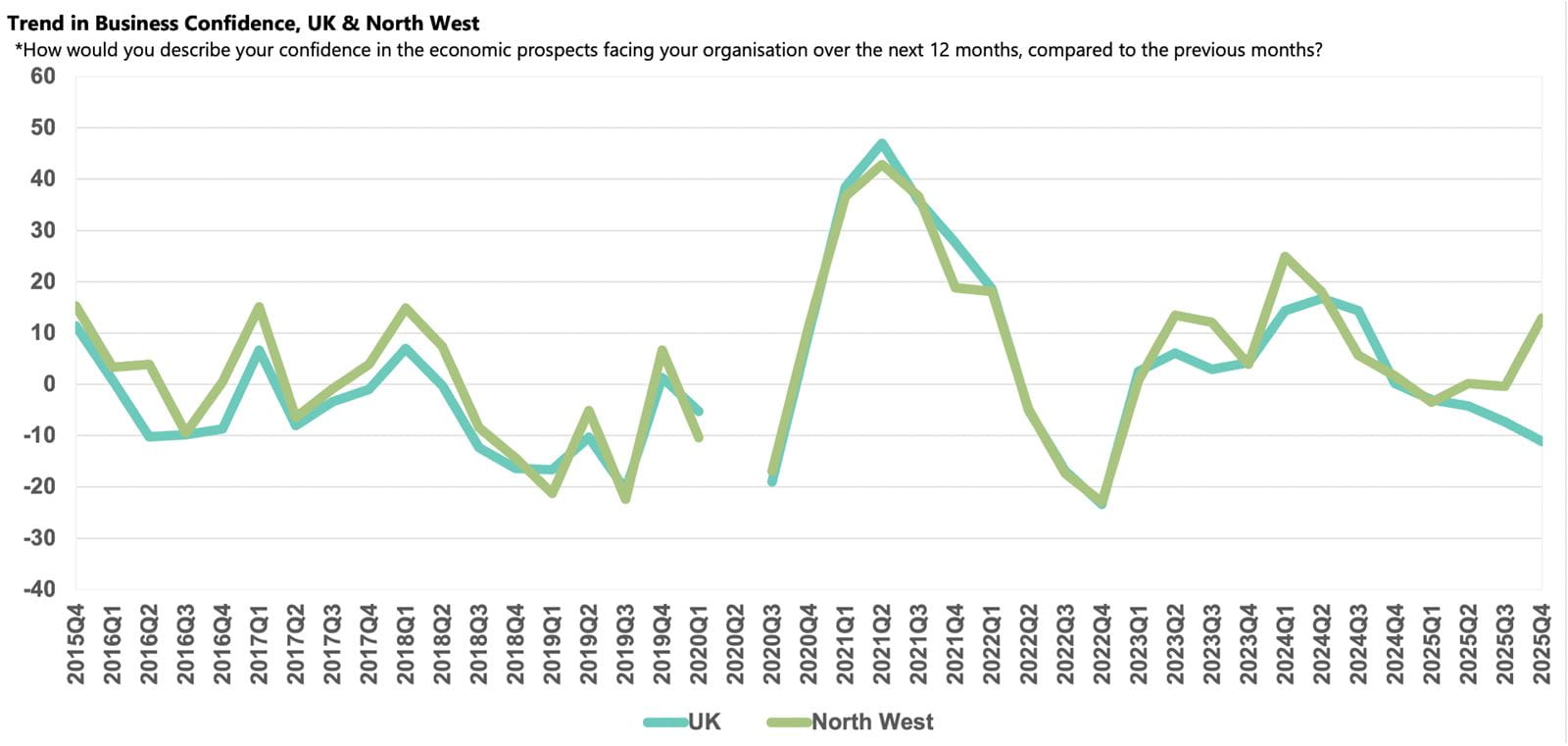

Q4: North West businesses are the most confident as sentiment returns to positive territory

The latest national Business Confidence Monitor (BCM) shows that business sentiment slipped deeper into negative territory amid uncertainty about the Budget and rising concern about both the tax burden and regulations. However, companies are optimistic that domestic sales and exports growth will improve over the next 12 months.

The survey results are based on 1,000 telephone interviews among ICAEW Chartered Accountants covering a range of UK sectors, regions and company sizes, ensuring a representative picture of the UK economy. The latest quarterly findings are based on the period 8 October to 11 December 2025.

- Business confidence in the North West rose to +12.9 in Q4 2025, above the historical norm (+5.8) and significantly ahead of the UK average (-11.1).

- The relatively upbeat outlook is supported by robust domestic sales and exports growth, both of which are expected to continue to improve.

- The tax burden remains the most prominent business challenge, followed by customer demand and regulations. All three concerns were less frequently cited than the national average.

- Annual input price inflation ticked up but remained below the UK average and is expected to dissipate next year.

- There were further signs that the labour market is cooling in the North West as employment growth and wage inflation both eased. However, businesses are upbeat about their recruitment plans for 2026

- Investment remains strong but expansion is expected to moderate next year, while above average R&D growth is expected to slow sharply.

