This TAXguide sets out the answers to various questions raised at MTDtalk on 2 June 2025 and Tax in Practice on 1 July 2025. It does not answer every question raised as some were similar, but seeks to group the responses by theme.

MTDtalk on 2 June 2025 was a two-hour webinar designed to give practitioners a greater understanding of the Making Tax Digital for income tax (MTD income tax) rules. Tax in Practice on 1 July 2025 gave the opportunity to address some of the questions raised. This TAXguide captures selected questions and answers from those webinars by theme and captures frequently asked questions published previously by ICAEW.

The webinars can be accessed at:

Who is in and who is out?

How does the turnover threshold work for MTD income tax?

Taxpayers with turnover of more than £50,000 are required to join MTD income tax from April 2026. The turnover threshold reduces to £30,000 from April 2027 and to £20,000 from April 2028. The turnover test is applied to:

- Turnover/gross income (not profits).

- Turnover from self-employment and property only, added together (see below for the specific boxes on the tax return).

- Each taxpayer individually (so where there is income from jointly held property the individual’s share of that gross income per the tax return is what counts).

- When determining whether the turnover threshold is exceeded, if the relevant reference period is less than 12 months the qualifying income must be adjusted proportionately on a time or other just and reasonable basis.

Income not reported on the tax return is not included for the purposes of the turnover test. Examples of this include income not reported because it is wholly covered by:

- the trading allowance;

- the property allowance; or

- rent a room relief.

The test does not include partnership income or any other income that is not listed below:

| Self-employment turnover (exclude income as a foster carer or shared lives carer) | SA103F box 15, SA103S box 9, SA200 box 3.6 |

|---|---|

| Self-employment other income |

SA103F box 16, SA103S box 10 |

| UK property income |

SA105 box 20, SA200 box 6.1 |

| Other UK property income (grant of lease) |

SA105 box 22 |

| Other UK property income (reverse premiums) | SA105 box 23 |

| Other UK property income (FHL) |

SA105 box 5 |

| Foreign property gross income |

SA106 box 14 |

| Foreign property income (reverse premiums) |

SA106 box 16 |

Which period is the turnover test applied to for MTD income tax?

When MTD income tax starts in April 2026, the £50,000 turnover test will be applied to the information in the 2024/25 tax returns that are due to be filed by 31 January 2026. There will be a requirement for each taxpayer, or their agent, to sign up individually but HMRC will, at some point, set up the obligations to file quarterly updates if taxpayers do not sign up.

Where a taxpayer no longer has any income from self-employment or property, they will

need to notify HMRC that these income sources have ceased and ensure that the MTD income tax obligations are cancelled. A taxpayer whose turnover/gross income exceeds £50,000 in 2024/25 but drops below £50,000 in 2025/26 will still need to comply with MTD income tax requirements from April 2026.

When the turnover threshold reduces to £30,000 in April 2027, it will be applied to information in the 2025/26 tax returns due to be filed by 31 January 2027. When the turnover threshold reduces to £20,000 in April 2028, it will be applied to information in the 2026/27 tax returns due to be filed by 31 January 2028.

A taxpayer that breaches the turnover threshold for the first time in a tax year (including a taxpayer new to self assessment (SA)) is required to join from 6 April following the due date for the SA tax return for that tax year.

Does MTD income tax apply to partnerships?

HMRC intends to introduce MTD income tax for partnerships, but no start date has been announced. When introduced, the MTD income tax obligations will apply to the partnership rather than individual partners. Until MTD income tax is extended to partnerships, partners must continue to report partnership income annually along with income from other non-MTD sources.Does MTD income tax apply to non-resident landlords with no national insurance number?

No. Taxpayers without a national insurance number are specifically excluded. To join MTD income tax, a taxpayer must have a national insurance number. A temporary national insurance number is not a national insurance number for these purposes. This exemption only applies for a tax year where the taxpayer does not have a national insurance number on 31 January before the start of that tax year.

Does MTD income tax apply to executors while they are collecting rent from estate property and filing tax returns?

No. Estates are exempt from MTD income tax. See full list of exemptions.

Is grant income taken into account when assessing whether a taxpayer exceeds the threshold for joining MTD income tax?

If grant income is reported in one of the boxes on the SA return against which the threshold is tested, then it will be taken into account. For more detail on the boxes used on SA return to check whether a taxpayer’s qualifying income exceeds the threshold, see above.

Do recharges relating to the property count as qualifying income (eg, property insurance recharge or service charges)?

If these charges are reported in one of the boxes on the SA return against which the threshold is tested, then they will be taken into account. For more detail on the boxes used on SA return to check whether a taxpayer’s qualifying income exceeds the threshold, see above.

If a client has £40,000 qualifying income for 2024/25, but only £15,000 for 2025/26, I understand that they don’t have to register. Is that because the £30,000 threshold is based on the 2025/26 tax return and not 2024/25?

Yes. The tax year against which the thresholds are tested are as follows:

| From April 2026 | From April 2027 | From April 2028 |

| Gross qualifying income over £50,000 | Gross qualifying income over £30,000 | Gross qualifying income over £20,000 |

| Based on 2024/25 returns | Based on 2025/26 returns | Based on 2026/27 returns |

If rental income is joint with spouse, do you just include the individual’s share or the total income to decide if a taxpayer’s qualifying income exceeds the MTD income tax threshold?

