UK economy grew only slightly in August

Official figures revealed that the UK economy grew by 0.1% in August 2025, up marginally from a revised contraction of -0.1% in July. Manufacturing was the main driver of economic growth, which grew by 0.7%. In contrast, the services sector saw no growth in August, amid weaker transport and storage activity and retail output. Construction output fell by 0.3%, partly reflecting lower repairs and maintenance activity. This small GDP increase is unlikely to indicate a noteworthy pickup in economic growth across the third quarter. High inflation and falling business confidence are expected to restrain output in September.

UK Business confidence in freefall

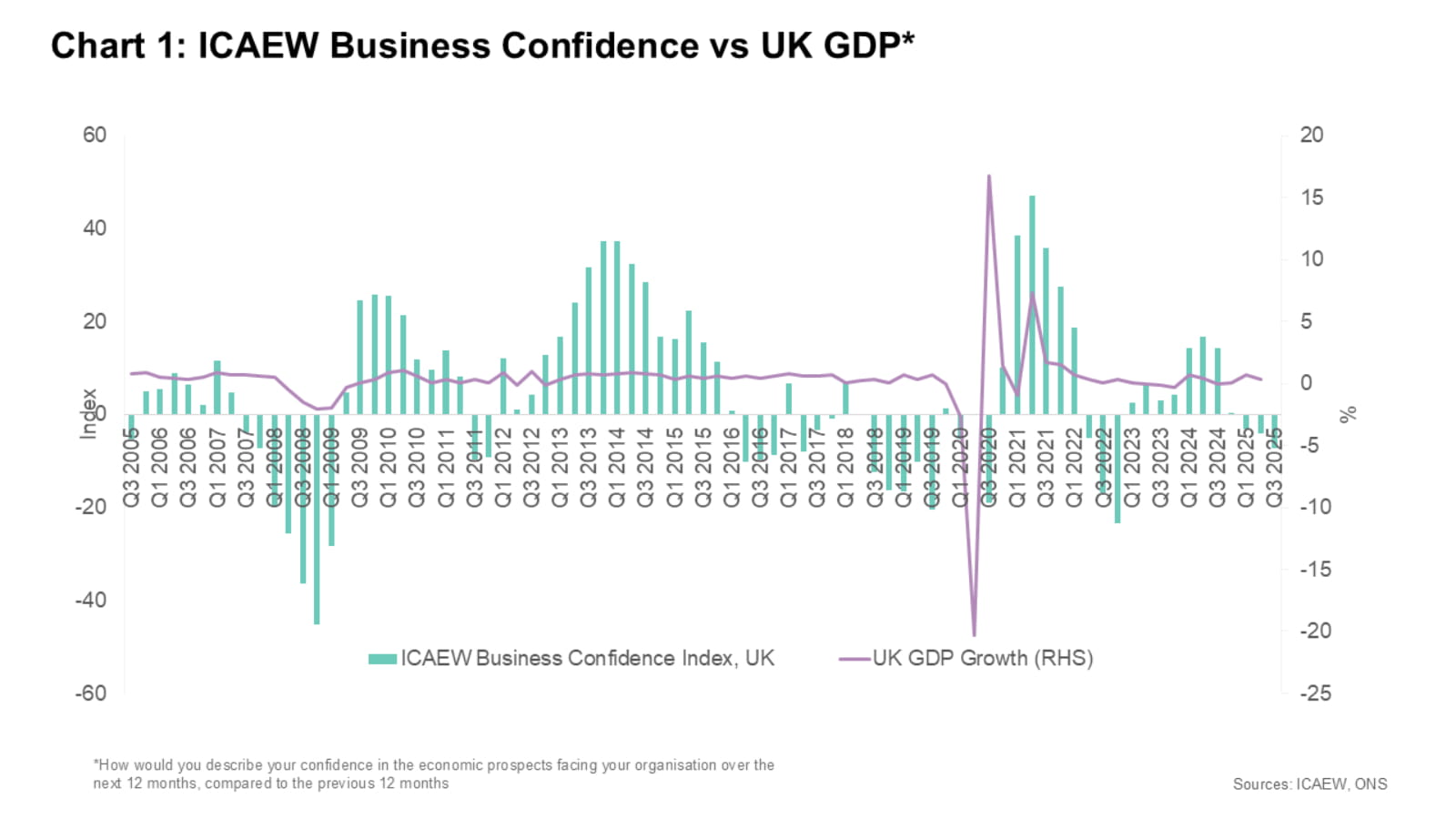

ICAEW’s Business Confidence Monitor (BCM) for Q3 2025 stood at -7.3 on the index, down from -4.2 in the previous quarter. Confidence is now at its weakest level since Q4 2022, having fallen for five consecutive quarters (see chart 1). Record-high tax concerns are the likely cause, squeezing profit growth, recruitment and investment activity. Muted domestic sales growth also weighed on sentiment, as firms continue to lower their expectations for the year ahead. By sector, sentiment was most negative among property businesses (-23.2), amid a challenging housing market and weak commercial demand.

Tax concerns set new record ahead of Budget

ICAEW’s BCM also found that six in 10 (60%) businesses said the tax burden was a growing challenge, a historic high for the survey and a ten-fold rise over the past five years, from just 6% in Q3 2020. It’s the third time since Q4 2024 that the proportion of firms citing tax concerns broke the survey record. Regulatory requirements are the second biggest challenge to performance despite government plans to reduce this burden, with 47% of companies citing this as an issue, the highest since Q4 2018.