Business confidence in North West

Business confidence in the North West returned to positive territory in Q4 2025, rising to +12.9 from -0.4 last quarter, moving above the regional historical average (+5.8) and significantly ahead of the national average score which sank further to -11.1. The North West was the only region to record a positive confidence score in Q4 2025.

The rise in confidence is supported by above average sales growth reported by businesses in the region, with major announcements reaching the news headlines, including an £8bn order to supply 20 Eurofighter Typhoon jets to Turkey, guaranteeing jobs at BAE Systems factories in Lancashire. Anecdotal evidence also points to a spike in confidence in Construction in the North West during the quarter, with ONS data showing a 1.4% expansion in output in the sector in the preceding quarter. In addition, while companies in the North West face the same major headwinds as other regions, they are less likely to report the tax burden and regulatory requirements as major challenges than most other parts of the UK.

Domestic sales and exports growth

Domestic sales continued to expand above the historical norm (3.2%), rising by 3.7% in Q4 2025 and significantly ahead of the national average (2.9%). Businesses are increasingly optimistic about the coming year, raising their growth projections to 5.1%, ahead of the UK forecast (4.2%) and among the strongest forecasts across UK regions. The outlook for the Business Services and IT & Communications sectors likely support this positivity.

Exports growth picked up to 2.8%, moving above the region’s historical norm (2.6%) and faster than the national average (2.5%). Businesses continue to expect an uplift in the year ahead but have tempered their forecast to 4.4%, still more optimistic than the national outlook (4.1%). Again, it is likely that the views of the Business Services and IT & Communications companies underpin the upbeat projection.

Business challenges

Overall, businesses in the North West were less likely than average to report the most widespread national concerns as rising challenges in Q4 2025. That said, like elsewhere in the UK, the tax burden remains the most significant concern among businesses in the North West, reported by 56% of companies in Q4 2025. Following a slight fall from the record high recorded last quarter (60%), it is the second lowest proportion among UK regions, only above the West Midlands (54%) and lower than the national average (64%). However, the proportion is significantly higher than the historical average (17%). Likewise, concern about regulatory requirements also eased and, at 38% of companies, is the lowest proportion of any UK region in Q4 2025 and lower than the national average, which rose to 51% in the quarter.

Despite relatively strong sales growth, there was a slight rise in concern about customer demand as a growing challenge, at 39% and edging ahead of the regional historical norm (38%) but again lower than the UK overall (41%). One issue that was more apparent in the North West was late payments, reported by 26% of companies, up from the previous quarter and above both the national average and regional historical norm (both 22%). Late payments can be a sign that businesses are in financial distress and this is the highest proportion reported in the region since Q4 2023.

Labour market

There were signs that the labour market is cooling in the region in Q4 2025, with businesses reporting that annual employment growth slowed to 1.1%, the lowest since Q2 2021 but faster than the UK average (0.8%). Alongside weaker labour demand, there was also a drop in concern among businesses in the region about the availability of management and non-management skills and staff turnover in Q4 2025, with all issues reported below their regional norms. Companies remain upbeat about their recruitment plans for the coming year, expecting employment to expand by 2.0%, above the historical norm and national projection (both 1.3%).

Amid slowing employment demand, wage inflation dipped slightly, but at 3.1% it remains above the national average (2.9%). Businesses are more optimistic than they were last quarter about the trajectory of pay rises and expect growth of 2.7% in the year ahead, closer to the regional historical norm (2.2%).

Input and selling prices, and profits growth

Annual input price inflation edged up to 3.9% in the North West in Q4 2025, but remains below the national average (4.1%). Despite the uplift in the quarter, businesses continue to expect the rate of inflation to ease to 2.8% 2026, significantly closing the gap to the region’s historical norm (2.6%) and one of the lowest rates projected across the UK.

Companies reported that their annual selling prices increased by 2.7% in Q4 2025, a slight uplift compared to the previous quarter. However, with input inflation and salary growth expected to ease, businesses intend to raise their prices at a slower pace of 2.1% in the year ahead, broadly in line with the UK average (2.2%).

Robust sales growth supported a further increase in the profits growth reported by companies in the North West, rising by 3.3% in the year to Q4 2025 and ahead of the regional historical average (2.9%). This was the second-fastest rate behind London (3.5%) and above the UK average (2.7%). The upbeat outlook for sales growth underpins a similarly strong view for profits growth, with businesses projecting a 5.4% expansion, markedly above the UK-wide forecast (4.3%). Only the South West has a stronger profits outlook (5.9%).

Investment

Capital investment growth has been relatively strong over the past year in the North West. Last quarter was an exception, with annual growth dipping below the region’s historical average, but even then the rate was in line with the UK average. Businesses reported a sharp rise to 3.5% in Q4 2025, the fastest rise in the UK and significantly above the historical norm (2.2%). While still relatively optimistic, businesses plan to slow the rate of expansion to 1.8%, still among the stronger forecasts and above the UK projection (1.6%).

The region has also posted above-average R&D budget growth in recent quarters and Q4 2025 saw a further rise to 2.5%, comfortably above the historical norm (1.9%) and the national average (1.6%). However, businesses plan to reduce the growth in R&D budgets sharply to just 0.2% in the year ahead which is significantly lower than the UK average (1.3%).