You just include the individual taxpayer’s share (ie, the amount from Box 20 on their SA105). For more detail on the boxes used on SA return to check whether a taxpayer’s qualifying income exceeds the threshold, see above.

If rent a room is over the limit, then you have to report the total income on the SA return and then take off the £7,500 allowance. So, does the full rent go into the calculation for the threshold or just the amount over £7,500?

It is the full rent as that is the amount reported in the relevant box on the SA return. For more detail on the boxes used on SA return to check whether a taxpayer’s qualifying income exceeds the threshold, see above.

If small amounts of property income or side hustle under the £1,000 limit is the only thing tipping the person with other rental income/self-employment income over the MTD qualifying income threshold - will it be counted for the purpose of eligibility?

It depends on whether that small amount of income is reported on the SA return. For example, a person with employment income and a small side hustle below £1,000 does not have to report the side hustle on a SA return as the income is below the trading allowance. However, a person with a sole trade and a side hustle below £1,000 is likely to have to report the side hustle on their SA return as claiming the trading allowance would prevent them from claiming a deduction for expenditure in their main sole trade.

Can you leave MTD income tax if your turnover/gross income drops below the threshold?

A taxpayer who is in MTD income tax and whose turnover/gross income falls below threshold for three successive tax years can claim exemption from the start of the following tax year.

Example:

| Tax year | Turnover | Notes |

| 2024/25 | £55,000 | Base year so mandated for 2026/27 |

| 2025/26 | £25,000 | |

| 2026/27 | £35,000 | First mandated year |

| 2027/28 | £15,000 | Second mandated year |

| 2028/29 | £15,000 | Third mandated year |

| 2029/30 | £15,000 | Fourth mandated year |

| 2030/31 | Not mandated as three prior successive tax years are all £20,000 or less. |

If you will be mandated to join MTD income tax due to your 2024/25 turnover, but turnover in 2025/26 and the following two years is below the turnover threshold, does 2025/26 count as one of the three years under the threshold to come out of MTD income tax?

Unfortunately, 2025/26 does not count as it is not a year where the taxpayer is mandated to use MTD income tax. In this example, the taxpayer would need to have turnover below the threshold in 2026/27, 2027/28 and 2028/29 to cease being mandated to use MTD income tax.

A taxpayer’s turnover on the accruals basis in 2024/25 is £51,000. Their debtors on 5 April 2025 are £2,000. On the cash basis, turnover for 2024/25 would be £49,000. Are there any issues with using the cash basis in 2024/25 to delay MTD income tax mandation by a year?

Provided the client qualifies to use the cash basis rules, using the cash basis is not a problem.

Will non-UK residents be exempt?

Those who complete the residence, remittance basis etc (SA109) pages of the SA return will not be required to comply with MTD income tax until April 2027. This is to allow more time to reflect the changes to the taxation of non-UK domiciled individuals.

If a taxpayer receives a one-off fee for consultancy work declared as other untaxed income, is it included?

This would not be included as income reported in box 17 of the SA100 does not count towards qualifying income. For more detail on the boxes used on SA return to check whether a taxpayer’s qualifying income exceeds the threshold, see above.

What will happen if a taxpayer has qualifying income over the threshold in 2024/25, but they will cease trading in 2025/26?

If all mandated income sources have ceased, it will be possible to opt out the taxpayer. HMRC advisers on the agent-dedicated line (ADL) or self assessment (SA) helpline should refer the caller on to the MTD teams.

A taxpayer has £49,500 of property income and £800 of income from a side hustle that does not need to be reported on their SA return as they have no other self-employment income. As the taxpayer’s qualifying income in 2024/25 is technically over £50,000, do we need to notify HMRC?

As a taxpayer’s qualifying income is based on what is actually reported on the SA return, in this example they would not be mandated to join MTD income tax in 2026/27. There is no obligation to notify HMRC in this example. For more detail on the boxes used on SA return to check whether a taxpayer’s qualifying income exceeds the threshold, see above.

If trust income is mandated to a beneficiary so they include the rental income on their tax return and their share of the gross rental is more than £50k then will this individual be in MTD income tax from April 2026?

As the beneficiary’s share of the trust rental income should be reported on the SA107 pages, it will not count towards the threshold for MTD income tax.

If a taxpayer is not mandated to join at the start of the tax year, but it becomes clear during the tax year that their income is going to exceed the threshold, what action should they take?

The taxpayer does not need to do anything other than file their SA return. Based on that return, HMRC will mandate the taxpayer to join MTD income tax from a future date, generally the start of the tax year following the filing date for the return in which the threshold is exceeded.

A client starts a new business with an anticipated turnover of £60k pa. Should they sign up to MTD immediately even if they have never submitted a tax return before?

The taxpayer is not required to join immediately. In fact, they must have filed a SA return within the last two years to be able to sign up.

A taxpayer that breaches the turnover threshold for the first time in a tax year is required to join from 6 April following the due date for the SA tax return for that tax year.

If a sole trader is declared bankrupt, does the MTD income tax filing obligation cease immediately?

Yes.

Are MPs excluded from MTD income tax if they have self-employment or property income?

MPs are not among the excluded groups of taxpayers.

