Q4: Businesses in the South East are the least confident in the UK amid record tax concerns and rising regulatory challenges.

The latest national Business Confidence Monitor (BCM) shows that business sentiment slipped deeper into negative territory amid uncertainty about the Budget and rising concern about both the tax burden and regulations. However, companies are optimistic that domestic sales and exports growth will improve over the next 12 months.

The survey results are based on 1,000 telephone interviews among ICAEW Chartered Accountants covering a range of UK sectors, regions and company sizes, ensuring a representative picture of the UK economy. The latest quarterly findings are based on the period 8 October to 11 December 2025.

- Sentiment in the South East declined sharply in Q4 2025, dropping to -19.1, the lowest confidence score across the UK.

- While strong domestic sales and exports sales growth is expected to accelerate in the year ahead, reports of tax pressures remained at survey record highs.

- Concerns about regulatory requirements and customer demand also rose.

- Labour demand cooled in the year to Q4 2025 and the outlook for the year ahead is muted.

- Despite rising input price inflation, profits growth improved compared to the previous quarter, with further uplifts expected next year.

- Businesses in the South East increased both their capital investment and R&D budget growth in the year to Q4 2025 and the outlook is relatively upbeat.

Business confidence in South East

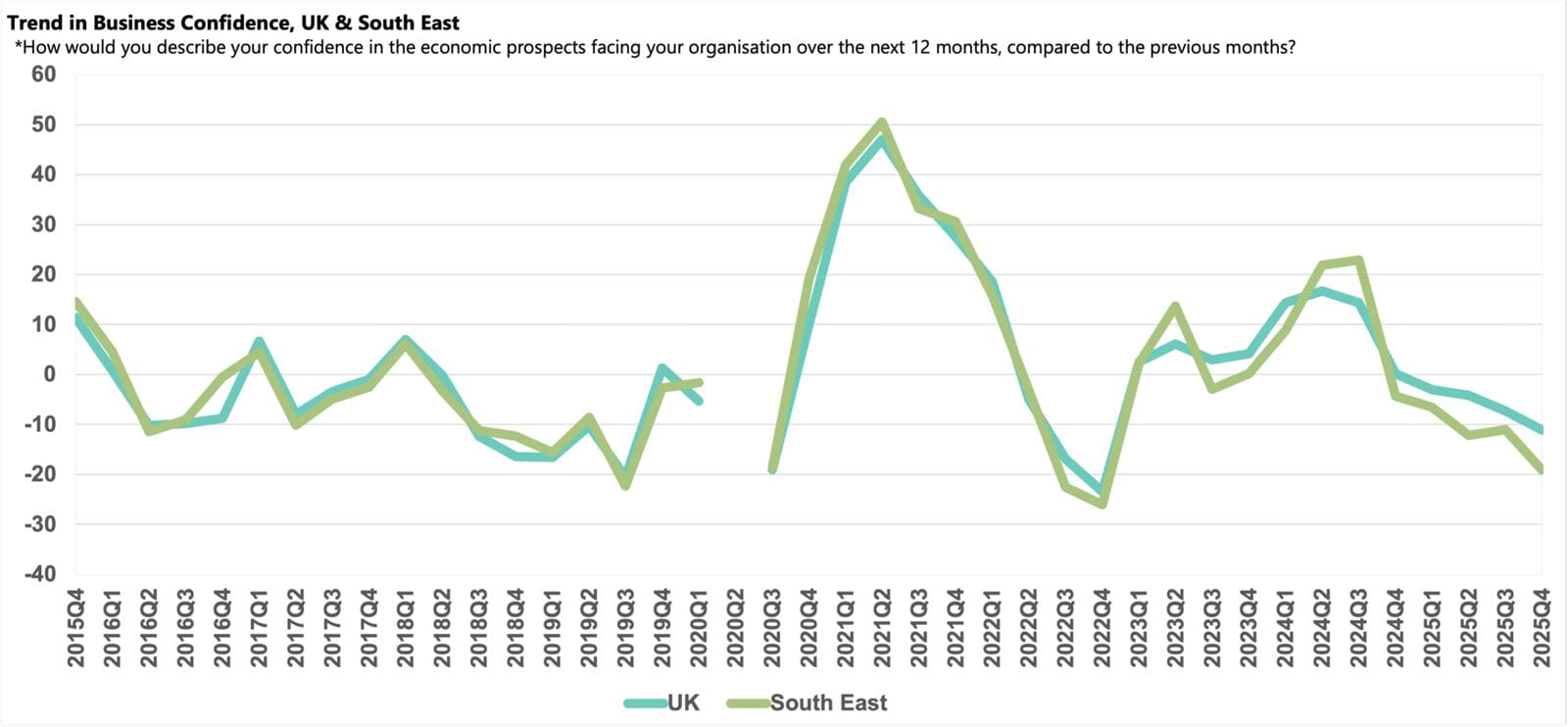

Business sentiment in the South East declined significantly in Q4 2025, with companies in the region now the most pessimistic in the UK. The Business Confidence Index contracted into deep negative territory at -19.10 in Q4 2025, from -11.0 in Q3 2025. This decline widened the gap to both the region’s historical average (+4.7) and the national average (-11.1), with the index at its lowest level since Q4 2022.

