The UK has an ambition to be the first country in the world to make disclosures aligned to the Task Force on Climate-related Financial Disclosures (TCFD) framework fully mandatory across the economy, with the majority of measures planned to be in force by 2023.

The Financial Conduct Authority (FCA) issued a Listing Rule requiring that, for accounting periods beginning on or after 1 January 2021, companies with a premium listing include a statement in their annual report and accounts (ARA) setting out whether they have made disclosures consistent with the recommendations of the TCFD, or to explain why they have not done so.

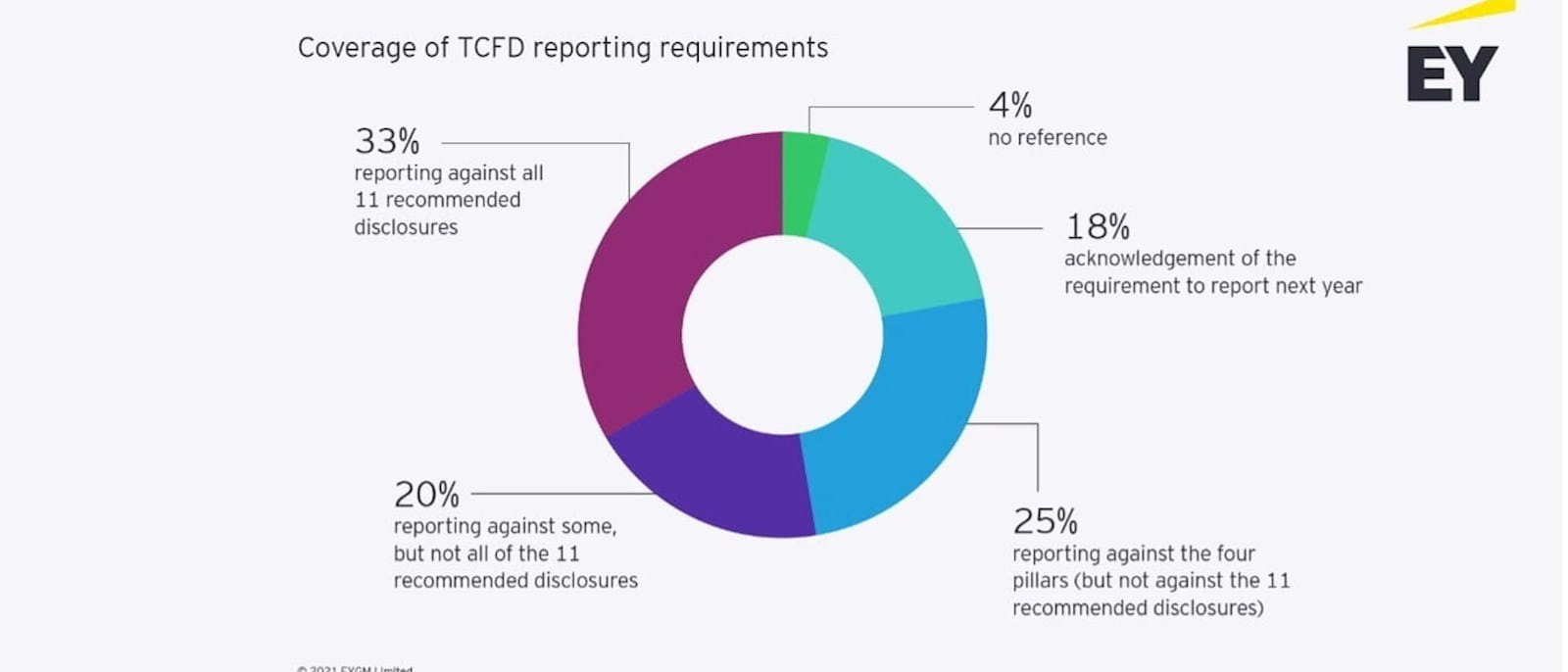

Based on EY’s review of TCFD reporting in over 100 ARAs of 31 December 2020 FTSE 100 and FTSE 250 reporters as shown in Fig. 1, only a third report fully against all 11 TCFD recommended disclosures and nearly a quarter either make no reference to it or simply acknowledge the requirement to report next year. It is clear that companies have their work cut out for them in the next six months.

It is worth pointing out that the disclosure of climate change in the financial statements lags behind narrative reporting and is often not reflective of the quantified information that is already being provided to the CDP (formerly the Carbon Disclosure Project).

Key observations on narrative reporting against the four TCFD pillars

Governance

Most companies in our sample included information on climate governance. Some companies had independent advisory committees, comprising external experts to act as a sounding board. Many reported that climate risks are the responsibility of the whole board, whilst a few named a director or the relevant committee responsible for climate-related issues and 42% of companies have a board committee with specific responsibilities regarding sustainability.

There were a number of approaches between companies at management level, such as the establishment of climate-related internal task forces or working groups. The role of management was generally articulated less clearly than the role of those charged with governance.

Strategy and Risk

Many companies in our sample provided descriptions of climate-related risks and their impact under the TCFD Risk Management pillar. However, strictly speaking these recommended disclosures relate to the TCFD Strategy pillar, with the Risk Management pillar being focused more on the climate-related risk process itself and its integration with the wider risk management process.

Attributing disclosures to the appropriate TCFD pillar will help promote consistency in reporting, however we recognise that integration with other, pre-existing ARA disclosure requirements may result in varied practice developing in this respect in the context of UK corporate reporting.

Ultimately, ensuring that adequate attention is given to improving processes, making the required disclosures and taking meaningful action in response to climate change are more important than the placement of those disclosures.