If a taxpayer is digitally excluded, it is assumed that they will continue to complete SA returns. Does that mean the SA system will continue to exist indefinitely?

SA is expected to be retained in the longer term, but to be moved on to a new IT platform. HMRC is required to provide an alternative service for the digitally excluded and ICAEW would press to ensure that a filing method that accommodates digitally excluded taxpayers will continue to be available.

Signing up

Will those who are currently making SA returns be automatically enrolled into MTD income tax?

No. Every taxpayer has to be signed up individually. Time should be planned in for performing this task.

Will HMRC inform taxpayers directly that they are mandated to use MTD income tax and must sign up?

HMRC will contact taxpayers that it considers must sign up. The first batch of mandation letters are being sent in November 2025 to taxpayers who filed their SA tax return for 2024/25 by the end of August 2025. Mandation letters will be sent to taxpayers who file their 2024/25 SA tax returns between September 2025 and January 2026 in February and March 2026.

Although HMRC intends to send out mandation letters, it is the taxpayer’s responsibility to:

- check if they are required to comply with MTD income tax from April 2026; and

- sign up for MTD income tax.

If a taxpayer believes that they are required to comply but has not received a mandation letter, they should sign up for MTD income tax.

Do people have to have signed up by 1 April or 6 April, or can they wait until May or June?

Taxpayers do not have to be signed up by the start of the tax year, but they do need to have signed up in time to submit their first quarterly update (due 7 August).

What action will HMRC take if a mandated taxpayer does not sign up to MTD income tax and continues to submit SA returns?

It is understood that HMRC will take action to sign up mandated taxpayers. If quarterly updates have been missed, there could be penalty point implications – possibly also record keeping penalties. However, penalty points will not apply to quarterly updates filed late for the 2026/27 tax year.

Will I be able to sign up my client for 2026/27 now even though I cannot sign them up for the trial because they are currently excluded as they have trust income?

Most sign up restrictions were lifted in December 2025 to enable sign up for the 2026/27 tax year. It was announced at Autumn Budget 2025 that taxpayers in receipt of trust income will not have to join MTD income tax until April 2027.

If you register a client early to get ahead but it turns out that their income for 2024/25 means they are not mandated, can they then be removed?

Yes, they can opt out, but their records will stay on HMRC’s ETMP platform and they will remain subject to the new penalty regime. We are waiting for clarification about what filing options will be available to a taxpayer in this situation.

If a client has a qualifying income source that exceeds £50,000 in 2025/26 that ceases in 2025/26 (as will be stated on the 2025/26 SA return) will HMRC automatically remove them from being mandated to join MTD income tax for 2026/27 or do we have to formally inform HMRC separately?

We would advise informing HMRC. This is because the 2025/26 return may be filed after the first quarterly update is due for 2026/27. Before opting out, you would need to be certain that all mandated sources have ceased.

If a taxpayer is not required to enrol based on their 2024/25 return but when their 2025/26 return is prepared the qualifying income is above £50,000, when would the taxpayer need to sign up from?

In this example, the taxpayer should be mandated to use MTD income tax from the start of the 2027/28 tax year. HMRC should inform the taxpayer that they are mandated to use MTD income tax for the 2027/28 tax year after they have filed their 2025/26 SA return. The signing up process is always for the current tax year (2026/27 will be the current tax year in this example) and the next tax year (2027/28 in this example).

The signing-up process asks for the business start date. What if the business started decades ago and the exact date is lost / unknown?

The exact business start date is now only required if the business commenced in the last two tax years.

Who can claim a digital exemption from MTD income tax and when will it be possible to apply?

A digital exclusion exemption can be claimed where it’s not practical to use software to keep digital records or submit them (this may be due to age, disability, location or another reason) or by practising members of a religious society (or order) whose beliefs are incompatible with using electronic communications or keeping electronic records. has been possible to make an application since the end of September 2025. To avoid making unnecessary applications, ICAEW would only recommend applying once a taxpayer has been informed that they are mandated.

Does an agent have to sign up their client if the client is submitting their own quarterly updates?

The sign-up process for MTD income tax can be completed by either the taxpayer or the agent. Even if the client is submitting their own quarterly updates, the agent may want to complete the sign-up process on behalf of the client in order to check the client’s details before they are transferred across to the ETMP platform.

An agent must be authorised by the client in their ASA to be able to compete the sign-up process (see below for information about how to create the dynamic link between the online services account and the ASA to avoid having to reauthorise existing clients).

Agent access (ASA and multiple agents)

Will MTD income tax information be on the Agent Services Account (ASA) rather than the online services account?

MTD income tax is managed through the ASA.

Why can't you see in the ASA clients transferred from existing SA authorisations?

This is an ongoing pain point that we raise with HMRC.

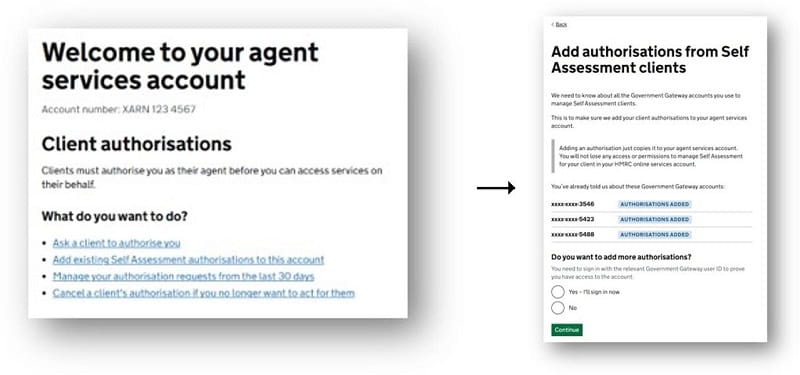

How do you set up the dynamic link between ASA and online services account?