Further tax rises would negatively impact recruitment, investment and prices

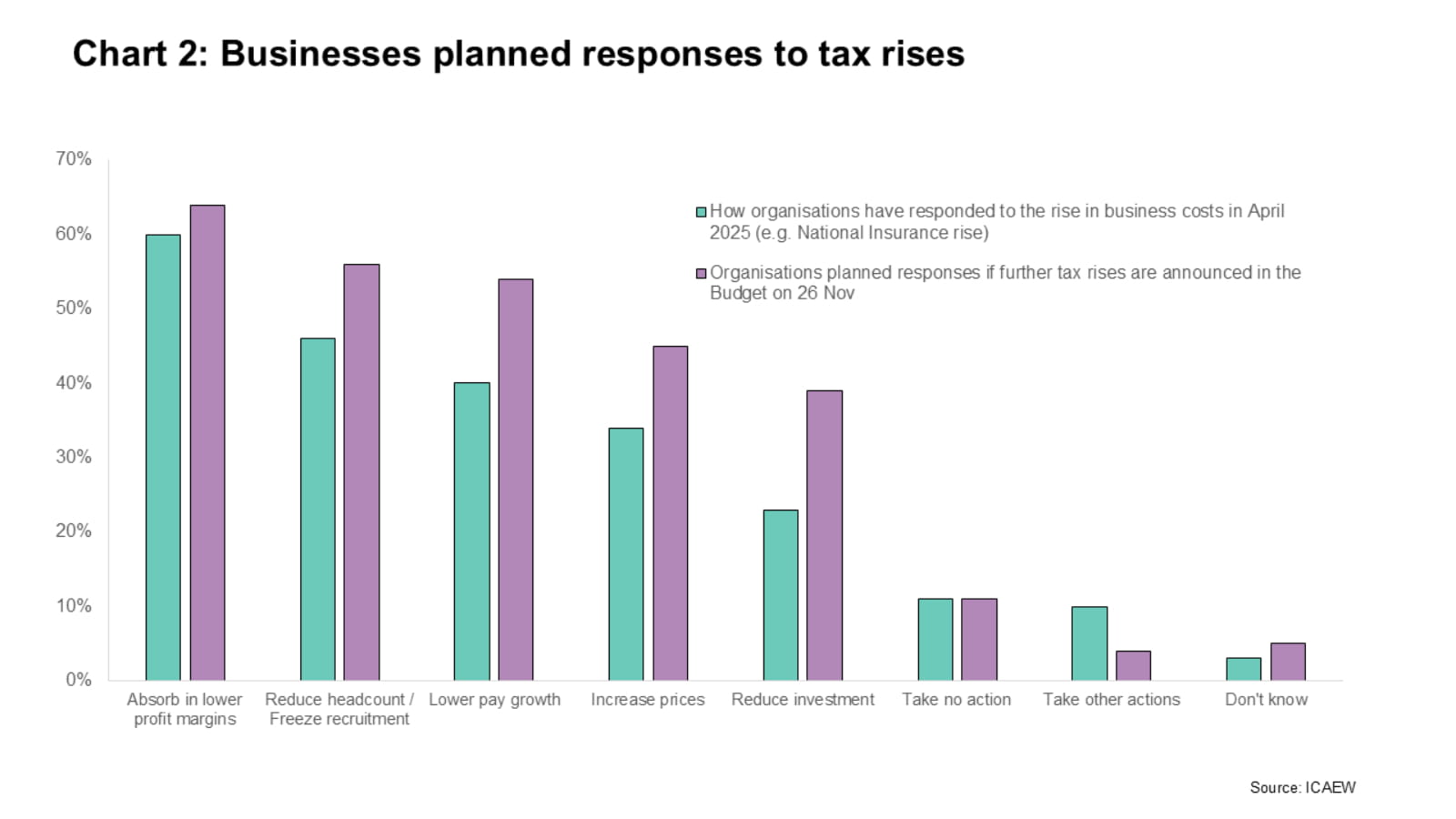

Separate ICAEW research found that 80% of businesses had been negatively impacted by April’s rise in business costs (notably the employer national insurance increase). In response, nearly half (46%) of firms responded by cutting jobs or freezing recruitment. A third (34%) increased prices and one in five (23%) reduced investment (see chart 2).

While just under two-thirds (64%) of firms would look to partly absorb higher costs through taking lower profit margins, more than half (56%) of businesses said they would cut headcount or freeze recruitment in response to more tax rises in the next Budget. Nearly half (45%) of firms said they expect to raise their prices if taxes rise. Over one in three firms (39%) said they would reduce investment.

