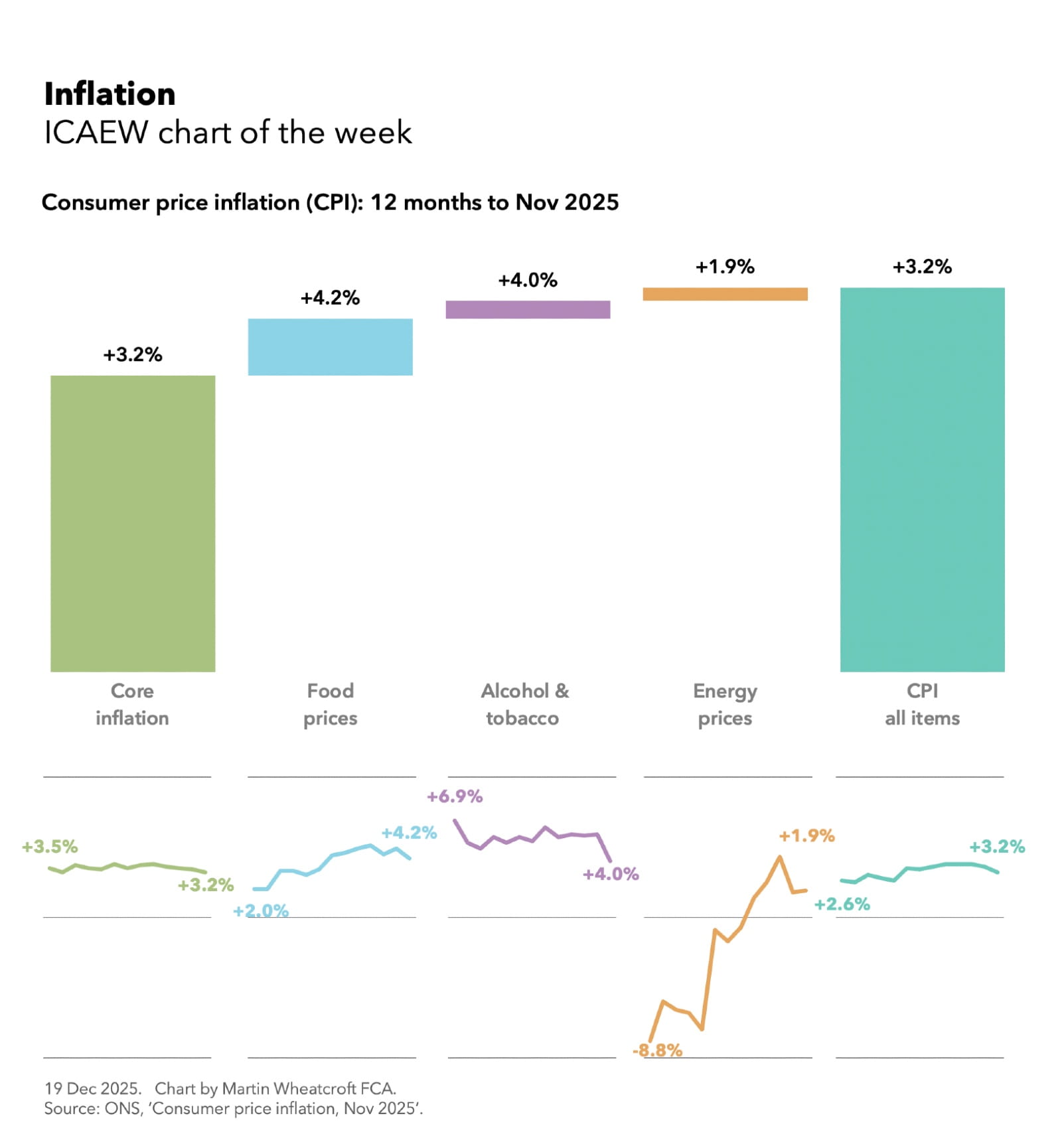

According to the latest release from the Office for National Statistics (ONS), prices in the UK rose by 3.2% over the course of the 12 months to November 2025.

Our chart this week analyses this in more detail, breaking down the 3.2% annual rise in the consumer price inflation (CPI) index over the 12 months to November 2025. It shows that core inflation rose by 3.2%, while prices for food, alcohol and tobacco, and energy increased by 4.2%, 4.0% and 1.9% respectively.

Last year’s CPI was 2.6% in the year to November 2024, when core inflation, food, alcohol and tobacco, and energy inflation of 3.5%, 2.0%, 6.9% and -8.8% contributed 2.7%, 0.2%, 0.3% and -0.6% to the total increase respectively (taking into account their respective weightings). This compares to the 12 months to November 2025 – as shown in the chart – when core inflation, food, alcohol and tobacco, and energy inflation of 3.2%, 4.2%, 4.0% and 1.9% contributed 2.5%, 0.5%, 0.1% and 0.1% respectively to the total increase in the CPI.

Core inflation covers almost four-fifths of the goods and services that make up the CPI index and is therefore a better indicator of underlying trends, as it excludes food, alcohol and tobacco, and energy – some of more volatile components of consumer spending. The gradual trend downwards from 3.5% in the 12 months to November 2024 to 3.2% in the 12 months to November 2025 is therefore a positive sign that overall inflation is on its way back to being in the Bank of England’s target range of 2% plus or minus 1%.

However, there is still some concern about the rate of services inflation (a subcomponent of core inflation) which has remained relatively high at 4.4% in the 12 months to November 2025. While this is an improvement over the 5.0% comparative for a year ago, the Bank of England will want to see this come down further in the new year if they are going to go beyond the interest rate cut announced yesterday.

Many of our individual experiences of inflation are likely to feel worse than this given that food prices (including non-alcoholic beverages) have increased by 4.2% over the past 12 months, with some foodstuffs having increased by a lot more. According to the ONS, beef costs 27.7% more than a year ago, chocolate is up 17.3%, coffee is up 14.5% and butter is up 12.1% – all noticeable increases to most consumers. The positive news is that although annual food price inflation accelerated from 2.0% a year ago to a peak of 5.1% in the 12 months to August 2025, it has started to slow again since then.

Alcohol and tobacco prices constitute an even smaller component of the index (about 4% compared with the 11% represented by food) but are very visible to consumers who indulge. The positive news for those individuals is that the annual rate of increase in these prices has slowed from 6.9% a year ago to 4.0% in the 12 months to November 2025, with the latter comprising a 3.8% increase in the prices of alcoholic beverages and 4.2% in tobacco prices.

Energy comprises just over 6% of the overall index but its volatility can still have a significant influence on the overall index despite that weighting. This time last year energy prices had fallen by 8.8% over the previous 12 months, pulling down the overall rate of inflation by 0.6 percentage points. This year energy prices are up 1.9%, contributing 0.1% to the overall rise.

The good news was that the downward trend in inflation, particularly core inflation, was thought sufficiently positive to enable the Monetary Policy Committee (MPC) of the Bank of England to vote for a cut in interest rates in December. However, the close vote suggests that the MPC would like to see a further slowdown in the rate at which prices are rising before going further.

More on the economy

View ICAEW reports, publications, analysis and supporting media on the economy. Featuring expert analysis on the latest national and international economic issues and trends, and interviews with prominent voices across the finance industry.