What is GDP?

GDP (gross domestic product) is a measure of all the economic activity of companies, governments and people in a country and is used to indicate the health of that economy.

It is calculated either by adding up the value of all the goods and services produced or by value of all the income earned in a country over a specific period. When you hear about economic growth in the news this typically refers to GDP growth. An annual GDP growth rate of 2%, then, simply means that the economy has grown by 2% over the past year.

GDP doesn't tell the whole story. For example, it doesn’t tell you whether people’s living standards are increasing, it doesn't consider whether the growth is environmentally sustainable, or whether people’s wellbeing have improved.

How does GDP affect people and businesses?

If GDP goes up a lot, people are likely to be earning and spending more and businesses are more likely to increase recruitment and investment. People and firms pay more in tax because they're earning and spending more, providing more money for the government to spend on public services.

Conversely, if GDP growth is weak or falling, companies are more likely to cut jobs, people earn and spend less, leaving them feeling worse off. Governments tend to generate less tax revenue, which means they may decide to cut public spending or raise taxes.

What is the state of play in November 2025?

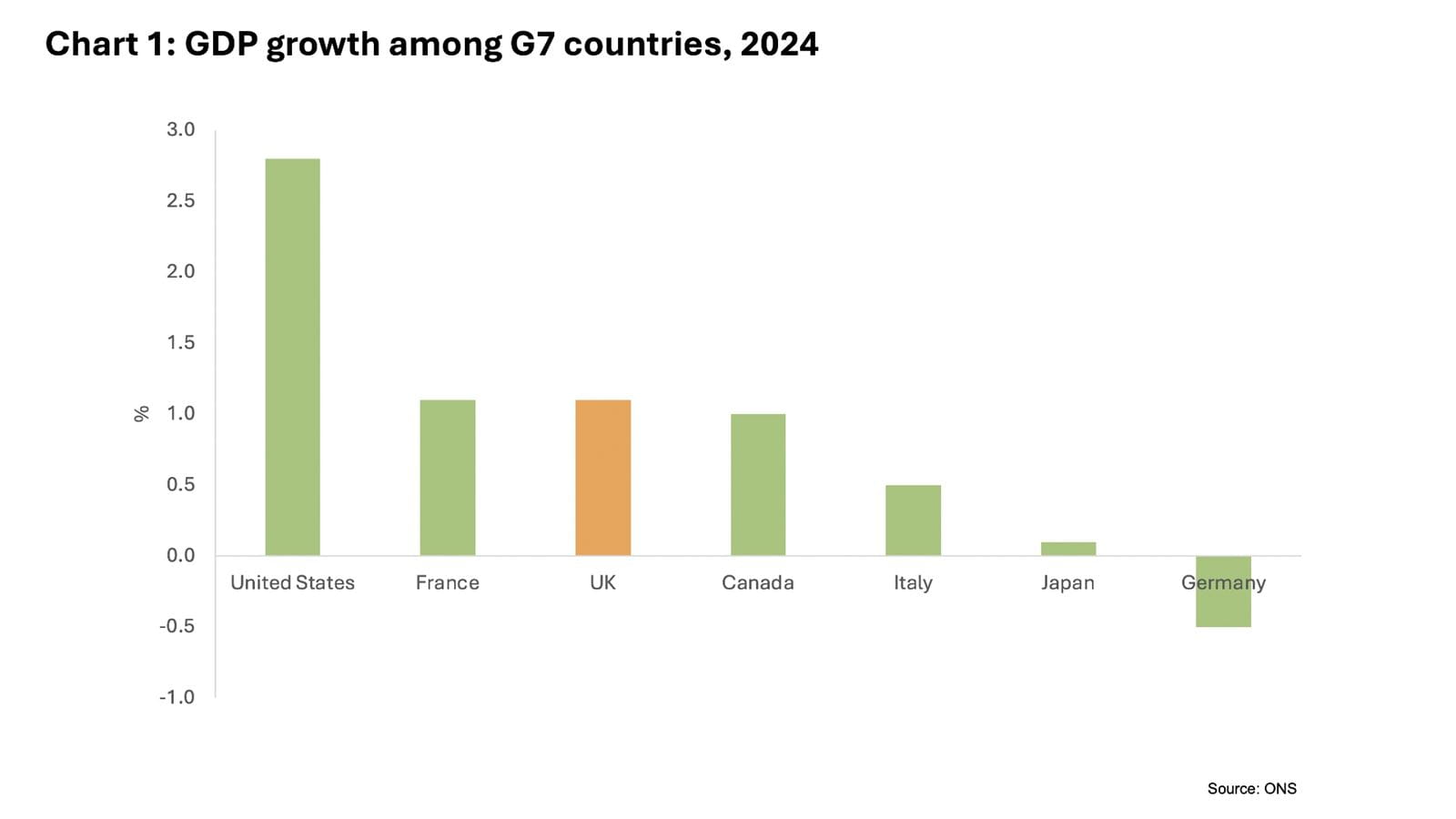

Following a strong first half of the year, UK GDP growth slowed to 0.1% in Q3 2025, down from 0.3% in the previous quarter. In 2024, the UK economy was also the second joint fastest growing G7 economy. UK GDP is estimated to have increased by 1.3% in Quarter 3 2025, compared with the same quarter a year ago, below the historic average of 2.3%.

