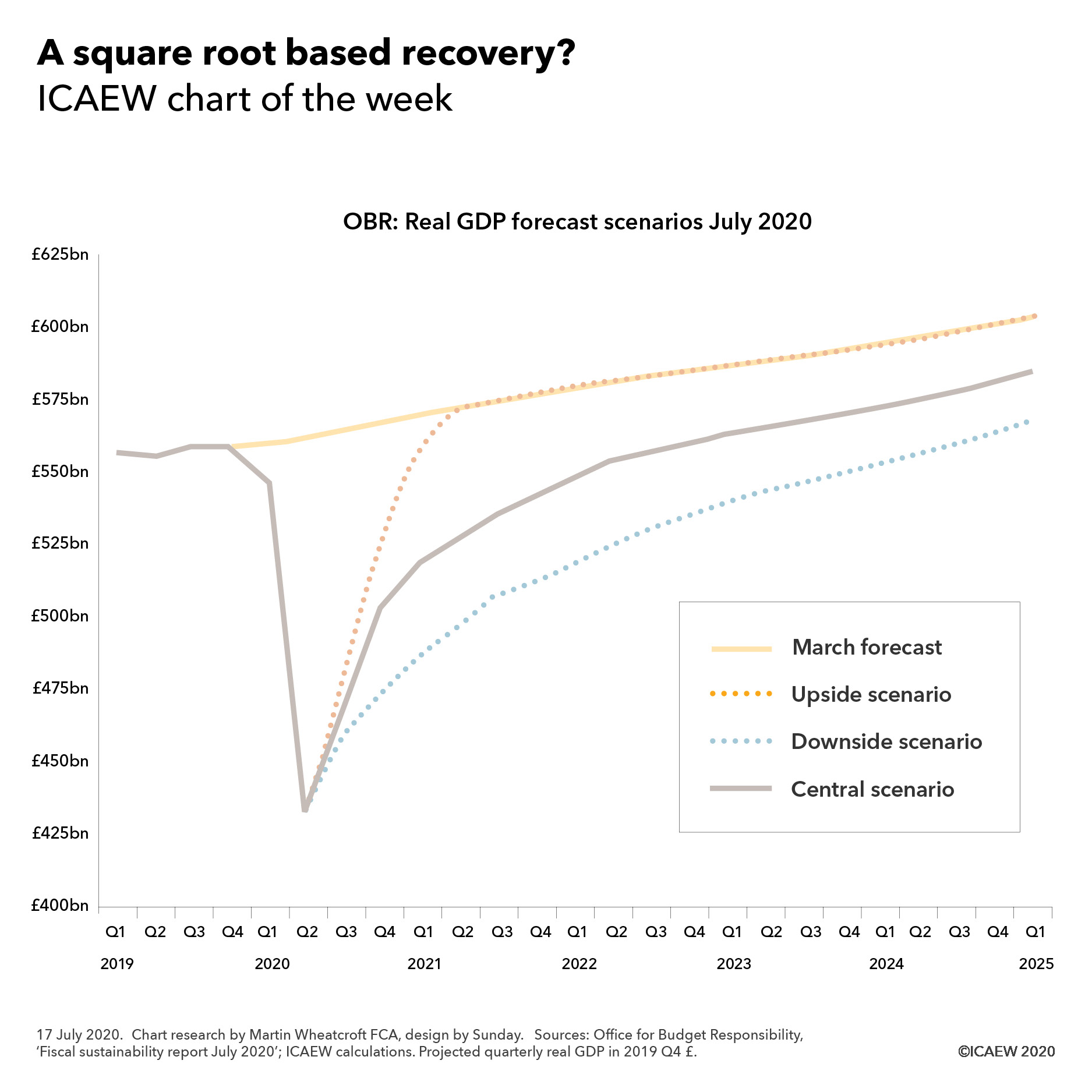

The #icaewchartoftheweek is on the economy this week, with the Office for Budget Responsibility indicating that hopes of a sharp V-shaped recovery have receded. Instead, their central scenario is for a square root-based recovery – with economic activity recovering less quickly than originally hoped and not to the same level predicted before the pandemic took hold in the UK.

According to the OBR, quarterly GDP fell from £558bn in the fourth quarter of 2019 to £432bn before inflation in the second quarter of this year, a drop of almost 23% in the level of economic activity. Under the OBR’s central scenario GDP in real-terms is not expected to get back to where it was until the fourth quarter of 2022. At a predicted £584bn (excluding inflation) in the first quarter of 2025, GDP would be 3% lower than where it was predicted to be prior to the pandemic.

The OBR hasn’t completely ruled out a V-shaped recovery as a possibility and their upside scenario would see the economy returning to the previous trend by the second quarter of 2021. However, with job losses starting to accelerate, such a speedy return to trend seems increasingly unlikely.

The good news is that the OBR’s downside scenario, for which no symbol has yet been assigned, is not as shallow as the dreaded U-shaped recovery that some economists are worried about. In the downside scenario, economic activity recovers by the middle of 2024, unlike a U-shaped recovery that might extend into the second half of the 2020s.

In practice, the fortunes of different sectors of the economy are likely to vary, with some suggesting the recovery is more likely to be K-shaped, with some sectors stalling just as others emerge to grow back strongly following the end of the lockdown. The Government will be hoping that the fiscal interventions it has announced to support the hospitality, leisure and housing sectors in particular will help prevent the 'full K'.