Updated guidance

This guidance has been superseded by the ICAEW Statement on members engaging in public practice, which came into effect on 1 January 2025.

1. In order to clarify the scope of public practice, ICAEW has produced this statement to define when you are, and are not, considered to be engaging in public practice and so in need of a practising certificate.

2. The statement is relevant to all members, whether you work in a traditional practice environment, undertake sub-contract or interim roles or do some voluntary work in your spare time. Failure to hold a practising certificate when you would be considered to be engaging in public practice could result in disciplinary action against you. It is therefore important that you consider the contents of the statement and the annexes before concluding whether a practising certificate is needed. Your considerations should cover all the roles that you have as a practising certificate may be needed for any of them.

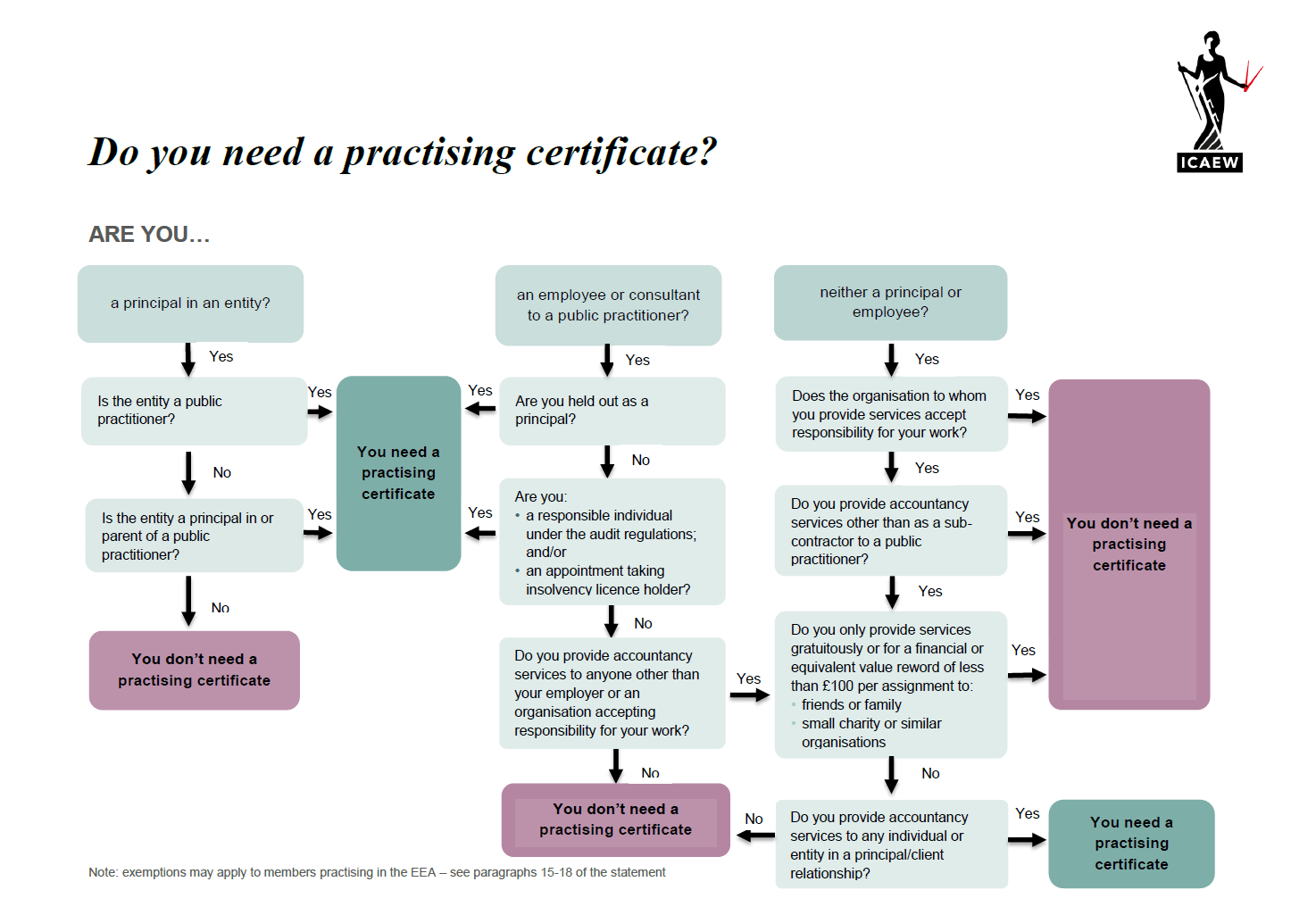

3. Annex 2 lists some sample scenarios and annex 3 contains a flowchart to help members decide whether a practising certificate is needed.

4. You need to hold a practising certificate if you are a member engaged in public practice in the United Kingdom[1], or elsewhere in the European Economic Area (EEA[2]). However, there are some exemptions for members in practice in the EEA outside the UK, see paragraphs 15-18. Members who are principals of entities that are not engaged in public practice do not require a practising certificate for that role but may do so for other roles they undertake.

5. If you are a responsible individual or a key audit partner in an audit firm then you must hold a practising certificate under ICAEW audit and local auditor regulations. You must also hold a practising certificate if you are a licensed insolvency practitioner who accepts appointments.

[1] For these purposes United Kingdom includes the Channel Islands and Isle of Man.

[2] The EEA comprises the European Union member states, Iceland, Liechtenstein and Norway.

Member's responsibility

6. As a member it is your responsibility to determine whether or not you should hold a practising certificate and your decision will be judged by reference to this statement. Further guidance and support is available from Advisory Services by calling +44 (0)1908 248 250.

Obtaining a practising certificate

7. How a practising certificate can be obtained is set out in the Practising Certificate Regulations. You should also bear in mind the Continuing Professional Development (CPD) Regulations.

When am I engaged in public practice?