A slide in MTDtalk 2 June 2025 shows how to create the link.

I think we have already copied across our authorisations but do we need to do this again in case we've had any new clients?

You don’t need to keep copying across authorisations once the dynamic link has been created. If you add new SA client authorisations in the online services account, the same clients will automatically be authorised in the ASA.

How do we know if the account is linked or not?

A slide in MTDtalk 2 June 2025 shows how to check what accounts have been linked and how to add further accounts.

Update your Agent Services Account

We are a new entity and are struggling to establish with HMRC whether we are correctly set up correctly with our new agent access for both clients not affected yet and ones that we will be entering into the trial. Any ideas who would be the best team to speak to?

You should be able to see which clients you have SA authorisation for in your HMRC online services account. In your ASA you should be able to see that the two accounts are linked (see slide in previous question).

When will HMRC merge the old authorisation (full payment history, etc) to the new ASA so we don't have to do two authorisations, to get complete authority and overview for a client?

You don’t need to complete two authorisations. Once you have created a dynamic link between the HMRC online services account and the ASA authority will be recognised for both SA and for MTD income tax. If you add new SA client authorisations in the HMRC online services account, those clients will automatically be authorised for MTD income tax in the ASA.

Can 'supporting agents' also file VAT returns?

Multiple agent functionality is currently only available for MTD income tax. However, an agent could be authorised as a supporting agent for MTD income tax and as the VAT agent.

What are the differences between a main agent and a supporting agent?

A taxpayer can only have one main agent for MTD income tax, but they could have several supporting agents. The key difference is that a supporting agent is unable to file the year-end tax return. Full details of the differences can be found at Choose agents for Making Tax Digital for Income Tax - GOV.UK. One point to note where there are multiple supporting agents is that they will all have access to details of all of the taxpayer’s mandated income sources – even if the taxpayer has only engaged them to act in respect of one (eg, self-employment or property income).

Digital record keeping

Can ICAEW produce simple examples to illustrate what must be on spreadsheets to comply with "digital records"?

As a minimum, a digital record must include:

- the amount of income or expense per financial item;

- the date that it was incurred or received; and

- the category of financial information (as specified in the MTD Update Notice).

The categories could just be “income” or “expense” if they are eligible to use “three-line accounts”.

If a client just drops their business bank account into a spreadsheet would that suffice?

A taxpayer could create the digital records in a spreadsheet based on bank information (provided the records meet the minimum details set out above). But the spreadsheet must be linked to a bridging product that can submit the information to HMRC quarterly. Software (possibly the same product) is also needed for the year-end tax return – there is no free HMRC service.

Does the need for expense analysis over the VAT threshold count per trade or is it if gross income is over the VAT threshold?

Taxpayers can choose to categorise their digital records in less detail if they have:

- total UK property income of less than £90,000 before expenses (this also applies if you are a landlord that jointly lets a property); or

- total income from self-employment of less than £90,000 before expenses.

If they have more than one income source, you can only use simpler categorisation for both income sources if their turnover is below the VAT threshold for each income source.

A self-employed financial adviser receives monthly commission statements. Will the transaction level detail requirements be met by listing each month's total income from the commission statement or will they need the back-office reports to detail each product sale and each commission line?

It is possible to treat a summary document such as a monthly commission statement as a single invoice for the purpose of creating a digital record.

If a landlord is using simplified reporting as their income is below the VAT registration threshold, they must still record their residential property finance costs separately. Does this mean that they require quarterly mortgage statements, or are estimates acceptable (eg, the split between capital and interest)?

It is possible to record the full mortgage payment (both capital and interest) if the split is unknown during the tax year. If the full payment is recorded, an adjustment will be required before the tax return is finalised. Another option would be to estimate the split and correct at year end.

What happens if a taxpayer is using simplified reporting and their turnover exceeds the VAT registration threshold during the year?

If the turnover goes above £90,000, the taxpayer will need to categorise all digital records for that income source in full from the start of that tax year – otherwise they will be unable to file their return following the end of the tax year. If there is a chance that the limit will be exceeded for an income source, it may be better to decide at the start of the tax year to not use simplified reporting.

We have a hairdresser client who takes payments via a card reader and fees are deducted from the amounts she receives. Is it acceptable to only record her net hairdressing fees?

It is acceptable to create the digital records for the quarterly updates using the net income. However, HMRC expects that an adjustment would be made to record the gross income and transaction fees before the tax return is finalised.

If a taxpayer receives, say, 50 invoices, from a supplier in a particular month and the supplier issues a statement for that month including all those invoices, is it acceptable to only post the total as shown on supplier's statement?

Potentially - yes. But you would need to be able to identify the category or categories of business expense that it relates and exclude any disallowable or capital amounts.

