Contributing to your CPD?

If this article is supporting your professional development, it can count towards your verifiable CPD hours. Use the pop up at the bottom right corner of your screen to add reading this article as an activity to your online CPD record.

UK economy went from bad to worse at the end of 2023

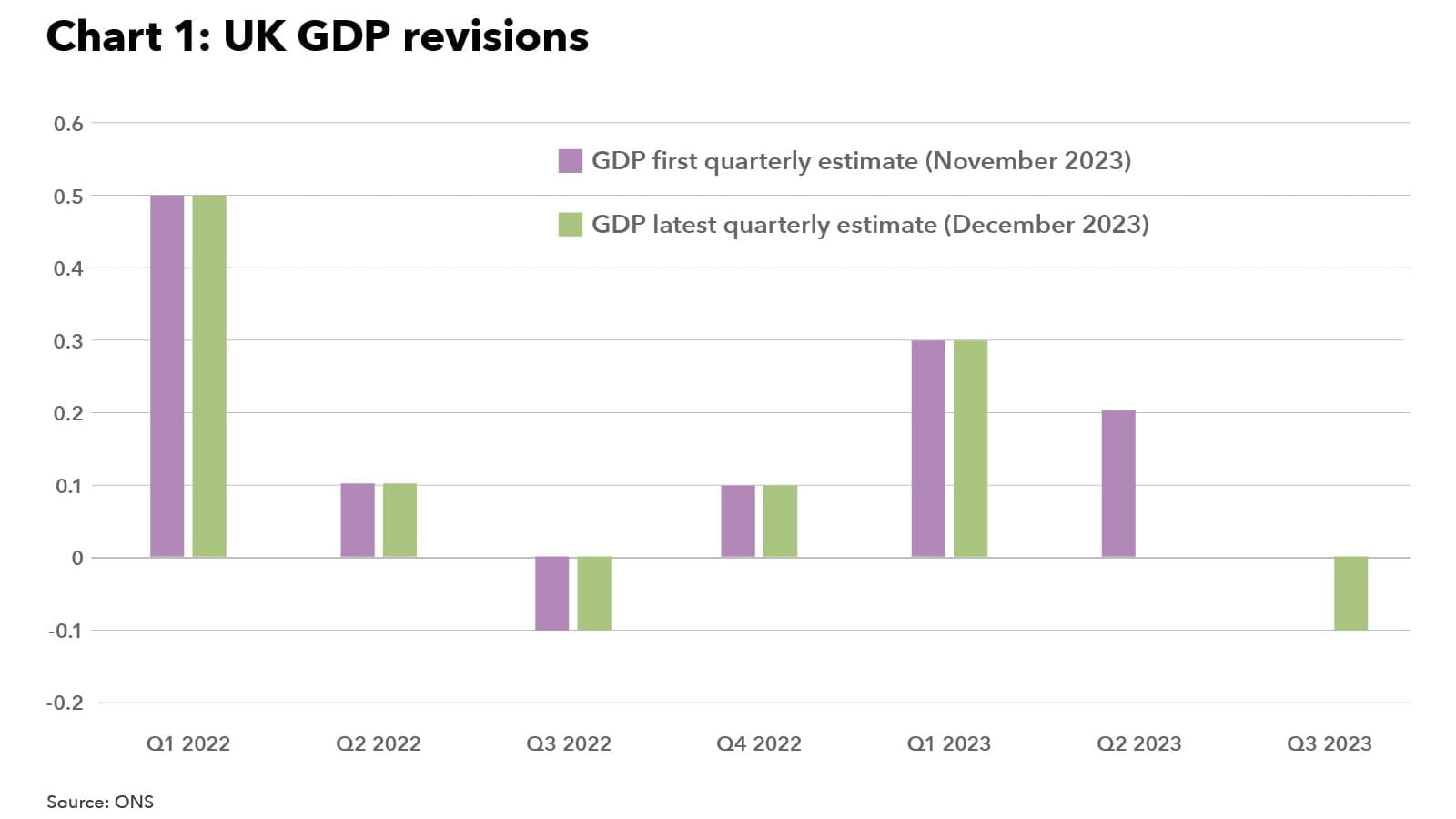

Revised official figures revealed that the UK economy contracted by 0.1% in Q3 2023, down slightly from the previous estimate of no growth (see above). With UK GDP also contracting by 0.3% in October, the first month of the fourth quarter, the UK is on the brink of a small technical recession (defined as two consecutive quarters of negative GDP growth). A 0.2% decline in services output was the main contributor to the overall fall in October GDP. Industrial production fell by 0.8% and construction sector output dropped by 0.5%.

