During the pandemic, “there was a period when you could sell literally nothing”, says Wol Kolade, boss of mid-market private equity firm Livingbridge. That has led to longer hold times, but the taps were turned back on last year.

A total of 969 UK companies with an enterprise value (EV) of between £10m and £100m were backed by private equity firms during the past five and a half years, according to data prepared for Corporate Financier by Unquote. This compares with 137 buy-outs with an EV of less than £10m, and 381 deals with an EV of more than £100m. Mid-market buyout firms have been busy investors.

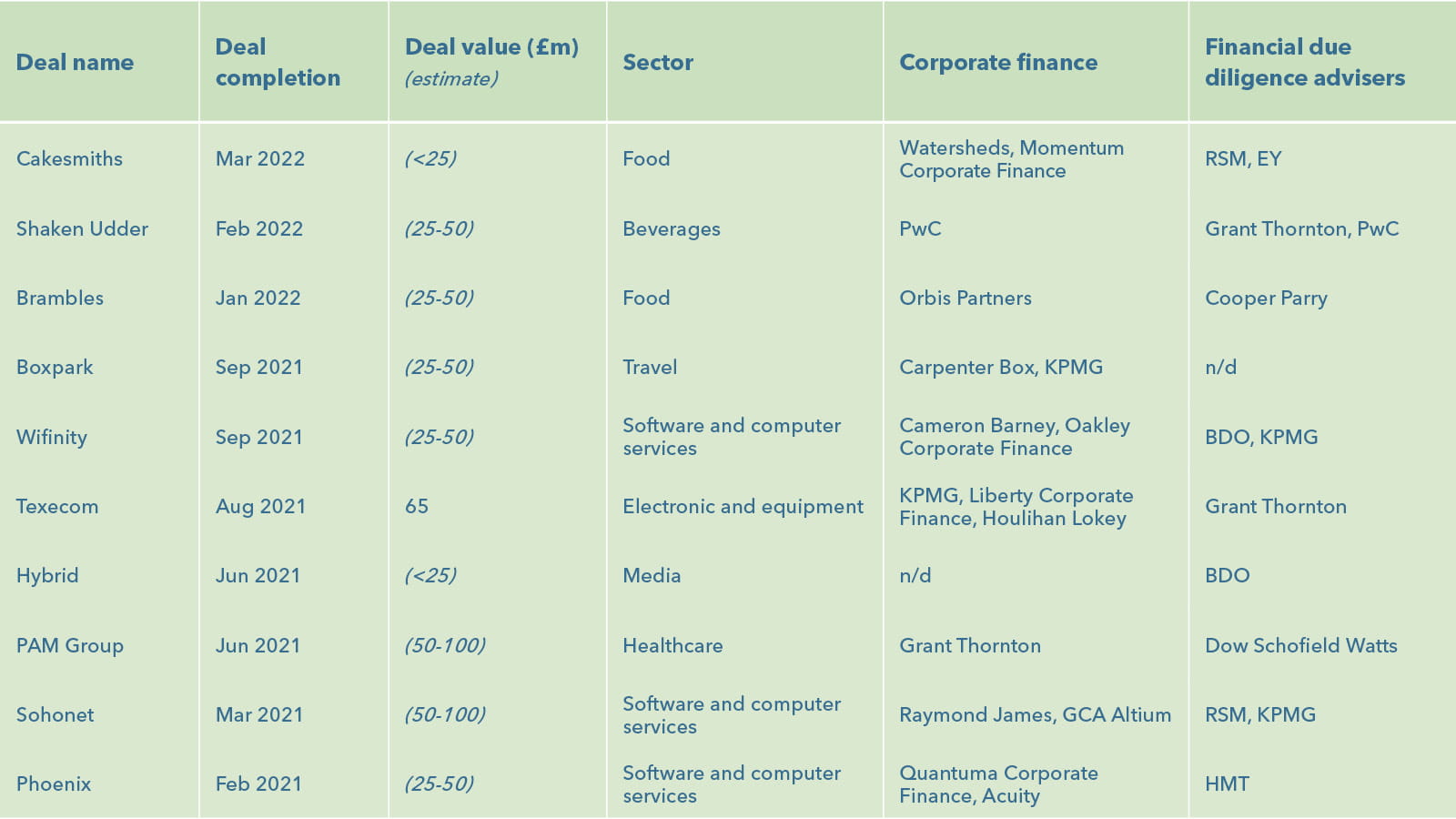

LDC tops the table of mid-market (£10m-£100m EV) UK buy-out houses in terms of deal numbers, with 67 transactions in this range during the period, while Inflexion, despite having only 25 transactions, leads by deal value.

Richard Swann, partner at Inflexion who chairs its investment committee, says: “There’s plenty of available capital and debt financing in the mid-market, so the dynamics suggest no problems at all.”

Some of the headwinds are seeing banks pull away from issuing debt packages for transactions, with possible ramifications for valuations of existing portfolio businesses.

“Don’t worry about the deals private equity can’t do today,” warns Chris Hughes at Bloomberg, “worry about the performance of the deals they’ve done and where the next round of fees is coming from.”

Investor enthusiasm has seen the raising of ever-bigger funds. That may wane as profitability is impacted by an economic downturn. But for now, mid-market buy-out houses aren’t seeing any problem with capitalisation.

Swann says the perceptions of private equity have changed – in some quarters “it was regarded as something of a buyer of last resort”. But now, accounting for more than 50% of M&A activity, he says advisers still don’t realise the “breadth and scope” of the sector.