How will MTD income tax work for jointly held properties?

Each individual is required to comply with MTD income tax requirements for their income from property. This includes their share of income from any jointly held properties. There is no form of reporting by property or portfolio of properties. Each taxpayer’s UK income from property needs to be aggregated before being submitted to HMRC, likewise for income from overseas property.

This will create very significant practical problems for taxpayers who have different property holdings with different groups of joint owners. In some cases, the accounting may be done by different people and using different software products and the taxpayer may have great difficulty obtaining the information in time to submit the quarterly update and in complying with the requirement to have digital links from the transaction records through to submission. HMRC has announced two concessions that allow joint property owners to:

- report income (gross) from jointly held properties in their quarterly update while leaving reporting of expenses until the year end finalisation process; and

- create a single digital record for each category of income from jointly held properties and a single digital record for each category of expense from jointly held properties. This removes the need for each joint property owner to create digital records of each transaction.

The data flows and choice of software will need careful consideration where there is income from jointly held property.

It may be the case that only some of the joint owners are required to comply, it depends on how the threshold test applies in their particular circumstances.

Digital links

How do I create digital links between different pieces of software?

The basic premise is that a digital record is only created once and thereafter data is transferred electronically.

Acceptable forms of digital transfer include:

- linked cells in spreadsheets;

- emailing a spreadsheet with digital records for importing into another software product;

- transferring digital records to a portable device (eg, a memory stick) to be imported into another system;

- XML, CSV imports and exports;

- file downloads / uploads;

- Optical Character Recognition (OCR), AI capabilities, and other automated data transfers (including cloud features); and

- API transfers.

Unacceptable forms of digital data transfer include:

- manually transferring data within or between software programs (that collectively make up MTD compatible software)

- digital links that involve manual interventions such as transferring data by hand or moving data between software.

- the use of ‘cut and paste’ or ‘copy and paste’ to select and move information.

If I am using my accounting software for quarterly reporting and a different product for tax returns is the accounting software somehow supposed to be linked to the tax return software or is manual entry allowed into the tax return software?

Manual entry isn’t allowed but shouldn’t be necessary. Nor should you need to link products. This is because the quarterly updates submitted to HMRC should pre-populate the tax return software – even if it is a different software product. But you will need access to the accounting software for details of transactions to be able to identify any adjustments required.

Are digital links required from a third-party’s systems (eg, letting agent)?

The requirement to create digital links does not apply in this case. Even though a letting agent may record the taxpayer’s letting income, the system is not maintaining the digital accounting records for the taxpayer. The taxpayer creates the digital accounting records from the letting statements provided by the letting agent.

Are digital links required from till systems?

While the till system is recording sales receipts, the digital accounting records can be created from the daily sales totals (rather than a line-by-line entry).

Taxpayers using non-digital tills may record a single figure (for income) for their daily gross takings, often referred to as a Z reading, at the end of each working day. The daily readings that support the Z reading will only become a digital accounting record at the point that the information is entered into the accounting software or spreadsheet.

Taxpayers using electronic point of sales (EPOS) systems can digitally export their daily gross takings directly into their digital accounting records. While the EPOS records may be exported digitally, they must still be retained as part of the taxpayer’s records.

Quarterly updates

How will MTD income tax work where there are multiple sources of income from property and self-employment?

Separate obligations to comply apply to:

- Each separate trade (equivalent to the requirement to submit a separate SA103 for each trade)

- UK property income (equivalent to the SA105)

- Overseas property income (equivalent to the land and property section of the SA106).

There can be only one set of submissions (quarterly updates) for each obligation. If records relating to one obligation are held in more than one software product, they will need to be combined into one product before the submission is made to HMRC. This may be a problem where records for different divisions of the same trade or records for different properties are held in different systems.

Do MTD income tax quarterly updates all have to be to tax year quarters?

Quarterly updates are required for standard tax year quarters (ie, to 5 July, 5 October, 5 January, and 5 April). There is an option to elect for calendar quarters (ie, to 30 June, 30 September, 31 December, and 31 March). This does mean a bunching of agents’ workloads and any clash with the timing of VAT returns also needs to be considered. The due date for the quarterly updates is 7 August, 7 November, 7 February, and 7 May regardless of whether an election for calendar quarters has been made.

Can MTD income tax quarterly updates be amended?

Quarterly updates can be amended by resubmitting them. In a change from the original design, quarterly updates are now cumulative, year to date data. This will reduce the need for quarterly updates to be resubmitted as any corrections will be picked up by the next quarterly update.

The fourth quarterly update can be amended up to the year-end tax return being submitted. Once the year-end tax return has been filed changes will be made following a process similar to the process for amending a SA tax return (precise details not yet available).

The design of MTD income tax means that there is flexibility about how corrections can be made. For example, a correction can be made by either:

- Correcting the digital records and resubmitting the fourth quarterly update; or

- Adjusting the category totals in the software and correcting the digital records.

If using the second of these options, care would be needed to not resubmit the fourth quarterly update as there would be double counting of the correction.

It is not clear how and where adjustments to reflect non-tax-year accounting dates will be made, that is another of the significant design issues that ICAEW has raised with HMRC.

What data is actually required to complete the quarterly update for MTD income tax? Just quarterly turnover or with all types of expenses as well?