UK inflation fell to two-year low

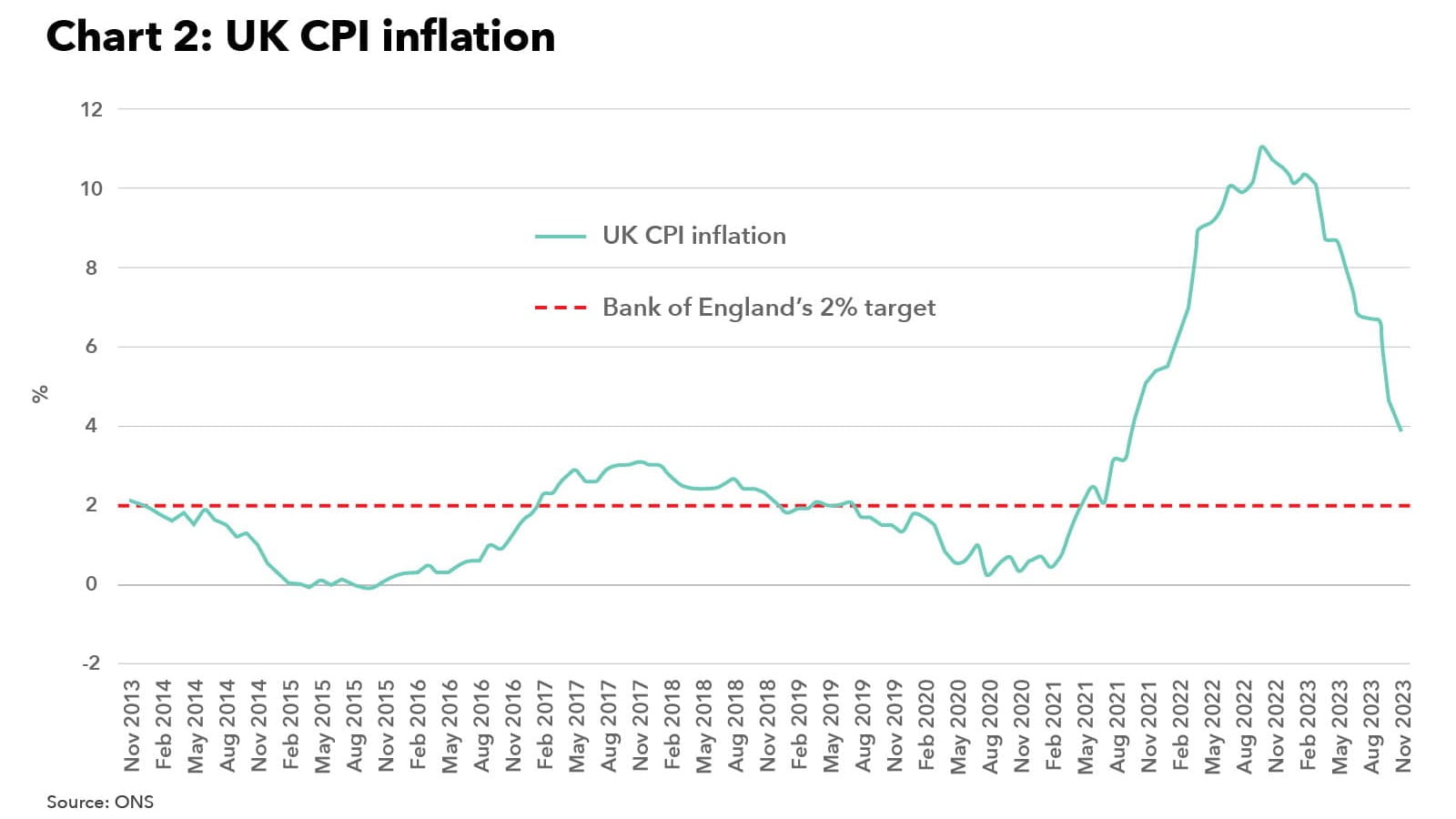

UK CPI inflation slowed to 3.9% in November 2023, the lowest rate since September 2021 (see above) and down from 4.6% in October. Falling fuel prices were the largest driver behind this drop in inflation. Slowing inflation for food and household goods also added to the downward pressure on the headline rate.

Against a backdrop of slowing inflation and a deteriorating economy, what can we expect in the year ahead?

Another year of economic stagnation for the UK

The UK economy is likely to continue stagnating as the boost from lower inflation is effectively wiped out by the squeeze on customer demand and business investment from the lagged impact of previous interest rate rises. The damage caused by 14 interest rate rises will crystallise further with the estimated 1.6 million homeowners, who will see their mortgage deal expire this year, facing a large jump in borrowing costs. Stagnation could turn into a full-blown recession if higher interest rates and the myriad other cost pressures facing businesses trigger a sizable spike in job losses.

While the UK may continue to narrowly avoid a downturn, sectors such as retail and construction will probably be in recession through most of 2024, given their direct exposure to the lagged impact of earlier interest rate rises.

Lower Inflation should spark interest rate cuts

Inflation should continue to slow at a decent pace in 2024. A notable fall in food costs amid improved supply chains and higher stock levels is likely to help drag the headline rate to within touching distance of the Bank of England’s 2% target by the autumn. However, living standards will remain pretty desperate as the boost from lower inflation is largely offset by a squeeze on incomes from higher mortgage costs, the end of the cost-of-living payments and rising taxes. Notably lower inflationary pressures and a crumbling economy is likely to push the Bank of England to lower interest rates a couple of times by the end of 2024.

Global economic conditions to remain challenging