8. You are engaged in public practice if you are a principal or are held out as a principal in:

- public practitioner; or

- the parent of a public practitioner; or

- an entity which is a principal of a public practitioner.

9. You are a principal if you are:

- a member in sole practice

- a salaried or equity partner of a partnership, a member of a limited liability partnership (designated and non-designated members), a statutory (de jure) director, a de facto director or a shadow director of a company; or

- a member ‘held out’ as a principal.

10. If you are employed in practice and have a functional title of ‘director’ you would not be considered to be a principal provided that it is clear on the firm’s website or elsewhere that you are not a principal in the practice.

11. There is no minimum earnings level below which a practising certificate is not required although accountancy services supplied gratuitously or for a financial or equivalent value reward of less than £100 per assignment will not give rise to a requirement to hold a practising certificate (see paragraph 19g).

When am I held out as a principal?

12. You would be considered to be held out as a principal if you are employed in an entity that fulfils the definition of a public practitioner and either:

- there are no other professional accountants in positions of seniority or supervision over you within the organisation; or

- the clients of the entity are otherwise led to believe that you are a principal.

What is a public practitioner?

13. A public practitioner is an entity (including an individual in sole practice) providing accountancy or reserved services (see paragraph 14) in anticipation of a financial or equivalent value reward that exceeds £100 per assignment where:

- the proportion of the entity’s reported turnover derived from the provision of accountancy or reserved services regularly exceeds 10%; and

- if the entity is part of a group, the proportion of the group’s reported turnover derived from the provision of accountancy or reserved services regularly exceeds 10%.

14. For the purpose of this statement accountancy or reserved services are:

- any of the services listed in annex 1

- any service that requires a specific licence that ICAEW can provide, even if the licence is obtained elsewhere

- any reserved legal services (other than those where you are a member of another qualifying membership body).

What does practising in the EEA mean?

15. You are in public practice in the EEA if;

- your main place of business is located within the EEA; and/or

- the place of business of your client is located within the EEA.

