Business, like life, can be full of surprises, but the key is to own the unknowns and create order out of potential chaos, says Gary Dolman.

It is a well-established fact that CFOs don’t like surprises – in their role, there are very rarely nice surprises. For this reason, the CFO can live in constant fear of ‘unknowns’ that may take on different guises. Perhaps the most constant fear for a CFO is whether their version of historical performance reporting contains an unknown error or misstatement.

It can also be the case that something has happened, unknown to the CFO but well understood by their advisers, that will affect the future (for example, a change in tax regulation). Then there are the future events that will have a significant impact on the business, but for which the CFO has not prepared – so-called ‘unknown unknowns’.

The squeezed middle

In a large company, responsibilities can be subdivided and delegated among many well-remunerated and highly experienced staff. These larger, better-equipped teams can call upon the services of experts as and when required, and can spend a great deal of time communicating with advisers, keeping them up to date with what the business is doing and receiving timely advice.

In a mid-sized business (middle-market enterprises – MME) financial and time constraints are often tighter. Many are not big enough to afford extra managerial heads within the finance function and budgets to call in experts can be limited. This leads to the CFO being the jack of all trades – but they may feel they are the master of none.

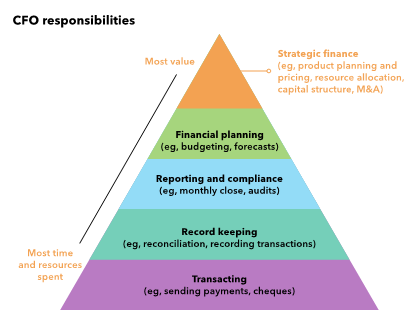

A modern-day CFO has many responsibilities. In a large organisation, each tier may be headed up by a direct report of the CFO, or rolled up to report to a financial controller or chief accountant. In the case of tax, there will probably be a head of tax who looks after the tax-related transacting, record keeping, reporting and compliance, as well as planning for future changes.

Within an MME, the management of these tasks will often reside directly with the CFO, who will attempt to tackle them by using outsourced suppliers. The danger with this approach is that outsourced suppliers do not work directly for the company and, because of time and budgetary constraints, are sometimes not kept in the loop on every specific. The CFO must work extremely hard to bridge this ‘information gap’ because what might appear trivial to some can generate myriad unfortunate unknowns and future problems. They also need to evaluate whether hiring an extra pair of hands is really a necessary cost to the business.

I often advise CFOs to hire a head of tax earlier than they feel comfortable doing. I point out that every decision that a company makes has a tax consequence. Managing a cost that is 20% of your profit plus additional VAT leakages and payroll taxes surely deserves a dedicated person.

One example I have witnessed was when a sales team concluded what they felt was a good deal, introducing their clients to a third-party provider and earning a 20% commission for doing so. With no tax expert involved, the contract remained silent on whether this commission included VAT. The result was that their net fee turned out to be nearer to 16% than 20% – a pretty unwelcome revelation.

The chaos of complexity

An MME may well have grown very quickly. Typically, this leads to core systems that were fit for purpose within a small organisation, but are now being stretched beyond their capability, either in terms of volumes or by trying to shoehorn in new technology products to meet a shortfall. This can create discrepancies and/or the need to repair certain data for reporting purposes. Equally, when growing via acquisition it is frequently the case that the acquired entity will continue to use existing IT infrastructure. Then data needs to be manipulated or rekeyed to reach a reliable consolidated view.

Having worked in investment banking, I have witnessed just how easy it is for this to happen. In investment banks, there is a control process whereby all new products have to be signed off by the back office departments – compliance, finance, settlements, etc. Sometimes the new product did not fit within an existing system, but was signed off on the basis that it would cover one trade only and could be accommodated via manual processes.

From a finance point of view, this meant the establishment of a spreadsheet and then manually entering the output into the general ledger. If the trade was found to be a success, the front office would continue to book more of these trades. In the short term, all would be well as those undertaking the manual processes could cope with the extra flow by expanding their spreadsheet.

The problems began as the volumes passed a manageable level, often coupled with new variants of the trade being entered into, with subtle differences from the original ‘we are only doing one of these’ trades. Events then took on a familiarly depressing path. Typically, the owner of the spreadsheet would move on and the task would be passed to someone new with a minimum of handover or documentation. Sometimes this would happen more than once.

Warning signs would then emerge because the reporting times lengthened, the outputs became erratic, or as a result of review by internal or external audit. The result was normally a profit and loss write-off and a need to go back to basics, either to build a new system or to create a more robust process of adaptation. More than once I heard people say: “This cannot happen again.”

Complexity without chaos

To try making order out of the chaos, a CFO needs to dedicate time to managing their IT stack in the same way that they manage and improve their people. Ideally, they would have a dedicated ‘finance IT’ person who can bridge the divide between the finance and IT worlds. They should be managing the finance IT development plan so that improvements are always being considered and worked on. This function can never be standing still and often requires difficult but important decisions. Inevitably, staff can become attached to systems they understand and will cite the ‘if it isn’t broken, don’t fix it’ rationale, despite the fact that it has become legacy and suboptimal in nature.

The head of finance IT needs to plot a course through the future, considering:

- what the future plans are for the business;

- what systems/technologies are appearing on the market; and

- the merits of ‘build vs buy’ strategies in process development.

This shouldn’t be a rigid three-year plan, but rather one that is constantly reviewed and updated in line with business and technology advances. One vital point to remember in this is the importance of the front-end sales/booking/stock/trading systems. If these are not fit for purpose then the mantra of ‘rubbish in, rubbish out’ will hold true. The CFO (and their IT support) needs to be constantly campaigning internally to drive improvements.

Owning the unknowns

While in the past the MME CFO would concentrate on a short-term budgeting and forecasting cycle and may have a semblance of a disaster recovery plan, the post-pandemic world is very different.

The CFO now needs to be looking at a very uncertain world and trying to consider how a business would respond to an event that has an impact on the business in both good and bad ways. They do not need to be Nostradamus and predict exactly what the event might be, but they can consider how they would deal with a situation that cuts or boosts revenues significantly.

This means a move away from unwieldy and delicate Excel spreadsheets that can only model one outcome. Instead, they need a scenario-planning mechanism that paints multiple pictures and highlights the constraints that will be encountered in the event of a particular outcome – such as running out of cash. Ideally, the scenario tool should be capable of sharing easily digestible output with a trusted team of auditors, plus tax, legal and other advisers, who can gain a quick understanding of where the business may be heading and advise accordingly.

Life as a CFO in an MME is undoubtedly difficult. By constantly evolving the finance IT stack and managing the in-house/outsourced decisions, they can improve their chances of dealing with the unknowns in whatever form they may take.

About the author

Gary Dolman, Non-Executive Director of ELEMENTARYb, the intelligent financial management platform providing complete control to MMEs

How to grow

Support from ICAEW on starting, growing and renewing businesses in the UK, and supporting the government's mission of kickstarting sustainable economic growth.

More support on business

Read our articles, eBooks, reports and guides on finance transformation

Finance transformation hubFinancial management eBooksCan't find what you're looking for?

The ICAEW Library can give you the right information from trustworthy, professional sources that aren't freely available online. Contact us for expert help with your enquiries and research.