Official figures revealed that the UK economy didn’t grow at all in the third quarter of 2023 as the squeeze from inflation and higher borrowing costs suffocated output, according to the Office for National Statistics (ONS). The dominant service sector contracted by 0.1%, mostly driven by declining output from health, management consultancy and commercial property rentals. This was offset by a 0.1% increase in construction output and no growth in the production sector. The monthly data was more positive, with the UK economy growing by 0.2% in September, up from 0.1% in August.

Growing domestic drag from higher interest rates

The detailed ONS breakdown of Q3 UK GDP revealed that consumer spending fell by 0.4%, the first quarterly decline since the end of 2022 and down from growth of 0.5% in Q2. The largest contributions to the fall in the quarter were from lower spending on transport and food and non-alcoholic drinks. Business investment fell by 4.2% in the third quarter, the biggest fall since Q1 2021. However, this fall in business investment did follow two quarters of strong growth of 4.1% in Q2 and 4.0% in Q1. Declines in Q3 investment were recorded in transport equipment; other machinery and equipment; and dwellings. In contrast, an improvement in the UK’s net international trade position helped prevent the economy contracting as exports rose by 0.5% and imports dropped by 0.8%.

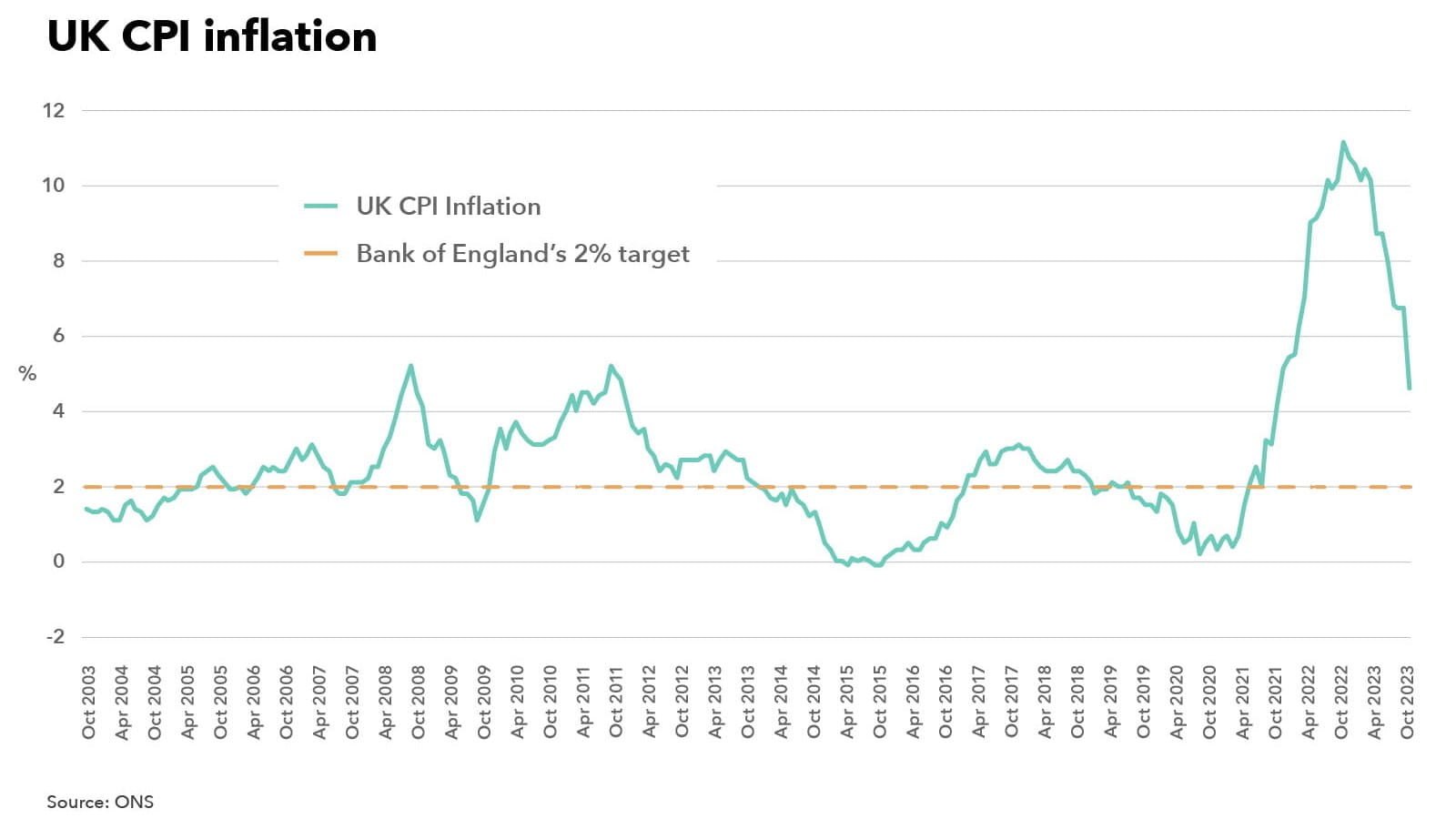

Halving inflation little to do with government action

UK CPI inflation slowed to 4.6% in October 2023, according to ONs figures, the lowest rate for two years (see Chart 1) and down from 6.7% in September which made it the largest fall since 1992. This meant that the Prime Minister’s target to halve Inflation - from 10.7% at the end of 2022, to 5.3% or lower in the last three months of 2023 – was achieved. Significantly, inflation still remains more than double the Bank of England’s 2% target. Furthermore, lower inflation over the past 12 months was more due to the downward pressure on prices from falling global energy costs and rising interest rates than any government action.