16. If you are also a member of another body in the EEA that ICAEW recognises to be of appropriate standing (see paragraph 17) you are not required to hold an ICAEW practising certificate if you do not have any clients in the UK or Republic of Ireland and either 16a or 16b applies:

- you hold a practising certificate, licence or other authority issued by that EEA body which allows you to practise in the country in which you have your main place of business and any other EEA country in which the requirement for accountancy services arises;

- that EEA body does not require you to hold a practising certificate, licence or other authority to provide accountancy services in the country in which you have your main place of business; or in any other EEA country in which the requirement to provide accountancy services arises.

17. The following bodies are recognised by ICAEW as being of appropriate standing:

- any state or emanation of a state

- any Federation of European Accountants (FEE) or International Federation of Accountants (IFAC) body provided that it is headquartered within the jurisdiction within which you are practising.

18. For example, you live and work in France, are also a member of the French accountancy body and are asked to provide basic management accounting information to a client in France. The French body does not require you to hold a practising certificate to provide such services. In these circumstances you would not be required to hold an ICAEW practising certificate.

Further circumstances in which a practising certificate is not required

19. The following are circumstances in which you would not require a practising certificate:

- you are an employee and are not held out as a principal

- you are an employee and required by your employer to hold an office such as trustee, administrator, independent examiner or the donee of a power of attorney

- you are working for an entity where the relationship is not one of client and principal and the entity accepts responsibility for your work

- you are a former principal of a public practitioner and continue to provide services to that firm as a consultant (and not held out as a principal)

- you are a self-employed consultant (and not held out as a principal) to a public practitioner that accepts responsibility for your work

- you are an office holder of an entity that is not a public practitioner

- gratuitously, or for a financial or equivalent value reward of less than £100 per assignment, you provide accountancy services solely to assist any of the following:

- friends or family

- a small charitable, community, religious, sporting or similar non profit-making entity (see paragraph 21)

- members of the public via an organisation such as a voluntary advice bureau.

In all of these circumstances it is strongly recommended that you clarify your position by a written agreement.

20. You would not require a practising certificate if you are a principal in an entity which is authorised by the Financial Conduct Authority (FCA) or Prudential Regulation Authority (PRA) and has not been designated as an 'authorised professional firm'.

21. For the purpose of exemption 19gii, small is determined by the point at which accruals accounting is required for charities so includes any entity falling under that income limit (currently £250,000).

22. You may be involved in more than one such role at any time and each role should be considered separately.

Professional Indemnity Insurance (PII)

23. As a member in public practice in the UK or Republic of Ireland you must also comply with the PII regulations.

24. If you are a member in public practice elsewhere in the EEA you may be subject to the requirements of that particular EEA country, or any other professional body of which you are also a member, to hold PII.

25. If you are not required to hold PII, you should still consider taking out appropriate insurance to protect you against any potential liabilities arising from your activities.

26. A member who provides accountancy services in circumstances where a practising certificate is not needed should inform the recipient of the accountancy services of the absence of PII (if this is the case).

Practice Assurance

27. All practising certificate holders are subject to the Practice Assurance Regulations.

Anti-money laundering supervision

28. If you conclude that you are not in public practice, you should still consider whether your activities fall within the scope of HM Treasury's Money Laundering Regulations and its requirement for anti-money laundering supervision. Such supervision can be provided by ICAEW or another supervisor.

29. Different requirements for anti-money laundering supervision apply outside the UK.

Use of designatory letters and firm description

30. Whether or not you use your designatory letters or describe yourself or your firm as chartered accountant(s) does not affect the requirements to hold a practising certificate.

31. As a member, you are encouraged to use the designatory letters ACA or FCA to which you are personally entitled. If your firm is eligible to use the description ‘chartered accountants’ it is also encouraged to do so. However not using the description or designatory letters does not remove the requirement for a practising certificate.

Retired and life members

32. You may qualify for a reduced rate subscription as a retired member or be a life member. In both cases all remunerated business and professional activities must have ceased and your practising certificate must be surrendered. This does not prevent you from undertaking voluntary activities as set out in paragraph 19g.

