The debate about climate change has been on the increase in recent years. Greta Thunberg and activist groups have brought the issue into focus, while it has also been subject to greater scrutiny from investing and other stakeholder communities. The demand is the same: protect the climate by changing the way the world produces and uses energy.

Increasing numbers of larger or listed companies are reporting climate-related risk in their annual reports. The framework for narrative disclosures developed by the Task Force on Climate-related Financial Disclosures (TCFD) is a useful tool for doing this. For those applying IFRS, the International Accounting Standards Board (IASB) has published an article on accounting for climate change, IFRS Standards and climate-related disclosures, but what about UK GAAP? How should smaller businesses account for and disclose the effects of climate change?

Defining climate-related risks

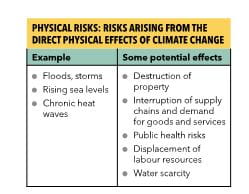

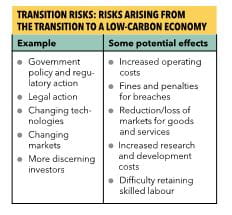

It is difficult to envisage the accounting effect of climate-related risks when it is referred to under a single banner such as climate change. By breaking it down into specific risks, for example, physical or transition risks (see tables, right), it’s easier to see how it could affect your business and accounting.<

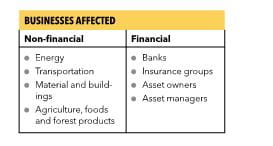

All businesses are likely to experience some disruption as the world around us changes and we adapt to the effects of climate change. However, some are likely to be affected more quickly than others with the TCFD identifying the sectors below as higher risk.

How is it reported?

Many UK GAAP preparers will be subject to the requirement in UK company law to prepare a strategic report, although much of the forward-looking content is required only of quoted companies, many of which will not be UK GAAP preparers. However, the strategic reports of UK preparers must give a description of the principal risks and uncertainties facing the company, which would include the risks of climate change, if these are material to the business.

Accounting for risks

Whether, and to what extent, the risks of climate change should affect a company’s financial position is a key question for preparers and presents a complex challenge. Unless your business identifies a likely direct effect in the foreseeable future – for example, a factory in a flood plain that is at risk or a component for petrol engines for which demand might tail off – then the effects can seem indistinct and far off. But it is important to consider plausible scenarios when assessing forward-looking information affecting the financial statements. This might come through in the following ways:

Reductions of asset lives (FRS 102 Sections 17-19)

Broadly speaking, an asset’s useful life is the period over which you expect to use an asset in your business. This should be estimated realistically and reviewed at the end of each reporting period when there are indicators that it may have changed. Factors to consider when determining the useful life of an asset might be the asset’s expected usage, wear and tear, technical or commercial obsolescence and legal limits placed on the asset’s use.

In the context of climate change, asset lives could be reduced because of (among other things):

- lower demand for their output in the transition to a low carbon economy;

- their location in an area under threat of extreme adverse weather conditions; and/or

- regulation prohibiting the future use of equipment that produces high emissions.

Impairment calculations (FRS 102 Section 27)

Goodwill, property, plant and equipment (PPE) and intangible assets are tested for impairment when circumstances indicate that an impairment might exist. Indicators of impairment might relate to the assets themselves or to the economic environment in which they are operated.<

Generally, preparers are not looking many years in advance to identify impairment indicators. However, it may be appropriate to consider physical and transition risks as indicators, if it is reasonable to foresee that your business may be affected. For some of the industries referred to in the table above, this task might be required sooner rather than later.

If an impairment test is conducted, then the asset’s recoverable amount is determined, which is the higher of value in use and fair value less costs to sell. Where a value in use calculation is prepared, it is based on management’s assumptions about the future and it may be appropriate to include increased costs, reduced revenues, shorter asset lives and increased discount rates consistent with climate-related risk, either as a base case or plausible downside scenario.<b<> </b<>

An asset’s fair value might also be affected, for example to reflect the expectations of fossil fuel prices or potential changes in laws and regulations. This is equally true whether the fair value is determined for impairment purposes or in a different context (eg, if the asset is carried at fair value under the revaluation model for PPE and intangibles).

Increases in provisions and contingencies (FRS 102 Section 21)

The costs of dismantling and removing an item of PPE and restoring the site on which it is located are part of the asset’s initial cost. If the useful life of the asset is reduced because of climate-related risk, then any associated provision could well increase due to increased costs of retirement and/or bringing the cost forward in time.

There could be a greater number of onerous contracts resulting from increased costs or reduced demand, as well as provisions for fines and penalties for non-compliance with regulations. There may also be contingent liabilities for litigation if third parties consider that a company has not upheld its environmental responsibilities.

Materiality

It is important to consider materiality when incorporating climate-related risk into the financial statements, which also means thinking about the information needs of the users of your accounts. For larger, listed clients, the fact that the investor community has been calling for enhanced disclosure of climate-related risk may make some of those risks material by nature, even if the financial effects are not.<

By contrast, small private business owners may have access to sources of information beyond financial statements, especially if they also manage the business. In these cases, assuming the quantitative impact is not material, disclosure in the financial statements may not be considered material by nature either.

When it comes to the numbers, assessing materiality will mean forecasting different possible futures for your business. Even if there is no material effect on the carrying amounts of assets and liabilities as of now, the process of considering potential outcomes could be a useful strategic tool.

Can UK GAAP preparers look to IFRS for greater guidance?

FRS 102 was developed for smaller, less complex businesses than IFRS is intended for, and so it contains less detailed guidance. However, Section 10 of FRS 102 indicates that preparers may consider the requirements and guidance of similar areas in EU-adopted IFRS when developing accounting policies. This could be helpful, and a summary of that guidance, relevant to climate change, is provided in the IASB’s November 2019 In-Brief IFRS standards and climate-related disclosures available at ifrs.org

About the author

Anna Malcolm,Senior Manager, EY Financial Reporting Group