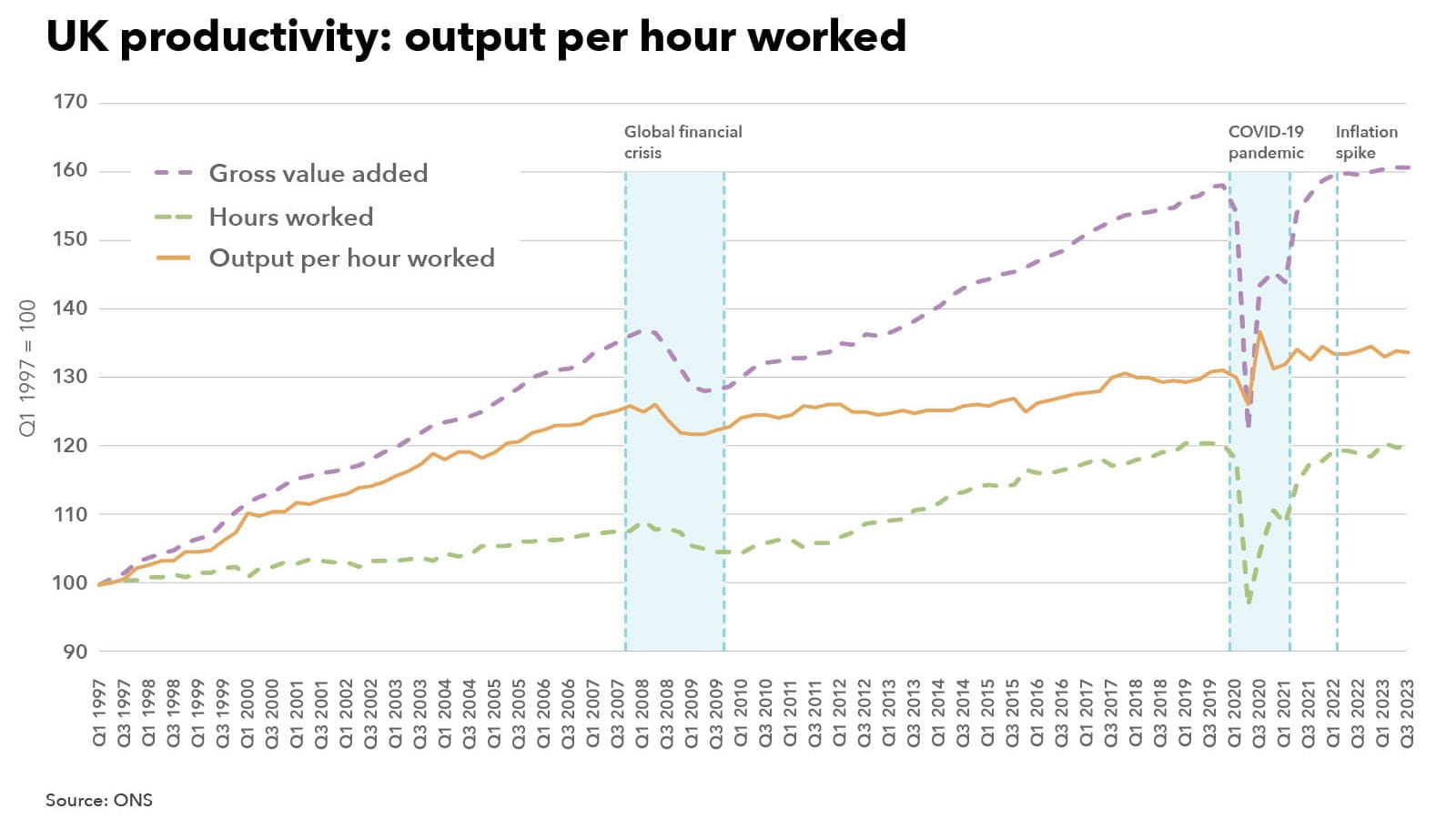

Productivity in the UK falls

UK productivity – as measured by UK output per hour worked – fell by 0.2% in Q3 2023 (see Chart 2) and by 0.3% on the same quarter a year ago. The decline means that productivity is now only 2.5% above its 2019 level. Raising productivity over time is vital to deliver sustainably higher wages and improve living standards. Productivity in the UK grew by around 2% per year before the 2008/09 global financial crisis but has been much weaker since then with the COVID-19 pandemic and the recent inflation surge also weighing on productivity.