Quarterly updates are unadjusted summary totals of the income and expenditure categories cumulatively to date in the tax year.

If a taxpayer has income below the threshold to use simplified accounting (three-line accounts), the categories could be “income” and “expense”, although landlords receiving rental income from residential property, must record their residential property finance costs separately from other expenses. Non-business expenditure should be excluded, but if not, these must be adjusted before the end of year return is submitted.

Landlords with jointly owned properties can choose to just report the income from jointly-held property in the quarterly updates, and report the related expenditure in the tax return. However, they must report both property income and expenses relating to properties owned in their sole name.

Full details of the income and expenditure categories for taxpayers not using simplified reporting can be found in the MTD update notice.

As I understand it, the data is the cumulative total to each quarter rather than the transactions in the period as for VAT. Is that correct?

Yes, with effect from the 2025/26 tax year, that is correct. Cumulative reporting applies for MTD income tax. This means that errors can be corrected in the next quarter rather than having to amend earlier quarters.

Re cumulative quarterly reporting, please confirm this is for trade accounting year (where not 31 March / 5 April).

The quarterly updates are for the tax year or calendar quarters (31 March/5 April), not the accounting year for the trade. An adjustment will be required to get from these figures to the correct figures for the tax year. We are still waiting for details of how MTD income tax software will deal with businesses that don’t have a 31 March/5 April accounting date and which products will offer this functionality.

If a taxpayer (or agent) is on holiday from 1 July to 8 August and unable to file a quarterly update, can an exemption be claimed or are early returns accepted?

There is no exemption, but you could file early if all transactions have been recorded for the quarter. Gov.uk says: “If you do not expect to have any further transactions to record, you can send an update up to 10 days before the end of the update period. For example, you may be going on holiday and know that you will not be working for the remainder of the period and will receive no further income."

Note that late filing of a quarterly update will trigger a penalty point (but not for the 2026/27 tax year).

Some software may also allow more frequent filing than quarterly, but you will need to submit to the quarter end to fulfil the submission obligation.

Is there any disadvantage to having a calendar quarter end rather than a fifth of the month quarter end? I’m sure I read something about having to do a year end adjustment for the extra five days in you use calendar quarter ends.

A legislative fix is expected for the five days and draft legislation has been published, so there is no disadvantage. Those who elect for calendar quarters will have a start date of 1 April rather than 6 April. But you should check whether your software accommodates calendar quarter reporting (most are expected to).

Are two separate quarterly updates needed if taxpayer has UK and overseas rental income?

Yes.

If a taxpayer has both rental income and a self-employment, does MTD require one joint quarterly update or two separate updates (ie, one for each source)?

A separate update is required for each source. If a taxpayer has multiple sole trades, each trade requires a separate update (matching the number of SA103 pages that are filed under SA). The number of quarterly reporting obligations effectively matches the number of supplementary pages (eg, SA103, SA105 and SA106) required for that taxpayer.

If there are properties in joint names does each individual submit a quarterly update?

Yes. Each individual will submit an update of their share of the property income. Landlords with jointly owned properties can choose to just report the income from jointly-held property in the quarterly updates, and report the related expenditure in the tax return. However, they must report both property income and expenses relating to properties owned in their sole name.

A taxpayer has self-employment income of just over £50,000 and they rent out their garage (jointly-owned with husband) for £150 per month. The taxpayer currently declares their share of rental income (£900) on their SA return and the property allowance covers the income. Will the taxpayer have to submit quarterly updates for their property income too, even though it is covered by the property allowance?

Technically, the taxpayer does not need to declare their share of the property income as their property income is below £1,000. But if they do, then the taxpayer will have two obligations per quarter – one for their trade and one for their property income. However, given their income level, they could use simplified reporting.

Are there any limits to the number of resubmissions that can be made to the fourth quarter?

There are no limits on the number of resubmissions. However, it will not be possible to resubmit the fourth quarter once the tax return has been submitted.

If a taxpayer is mandated for MTD income tax in 2026/27 due to the income on their 2024/25 SA return, but their income ceases in June 2026 can they claim not to be mandated for 2026/27, or will they have to submit the first quarterly update, and then three at nil for 2026/27?

The taxpayer would be mandated to join MTD income tax in 2026/27. There will be a facility to inform HMRC that a source has ceased mid-year to remove quarterly obligations for the remainder of the year.

If income is received in advance monthly but there is a clawback if units are not produced, can an adjustment be made quarterly and then a final adjustment at year end?

Yes. There is no need to amend earlier quarters as the figures are cumulative to the latest quarter submissions.

If a taxpayer’s share of joint property income is more than £90k (ie, above the threshold for simple reporting), do expenses need to be reported quarterly?

There are two separate reporting easements: one for simple reporting and one for jointly-held property. Even if a taxpayer doesn’t qualify for simple reporting, they can still choose to not report their expenses relating to jointly-held property on a quarterly basis. They can just report their share of the property income quarterly and record their expenses digitally in time for the submission of their tax return.

If non-UK property income is based on US tax return figures, how do I report these on a quarterly submission through the year when I don't get US tax return information until after the quarterly submissions start for the year?

MTD income tax requires the taxpayer to keep digital accounting records and the quarterly update is the submission of summary totals from the digital accounting records. You would need to consider how the taxpayer will meet this obligation if the recordkeeping is currently primarily undertaken in the US.

