Buying a house in Italy is a dream come true for many, but if you do not know the property tax rules you could be faced with some unpleasant surprises. Andrea Matera explains what you need to know.

When buying a property in Italy, there are taxes to pay dependent on several variables, including:

- Is the purchaser an economic entity or a private individual?

- Is the purchaser buying the property as their main home or will they use it to generate income?

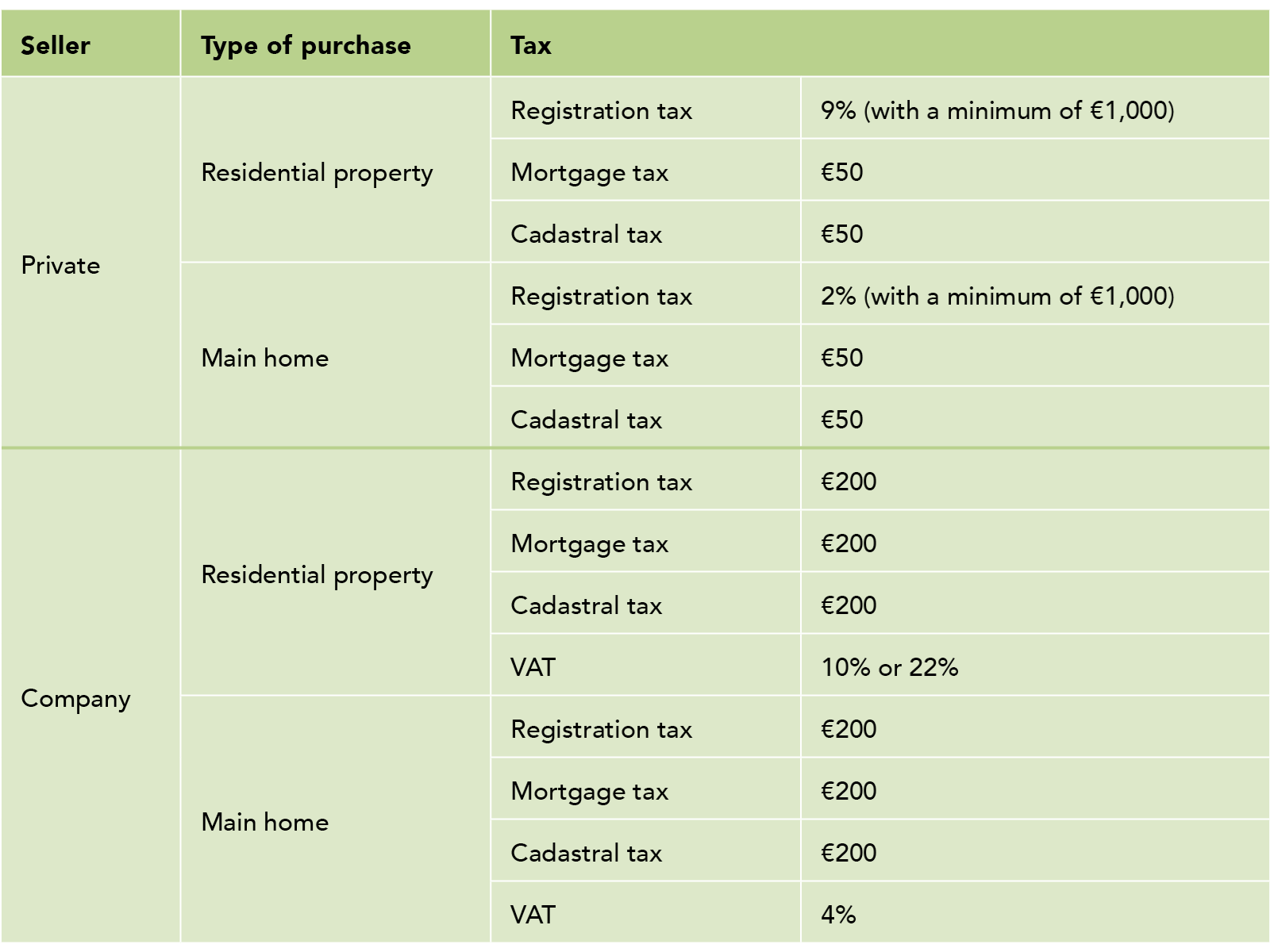

The general rule for the purchase of a property for residential use, whether the buyer is a company or private individual, is the payment of three specific taxes. These are:

- registration tax of 9% of the sale price (subject to a minimum of €1,000);

- the fixed mortgage tax of €50; and

- fixed cadastral tax of €50.

If the sale is made by a company, the general rule is that the sale is exempt from VAT. However, there are two types of sales of residential property by companies where VAT must be charged. These are:

- sales made by companies constructing or renovating buildings within five years of the completion of construction or renovation. VAT can also be charged after five years if the seller chooses to subject the transaction to VAT (the choice must be expressed in the deed of sale or preliminary contract); and

- the supply of residential buildings intended for social housing, where the seller chooses to subject the transaction to VAT (again, the choice must be expressed in the deed of sale or in the preliminary contract).

