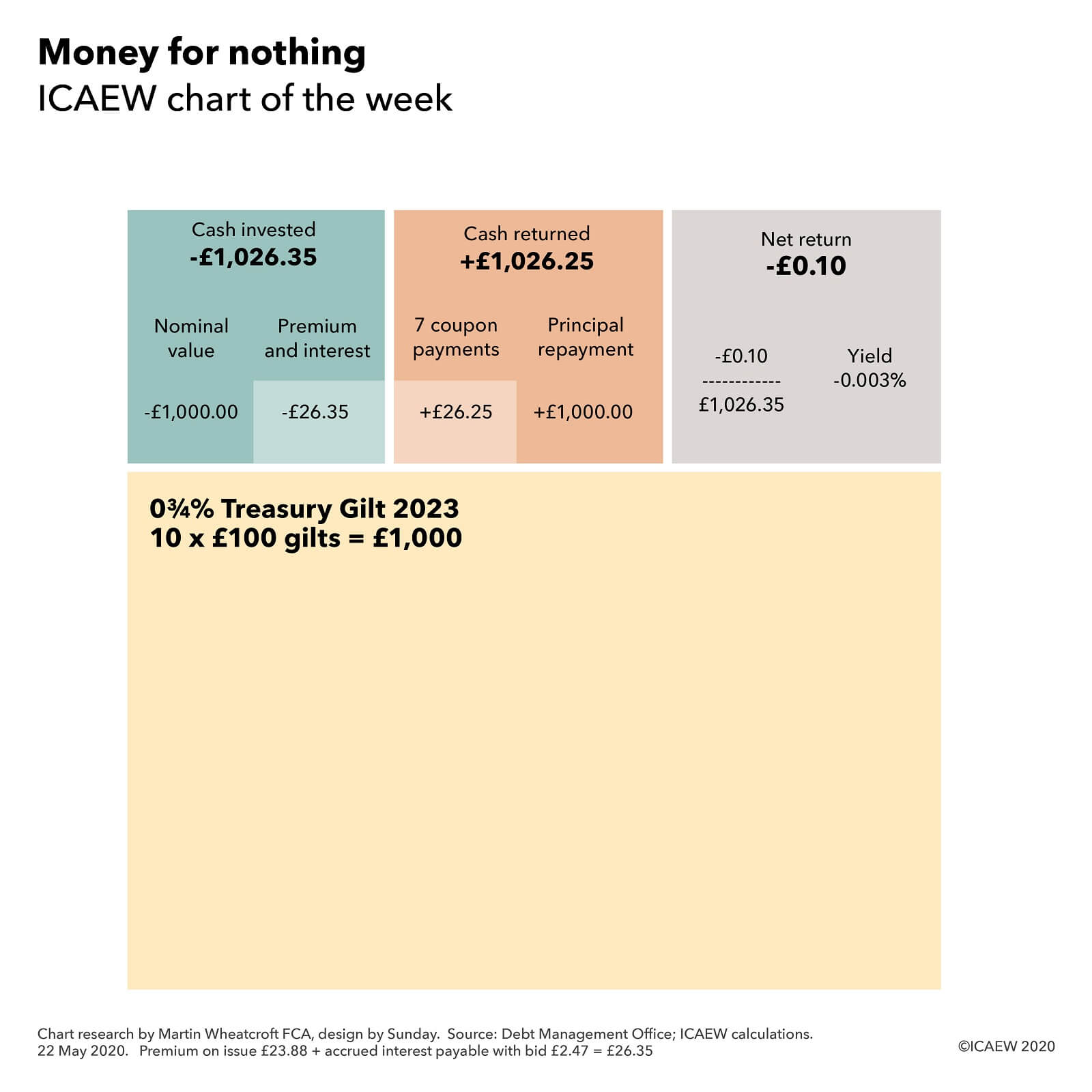

The news this week that the UK Government issued debt with a negative interest rate is the subject of the #icaewchartoftheweek. This shows how purchasers of the 0¾% Treasury Gilt 2023 at an auction on Wednesday 20 May accepted a negative yield of -0.003% on their investment.

At an average price of £102.388 for each £100 gilt or £1,023.88 for ten gilts, someone buying gilts at the auction would have paid £1,026.35 to the Government for each £1,000 of nominal value purchased, once £2.47 for interest already accrued payable with the bid is included.

That investor will receive less money back, with 7 semi-annual coupon payments of £3.75 before repayment of the principal of £1,000 on 22 July 2023 adding up to £1,026.25, a net loss of 10p.

This is a return of just under -0.01% over 38 months on the £1,026.35 invested, equivalent to an annualised yield of -0.003%.

This is only just negative, and the UK Government still needs to pay to borrow for longer periods, with yields on 10-year and 30-year gilts still in positive territory at around +0.24% and +0.63% respectively.

Although this gilt auction is a milestone, being the first fixed-rate government bond with a duration over two years to be issued at a negative yield in the UK, this is not a new phenomenon in the world of government borrowing. For example, with 10-year and 30-year government bonds currently yielding -0.49% and -0.07% respectively, Germany’s €156bn of projected borrowing this year should end up reducing its interest bill!

Whether this presages a similar situation in the UK is unknowable, so we are not yet at the stage of money for nothing.