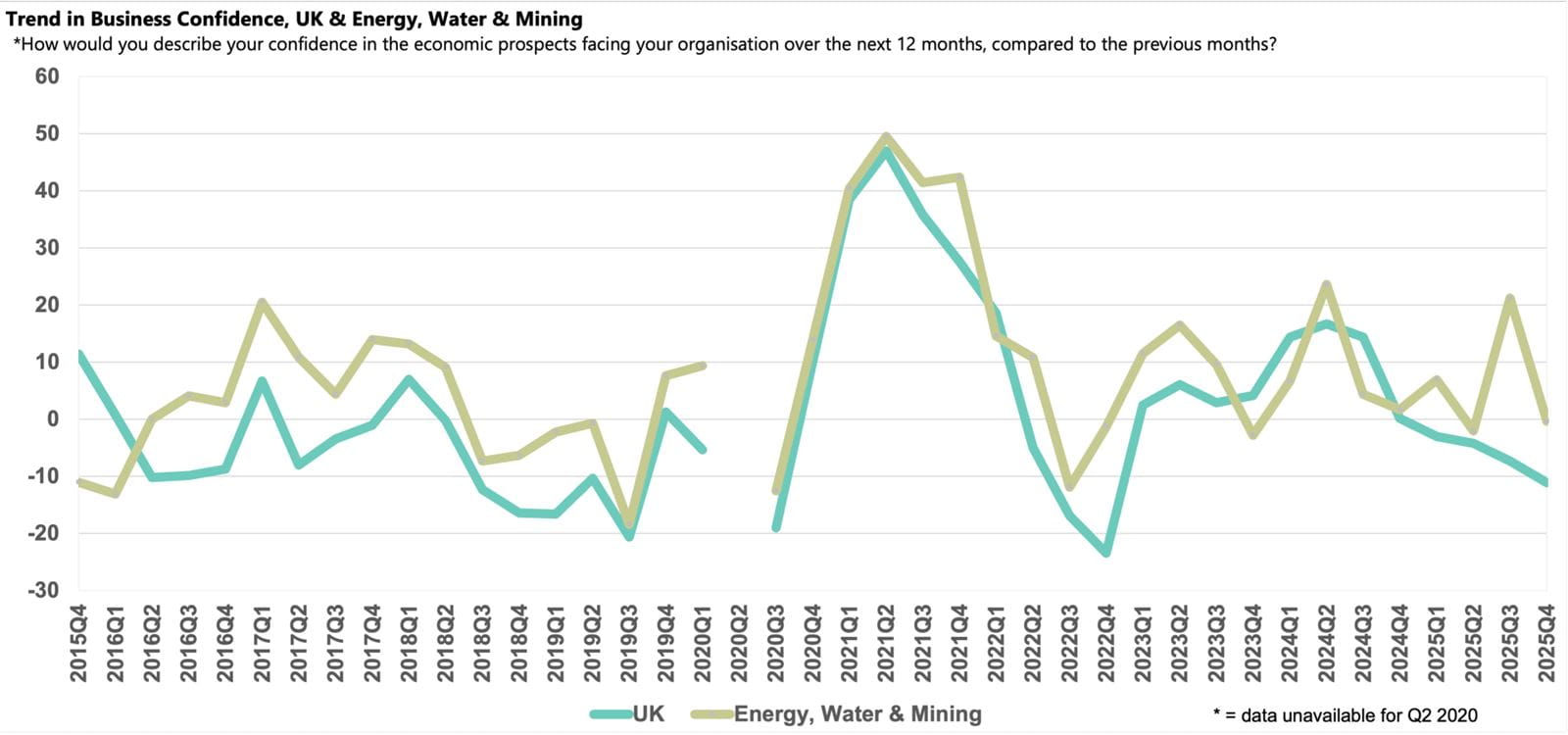

Q4 2025: Confidence dips back into negative territory but remains ahead of most other sectors.

The latest national Business Confidence Monitor (BCM) shows that business sentiment slipped deeper into negative territory amid uncertainty about the Budget and rising concern about both the tax burden and regulations. However, companies are optimistic that domestic sales and exports growth will improve over the next 12 months.

The survey results are based on 1,000 telephone interviews among ICAEW Chartered Accountants covering a range of UK sectors, regions and company sizes, ensuring a representative picture of the UK economy. The latest quarterly findings are based on the period 8 October to 11 December 2025.

- Confidence in Energy, Water & Mining slipped back into negative territory in Q4 2025, though at -0.3, sentiment was still significantly ahead of the national average (-11.1).

- Domestic sales growth lagged the national average, but a significant uplift is expected, while exports growth slowed with further moderation anticipated over the coming year.

- Annual input price inflation cooled slightly and businesses predict that price growth will ease below the historical norm, supporting above-average profits growth expectations.

- Regulations continue to be the most prominent growing challenge for the sector, closely followed by concerns about the tax burden.

- Capital investment and R&D budget growth outpaced their respective national averages in the year to Q4 2025, though companies in the sector plan to moderate both in the year ahead.

Business confidence in the Energy, Water & Mining sector

After an uptick in the previous quarter, sentiment among Energy, Water & Mining businesses slipped back into negative territory in Q4 2025. The Business Confidence Index for the sector declined from +21.2 in the previous quarter to -0.3. While confidence was down significantly compared to the sector’s historical norm (+7.7), companies in the sector remain among the least pessimistic in the UK, with sentiment significantly above the national average (-11.1).