1 LDC

The private equity arm of Lloyds Banking Group is the country’s biggest dealmaker by sheer numbers, with 67 deals in our timeframe, 90 portfolio companies and plans to back 100 mid-market companies over the next five years. It deployed £400m of investment in 2021 and began 2022 with chunky buy-outs of three firms in the food and drink sector – part of a long-standing LDC heritage of supporting consumer brands.

LDC has invested 50% of its capital over the past decade in the North and Midlands. Chief executive Toby Rougier sees its mandate as “creating the world-class businesses that are vital to our growth and vibrant local economies”.

On average, the businesses LDC exited in 2021 increased revenues by 64% and grew their employee numbers by 60% over the ownership period.

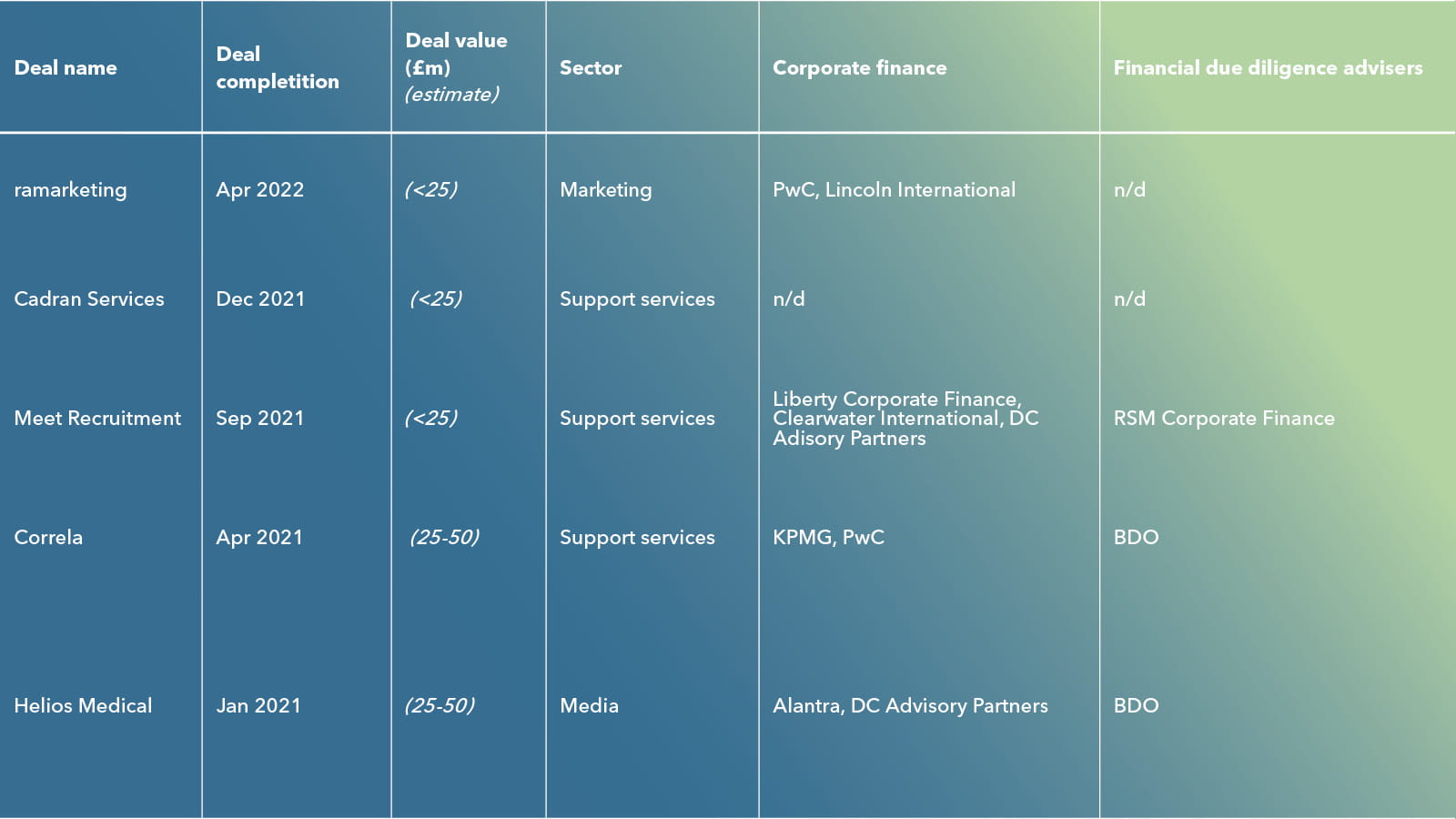

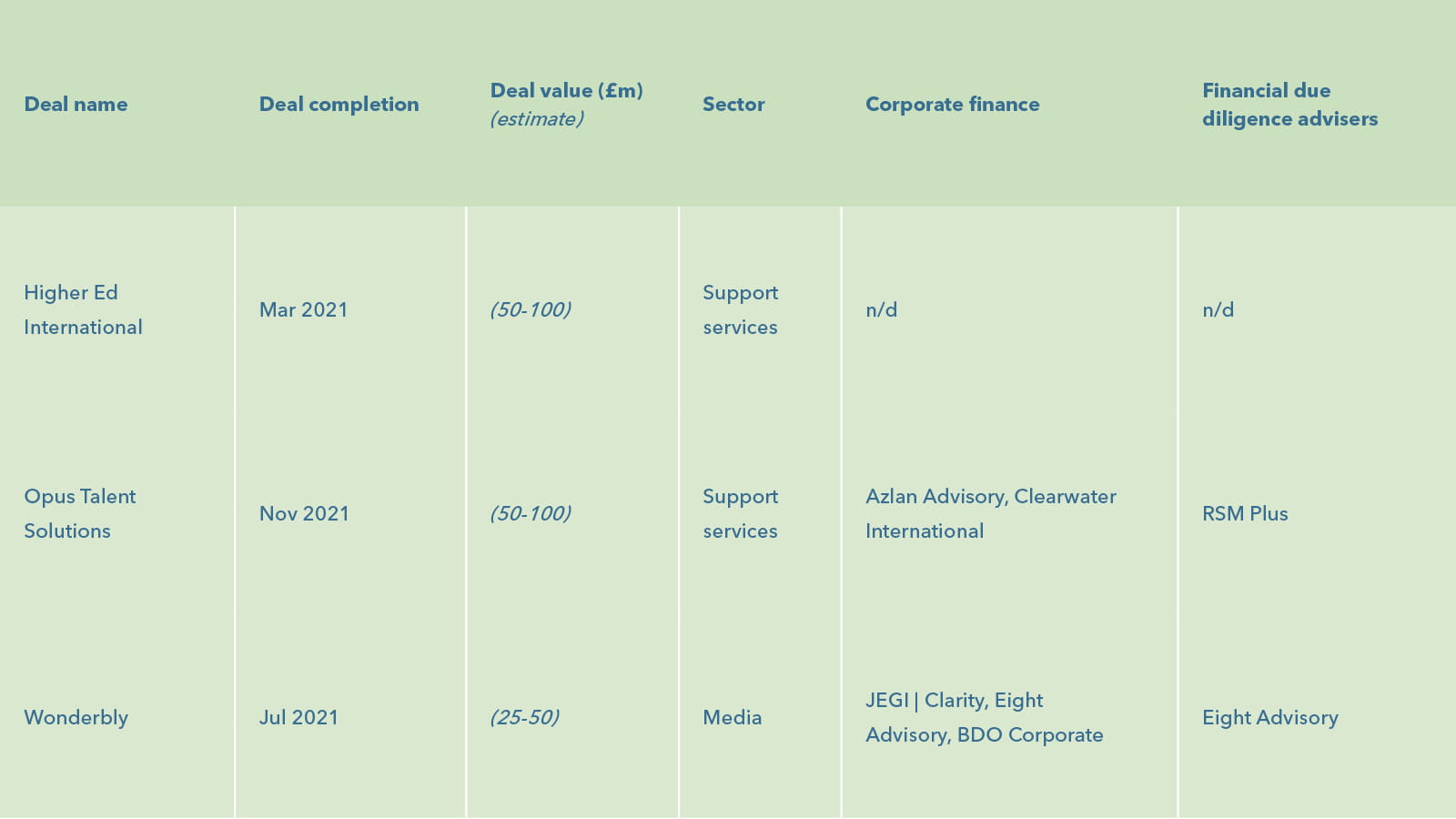

N/D = NOT DISCLOSED

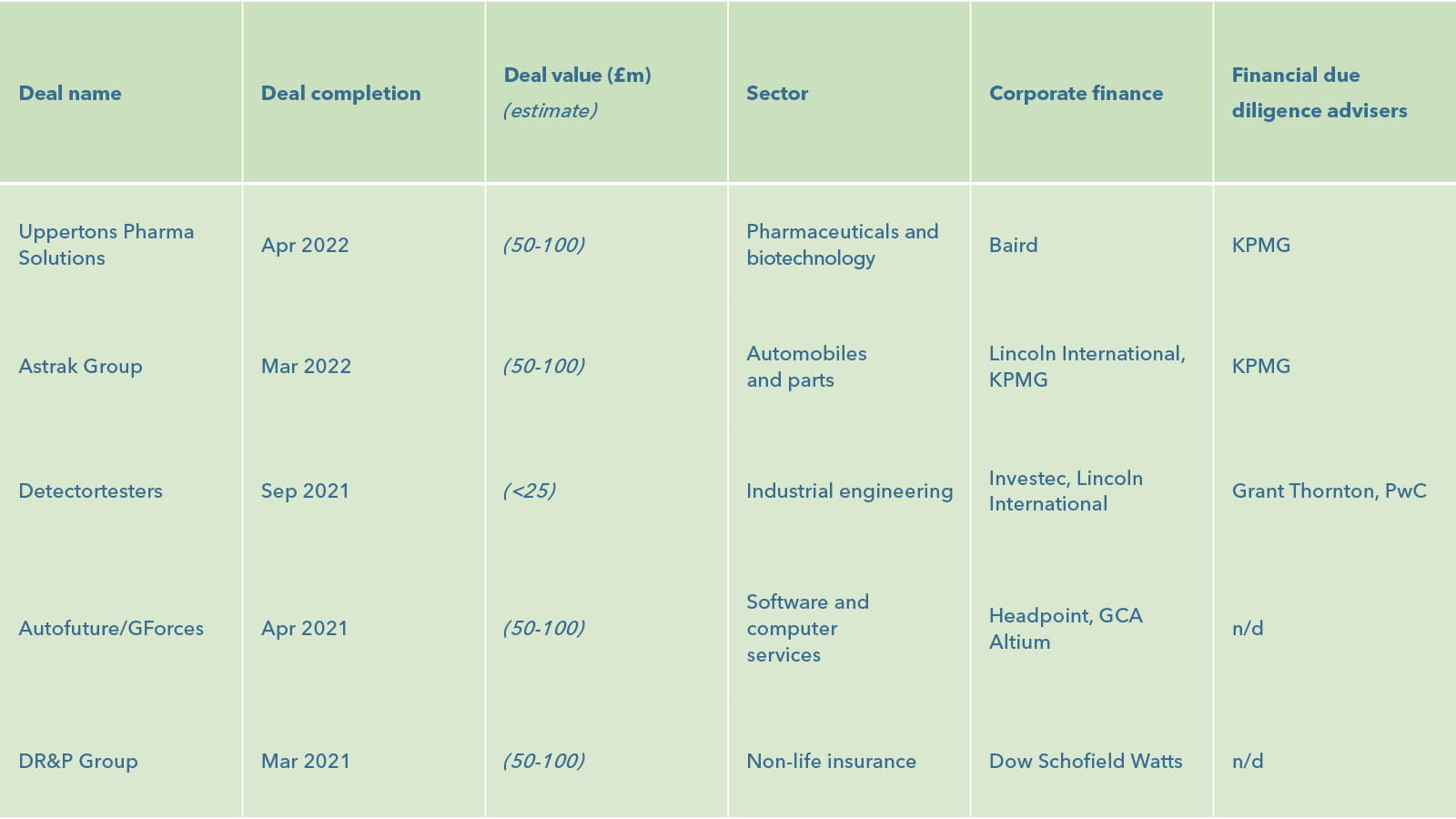

2 Inflexion Private Equity

“In a typical year, we invest between £1.2bn and £1.5bn,” says Inflexion partner Richard Swann, making it the largest UK mid-market PE player by accumulated deal size, if not number. “High-margin, high-knowledge, high-IP businesses with international relevance” are the firm’s sweet spot, covering tech as well as parts of the healthcare and pharma sectors. The firm has completed 27 deals over the past five-and-a-half years.

Inflexion’s current portfolio stands at 56 businesses with some £900m of earnings before interest, taxes, depreciation and amortisation. “If you added the equity capital to the debt we manage, we’d be a £13bn market cap, FTSE40 company. That’s the scale and influence of mid-market players,” says Swann.

Inflexion has three funds currently: Buyout Fund VI, which is targeting a £2.5bn close this year, Partnership Capital (£1bn) and Enterprise (£400m).

