Introduction

This helpsheet has been issued by ICAEW’s Technical Advisory Service to help members understand the limited situations in which a subsidiary may be excluded from consolidation under FRS 102 and the accounting treatment for such subsidiaries.

Members may also wish to refer to the following related helpsheets:

Exemptions from consolidation

Most exemptions surrounding consolidation are contained within company law and are echoed within FRS 102.

Companies Act 2006 section 399 “Duty to prepare consolidated accounts” only applies to an entity that is a parent entity at the end of its financial year. As such, consolidated accounts will not be required by an entity that ceases to be a parent before its period end date, ie if it disposes of all of its subsidiaries.

This is regardless of the size of the group the parent entity once headed.

Exemptions from preparing consolidated accounts

FRS 102 paragraph 9.3 outlines the exemptions from preparing consolidated accounts. Broadly, for accounting periods commencing on or after 1 January 2021, a parent need not prepare consolidated accounts if:

- the parent, and the group headed by it, qualify as small under s383 of the Companies Act 2006 and the parent and the group are considered eligible for the exemption as determined by reference to sections 384 and 399(2A) of the Companies Act 2006; or

- the parent is included in the consolidated accounts of a UK parent, its immediate parent is established under the law of any part of the UK and all the requirements set out in s400 of the Companies Act 2006 are met*; or

- the parent is included in the consolidated accounts of a non-UK parent and all the requirements set out in s401 of the Companies Act 2006 are met*; or

- all the subsidiaries are required to be excluded from consolidation by FRS 102 paragraph 9.9 (Companies Act 2006 s402); or

- for a parent not subject to the Companies Act 2006, if the statutory framework that applies to it (if any) does not require the preparation of consolidated financial statements.

* These exemptions do not apply if any of the parent’s transferable securities are admitted to trading on a UK regulated market.

The term “included in consolidated accounts” is met regardless of the period of transactions that have been included in the consolidation. If the balance sheet has been combined and transactions for the period since acquisition have been incorporated into the group profit and loss account, even if this is just 1 day, then the entity has been included in consolidated accounts.

BREXIT

For accounting periods beginning before the end of the transition period (31 December 2020):

- The consolidation exemption offered by s400 was wider such that it was available where the company is included in the consolidated accounts of an EEA parent and its immediate parent is established under the law of an EEA state.

- The consolidation exemption offered by s401 was available where the parent was included in the consolidated accounts of a non-EEA parent.

In practical terms the change in legislation as a result of Brexit did not alter the availability of the exemptions available, it simply amended which section of Companies Act 2006 was being applied, dependent on whether the parent taking exemption had a UK or non UK registered parent itself.

Excluding subsidiaries from consolidation

Where a parent entity is required to prepare consolidated accounts, as a general rule, both the Companies Act 2006 and FRS 102 require that all subsidiaries are included within the consolidation.

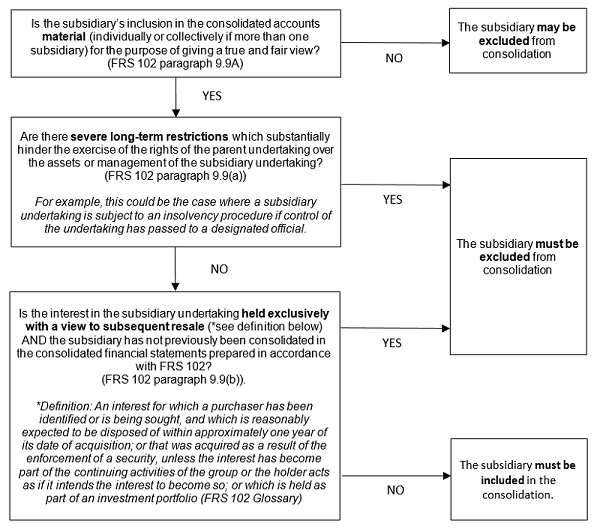

The Companies Act 2006 s405 does, however, offer a number of situations in which subsidiary undertakings are permitted to be excluded from consolidation. FRS 102 narrows the scope of these exclusions to the very limited circumstances set out in the following flowchart.

Accounting for subsidiaries excluded from consolidation

Where a subsidiary is excluded from consolidation, it is necessary to consider how to account for the subsidiary.

Excluded due to immateriality

If a subsidiary is excluded from consolidation on the grounds of immateriality, whilst users are unlikely to be influenced by the accounting for the subsidiary, the subsidiary should be accounted for in accordance with FRS 102 paragraph 9.26 which enables a choice of accounting policy between:

- Cost less impairment; or

- Fair value with changes recognised in other comprehensive income (OCI); or

- Fair value with changes in fair value recognised in profit or loss.

Whichever accounting policy is adopted, it must be applied consistently to all such subsidiaries.

Excluded due to severe long term restrictions

A subsidiary excluded from consolidation on the grounds of severe long term restrictions shall be accounted for in accordance with FRS 102 paragraph 9.26 (as above), except where the parent still exercises a significant influence over the subsidiary, in which case the parent should treat the subsidiary as an associate using the equity method as set out in FRS 102 paragraph 14.8 (FRS 102 paragraph 9.9B).

Excluded due to being held exclusively with a view to resale

A subsidiary excluded from consolidation on the grounds that the subsidiary is held exclusively with a view to subsequent resale shall be measured at fair value through profit and loss if it is held as part of an investment portfolio, otherwise the requirements of FRS 102 paragraph 9.26 apply (as above) (FRS 102 paragraph 9.9C).

If in doubt seek advice

ICAEW members, affiliates, ICAEW students and staff in eligible firms with member firm access can discuss their specific situation with the Technical Advisory Service on +44 (0)1908 248 250 or via webchat.

© ICAEW 2026 All rights reserved.

ICAEW cannot accept responsibility for any person acting or refraining to act as a result of any material contained in this helpsheet. This helpsheet is designed to alert members to an important issue of general application. It is not intended to be a definitive statement covering all aspects but is a brief comment on a specific point.

ICAEW members have permission to use and reproduce this helpsheet on the following conditions:

- This permission is strictly limited to ICAEW members only who are using the helpsheet for guidance only.

- The helpsheet is to be reproduced for personal, non-commercial use only and is not for re-distribution.

For further details members are invited to telephone the Technical Advisory Service T +44 (0)1908 248250. The Technical Advisory Service comprises the technical enquiries, ethics advice, anti-money laundering and fraud helplines. For further details visit icaew.com/tas.

Download this helpsheet

PDF (189kb)

Access a PDF version of this helpsheet to print or save.

Download-

Update History

- 01 Dec 2015 (12: 00 AM GMT)

- First published

- 02 Feb 2021 (02: 35 PM GMT)

- Changelog created, helpsheet converted to new template

- 02 Feb 2021 (02: 36 PM GMT)

- Updated for proposed Brexit related changes and removed refs to Sept 2015 version of FRS 102.

- 29 Oct 2021 (12: 00 PM BST)

- Helpsheet reviewed, no changes to content.

- 07 Nov 2022 (12: 00 AM GMT)

- Name changed to Exemptions from preparing group accounts and when a subsidiary can be excluded from consolidation under FRS 102. Scope of helpsheet changed by including the exemptions section removed from the Groups and consolidated accounts helpsheet.

- 21 Jan 2025 (12: 00 AM GMT)

- Clarification/interpretation points added around Companies Act 2006, based on frequently asked questions received through the Technical Advisory helpline