Q4 2025: Confidence slips into deep negative territory amid growing concerns about customer demand.

The latest national Business Confidence Monitor (BCM) shows that business sentiment slipped deeper into negative territory amid uncertainty about the Budget and rising concern about both the tax burden and regulations. However, companies are optimistic that domestic sales and exports growth will improve over the next 12 months.

The survey results are based on 1,000 telephone interviews among ICAEW Chartered Accountants covering a range of UK sectors, regions and company sizes, ensuring a representative picture of the UK economy. The latest quarterly findings are based on the period 8 October to 11 December 2025.

- The Business Confidence Index for Construction dropped into deep negative territory to -16.2 in Q4 2025, dropping below the UK average (-11.1).

- The tax burden remains the primary growing challenge, but concerns about customer demand displaced regulation as the second major issue amid concerns over future sales.

- Domestic sales growth continued ahead of the historical average, but companies now expect growth to slow over the coming 12 months.

- Input price inflation ticked up in Q4 2025 and while profits growth improved, the sector has the lowest profits forecast of any sector, at less than half the UK-wide projection.

- Labour demand slowed further but salary inflation edged up and concerns about the availability of non-management skills remain prominent.

- Businesses plan to raise their capital investment growth but scale back R&D budgets.

Business confidence in the Construction sector

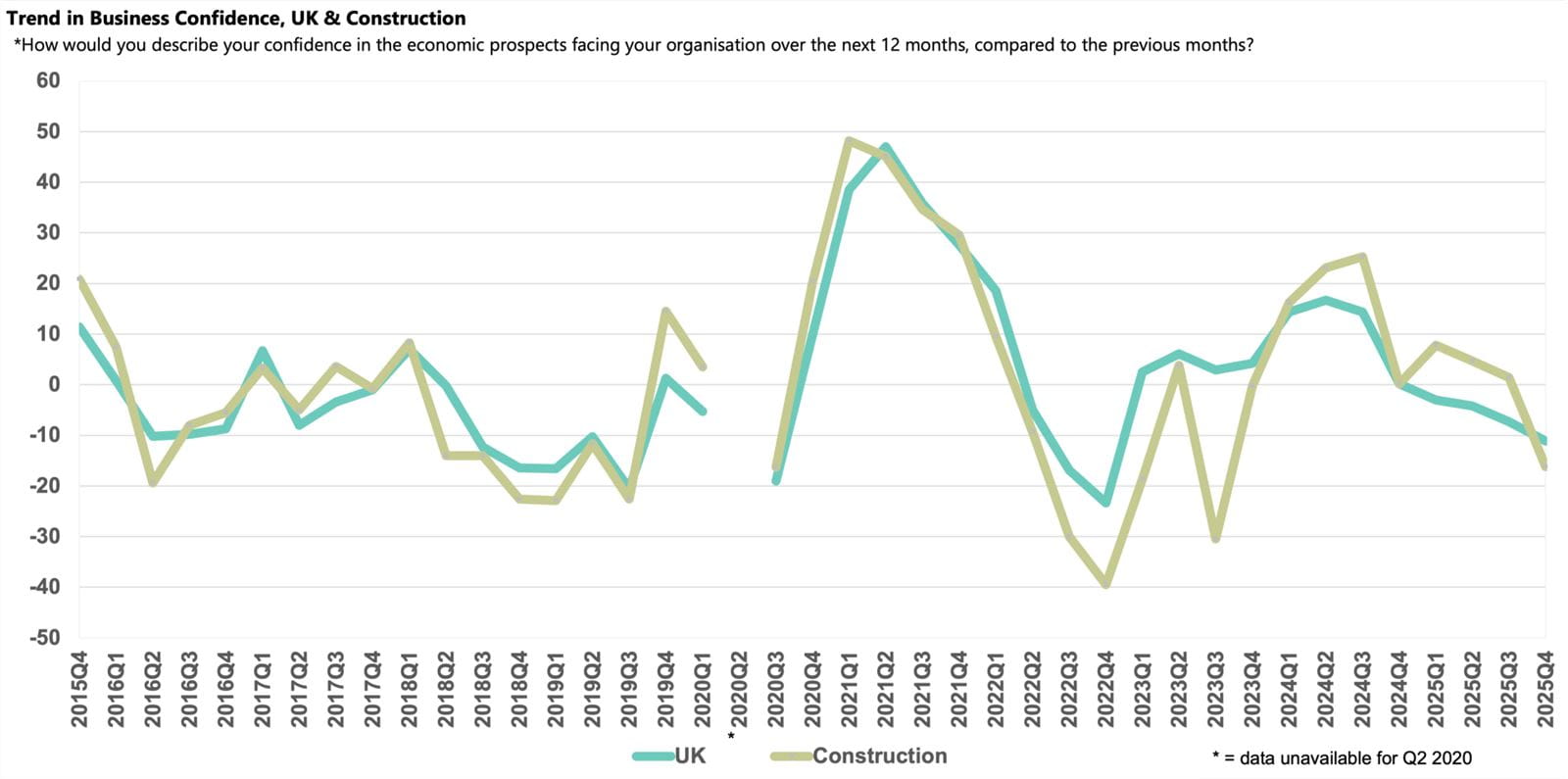

There was a sharp deterioration in the Business Confidence Index for Construction, falling into deep negative territory to -16.2 in Q4 2025 from +1.4 in Q3 2025. This is both the lowest reading and the first negative score for the sector since Q4 2023. Sentiment in the sector remains below its historical average (+3.6) and now sits below the UK average (-11.1).