N/D = NOT DISCLOSED

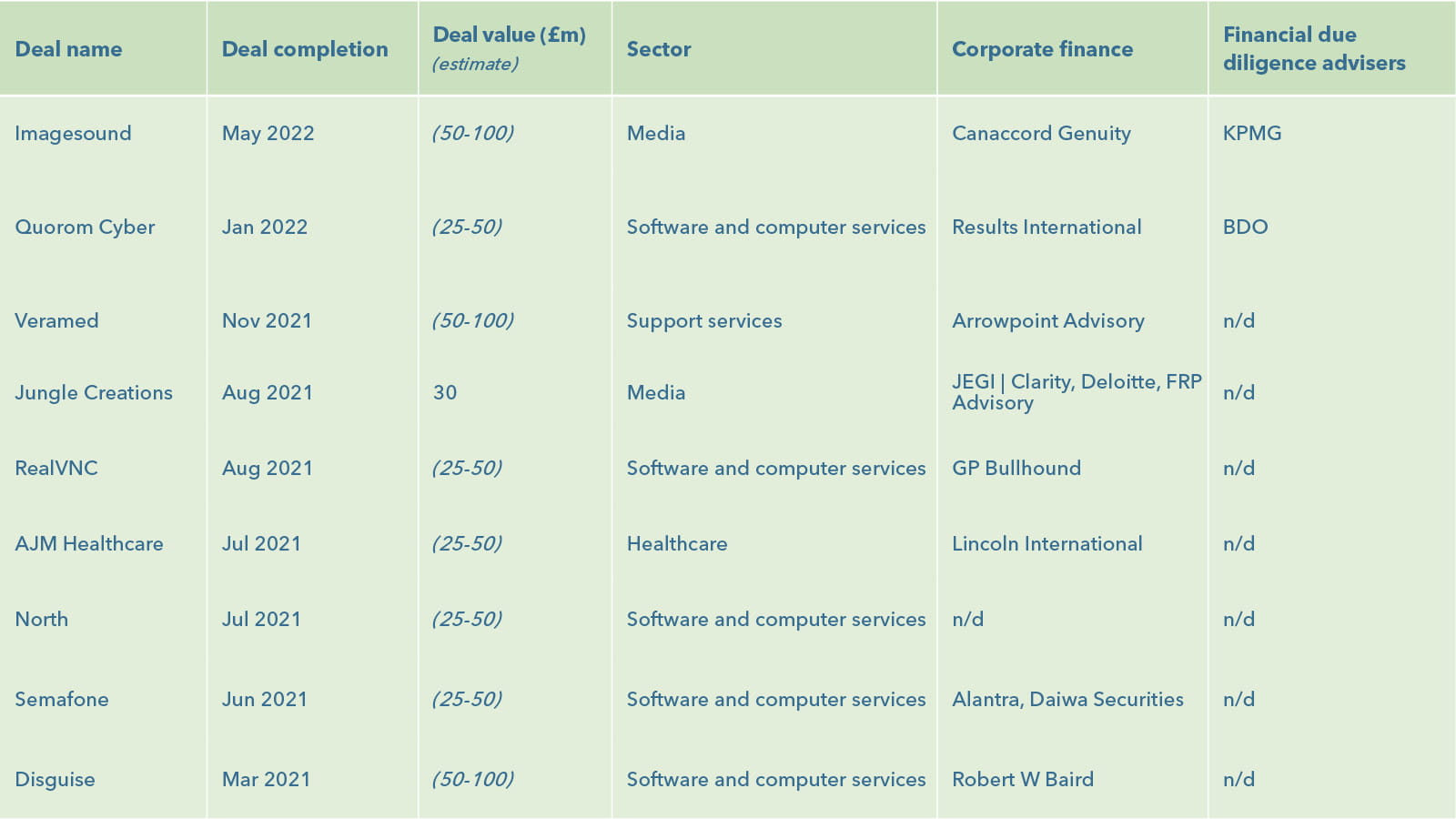

3 Livingbridge

London-based Livingbridge had a busy 2021, investing in seven businesses, deploying its flagship £1.25bn mid-market seventh fund, as well as a £350m small cap fund. “We’re still very much in deployment mode,” says the firm’s head, Wol Kolade, who adds that investments are focused on “thinking-type businesses”, as evidenced by recent software and IT deals for companies such as Quorum Cyber, RealVNC and Semafone.

Livingbridge’s investments are mainly UK-based, but with offices in Boston and Melbourne it also looks for international opportunities. It invests into businesses with enterprise values of up to £300m, and has projected