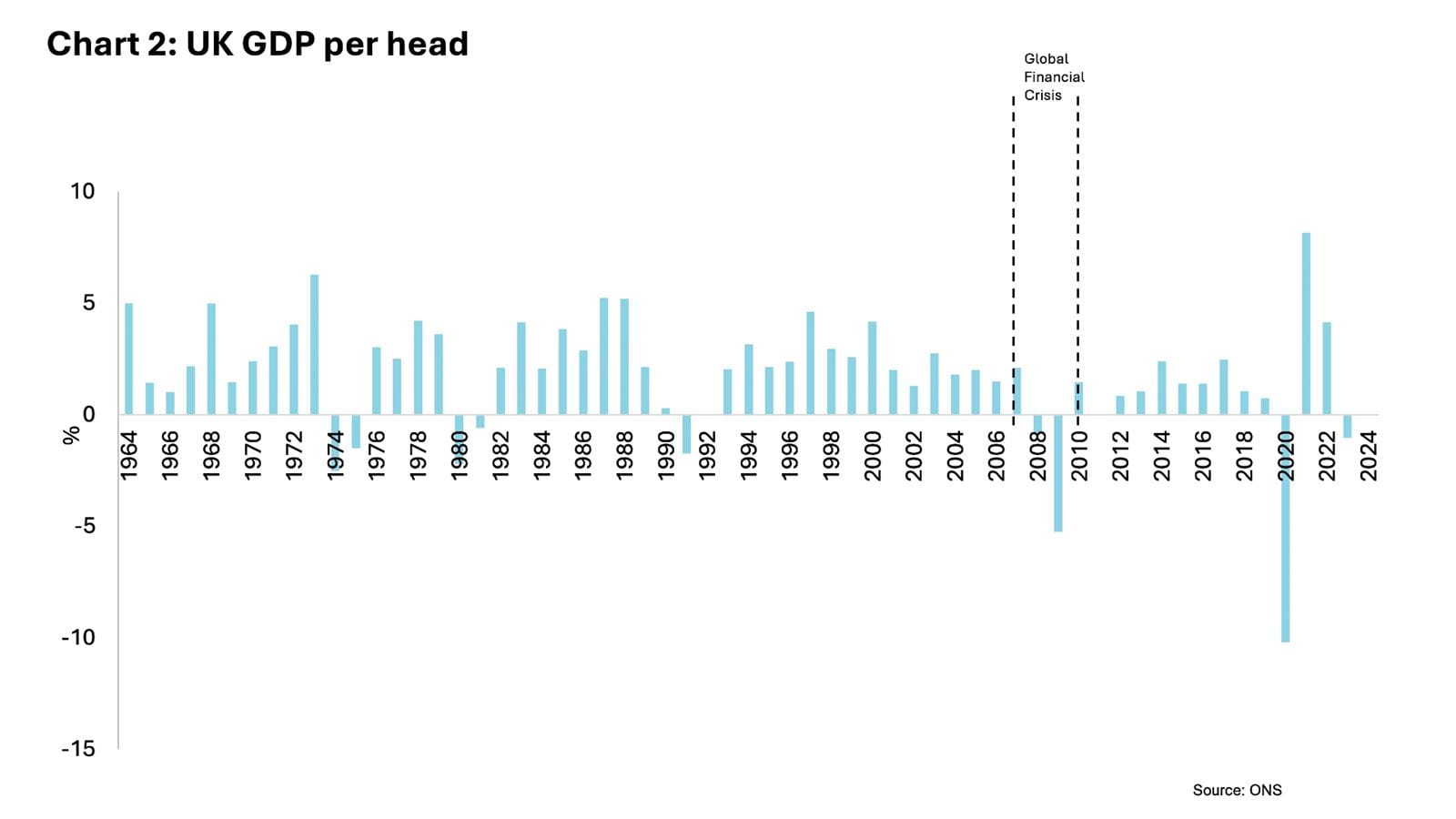

UK GDP per head – a better measure of change in living standards – showed no growth in Q3 2025, following six consecutive quarters of positive growth; but it is up 0.8%, compared with the same quarter a year ago.

UK GDP per head has grown by an average of just 0.5% a year since the global financial crisis (see Chart 2), compared to an average of 2.4% year over the previous 50 years that preceded the crisis.

What is the outlook for UK GDP?

The Bank of England also released its Quarterly Monetary Policy Report which revealed that the Bank forecast GDP growth would slow from 1.5% this year to 1.2% in 2026, before picking up to 1.6% in 2027 and 1.8% in 2028. However, policymakers warned that inflationary pressures could continue to weigh on households and businesses.

Some of the main challenges facing UK GDP

- Poor productivity lowers potential output and weakens the resilience of an economy.

- Low labour supply stunts GDP by stifling firms’ ability to produce goods and services.

- Anaemic investment limits future GDP growth by restraining innovation and productivity.

- Restrictive economic policy including the squeeze on households’ and firms’ finances from higher taxes (for example, the increase in employer national insurance announced at the Budget).

- External shocks (for example, global trade friction, Brexit) that cause short- and long-term barriers to GDP growth.

ICAEW on the Budget