UK households boost savings

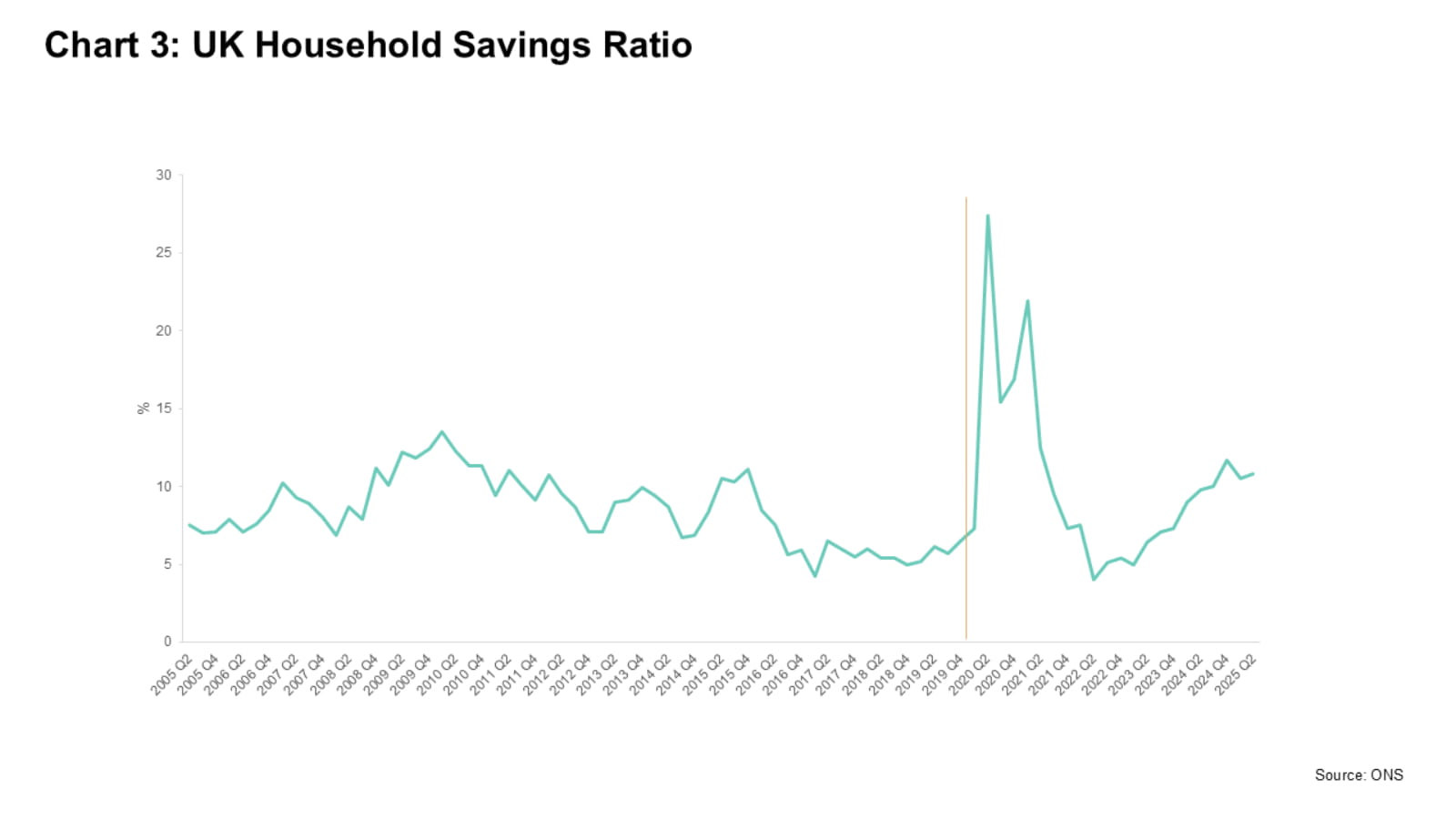

The household saving ratio – the percentage of household disposable income that is saved – rose to 10.7% in Q3 2025, from 10.5% in Q2 (See chart 3). This is largely driven by a rise in non-pension saving contributions. The UK’s savings rate remains above the historical average since surging to an all-time high of 27.4% in Q2 2020, during the Covid pandemic. It suggests that households are choosing to save rather than spend their earnings, possibly reflecting growing speculation over more tax rises in next month’s Budget. Growth is heavily reliant on household spending, which accounts for around two-thirds of UK GDP.

UK Inflation may have already peaked

UK CPI inflation stayed at 3.8% for the third successive month in September 2025. This was lower than expected, but still almost double the Bank of England’s 2% target. Downward pressure on the headline rate primarily came from lower prices for a range of recreational and cultural purchases, including live events. Food prices fell for the first time since May 2024. It looks like the recent spike in inflation has now peaked. September’s unchanged outturn is likely to have been followed by a slight slowdown this month, with downward pressure from a smaller rise in October energy bills. This is likely to pull headline inflation moderately lower.

Implications for accountants, business owners and the economy

Overall, this month’s figures will do little to allay fears over the UK economy’s wellbeing. November’s Budget has cast a long shadow over the UK economy, with growing worries about more tax rises prompting greater caution among consumers and businesses to spend and invest. Despite softer inflation than expected, the chances of a November interest rate cut look remote. Rate-setters will likely want to analyse the impact of any measures announced in the Budget before relaxing policy again.

UK economy – what to watch for next month

- On 6 November, the Bank of England’s Monetary Policy Committee are expected to keep interest rates on hold at 4.00%. Alongside its November policy decision, the bank will publish its latest economic forecasts for the UK economy.

- Quarterly GDP data, which will be released on 13 November, could confirm that UK GDP growth slowed slightly in the third quarter of 2025, following 0.3% growth in Q2 2025.

- The inflation figures for October 2025, due out on 19 November, should see a small fall in the headline rate from 3.8% in September.

ICAEW on the Budget