This drop in confidence is underpinned by subdued domestic sales growth and a slowdown in exports growth compared to the previous quarter, while the push toward net zero has brought stricter regulations for the Energy, Water & Mining Sector and this is reflected in the uptick in companies reporting these requirements as a growing challenge over the coming year. Over a fifth of businesses in the sector are also concerned about the lack of government support. However, companies have relatively strong profits growth expectations for the coming year buoyed by an expected rise in domestic sales growth, but the marginal 0.2% rise in the OFGEM energy price cap announced for January 2026 limits the scope for some companies in the sector to raise their prices.

Domestic and export sales growth

Annual domestic sales growth picked up slightly to 2.4% in Q4 2025, though this increase was weaker than most other sectors, lagging the national average (2.9%). Over the coming year, businesses in the Energy, Water & Mining sector expect growth to improve significantly, rising to over double the historical average (2.7%), to 5.9%. This projected expansion is second only to companies in the IT & Communications sector and significantly higher than the national forecast (4.2%).

Meanwhile, following a sharp uptick in the previous quarter, businesses in the Energy, Water & Mining sector reported that exports growth slowed to 2.9%. However, even with this slowdown, growth was marginally above the national average (2.5%) and matched the sector’s historical norm. Looking ahead, companies anticipate growth will continue to moderate over the coming year to 2.3%, a weaker outlook than most other sectors and just over half the national average growth projection (4.1%).

Labour market

After rising in the previous two quarters, annual employment growth in the Energy, Water & Mining sector slowed significantly to 1.2% in Q4 2025, marginally below the sector’s historical norm (1.3%) but still markedly above the national average expansion of 0.8%. Companies plan to slow their recruitment further over the coming year and the projected employment growth of 0.2% is notably lower than the 1.3% rise forecast nationally.

Despite subdued employment growth, businesses in the sector continue to face issues with skills availability. Of the companies surveyed, 20% cited the availability of non-management skills and 17% reported the availability of management skills, with both issues above their respective historical norms and the national averages.

Alongside the slowdown in employment growth, Energy, Water & Mining companies reported that salary inflation eased compared to the previous quarter, dropping to 2.9%. This increase equalled the average rise recorded in the UK but remains above the sector’s historical norm (2.5%). Businesses expect salaries to rise at a sharper pace over the coming year, projecting growth of 3.4%, the strongest outlook of any sector and significantly faster than the 2.8% rise anticipated across the UK.

Selling and input prices, and profits growth

Businesses in the Energy, Water & Mining sector reported a slowdown in input price inflation in Q4 2025, dropping to 3.9% year-on-year. This moderation brought cost growth below the national average (4.1%) but companies in the sector anticipate growth will slow further over the coming year to 2.7%, below both the historical norm (2.9%) and the national average projection (3.0%).

Companies maintained the rate at which they raised their selling prices at 1.8% in the year to Q4 2025, a softer increase compared to the 2.3% uplift recorded nationally. With the OFGEM price cap rising by just 0.2% from January 2026, businesses in Energy, Water & Mining project selling price growth of 2.1% over the next 12 months, matching the sector norm but slightly below the national average (2.2%).

Weak domestic sales growth and slowing exports growth appears to have impacted profits expansion in Energy, Water & Mining, with a 2.2% rise in the year to Q4 2025, below both the sector’s historical average (3.0%) and the national average (2.7%). Strong domestic sales growth and a further moderation in cost pressures supports above average expectations for next year, with businesses anticipating profits growth of 5.5%, notably above the rate projected for the UK (4.3%).

Business challenges

The latest survey data show that companies in the Energy, Water & Mining sector were increasingly concerned about regulations in Q4 2025. These concerns are undoubtedly linked to the Employment Rights Bill, which achieved Royal Assent in December and stricter requirements accompanying the transition to net zero. The proportion of companies citing regulatory requirements as a rising challenge climbed further above the sector’s historical average (42%), reaching 55%. Also connected to the transition to net zero, 22% of businesses reported government support as a growing concern, nearly twice the historical average (13%).

Unlike other sectors, concerns over the tax burden were less prevalent among Energy, Water & Mining companies in Q4 2025 compared to the previous quarter. However, over half (53%) of businesses surveyed reported the tax burden as a rising challenge, more than double the sector’s historical average (20%). Other issues that rose in prominence in other sectors in the quarter are less prevalent in Energy, Water & Mining. For example, concerns about competition in the marketplace (28%) and customer demand (27%) have both increased on average across UK businesses but are both in line with the sector’s historical norms.

Investment

Despite easing below the sector’s historical norm (3.0%) in Q4 2025, the Energy, Water & Mining sector reported higher annual capital investment growth than most other sectors, at 2.9%, significantly exceeding the national average (2.0%). However, companies intend to moderate capital expenditure growth considerably over the coming year to 1.1%, lower than the national projection of 1.6%, perhaps reflecting businesses uncertainty about future UK energy policy.

Annual R&D budget growth softened to 2.5% in the year to Q4 2025, though this was still a sharper increase than both the national average (1.6%) and the sector historical norm (1.8%). Companies plan to ease R&D budget growth further, but the projected rise of 1.8% is stronger than the 1.3% uplift expected for the UK on average, and only businesses in IT & Communications anticipate faster growth next year.