Global economic growth is likely to slow in 2024 as the squeeze from high interest rates, geopolitical uncertainty and growing international trade restrictions partly counter the boost to output from lower inflation. While a soft landing for the US is still possible, China’s GDP growth is expected to be tepid, amid a weakening property sector and muted global demand. The UK is likely to lag most other advanced economies as chronic supply-side constraints, including staff shortages, hold back the UK’s growth potential relative to its peers.

Implications for accountants, business owners and the economy

The latest economic data puts the Prime Minister’s target to get the economy growing in jeopardy, with high borrowing costs and waning customer demand suppressing economic activity. The outlook for this year is challenging, with living standards likely to remain squeezed.

UK economy – what to watch for this month

- A decline in November 2023 UK GDP, to be released on 12 January, would all but confirm that the UK entered a technical recession at the end of last year.

- The detailed official productivity figures for Q3 2023 to be published on 15 January is likely to show that the COVID-19 pandemic and the recent inflation surge has weakened UK productivity.

- The inflation figures for December due out on 17 January should reveal another fall in the headline rate amid slower food inflation.

Further reading

- For more insights, analysis and resources for organisations facing rising costs of doing business, visit ICAEW’s Cost of doing business hub.

- ICAEW also works with caba to promote the mental health of chartered accountants and their families producing articles, guides, webinars, videos and events that can provide support during these difficult times.

- ICAEW’s Resilience and Renewal campaign explores some of the most serious systemic challenges facing the UK economy and brings together government ministers, leading academics, economists and thought leaders to look at how to build a better, more resilient future economy and the vital role UK business and chartered accountants play.