The pace of change and the volume of sanctions imposed in 2022 has increased the risk of ICAEW supervised firms inadvertently enabling sanctions evasion. We recognised the need to perform monitoring activity to identify and mitigate the risks.

Use this review to benchmark your firm’s policies and procedures for screening clients and to assess the level of risk to which your firm may be exposed. Mitigate risks by implementing the policies and procedures outlined in this review.

About this sanctions guidance

This guidance is taken from the ICAEW Sanctions Thematic Review which we carried out earlier in 2022. It forms part of our work as an anti-money laundering supervisor.

The sanctions regime is not new. We have been checking that ICAEW supervised firms understand the regime and the anti-money laundering (AML) risks presented in their client bases through our AML monitoring reviews for many years.

Historically, we have had a limited number of findings in this area, but the pace of change and volume of sanctions imposed in spring 2022 means the risk of our firms inadvertently enabling sanctions evasion has increased.

We undertook this review to build our understanding of sanctions compliance within the firms where risk is concentrated – either due to the services offered or the geographical reach of the firms.

We asked the firms how they;

- responded to the fast pace of change in the financial sanctions’ regime in spring 2022;

- identified, handled and mitigated the AML risks associated with sanctions;

- managed resources to respond to the changes; and about

- the level of exposure to sanctioned individuals/entities.

More detail about our methodology is available in the report.

This review sets out the qualitative and quantitative data and trends we observed from the survey responses.

For firms that took part in this review, this report will enable them to benchmark their own policies and procedures for screening clients and to assess the level of risk to which they may be exposed.

Other firms will also find this review useful as it describes the policies and procedures that they may be able to implement to mitigate the risks of inadvertently enabling sanctions evasion.

Watch the ICAEW Sanctions Thematic Review webcast

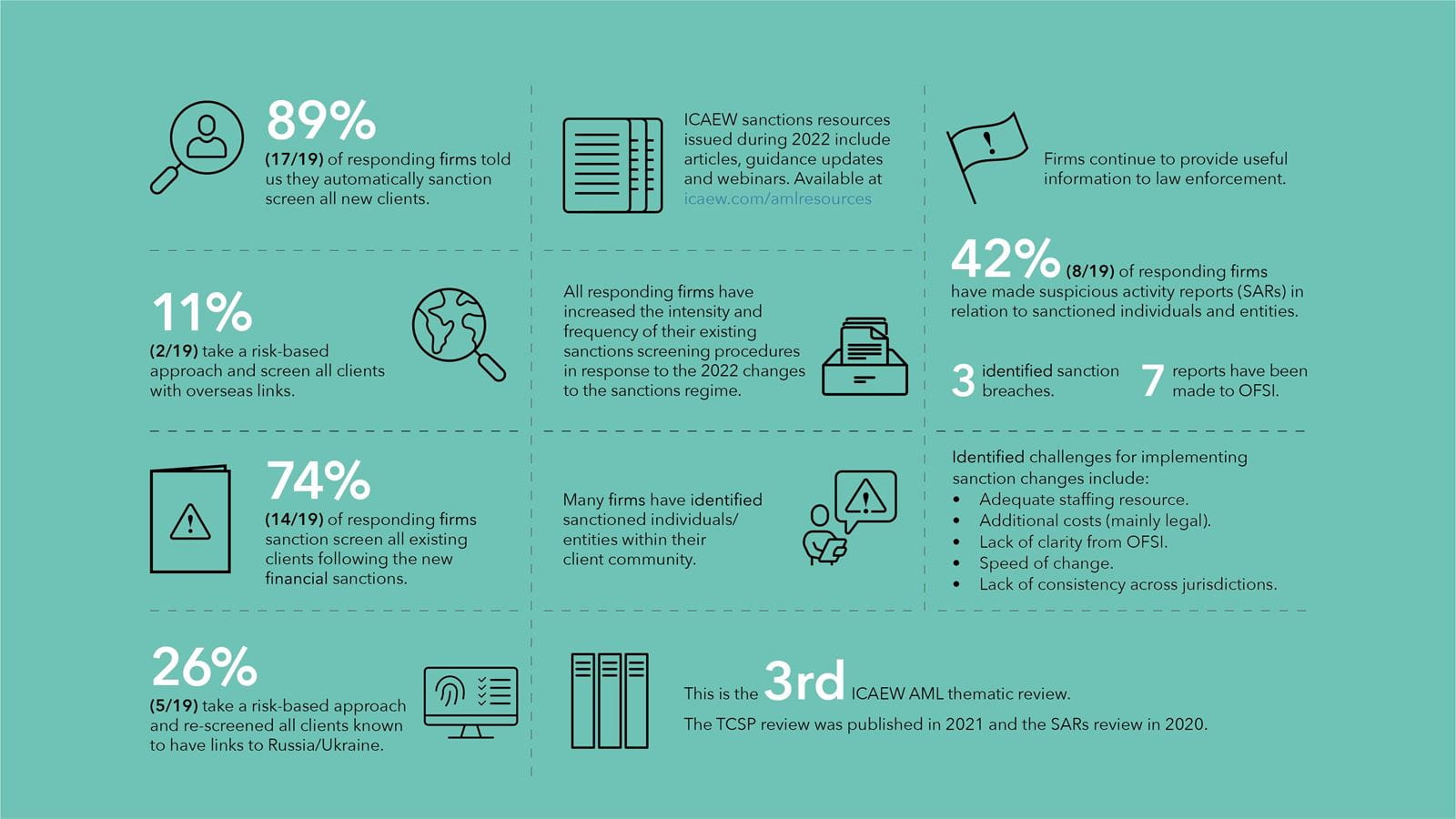

ICAEW’s Head of AML, Michelle Giddings summarises the key findings and how the largest firms are maintaining good compliance with the sanctions regime. You may identify new policies and procedures you wish to implement to protect your firm from the risk of enabling sanctions evasion.View a snapshot of the findings from the ICAEW Sanctions Thematic Review

Sanctions resources

Throughout 2022 we have provided a breadth of sanctions resources for our firms including articles, guidance updates and webinars that been communicated in our newsletters to AML supervised firms; AML – the essentials and Regulatory and Conduct News, on our Regulation and Conduct LinkedIn page and published on icaew.com/amlresources.

ICAEW also supports its members through the client screening service that allows ICAEW members to perform up to three name checks per week.

Links to these resources are listed in the ‘further resources’ section.

Other ICAEW thematic reviews

The previous reviews identify the money laundering risks that can be linked to offering trust and company services icaew.com/TCSPreview (2021) and a review of firms identifying suspicious activity and submitting suspicious activity reports (SARs) icaew.com/SARsReview (2020) as well as guidance on these topics.