33. Life members and members paying the retired member rate who wish to engage in public practice may apply to hold a practising certificate. The life membership or retired rate will be suspended for the period of holding the practising certificate and the member shall be subject to normal membership fees and practising certificate fees and regulations and must also comply with the requirements for Continuing Professional Development. When the practising certificate is subsequently surrendered the life membership or retired rate will be reinstated with effect from the start of the following membership year, provided all other conditions of eligibility for that rate apply.

Annex 1 Guidance on accountancy and reserved services

The following is a list of services considered by ICAEW, for the purposes of this guidance, to be accountancy or reserved services relating to both financial and non-financial information.

- bookkeeping work

- maintaining client payroll

- preparation of management or financial accounts

- external audit and assurance services

- internal audit of accounting and internal control systems

- advice or consultancy on accounting and financial reporting systems

- dealing with personal or business tax returns

- providing tax advice

- representing a client in a tax situation (eg, client is having an investigation and needs someone to deal with the tax authorities)

- estate administration

- investment business advice and other activities undertaken under a licence from a Designated Professional Body (DPB). For further information refer to the Designated Professional Body (Investment Business) Handbook

- preparation of cash flows and budgets

- business funding advice, except where the purpose of the advice is to actively seek or negotiate the source of funds

- due diligence (ie, investigations into the accounting or financial aspects of a transaction such as a company take over)

- preparation of business plans

- management consulting on accountancy activities

- accepting insolvency appointments

- credit-related regulated activities undertaken under a licence from a DPB. For further information refer to the Designated Professional Body (Consumer Credit) Handbook

- compliance services (including file reviews) supplied to firms of accountants

- valuing incorporated and unincorporated businesses, shares and related instruments, and intangible assets

- forensic accounting

- expert witness services where these are related to accountancy or reserved services

- reserved legal services, when conducted in a firm authorised by ICAEW for that wor

- acting as the executor or administrator of a will

The following services are not regarded as accountancy or reserved services for the purpose of this guidance:

- investment business and other activities conducted under authorisation from the FCA or the PRA

- acting as a trustee

- training services to accountancy firms or students

- business funding advice where this only involves seeking or negotiating the source of funds

- management consulting on non-accounting matters

- company secretarial and other company services such as company formation, providing correspondence/registered office address

- computer hardware and software installation

- computer training

- advising on corporate governance

- advising on general business strategy where this is not primarily financial advice

Annex 2 - Guidance on public practice

The ICAEW statement sets out when a member is engaged in practice and must therefore hold a practising certificate.

The following is a list of common situations to help members decide if they need a practising certificate. If you undertake more than one role it is possible that you may require a practising certificate for some roles but not others. You should therefore check the guidance and common situations for each role that you undertake.

| Member role | Is a practising certificate needed? | |

| 1. | I provide bookkeeping services to a small number of clients on a part time basis. |

Yes – for the purpose of this guidance bookkeeping services fall within the definition of accountancy services and therefore you need a practising certificate. |

| 2. | My only role is as the marketing principal in a public practitioner. |

Yes – you are a principal in a public practitioner. Your personal role is irrelevant. |

| 3. | I am an employee/principal of an entity whose primary purpose is to provide financial services (ie, services that would need a licence from the Financial Conduct Authority or the Prudential Regulation Authority), insurance services, computer installation or computer applications. |

No – the entity is not a public practitioner and therefore you do not need a practising certificate. |

| 4. | I am a principal in an entity whose only activity is to be a principal in a public practitioner. |

Yes – as a principal in an entity that is a principal in a public practitioner you must hold a practising certificate. |

| 5. | I am a non-executive director in an accountancy practice. |

Yes – you are a principal in an entity that is providing accountancy services. |

| 6. | I am a principal in a non-trading holding company where more than 10% of the turnover of the group is the provision of accountancy services. |

Yes – as the group meets the definition of a public practitioner, and you are a director of the holding company, then you are engaged in public practice and need a practising certificate. |

| 7. | I am a principal in a holding company where less than 10% of the turnover of the holding company is the provision of accountancy services but more than 10% of the turnover of the group is the provision of accountancy services. |