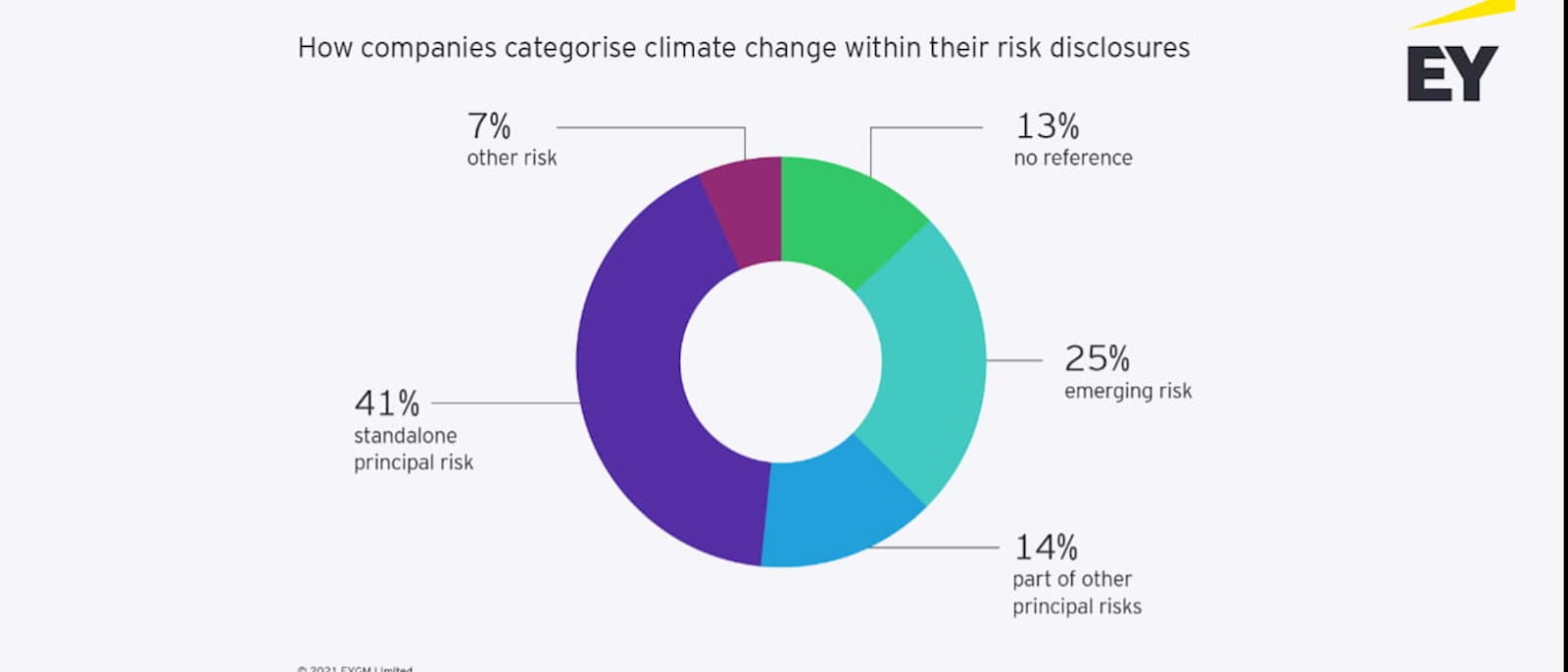

Climate-related risk processes included top-down and bottom-up risk assessments. A number of companies stated explicitly that they had included climate change on the risk register, and undertaken risk projects to strengthen their understanding of current and future climate-related risks. Only 13% of companies within our sample did not make any reference to climate-related risks and 55% had climate change either as a standalone principal risk or as an explicitly referenced constituent of other principal risks. Examples of mitigation activities included setting an internal price on carbon to encourage low-carbon spending, and encouraging specialists to better understand climate-related risk.

Metrics and Targets

Climate Action 100+, the world’s largest investor engagement initiative on climate change, published its Net Zero Company Benchmark analysis in March 2021. In this it noted that 52% of the world's largest emitters had made a net zero commitment of some type but more work is needed on interim targets and the strategy for decarbonisation.

Our findings resonate with this - a number of companies within our sample have set goals such as ‘net zero’, but it is not always clear how progress towards these will be measured, monitored or assured. From our engagement it also appears that reporters are not always clear on the difference between the concepts of net zero, science-based targets and carbon neutrality.

Some businesses will undoubtedly worry about this additional reporting burden. By providing noteworthy examples from FTSE 350 ARAs as well as tips for reporting, including in respect of the integration of information across the ARA, we hope our publication will help premium listed companies respond to mandatory reporting and investor expectations in relation to TCFD recommendations or, where disclosures have already been made, assess their maturity.

But reporting is only ever the outcome. Simply reporting against TCFD and hiding behind disclosures without truly addressing climate change is not going to drive the required transformation to address the world’s climate crisis. This is why in addition to good disclosure examples, we also share hallmarks of leading practices and processes for integrating climate considerations across organisations.

Maria Kepa is a director in EY’s UK Corporate Governance team. Maria specialises in matters of front half reporting and advises premium listed companies on corporate governance arrangements.

Find a range of resources on non-financial reporting requirements for UK companies on ICAEW’s dedicated non-financial reporting hub.

Read the full EY report: Towards TCFD compliance – observations on reporting trends

Join our sustainability community

Join professionals with a collective ambition to deliver a #sustainable world. Membership of our Sustainability and Climate Change Community is free and open to everyone.