Company Voluntary Arrangements (CVAs) and Restructuring Plans (RPs) are very effective restructuring tools that can continue to rescue distressed companies. This is particularly so in light of the current macroeconomic headwinds facing many businesses.

Company Voluntary Arrangements

A company voluntary arrangement is a procedure whereby a company can restructure its debts and obligations via a proposal to its creditors. Provided that greater than 75% (in value) of creditors (of which 50% in value are unconnected) vote in favour of a company’s proposal, it is binding on all creditors.

Despite criticism in recent years that the procedure can be unfair to landlords, where a company’s future obligations to them under property leases are restructured by a company’s proposal, recent judgments have offered much-needed market reassurance that CVAs will continue to play a central role for companies looking to implement real estate lease restructurings.

In particular, judgments on two cases – one involving Debenhams (1) and the other relating to New Look (2) – have not only endorsed the use of the CVA, but also provide great clarity to restructuring practitioners. The court has rightly taken a very commercial approach to the use of CVAs to compromise leasehold liabilities.

Provided compromised landlords have the right to recover their premises and the relevant comparator clearly evidences a lower return to creditors than the CVA, the ‘fairness’ of the modifications itself is not something that the court would assess as part of an unfair prejudice challenge. The key takeaways from recent judgments are outlined in brief below.

Market rent, break rights and modifications to lease terms

The judgment in the New Look case made clear that modifications to leases (for example, move to turnover rent, rolling break rights, etc) by the terms of the CVA are purely a ‘commercial question’. The ‘fairness’ of the modifications itself is not something that the court would review as part of an unfair prejudice challenge, provided landlords have a break right to terminate their lease and recover the premises.

Going forward, this means that amendments to leases can be assessed by the company and its advisers as to what is commercially fair and reasonable to obtain support of landlords, while ensuring that a break right is available to landlords and that the CVA offers the best outcome.

Discounts applied to landlord voting claims/future rent in CVAs

The Insolvency Rules permit a discount to be applied for voting purposes in relation to future contingent claims, that is future rent. It is expected that a 25% discount will be applied to value future rent claims for voting purposes, as accepted by the court in New Look. This is welcome clarity for practitioners.

Secured financial creditors voting in the CVA

A secured creditor can vote its ‘under-secured’ portion of its total claim, that is any shortfall where the value of the security does not meet the total amount of the creditor’s claim, and this would not constitute unfair prejudice, depending upon the background and circumstances of the specific case.

Insolvency Service research

Since the judgments outlined above, in June 2022 the Insolvency Service commissioned RSM to conduct research into the treatment of landlords in CVAs. The overall conclusion of the report was that “landlords are, broadly, equitably treated compared to other classes of unsecured creditors”.

To conclude, in circumstances where a company requires an operational restructuring, or has a capital structure with unsecured debt – for example, from shareholder funding/intercompany loans or third-party debt instruments, or under-secured debt – a CVA is still a very viable restructuring tool that now has clear endorsement from recent judgments and support from the Insolvency Service.

Restructuring Plans

Falling under part 26A of the Companies Act 2006, the Restructuring Plan (RP) is one of the statutory procedures available to a company that has encountered or is likely to encounter financial difficulties. RPs require two court hearings: one to convene meetings of creditors (and if relevant, members) and a second – a sanction hearing – to approve the decisions of the class meetings.