In these cases, the buyer will have to pay:

- 10% VAT for sales and deeds of incorporation of rights in rem in respect of dwelling houses (including those under construction) classified or classifiable in cadastral categories other than A/1, A/8 and A/9, if they do not meet the requirements to benefit from ‘main home’ relief, or 22% VAT for sales and deeds of incorporation of rights in rem in respect of property classified or classifiable in categories A/1, A/8 and A/9;

- the fixed registration tax of €200;

- the fixed mortgage tax of €200; and

- a fixed cadastral tax of €200.

The purchase of a main home

A property is defined as a ‘main home’ when the purchaser and their family transfer their residence to it, making it their main residence.

In this case, the property will be relieved from IMU, the property ownership tax, but will continue to be subject – like any other property in Italy – to the TARI tax, which covers waste disposal.

To stimulate the real estate market, the purchase of a main residence qualifies for the following reduced tax rates:

- if the seller is a private individual or a company selling exempt from VAT

- proportional registration tax at the rate of 2% (instead of 9%), subject to a minimum of €1,000;

- fixed mortgage tax of €50; and

- fixed cadastral tax of €50.

- if buying from a company, selling subject to VAT

- VAT reduced to 4%;

- fixed registration tax of €200;

- fixed mortgage tax of €200; and

- fixed cadastral tax of €200.

To benefit from this significant reduction in costs by purchasing a residential property as their main home, the purchaser must make a specific request to the notary or subsequently make an amendment to the deed of sale. They must also comply with the following requirements:

- The property must not belong to one of the following cadastral categories:

- A/1 (stately homes);

- A/8 (dwellings in villas); and

- A/9 (castles and palaces of eminent artistic and historical value).

- The property must be located in the municipality where the purchaser has their residence.

If the purchaser resides in another municipality (based in Italy) or state, they must transfer their residence to the one where the property is located within 18 months of the purchase. The declaration of intention to make the change of residence must be contained, under penalty of forfeiture, in the deed of purchase.

Please note that the change of residence is deemed to have taken place on the date on which the person concerned submits the declaration of transfer to the municipality.

In addition, if the purchaser buys the property declaring it to be their main home and subsequent checks disallow this use, they will have to pay the difference in unpaid registration tax, plus penalties of 30% of the evaded tax and interest.

Homes for €1

The ability to buy an Italian home in need of renovation for €1 has received a lot of publicity. Italian municipalities list the €1 houses on offer, together with the main points of the resolution that gave the go-ahead to the initiative, plus general information on the area in which the property is located.

This Italian initiative started in some small municipalities with the aim of combating abandonment by the population and revitalising areas in difficulty. It then spread to large cities. But is it a real advantage?

Generally, houses sold for €1 are not in good condition and will require significant expenditure on their renovation. The buyer will therefore be forced to wait to be able to live in it; notices vary between municipalities, but often the buyer must complete the renovation project and revalue the property within a period decided by the municipality (usually one year) after purchase. Often, the municipality also requires a surety policy of €5,000 to guarantee the execution of the proposed renovation, which will be returned at the end of the redevelopment.

The costs

Once they have selected the property and won the tender by paying the symbolic sum of €1, the purchaser will have to bear the notary fees (€800-€900) for the deed and registration of the property purchased.

In addition to the notary fee, they will have to bear the taxes already mentioned above, namely registration tax (2% or 9% depending on whether the purchase is their main home), cadastral tax and mortgage tax.

Once this first step is completed, the redevelopment project must be drafted (€2,500-€3,000) and implemented within the terms agreed with the municipality and the various construction companies.

The purchaser, who will bear the expenses for the redevelopment of the property, can take advantage of the many tax incentives currently available. These include:

- superbonus 90 – the amount of expenditure differs depending on the work carried out. The maximum varies from €50,000-€96,000 of expenditure for work on the property unit;

- furniture bonus – up to a maximum of €8,000 for the purchase of household appliances, furniture, furnishings;

- architectural barriers removal bonus of 75%;

- renovation bonus – 50% up to a maximum of €96,000 for works;

- ecobonus – 50%, 65%, 70% or 75% maximum deduction limit from €30,000-€60,000, depending on the work carried out; and

- sismabonus – 50%, 70%, 75%, 80% or 85% up to a maximum of €96,000 of works.

The bonuses are inter loco cumulative. However, these deductions for building works can only be enjoyed by those who have taxable income in Italy. Those purchasing their main home will not be able to benefit.

Conversely, those who move their business centre to Italy or start a business that is taxable in Italy will be able to take full advantage of the incentives for the redevelopment of the property or properties purchased.

Taxes on capital gains from the sale of real estate

Again, a distinction must be made: is the seller a person or an economic entity?

If the seller is a person, they may request the notary, at the time of the transfer, to apply a substitute income tax (IRPEF) of 26%. No tax is payable in Italy if the property is owned for more than five years.

If the seller is an economic entity, the taxation of the capital gain will be counted in its balance sheet following the Italian provisions on the treatment of inherent income:

- in the exercise of arts or professions; or

- in the exercise of commercial undertakings.

Andrea Matera, ACA, Owner of Studio Andrea Matera in Genova and Rapallo, Italy