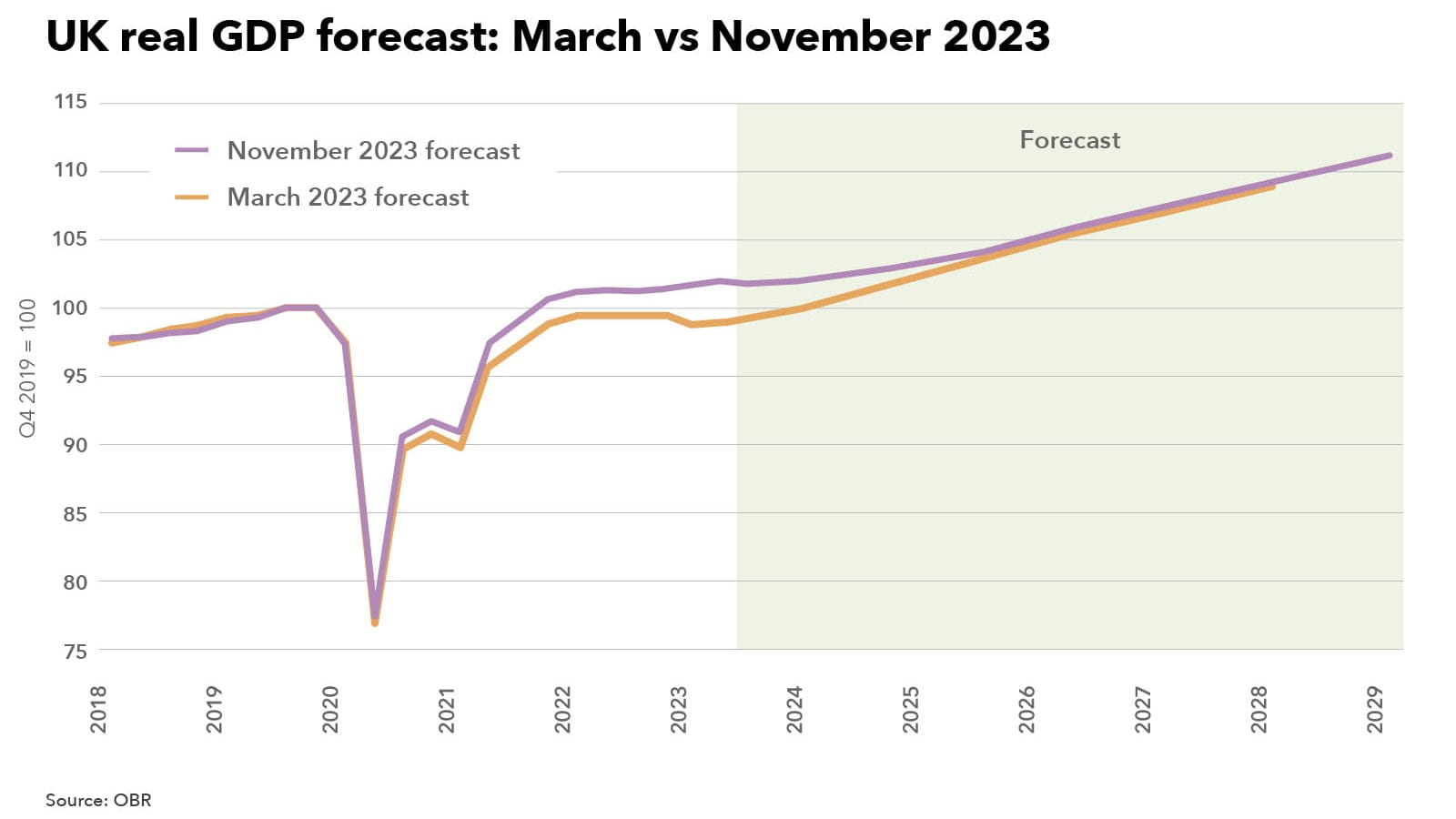

Outlook for UK economy weaker despite positive Autumn Statement

The focus of the Autumn Statement on helping to grow the economy was set against the OBR’s (Office for Budget Responsibility) latest forecasts which paint a bleaker picture of the UK’s near-term growth prospects. The OBR expects the UK economy to grow by 0.6% this year, beating their previous forecast of a 0.2% decline made in March. However, the OBR then expects GDP growth to be 0.7% in 2024 and 1.4% in 2025 (see Chart 3), down from what they expected in March of 1.8% in 2024 and 2.5% in 2025. While making the full expensing investment incentive permanent will help boost investment, the acid test of the myriad of supply-side measures announced in the Autumn Statement will ultimately be whether they are able to meaningfully increase the UK’s growth potential, otherwise living standards will remain constrained.

Implications for accountants, business owners and the economy

While the latest data confirms that the UK has avoided recession this year, the economy is in a tough period, with the lagged impact of previous interest rate rises, an onerous tax burden and a weakening jobs market likely to constrain GDP growth in the fourth quarter.

UK economy – what to watch for this month

- The GDP data, to be released on 13 December, is likely to show that the UK economy largely flatlined in October.

- As part of the next inflation figures for October, due out on 20 December, there will be a strong focus on core inflation – which strips out food, energy, alcohol and tobacco – to see if underlying price pressures are on a firmer downward trend. Currently, core inflation stands at 5.7%, higher than the headline rate of 4.6%.

- October’s fall in inflation seals the deal on an interest rate hold when the next decision is made on 14 December. Look out for a possible three-way voting split among rate setters with a member voting for a rate cut as concerns over a flatlining economy grow.

Further reading

For more insights, analysis and resources for organisations facing rising costs of doing business visit ICAEW’s Cost of doing business hub.

ICAEW also works with caba to promote the mental health of chartered accountants and their families producing articles, guides, webinars, videos and events that can provide support during these difficult times.

ICAEW launched a new campaign, Resilience and Renewal, which explores some of the most serious systemic challenges facing the UK economy and brings together government ministers, leading academics, economists and thought leaders to look at how to build a better, more resilient future economy and the vital role UK business and chartered accountants play.

Cost of doing business

Insights, analysis and resources for organisations facing rising costs of doing business amid a multitude of challenges, including energy prices, inflation, supply chain disruption and staff recruitment and retention.