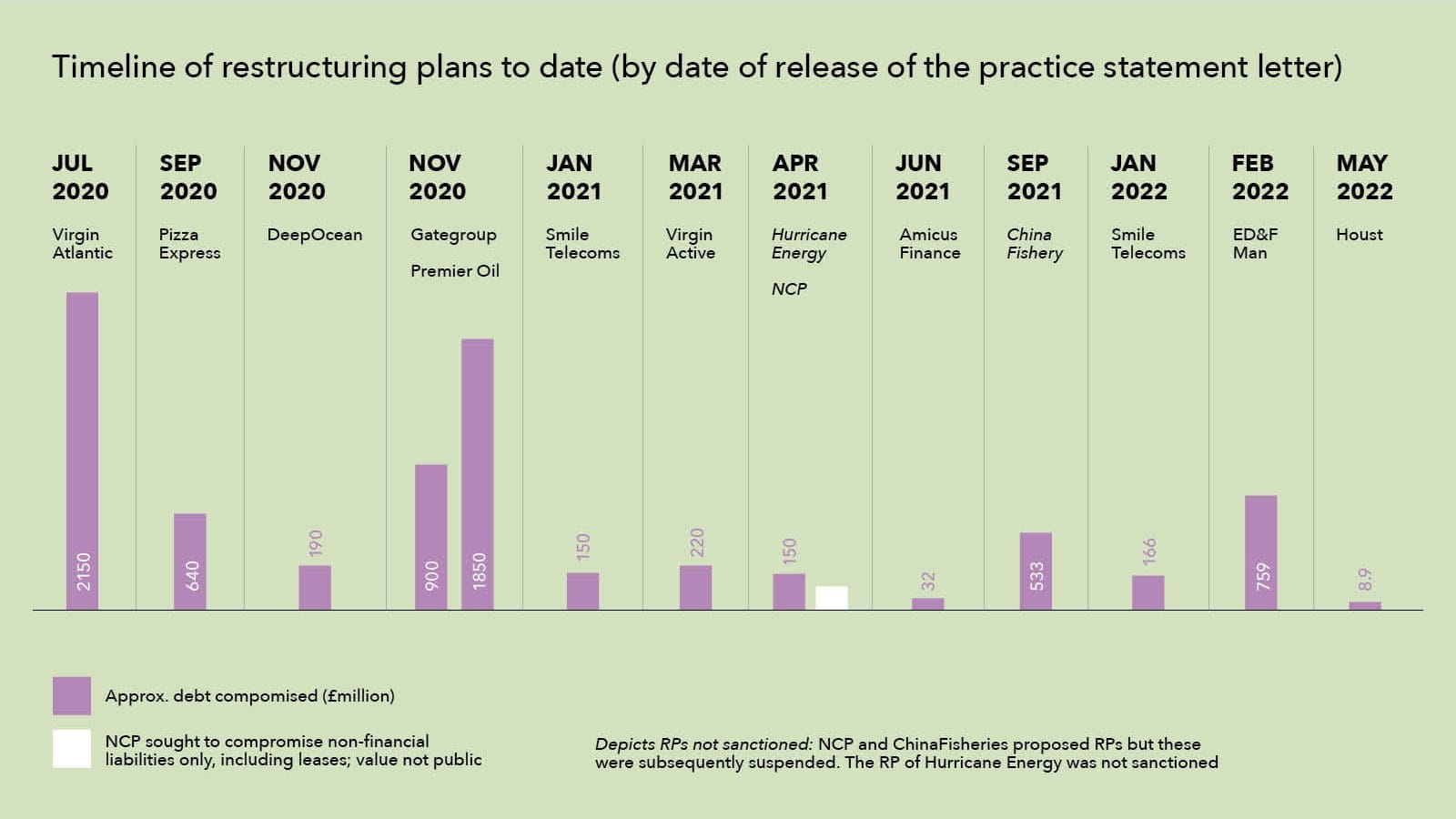

Eleven Restructuring Plans have received court sanction since RPs were introduced in June 2020, as illustrated below.

RPs can compromise dissenting secured creditors, unlike a CVA which cannot bind secured or preferential creditors without their consent. This offers the possibility of compromising both operational and financial creditors within a single process.

Government review of RPs

A review of RPs was included in the UK Insolvency Service’s recently published interim report on the permanent measures introduced under the Corporate Insolvency and Governance Act 2020. The report – based on independent research conducted by the University of Wolverhampton – concluded that RPs’ cross-class cram down power has been used successfully in cases where previously, a scheme of arrangement alone would not have been effective. The high quality of UK judges adjudicating on RPs is also seen as a real strength.

Use by SMEs

However, the review also highlighted potential areas for improvement. In particular, the report noted that RPs are seen as too costly and time-consuming for use in the SME market and put forward several suggestions to reduce costs of RPs for SMEs. They include:

- dispensing with the convening hearing, in favour of a single sanction hearing;

- permitting Insolvency and Companies Court judges, and not just High Court judges, to hear RPs

- using more junior counsel, as insolvency practitioners and lawyers become more experienced in using RPs;

- appointing a single independent valuation expert, bearing in mind that valuation evidence is often seen as a major source of expense; and

- avoiding huge amounts of evidence – applicants and judges would need to be pragmatic on the disclosure of information stakeholders need to reach an informed decision.

There have been two successful RPs of SMEs to date: Amicus Finance (November 2021) (3) and since the UK Insolvency Service report, Houst (July 2022) (4). The court in Houst was very conscious that, as an SME, the company faced difficult cost/benefit issues in pursuing its RP. It initially declined to sanction the RP, requiring further evidence before it was satisfied that the plan complied with the “no worse off” test.

It is hoped that Houst’s example may facilitate the use of restructuring plans by other SMEs and go some way in addressing the concerns outlined in the UK Insolvency Service report. In binding a dissenting preferential creditor (HMRC), Houst’s restructuring plan has achieved what would not have been possible via a CVA (which cannot bind secured or preferential creditors without their consent).

It is anticipated that the RP will continue to be a very effective restructuring tool and that its use by SMEs will increase.

Elaine Nolan is partner at Kirkland & Ellis and co-editor of Company Voluntary Arrangements: Law and Practice, with South Square’s Tom Smith QC, published by Oxford University Press

References

(1) Re Discovery (Northampton) Limited and others v Debenhams Retail Limited and others [2019] EWHC 2441 (Ch)

(2) Re Lazari Properties 2 Limited and others v New Look Retailers Ltd and others [2021] EWHC 1209 (Ch)

(3) Re Amicus Finance Plc (in administration) [2021] EWHC 3036 (Ch) (Part 26A restructuring plan) (sanction hearing)

(4) Re Houst Limited [2022] EWHC 1941(Ch) (Part 26A restructuring plan) (sanction hearing)

Recent articles

Future of insolvency

The insolvency landscape is changing, and its role is more essential than ever. From new regulation, trends and career roles to advice for firms and the challenges ahead, this special explores all angles of the issue.