five-year hold periods. A typical investment saw Livingbridge buy 51% of branded content creation house and social media publisher Jungle Creations for £30m in August 2021.

N/D = NOT DISCLOSED

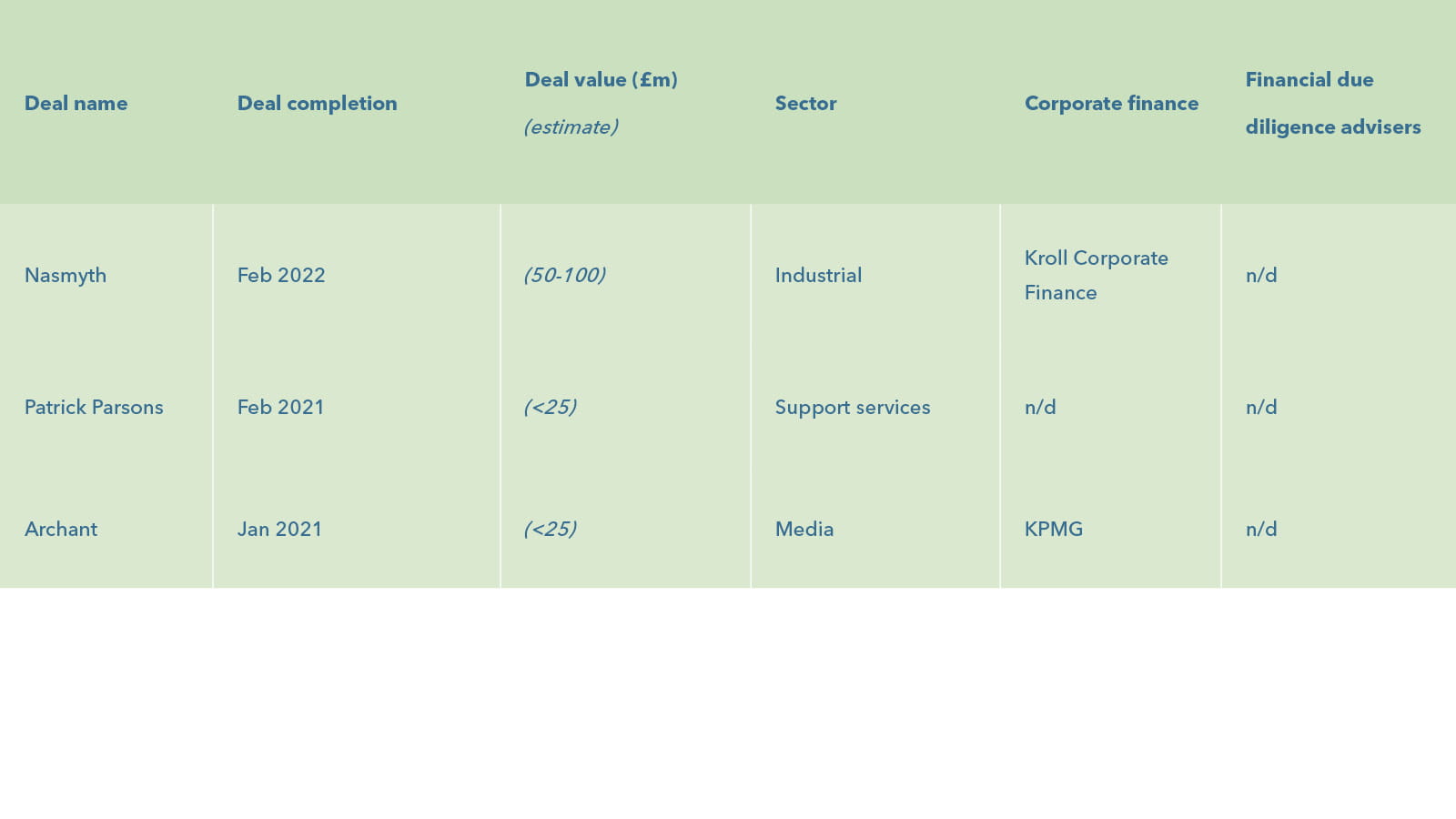

4 Rcapital

With 23 investments during our study’s period, Rcapital specialises in turnarounds for stressed or ‘difficult’ businesses. Its latest investment provides a good example: precision engineers Nasmyth Group serve defence and aerospace clients, but were negatively impacted by the fall in passenger air transport during the pandemic. With the business seeking recapitalisation, Rcapital stepped in to support management, provide stability and act as a catalyst for growth.