Yes – as the group meets the definition of a public practitioner and you are a director in the holding company, you are engaged in public practice and need a practising certificate. |

| 8. | I have been named as executor in my client’s will. |

Yes – if you will be charging for your services then you would be considered to be in practice. Don’t forget that probate is a reserved activity requiring authorisation or a licence from an approved regulator such as ICAEW. |

| 9. | I am an employee and a responsible individual for audit work. |

Yes – it is a requirement of the audit regulations that you hold a practising certificate. |

| 10. | I am an employee holding an insolvency licence from ICAEW and I accept insolvency appointments. |

Yes – it is a requirement of the insolvency regulations that you have a practising certificate. Note – there is no similar requirement for licence holders that do not take appointments. |

| 11. | I hold an insolvency licence from another body and accept insolvency appointments. |

Yes – although your licence is not obtained from ICAEW you are still in practice. |

| 12. | I have retired but remain with my former practice as a consultant. |

No – you are not a principal. However, if you continue to be held out as a principal you do require a practising certificate. |

| 13. | I act as an expert in tax matters for other firms of chartered accountants. |

Yes – you are providing tax advice to a third party so a practising certificate is required. However, if the firm does not hold you out as a principal to its clients and the firm accepts responsibility for your work then a practising certificate is not required. |

| 14. |

I provide audit review services to firms of accountants. |

Yes – you are providing accountancy services by way of business and so must hold a practising certificate. |

| 15. | I act as a subcontractor providing accountancy services to a public practitioner. |

No – you do not need a practising certificate provided that you are not ‘held out’ as a principal and the firm accepts responsibility for your work. This also applies if an agency contracts for the work. |

| 16. | I am the finance director of a company that has nothing to do with providing accountancy services. |

No – as the company is not providing accountancy services you do not need a practising certificate. |

| 17. | I have been asked to undertake an independent examination of a charity. I will not receive a fee. |

No – you would not require a practising certificate if you undertake this work gratuitously or for a financial or equivalent value reward of less than £100 per assignment (provided the charity's income is less than £250,000). |

| 18. | I give time voluntarily to advise the clients of the local Citizens Advice Bureau (or similar). |

No – you are undertaking this role gratuitously or for a financial or equivalent value reward of less than £100 per assignment and so do not need a practising certificate. |

| 19. | I have a voluntary role as trustee (or treasurer) of a charity. which involves preparing the entity's accounts. |

No – you are not a public practitioner and do not need a practising certificate. |

| 20. | I prepare accounts for a local charity. I receive no fee for this work. |

No – you would not require a practising certificate if you undertake this work gratuitously or for a financial or equivalent value reward of less than £100 per assignment (provided the charity's income is less than £250,000). |

| 21. | I am an employee and although not a principal my employer wants me to act as a trustee (or administrator or donee of a power of attorney). |

No – you are not being held out as a principal and do not need a practising certificate. Your position as trustee, administrator or donee is part of your employed role but given that such roles come with personal responsibilities you should check that your employer will indemnify you should any claim be made against you. |

| 22. | I am a non-executive director and a member of the audit committee of a manufacturing company. |

No – as the company does not provide accountancy services you do not need to hold a practising certificate for either of these roles. |

| 23. | I act as an interim manager, either personally or through a corporate entity, to businesses. |

No – provided your relationship to the entity that you work for is not a principal/client relationship. Note - in such circumstances it is strongly recommended that you have in place a written agreement or contract clarifying your position. |

| 24. | I have a 'portfolio career' in which I hold a number of different roles. |

It depends – each role should be assessed against the guidance in this statement. You will need a practising certificate if for any of your roles you are acting as a public practitioner (see definition in paragraphs 8-9 of the statement). The number of roles is irrelevant but the relationship between you and each entity is key. |

Annex 3 - Flow chart to help you decide if you need a practising certificate

More on practising certificates

Further information on practising certificatesGuidance on practising certificates