Building a shared service centre marks an important milestone for a business. It also presents unique challenges to a retained finance function. Alistair Marsden offers some tips on meeting these successfully.

The establishment of a shared service centre is only a step, albeit a large one, towards a world class finance function. It is, as the cliché goes, part of ‘a journey’. Motivating the retained finance function is important throughout this journey to ensure effective performance in terms of financial reporting accuracy, effective business partnering and strong internal controls.

What next?

The establishment of a shared service centre presents unique challenges to a retained finance function that has been reduced significantly in size, possibly feels a little bit unloved and may well be wondering, ‘what next?'

No golden rules

The first golden rule is that there are none!

A lot of consulting houses have sound methodologies on how to approach change management. But be wary of getting swept along on the back of such theory and dogma. In reality the situations that you deal with will be variable and unpredictable, and your decisions rely more on your own knowledge of the business and the people involved than on text book responses.

In the absence of golden rules, though, I can offer six tips (below) derived from my own experience of this sort of change programme. They are as follows:

Six tips for managing the retained finance function

1. Give ‘heart’ and ‘head’ equal importance

This is an emotional journey, and constant reminders of the business case to the exclusion of the emotional impact are a sure fireway to fail.

As a finance person, I know it is often easier to focus purely on the logic behind any decision. Most finance transformations have a sensible efficiency argument at their core, for example, ‘the establishment of a shared service centre in a low cost jurisdiction and headcount reductions in other countries to drive productivity and labour cost savings’. It’s hard to argue against that!

Yet driving the change means that the retained finance organisation will go through a lot of uncertainty and loss of jobs. At the same time the expectation is for higher performance from the remaining people. They have to maintain financial reporting accuracy and a strong control environment in a riskier climate as well as leading multiple system implementations and managing a team that is shrinking as staff are laid off.

You have to win both hearts and minds. Academic research suggests that the team will support your decision, even if they disagree with it, if a fair process is followed. As an example, during the reorganisation at Covidien we held regular and open meetings, often with some very direct questions about the project from staff leaving the organisation. It may have been easier to have avoided these meetings but the leadership team earned more respect by addressing the issues head on. During the transformation we posted as open jobs all roles that we legally could – including the more senior ones. We also promoted objective assessments of skills and experiences in the interview process, and gave feedback to unsuccessful candidates – not always easy conversations, but ones that earned us respect.

You need an 'end vision' in sight that acts as a guiding light to keep you all on course

2. Establish a clear vision for the finance organisation

Change brings a lot of uncertainty and stormy waters, so you need an ‘end vision’ in sight that acts as a guiding light to keep you all on course. When preparing the vision you should be asking how you want to be perceived by your stakeholders and by the finance team. You should consider both the service you offer and how you intend to develop your staff.

Allow the vision to be developed by the entire finance team. It should be motivational, encompassing not just what’s in it for finance internal customers but also what’s in it for finance staff (whose main concern is often their own development).

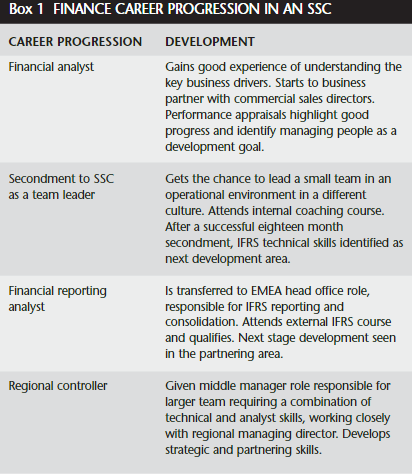

Remember that after the implementation of a shared service centre, career paths within the retained finance organisation can become hazy. It is therefore important to paint some pictures of how careers can progress in this new world and how the organisation can help in that. An example is set out in Box 1.

3. Pick the future finance leaders early and empower them to lead the finance transformation locally

Managing change happens most effectively in the physical location undergoing the change. No matter how skilled the head office leaders are, there is no replacement for local leaders with ‘skin in the game’, who can feel the pulse of their local organisation. Pick the future local leaders early in the transition. As well as reducing uncertainty this creates a team of motivated leaders that can drive the benefits realisation and the systems implementations as well as maintaining the local control environment.

4. Invest in personal development with a particular emphasis on interpersonal skills

You will be asking many of these local finance leaders to go into uncharted territory. They will need to be able to build effective teams and good relationships with the shared service centre and the wider business while the foundations of the organisation are being shaken.

While accounting technical skills cannot be ignored, the emphasis should be on leadership skills to enable the local leaders to drive the change locally. Financial reporting errors during change programmes are much more likely to come from a communication issue rather than a lack of technical knowledge. Effective coaching skills are important and should be included as one of the key skills required for more senior managers. Good coaching enables leaders to build capability at lower levels in the organisation, encouraging more effective communication by promoting two-way feedback and helping to soften the hard edges of a change programme.

So training budgets should be evenly balanced between technical and leadership development. Key to this is a relatively centralised budget based on formal departmental training needs analysis linked to performance appraisals. This enables the identification of training hot spots and more effective sourcing of training.

Training budgets should be evenly balanced between technical and leadership development

5. Pick your advisors carefully... but do not outsource leadership

You can’t do absolutely everything, so recognise where you and your team have strengths and have enough humility to see where you could benefit from support. From my experience, skills such as facilitation, coaching and communication are in short supply during the ongoing journey to world class.

Getting the balance right between external and internal resource is important. Too many internals and you may not have all the skills you need. Too many externals and you will not have the experience you need and you may become over-dependent on consultants.

Go for one or two trusty and highly skilled advisors from the outside and then use the change programme to stretch internal candidates and to build the in-house capability. The emphasis should be on advice; decision making must remain with functional leadership.

6. Keep the impetus going after the shared service centre is built

After so much change, you may feel inclined to sit back in the steady state. This is likely to have a demotivating impact on staff who have probably learned a lot from the challenges of the transformation. They will be hungry for the next challenge. Encourage innovation within the retained finance group to drive world-class performance.

Conclusion

So what about that unloved retained finance organisation I mentioned earlier – the one wondering ‘what next?’ In truth, if the transformation is successful then the retained finance organisation will have grown in skills and experience (if not in number), and should not only have a clear vision of what happens next but will now be saying ‘Bring it on!’

About the author

Alistair Marsden led the EMEA finance transformation at Covidien. He is an independent consultant and masters student at the University of Oxford.

Download pdf article

- Managing the retained finance function

Finance & Management Magazine, Issue 194, December 2011.

More support on business

Read our articles, eBooks, reports and guides on finance transformation

Finance transformation hubFinancial management eBooksCan't find what you're looking for?

The ICAEW Library can give you the right information from trustworthy, professional sources that aren't freely available online. Contact us for expert help with your enquiries and research.