N/D = NOT DISCLOSED

5 Northedge capital

NorthEdge’s USP is its location, or rather locations, with offices in Manchester, Leeds and Birmingham, which leads to on-the-ground knowledge of deals available across the English regions. Its £250m ‘Fund III’ is actively investing in targets in the £10m-£45m range. In total, £900m of private equity funds are managed by NorthEdge, investing in the tech, healthcare, business services and specialised industrials sectors.

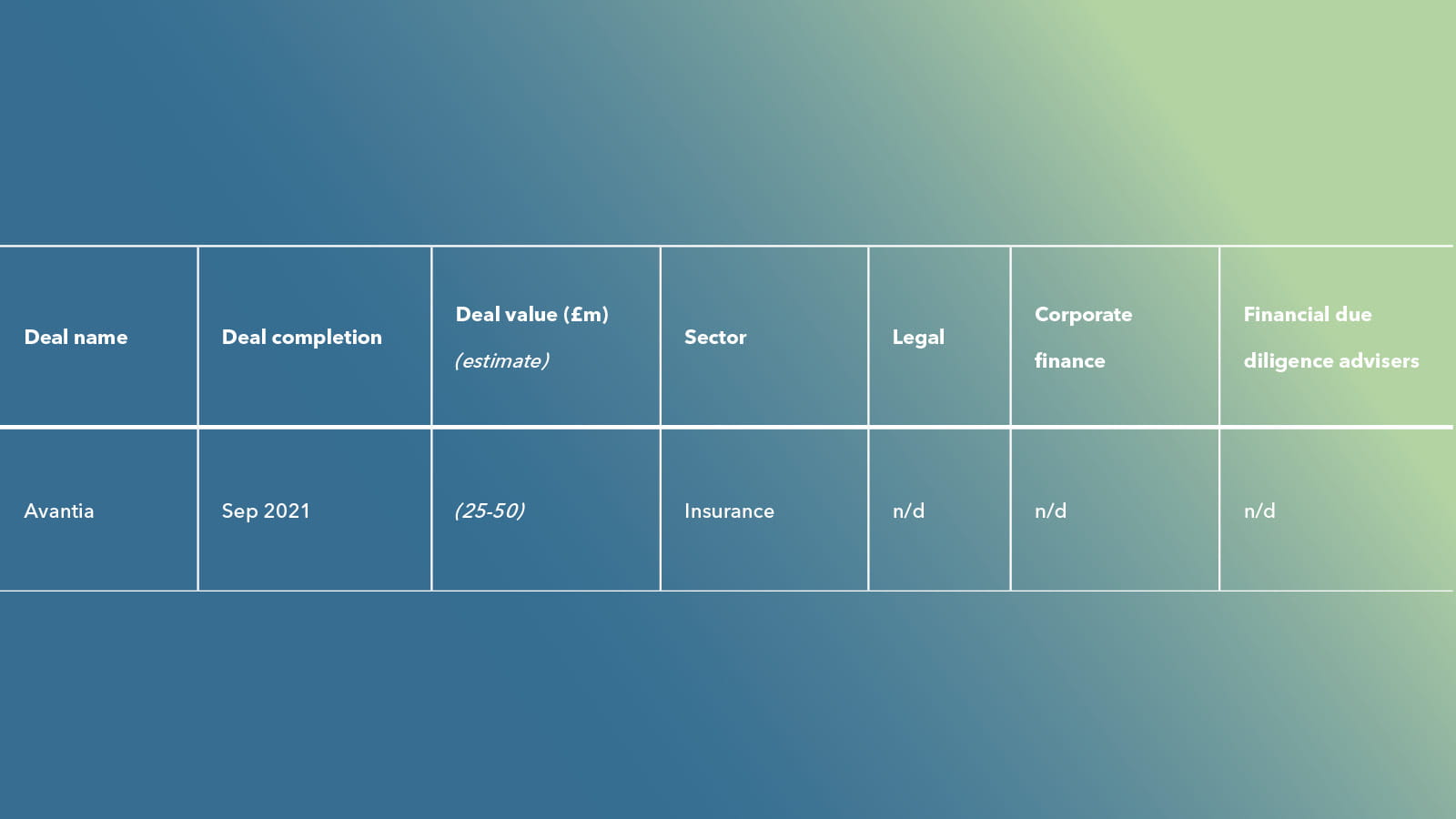

NorthEdge has moved beyond its regional base, however, with its latest deal – a primary management buy-out for ICP (Cadran Services), a global consulting and services firm founded in London and employing 250 people in the UK, the US and Asia. The investment came from NorthEdge’s £125m small to medium-sized enterprise fund and represents “another business services investment in our portfolio that operates in an emerging and exciting market, with huge potential for growth and innovation”, according to the company.