Confidence in the sector has been drifting down in recent quarters, but Construction businesses have remained more optimistic than the economy-wide average, clinging on to hopes that activity would rise sharply in the wake of government commitments to reform planning and build more homes. However, in the face of a raft of growing challenges, companies have become more pessimistic than average and are now among the least confident, alongside Retail & Wholesale and Property. ONS data report that construction output declined by 1.1% in the three months to November, with ONS citing anecdotal evidence that delays in work and customer spending were affected by economic uncertainty ahead of the autumn Budget announcement. Meanwhile, the Bank of England Agents’ Summary of Business Conditions for December 2025 noted that activity was down, with high build and funding costs keeping new house building and commercial projects below last year’s levels. Businesses in the sector remain concerned about the tax burden and regulatory requirements and are increasingly worried about customer demand, impacting their outlook for the coming year.

Domestic sales growth and customer demand

Businesses reported that domestic sales growth rose to 3.5% in Q4 2025, above the historical norm (2.7%) and the national average (2.9%). However, the proportion of companies reporting customer demand as a growing challenge increased to 47%, ahead of the sector norm (42%), with the issue only more common among Retail & Wholesale companies (61%). Construction businesses now expect growth to ease to 3.0% over the next 12 months, notably weaker than the 4.2% national forecast.

Input prices, selling prices and profits growth

Input price inflation continues to be sticky for the Construction sector, edging up to 3.9% in the year to Q4 2025. Despite the uptick, input prices are rising at a slower rate than the national average (4.1%). Companies foresee a sharp decline over the coming year to 2.7%, below the sector historical (3.1%) and economy-wide (3.0%) averages.

After rising in the last two quarters, annual selling prices in Construction edged down slightly to 2.6% in Q4 2025. Businesses plan to ease growth to 2.4% next year, just above the UK average (2.2%) but well above the sector historical average (1.5%).

Profits growth improved and, at 2.2% in Q4 2025, was close to the historical sector norm (2.3%). However, with sales growth expected to slow, companies are relatively pessimistic about the outlook for profits growth in the year ahead, projecting growth of just 1.9%, the lowest forecast of any sector and less than half the UK-wide projection (4.3%).

Employment and labour market challenges

Employment demand cooled further in Q4 2025, with annual jobs growth of 0.6% reported for the Construction sector, just half the historical norm (1.2%) and slightly weaker than the national average (0.8%). Construction businesses anticipate demand to pick up to 1.3% next year, matching the UK projection.

Consistent with softening labour demand in the sector, companies are less concerned about the availability of management skills and staff turnover this quarter. However, the availability of non-management skills continues to be an issue and was reported by 30% of Construction businesses, the largest proportion of any sector and above the historical average (26%).

Skills shortages may help explain the continued rise in wage pressures in Q4 2025, with companies reporting annual salary growth of 3.4% in the year, compared to 3.1% last quarter. This was the fastest rate reported across UK sectors and above the 2.9% national average. Companies expect salary growth to cool to 3.0% over the coming year, slightly ahead of the national projection (2.8%) but significantly higher than the sector historical norm (2.1%).

Business challenges

The tax burden remained the most significant concern for the Construction sector in Q4 2025. Following April’s tax rises and amid pre-Budget speculation, the issue was reported by 56% of businesses, down from the record high of 73% last quarter and lower than the national average (64%) but nearly three times the historical average (19%). Concern about regulatory requirements also eased, falling to 45%, though still significantly higher than the sector norm (36%) as companies continue to point to planning delays impacting activity in the sector. Customer demand is now the second most prominent concern in Construction, at 47% which likely reflected the increased economic uncertainty ahead of the November Budget.

There has been a steady rise in companies reporting government support as a growing challenge in the Construction sector and the issue was reported by 22% of businesses in Q4 2025, over twice the historical average (10%) and the joint highest rate alongside Energy, Water & Mining. The rise likely reflects the significant challenges the industry faces in meeting government housing targets, with ongoing planning, regulatory and skills issues impacting the delivery of new homes and an expectation that the government needs to do more to help the sector to meet its aspirations.

Investment growth

Businesses reported that annual capital investment shrank by 0.2% in Q4 2025, the only sector to report a contraction, with UK companies on average growing investment by 2.0% over the period. However, Construction companies plan to increase investment growth to 1.7% next year, above the sector historical norm and UK average projection (both 1.6%).

Prospects for R&D budgets appear to be less encouraging however, with Construction companies reporting that they plan to cut budgets by -0.7% over the next 12 months after sluggish growth of just 0.1% in the year to Q4 2025. Only businesses in the Property sector intend to cut budgets next year (-0.5%), with companies on average expecting growth of 1.3%.