If the taxpayer is currently reporting based on their US tax return figures, it is assumed that they are using the (unofficial) calendar year basis to make it easier to match and claim relief for US tax suffered on the income. It is currently unclear how non-aligned periods will work for MTD income tax.

We currently submit one SA106 per jurisdiction to claim tax credit relief on a jurisdiction-by-jurisdiction basis. However, we note that there is a single quarterly update obligation for an overseas property business. How will this work?

Clarification of this point is awaited from HMRC, but we understand that quarterly updates will require a split of income and expenses by country.

How do we change the quarterly reporting period from the fifth of the month to the calendar quarter?

A calendar quarter election is made in software if software supports reporting on this basis. The election must be made at the start of the tax year.

What happens if you register a client for MTD income tax on the basis of self-employment income and then, part way through the tax year, they start receiving property income that you didn't know about when you signed them up?

New income sources can be added by taxpayers or agents. Taxpayers can do this in the “Managing your Income Tax updates” section of their HMRC online services account. Agents can do this in the “Manage your client’s Income Tax details” section in the ASA. For a new source of income, you do not have to comply with MTD income tax until the start of the tax year following the filing date for the first return on which it appears.

Are quarterly updates for property income and self-employment due on different dates if the self-employment uses calendar quarter reporting (ie, from 1 April)?

The deadlines for quarterly updates are the same regardless of whether tax year or calendar quarter reporting is used. The deadlines are 7 August, 7 November, 7 February and 7 May following the end of the relevant quarter (so those that elect to use calendar quarters get an extra five days).

How does a software submission work if a taxpayer uses Software A for property owned with their spouse, a spreadsheet for property owned alone and Software B for property owned with siblings?

As there is a single quarterly submission for all property income sources of a taxpayer, the three separate sources of digital accounting records in this example would need to be digitally linked to enable the taxpayer to make a single quarterly submission for their property business. It may be worth considering making a family decision to use a specialist MTD-compatible software product for landlords that can support mixed portfolio reporting.

If a taxpayer uses the easement for jointly-held property, when do expenses need to be reported – quarter 4 or final submission?

The expenses for jointly-held property will need to be reported by the final submission (ie, in the tax return).

Is it possible to claim losses or reliefs on quarterly updates?

As quarterly updates are just a summary total of income and expenditure, it is not possible to claim losses or reliefs. These are claimed in the year end return.

Do quarterly updates contain a declaration, or is it just the year end return?

It is only the year end return that contains a declaration.

Do we need to get clients to approve the quarterly update before we submit on their behalf?

Please refer to: Topical guidance covering the application of professional standards to the provision of MTD for income tax services.

End of year process

MTD income tax covers income from self-employment and property. How is other income reported?

If a taxpayer is in MTD income tax, other income (eg, employment, pension, dividends or investment income) does not need to be reported quarterly to HMRC.

It is reported annually as part of the year-end tax return in a way that is similar to (but not quite the same as) the SA tax return (and to the current SA deadline). There are two ways to report this other income:

- Using MTD income tax accounting or bridging (submission) software that has additional functionality covering the rest of the tax return.

- Using a tax software product (eg, a commercial SA software product that has been upgraded to comply with MTD income tax).

Different products can be used to submit the quarterly updates and the year-end tax return. Different products can be used to submit quarterly updates for different trades, for UK property and overseas property. There will not be a paper option.

The current SA system (including the paper return) will remain available to taxpayers not in MTD income tax but in due course may be replaced by a new user interface.

What is the deadline for the final tax return? Is it still 31 January following the tax year?

Yes – the deadline remains 31 January following the end of the tax year.

What will the final submission look like? Will it be identical to the current SA100 or will it be presented in a different format?

The process will be different. MTD income tax software will be prepopulated with a lot more information from HMRC. In addition to the information submitted via the quarterly updates, we understand that it will include PAYE income; student loan repayments; income from state, private and occupational pensions; other taxable state benefits; construction industry scheme (CIS) subcontractor deductions; capital gains tax residential property disposals; and marriage allowance claims. The look and feel will vary depending on the software product.

The software will share the data with HMRC and HMRC will generate a tax calculation that is played back in the software. This calculation is then reviewed and if accepted, the final declaration and approval covers both the information contained in the return and the HMRC-generated tax calculation.

Do you have to put through amendments as a quarter 4 update?

If an amendment is required to the data submitted in the quarterly updates, the digital accounting record should be corrected. But in terms of correcting the number for the tax return, this could be done by resubmitting quarter 4 or by adjusting the summary totals in the software.

If adjustments are made to the quarter 4 update to correct the details ready for the tax return, how quickly will that happen? Is it instantaneous?

It is understood that it should be almost instantaneous.

Is there any more news on the HMRC re-opening the use of the online account to file the return?

Alongside the Spring Statement 2025, it was announced that taxpayers in MTD income tax will need to use commercial software for their final tax return (see MTD income tax will be extended in 2028). HMRC will not be providing a filing service.

If Software A is used for quarterly updates and Software B for the tax return, will the data from HMRC displayed in Software B (based on the four quarterly updates) contain as much detail as held on Software A itself?