N/D = NOT DISCLOSED

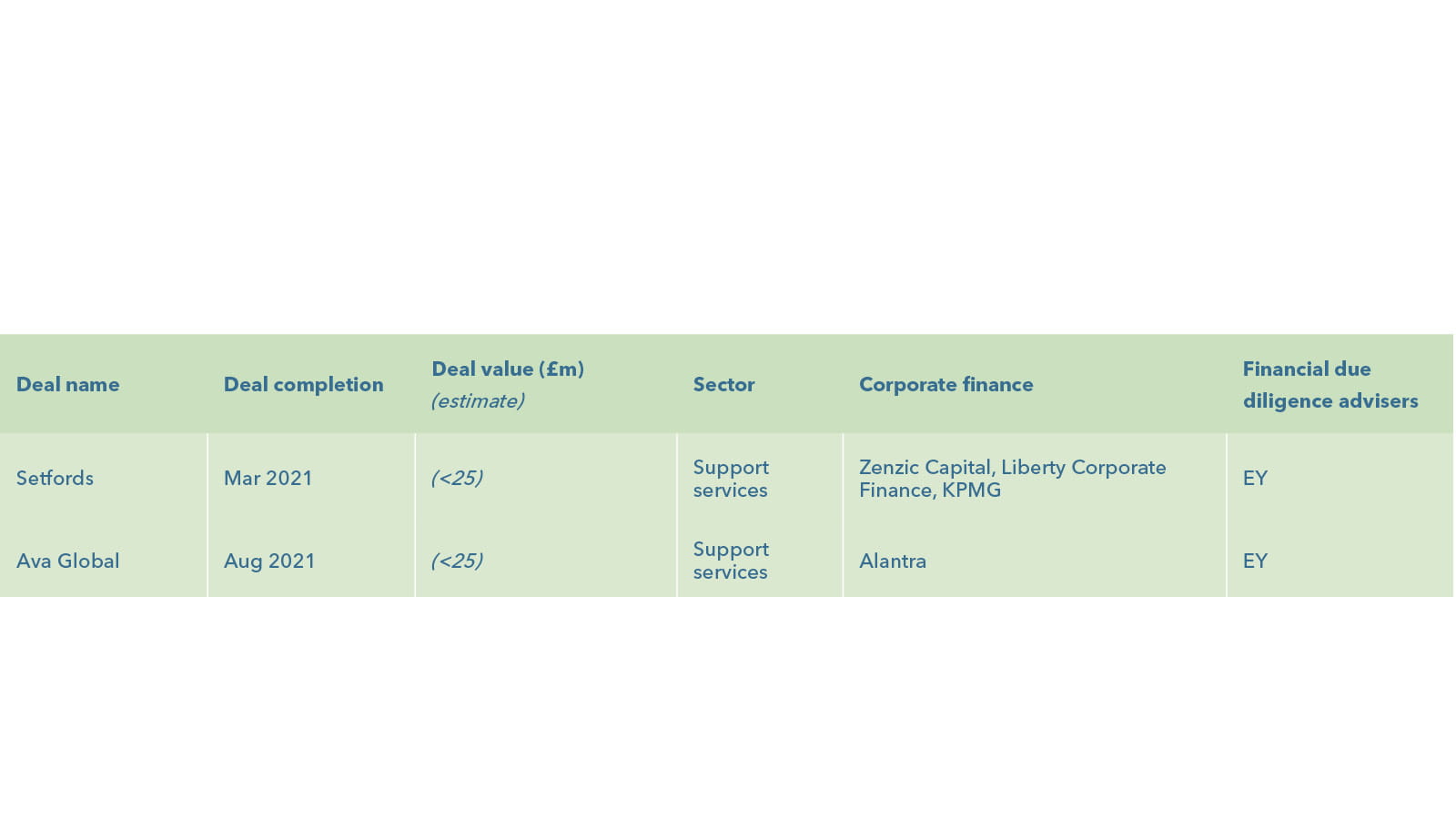

6 Endless

Birmingham-based Endless previously specialised in turnarounds, but despite broadening its approach has made few investments of more than £10m in the past 18 months. It could be set for a spurt of activity, with many earlier investments reaching the end of their hold periods.

Endless has also recently closed its Enact III SME fund at £100m, to invest in opportunities in the UK lower mid-market. This follows 2021’s £400m Endless V fund, which aims to back businesses that “do not meet the investment criteria of traditional private equity or bank funding, with the aim of driving change through the investment of capital, partnering with management, providing operational expertise, offering hands-on support and focusing on value creation”.

