Make your voice heard and share your valuable perspective and experience in the IFR4NPO consultation to shape the future of financial reporting in this sector.

Imagine trying to do your job without the Charities SORP. At first you might be tempted to relish the freedom, but would it really make your job easier? Globally, non-profit organisations (NPOs) and auditors that operate without sector-specific guidance are calling out for just that. An international study commissioned by the Consultative Committee of Accountancy Bodies (CCAB) in 2014 had respondents from 179 countries, with 72% agreeing or strongly agreeing that an international standard would be useful.

This is not surprising, because the benefits would be profound for NPOs, funders, regulators, and beneficiaries. If done well, internationally consistent high-quality financial reporting could have a positive impact on grant-making, regulation, due diligence, consolidation, audit, fraud, software, fundraising, and the recovery of indirect costs.

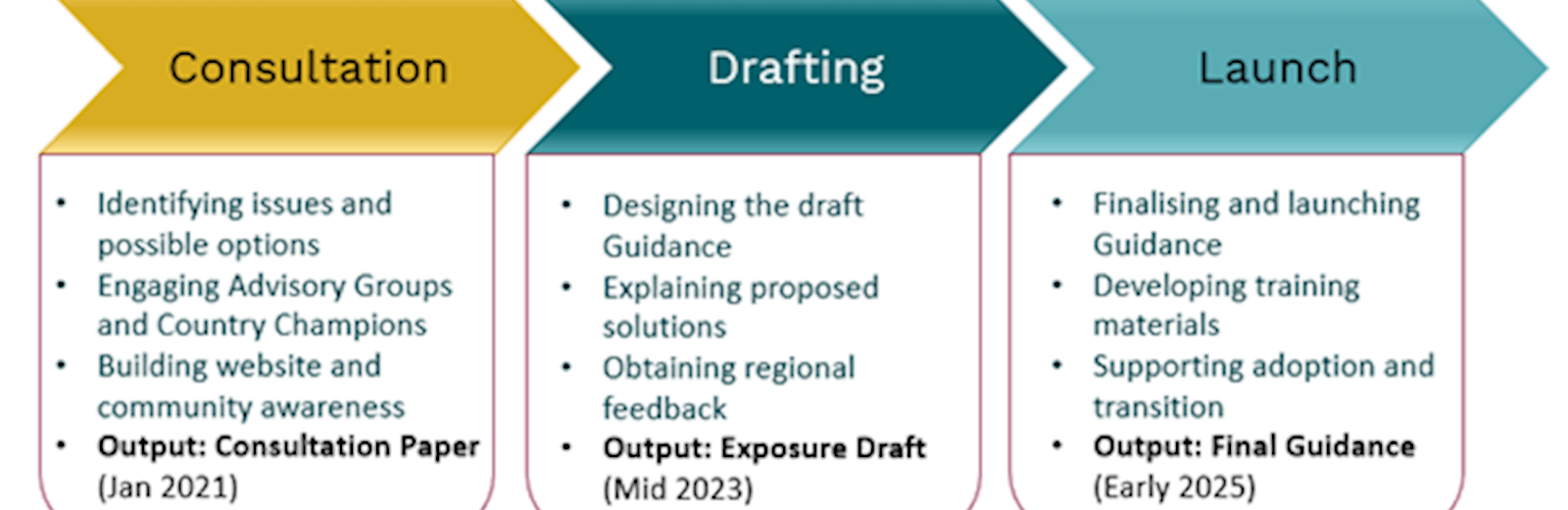

Both the International Accounting Standards Board (IASB) and International Public Sector Accounting Standards Board (IPSASB) have acknowledged the need for sector-specific guidance, but conceded they had neither the mandate nor the capacity to develop it themselves. So in 2019, Humentum (formally Mango) partnered with the Chartered Institute of Public Finance and Accountancy (CIPFA) to launch the IFR4NPO project to develop the world’s first internationally applicable financial reporting guidance for non-profit organisations (NPOs). With both implementing partners being non-profit organisations, this initiative is ‘by the sector, for the sector.’

The first major milestone was reached on 28 January 2021 with the publishing of the Consultation Paper, following international due process. International accounting standard setters are engaged alongside national standard setters from every continent, via the project’s Technical Advisory Group.

Once developed, the Guidance can be adopted by jurisdictions at their discretion and recognised as best practice by funders. We very much hope that countries with existing national guidance, such as the UK, will consider whether to adopt or align to it over time, thereby creating greater international consistency.

In the absence of internationally applicable guidance, funders and grantors, eager to ensure proper accountability and transparency, have created their own formats and templates for project-based reports. While many of these have merit individually, they are different from each other, and collectively create a costly burden on NPOs who often require sophisticated accounting systems and/or highly skilled accounting staff that they can ill afford, most especially when indirect cost contributions are so frequently squeezed.

For that reason, the project is forming a Donor Reference Group with the dual aim of ensuring that the needs of donors are met, while also advocating for harmonisation of project-based reporting formats. For example, if the accounting basis and top-level expenditure classification were consistent with the IFR4NPO Guidance, this would reduce the burdens for grantees and grantors across the sector. It’s fair to say that the complexity of the issues and difficulty in building consensus across the sector would be hard to underestimate.

Humentum has for years been supporting NPOs and grantors with navigating the current status quo – for example, by providing training for grantor desk officers who need to interpret grantee financial statements from other countries as part of their due diligence processes, and advising NPOs on structuring their costing and accounting to maximise cost recovery. In developing harmonized reporting, the IFR4NPO project aspires to fundamentally change the status quo.

The ultimate aim is to transform the accounting and regulatory landscape for the non-profit sector. This should lead to greater trust in the sector globally and put it on par with the private and public sectors, which should in turn also increase access to resources for social justice. It requires input from a wide range of stakeholders both in the UK and around the world to ensure it is relevant and useful. For example, we would value the perspective of users of the UK SORP, as well as those who conduct audits, have operations, or make grants internationally.

How can you make a difference? Even if you have never responded to an accounting standard consultation before, please consider investing some time by sharing your valuable perspective and experience to shape the future of financial reporting in this sector. Check out the project website www.ifr4npo.org, access the consultation paper, and subscribe to the newsletter for more information.

*The views expressed are the author’s and not ICAEW’s.