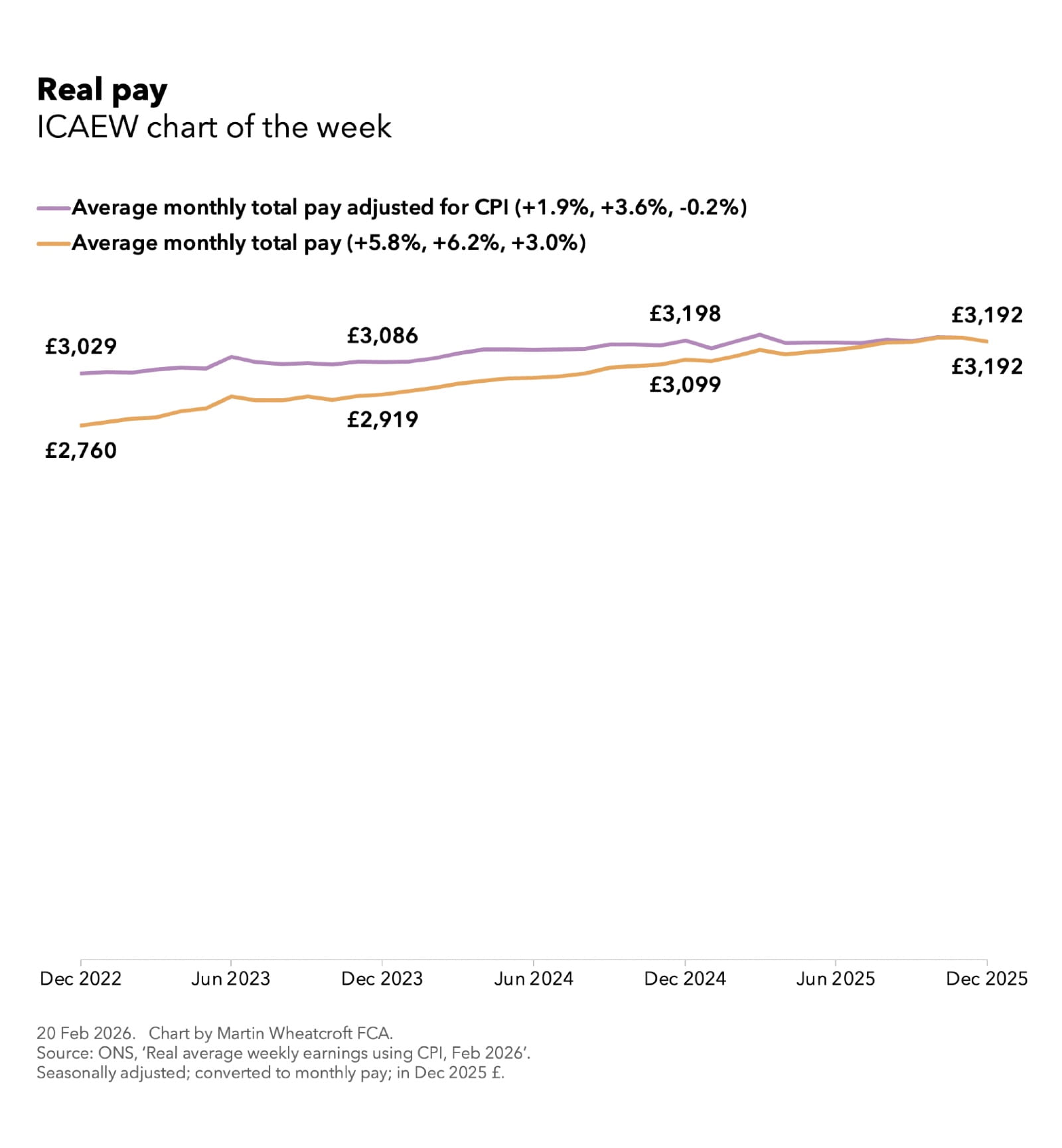

According to an Office for National Statistics (ONS) release on 17 February 2026, real average weekly earnings adjusted for consumer price inflation fell by 0.2% in the 12 months to December 2025, following increases of 1.9% and 3.6% over the course of 2023 and 2024 respectively.

After converting the ONS data from weekly to monthly and scaling up to December 2025 pound values, our chart this week illustrates these changes, showing how average weekly total pay (including overtime and bonuses) in real terms increased from £3,029 in December 2022 (in December 2025 values) to £3,086 and £3,198 in December 2023 and 2024 respectively, before falling to and £3,192 in 2025.

Our chart also shows how actual total pay (ie, not adjusted for inflation) increased from £2,760 to £2,919, £3,099 and £3,192 over that same period, increases of 5.8%, 6.2% and 3.0% respectively.

The increases in real pay over the course of 2023 and 2024 partly reflect a catch-up from the 4.9% real-terms fall seen in 2022 and the large minimum wage increases implemented in April 2024 that boosted pay for lower earners, while the real-terms fall in 2025 reflects a spike in inflation that eroded the value of pay awards over the course of the year.

The good news for many employees is that average pay rises during 2026 are expected to be more than the 3.0% experienced last year just as inflation is coming down. This should in theory mean (at least on average) more disposable income that can be either spent or saved.

The Chancellor for one will be hoping that people go out and spend their pay rises this year, as she really needs a boost to the economy if she is to stay on course with her fiscal plans.