The quarterly updates submitted to HMRC are just the totals of income and expenditure categories. HMRC does not receive details of the underlying data from the digital accounting records. Therefore, the detail displayed in Software B will just be the summary totals as submitted to HMRC. Agents will still need access to the taxpayer’s digital accounting records to identify any tax and accounting adjustments required.

Where does the information from HMRC get played back to if I use Software A for quarterly updates and Software B for the end of year tax return?

The summary totals submitted in quarterly updates using Software A should be visible in Software B (along with other information prepopulated by HMRC).

Cash accounting is now the default for self-employed individuals, but it is currently possible to opt to use traditional accounting. Will that still be possible?

Yes, it will still be possible to opt to use traditional accounting in MTD income tax.

Is it possible to make an adjustment to reflect residential property finance costs at the end of the year?

If details are not available during the year (eg, because there is an annual mortgage statement), this can be adjusted at the end of the year.

How do subcontractors record CIS deducted from their gross income?

The deductions will be pre-populated based on details held by HMRC, but the amounts can be overwritten if incorrect.

What is the process for disputing HMRC tax calculation? Do you approve so as not to be late and then dispute?

During the testing phase, if you disagree with HMRC’s tax calculation, you can contact HMRC’s dedicated MTD customer support team for help. We do not yet have details for the process from April 2026.

I currently use tax software to run scenarios (I create a dummy client) for tax planning. If MTD software won't calculate tax liabilities for such scenarios, then will I have to revert to spreadsheets to run tax planning scenarios?

Some software products may continue to include their own income tax calculators that could be used for this purpose. It will also be possible to pull calculations from HMRC’s system for different scenarios (but we understand why advisers may have concerns about doing so).

For farmers averaging we have an option in the calculator to see tax due if no averaging, two-year averaging and five-year averaging. Will we have to do that manually if the software does not have a calculator?

Some software products may continue to include their own income tax calculators that have this functionality.

Choosing software

Will all software offer calendar quarter updates?

No, but most are expected to. It is important to check this with the software supplier.

If software covers the year end process, does that mean all supplementary pages on the current SA return will be included?

No. It is important to check what income sources will be covered.

Will we need to wait until March 2026 before knowing which software is suitable, if still under development?

The software market and products will continue to evolve. It is accepted that this makes it difficult to select software.

How are separate obligations/submissions going to be managed for clients who may use a single bank account for multiple trades and records all of this in one accounting software? Will software makers be providing a solution to this or will all software only allow us to file for one of the trades, so clients will need to have multiple software subscriptions if they have multiple trades?

This is a good question to pose to software vendors when evaluating products and costs as different providers are taking different approaches to this issue.

If a taxpayer is already using a software product for their self-employment income and a spreadsheet for their property income, do they have to use the same software product for their property quarterly submission?

MTD income tax has been designed to allow flexibility about what software is used. For example:

- Software A could be used to for the digital accounting records and to submit quarterly updates of the self-employment income;

- a spreadsheet could be used to keep the digital accounting records of the property business combined with a bridging product (Software B) to submit the property income quarterly updates; and

- the tax return could be submitted using Software C.

Will HMRC provide software for small businesses without charge?

HMRC is not providing a filing solution for MTD income tax. However, some software providers are offering a free version of their MTD income tax product. In addition, some business bank accounts offer free MTD-compliant accounting software. It is important to check that any software meets the needs of the taxpayer to avoid having to switch products.

Further guidance on choosing MTD income tax software can be found at Choosing software for MTD income tax.

Penalties

Will penalties be notified digitally?

The guidance during the testing phase indicates that penalty decision letters will be issued.

Payment

Are tax payments made quarterly with an end of year adjustment?

The payment dates will remain the same as for SA. This means that the first payment on account will be 31 January during the tax year, the second payment on account will be 31 July following the end of the tax year and the balancing payment is due on 31 January after the end of the tax year.

Joining testing

In order to take part in testing, does the taxpayer need to have submitted a 2024/25 SA return?

No – the taxpayer just needs to have submitted at least one SA return and satisfy the other eligibility criteria. The 2024/25 SA return will still need to be submitted as normal.

Is there a way to contact HMRC to find out why, when we try to sign up someone for the beta testing this year, it's returning a message of "you cannot sign up this client voluntarily”? We think that the taxpayer meets the criteria.

It is understood that the two most common reasons for failing the eligibility test are that the taxpayer has partnership income or that they have a payment plan in place. Another reason is where agents use their online services account login – they should use their ASA login.

The sign-up pages may contain a link to report a problem (eg, with the wording “Is this page not working properly” that will open up a contact form).

Alternatively, ICAEW’s Tax Faculty may be able to assist with contacting HMRC’s MTD team.

Are there any software options available now that allow you to set up and run in "testmode” (ie, to get clients on board without the actual submissions/ joining HMRC testing)?

It is not possible to test the system in this way.

-

Update History

- 05 Jan 2026 (12: 00 AM GMT)

- Updated to reflect announcements at Autumn Budget 2025 and developments in HMRC guidance and processes.

- 10 Nov 2025 (12: 00 AM GMT)

- Updated to reflect the issue of mandation letters, applications opening for digital exclusion and to clarify the exemption where there is no national insurance number.

- 05 Aug 2025 (12: 00 AM BST)

- Updated to reflect draft legislation published on 21 July 2025.