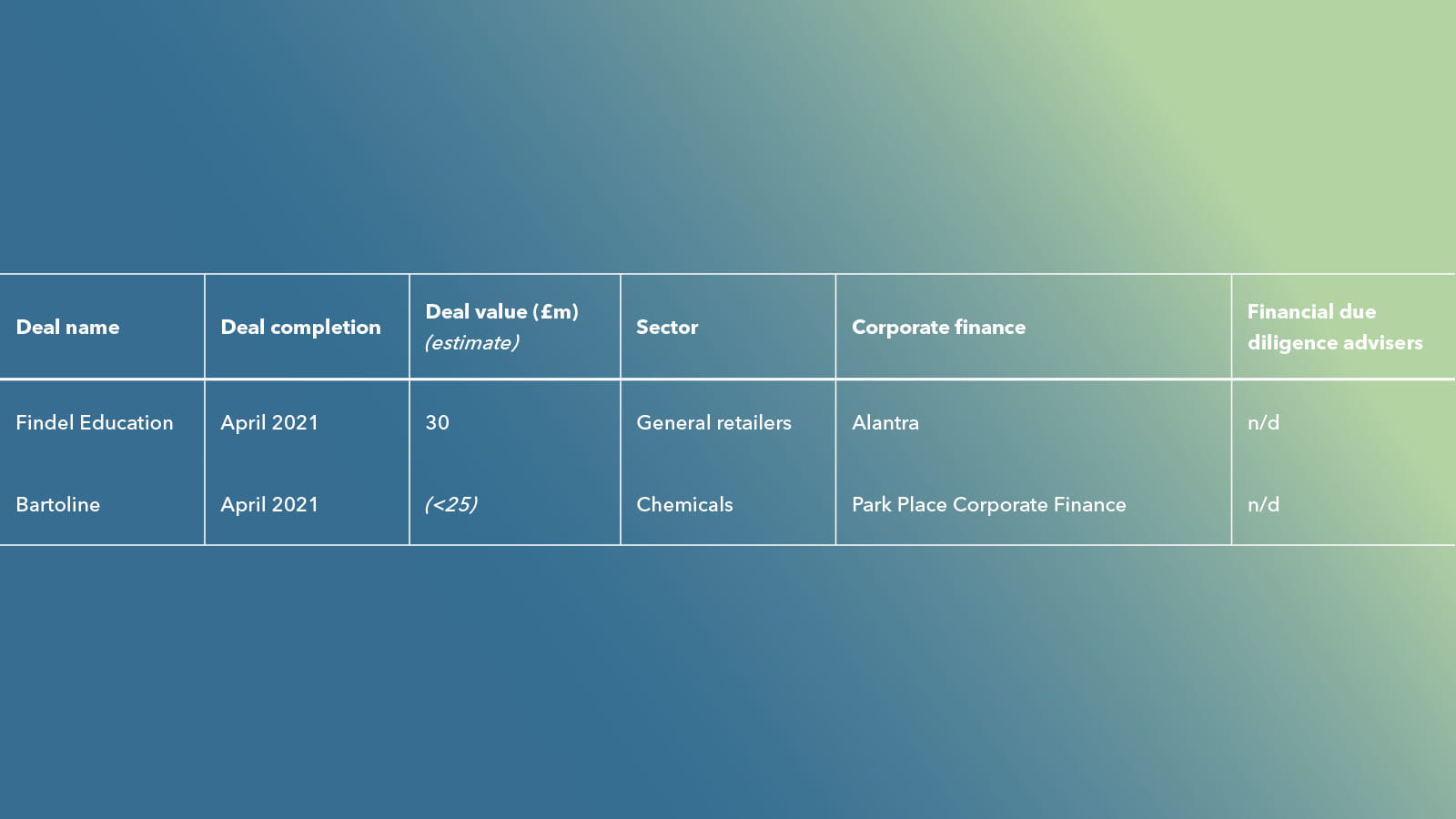

The first investment for Fund V was the backing of a £30m management buyout of Findel Education, a supplier of educational equipment to schools and nurseries, which was carved out of its corporate vendor, Studio Retail Group.

N/D = NOT DISCLOSED

7 ECI Partners

ECI, with offices in London, Manchester and New York, has had a quiet 2021 and, so far, 2022 in terms of mid-market purchases. Its fund strategy is to look for ‘growth and resilience’ for its blue-chip pension fund, insurance, private bank and family office backers. Closing its ninth fund last year, ECI announced a three-times return, as well as a couple of tech unicorns (Auction Technology Group and Wireless Logic) in the previous portfolio.

Its 11th buy-out fund is pursuing the same strategy, with £700m to deploy for 25 institutional investors. The firm has exited four investments so far in 2022, having exited seven in 2021 (which generated an average 3.5-times return). Recent investments have tended towards tech and B2B services. Just before press, ECI completed a deal for digital transformations company BCN Group, buying the Manchester-based growth company from Beech Tree Private Equity.

N/D = NOT DISCLOSED

8 Palatine Private Equity

Manchester-based Palatine runs a buy-out fund for £10m-£50m investments, as well as an ‘impact fund’ that actively targets companies creating positive social or environmental change, with investments of between £5m and £20m.

It claims to be the first UK private equity house to have a returns-based impact fund, with investments including Anthesis – a sustainability business consulting service – and Easyfundraising, which raises money for charities through online shopping rewards. Anthesis has already made use of Palatine’s backing with three M&A transactions in six months, as it seeks to buy its way to international growth.

Palatine closed its £220m Fund IV in 2021, again with an emphasis on environmental, social and governance investments.

N/D = NOT DISCLOSED

9 Phoenix Equity Partners

Phoenix has raised more than £1.5bn from mainly institutional investors across four funds since its foundation in 2001. With 13 mid-market buy-outs since 2016, the London-based team is headed by managing partner David Burns.

Concentrating on “niche sub-sectors with strong non-GDP correlated growth drivers”, active funds include the £420m 2016 fund, where some investments are beginning and some are being exited.

Fund manager and chief financial officer Steve Darrington says Phoenix typically looks to invest between £20m and £50m as a control investor, and looks at consumer and leisure, healthcare, education, financial services, media and information, services, and technology.

Darrington sees a strong future for mid-market private equity, where “to maintain its returns, the pendulum has got to start swinging back to smaller and medium-sized opportunities, where a business can grow and potentially disrupt its market, because they are the ones that can create alpha returns”.

10 Graphite Capital

Phoenix has raised more than £1.5bn from mainly institutional investors across four funds since its foundation in 2001. With 13 mid-market buy-outs since 2016, the London-based team is headed by managing partner David Burns.

Concentrating on “niche sub-sectors with strong non-GDP correlated growth drivers”, active funds include the £420m 2016 fund, where some investments are beginning and some are being exited.

Fund manager and chief financial officer Steve Darrington says Phoenix typically looks to invest between £20m and £50m as a control investor, and looks at consumer and leisure, healthcare, education, financial services, media and information, services, and technology.

Darrington sees a strong future for mid-market private equity, where “to maintain its returns, the pendulum has got to start swinging back to smaller and medium-sized opportunities, where a business can grow and potentially disrupt its market, because they are the ones that can create alpha returns”.

N/D = NOT DISCLOSED

First published in Corporate Financier, Issue 245, September 2022