The increased pessimism in the region is likely a result of the increasingly prominent challenges posed to businesses by the tax and regulatory burdens in the year to Q4 2025, alongside speculation of further tax rises before the Autumn Budget.

Domestic sales and exports growth

Despite the decline in confidence, businesses in the South East recorded an uptick in annual domestic sales growth in Q4 2025 to 2.9%, matching the rise reported across the UK. This increase in growth is likely linked to the rise observed in the locally important Retail & Wholesale sector in the year to Q4 2025. Businesses in the region expect a further uplift next year, with growth set to climb to 4.0%, above the region’s historical norm (3.2%), but slightly below the 4.2% rise forecast nationally.

Annual exports growth picked up to 3.3% in Q4 2025, marginally exceeding the region’s historical norm (3.2%). This increase was among the strongest in the UK, significantly outpacing the national average (2.5%). Businesses in the South East expect further improvement over the next 12 months, with the anticipated growth of 5.2% more optimistic than businesses in all regions apart from Wales and London. This increased optimism could be linked to the region’s comparatively large dependence on the Business Services and IT & Communication sectors which both foresee strong exports growth over the coming year.

Business challenges

The increases in employers’ National Insurance Contributions and the speculation of further tax rises in the months leading up to the November Budget continued to fuel concerns over the tax burden in the South East. Of the companies surveyed in the region, 69% cited the tax burden as a growing issue in Q4 2025, still a survey record high for the region at over three times the historical average (20%), with the issue only more prevalent in the South West.

Regulatory requirements were the next most widespread concern in the South East, as citations reached a seven-year high, at 56% in Q4 2025. This proportion was significantly above the region’s historical norm (40%) but more widespread compared to the UK average rate (51%).

Reports of customer demand increased from the previous quarter, with 51% of businesses in the South East citing this issue as a growing challenge in Q4 2025. This is more common than in any other region and above both the historical norm (39%) and national average (41%). There was other evidence from the survey this quarter that underlying conditions may be increasingly challenging, including a rise in concern about competition in the marketplace to 38% and an increase in businesses citing late payments to 25%, both above their respective historical averages.

Labour market

The demand for labour in the South East has cooled significantly following the increases in employers’ National Insurance Contributions and the National Living Wage in April and businesses increased their staff levels by just 0.1% in the year to Q4 2025. This sluggish expansion lagged both the national average (0.8%) and the region’s historical norm (1.3%). Businesses in the region plan to increase their staff levels at a sharper rate of 1.1% over the coming year, lower than the 1.3% rate projected nationally.

As employment growth has slowed, concerns over the availability of skills have also eased among businesses in the region, with both management and non-management skills challenges less widespread in the South East than in any other region and markedly below their respective historical norms in Q4 2025.

Meanwhile, stagnant employment growth in the South East appears to have fed through to salary inflation, which rose at a slower pace than in almost any other UK region in the year to Q4 2025, at just 2.3%. While this marked a four-year low for the region it was still just above the region’s historical average (2.2%). Companies in the region expect wage inflation will pick up slightly to 2.7% in the year ahead, which is broadly comparable to the UK projection (2.8%).

Input and selling prices, and profits growth

Businesses in the South East recorded a significant uptick in annual input price inflation in Q4 2025, with a reported uplift of 4.5%, outpacing the UK average (4.1%). Over the next 12 months, companies in the region predict that input cost growth will moderate significantly to 3.2%, still above the region’s historical norm (2.7%) and marginally exceeding the 3.0% increase expected UK-wide.

Despite the reported uplift in input price growth, companies maintained the rate at which they increased their selling prices at 2.3% in the year to Q4 2025, matching the national average. Over the coming year, businesses plan to raise their selling prices at a similar pace, with an expected rise of 2.4%, slightly widening the gap to the region’s historical norm of 1.3%.

Strong domestic sales and exports sales growth over the past year supported strengthening annual profits growth in the South East in Q4 2025, with businesses in the region reporting profits growth of 3.0% and outpacing the UK average (2.7%). Companies anticipate a marked improvement in profits growth in the coming year to 4.1%, rising above the regional historical average (3.3%), but slightly slower than the national forecast (4.3%).

Investment

Following a significant reduction in the previous quarter, businesses in the South East lifted the rate of capital investment growth to 1.7% in Q4 2025, though this increase was still weaker than the 2.0% rise recorded across the UK and the region’s historical norm (1.9%). While businesses in most other regions intend to slow the rate of their capital investment growth next year, companies in the South East plan to expand the rate to 2.1%. This is one of the strongest rates expected in the UK, with only businesses in the East Midlands projecting sharper increases.

At the same time, R&D budget growth increased to 2.4% in Q4 2025, exceeding both the national (1.6%) and historical averages (1.9%). Companies in the South East intend to grow their R&D budgets at a similar rate in the year ahead, with the projected rise of 2.3% one of the sharpest rises forecast across the UK.