The Office for National Statistics (ONS) published its latest quarterly experimental statistics on business births and deaths on 2 February 2023. This reports that business closures have increased since before the pandemic at the same time as business creations have fallen, resulting in net reductions in the number of VAT- or PAYE-registered businesses operating in the UK over the past six quarters.

The statistics are taken from the government’s Inter-Departmental Business Register, a database of approximately 2.8m businesses registered for either PAYE or VAT, just over half of the estimated 5.5m businesses operating in the UK (according to the Department of Business & Trade). The difference principally relates to sole traders with turnover below the VAT threshold who have not voluntarily registered for VAT, or for PAYE if they trade through a company. There is also a time lag on reporting the closure of businesses where a business continues to be registered, with the ONS waiting for several periods of zero VAT or zero payrolls before recording a business as closed.

The statistics are labelled as experimental because they are not as rigorous as annual statistics, but the advantage is that they provide data on business births and deaths in 2022, for which we will not get a full set of annual numbers until towards the end of this year.

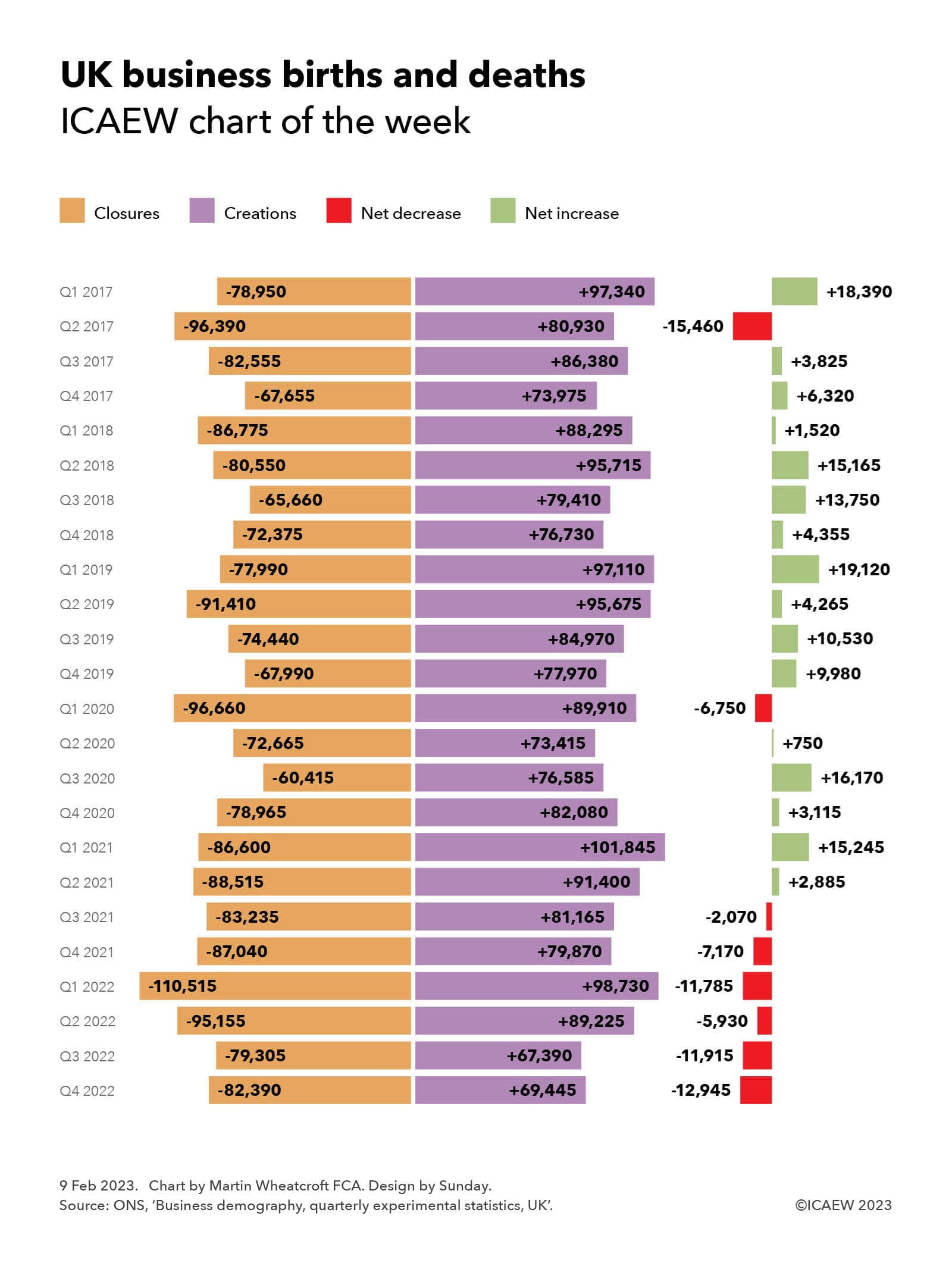

As our chart illustrates, the quarterly net change in businesses in 2017 was +18,390, -15,460, +3,825 and +6,320 respectively, followed by +1,520, +15,165, +13,750, +4,365 in 2018, +19,120 and +4,265, +10,530 and +9,980 in 2019. The pandemic saw a fall in business closures as government support enabled businesses that would otherwise have stopped operating to stay alive, with a net decrease of -6,750 in Q1 2020 followed by net increases of +750, +16,170, +3,115 in the second, third and fourth quarters of 2020.

A spurt in business creations in early 2021 saw net increases of +15,245 and +2,885 in the first two quarters, before net decreases of -2,070 and 7,170 in the last two quarters of 2021. With pandemic support measures coming to an end and the onset of the energy crisis, the trend moved further into negative territory with quarterly net closures of -11,785, -5,930, -11,915 and -12,945 in 2022.

Quarterly business deaths averaged around 81,400 in 2017, 76,300 in 2018, 78,000 in 2019, 77,200 in 2020, 86,300 in 2021 and 91,800 in 2022, while quarterly business births averaged around 84,700 in 2017, 85,000 in 2018, 88,900 in 2019, 80,500 in 2020, 88,600 in 2021 and 81,200 in 2022.

These numbers will not be pretty reading for Kemi Badenoch, the new Secretary of State for Business and Trade. With interest rates on the rise, energy costs still at very high levels and consumers cutting back on spending, the risks are that many more existing businesses will cease trading, while business creations may continue to be subdued.

One crumb of comfort is that businesses founded during downturns are believed to do better than those founded in good times. So, if you are thinking of striking out on your own with a new business idea, there may be no better time than now.