The Administrative Burdens Advisory Board (ABAB) carries out an annual survey as part of its role to ensure that HMRC understands the needs of small businesses. A record number of responses (10,052) were received to this year’s survey, which ran from 17 April 2024 to 3 May 2024. Of the responses, 84% came from businesses and 16% from agents.

ABAB has published the responses in its Tell ABAB report for 2023 to 2024. ICAEW’s Tax Faculty has picked out some of the key findings below.

MTD ITSA

From 6 April 2026, landlords and sole traders with gross income of more than £50,000 will have to keep records digitally and provide quarterly updates to HMRC using MTD compatible software. This will be extended to sole traders and landlords with gross income over £30,000 from 6 April 2027. More information can be found in ICAEW’s MTD hub.

The survey suggests that awareness of MTD ITSA is low with only 33.3% of respondents describing themselves as being very aware or aware. However, it is not clear how many of the businesses who responded to the survey are companies or partnerships, and so will not be directly affected by MTD ITSA.

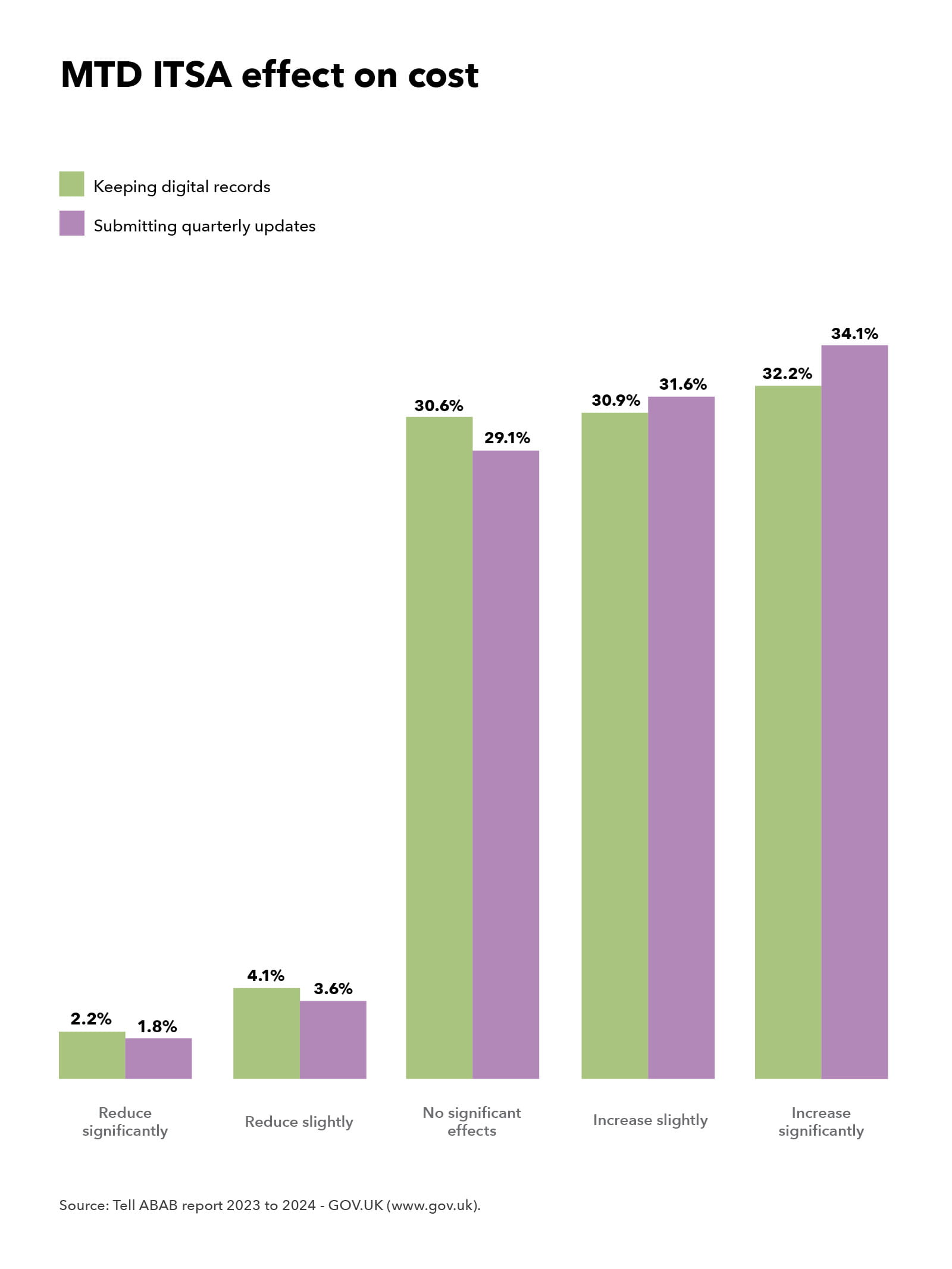

When asked what benefits MTD ITSA would have for their business or clients, the most popular answer (64.6%) was that it would have no benefits. The survey suggests that businesses and agents have concerns about MTD ITSA. When asked about the impacts of MTD ITSA, 63.1% thought that keeping digital records would increase costs, rising to 65.7% for submitting quarterly updates.

Caroline Miskin, Senior Technical Manager, ICAEW, said: “With only 18 months to go until the start date, HMRC has a lot to do to make people aware of MTD ITSA, alongside delivering a system that works for taxpayers, agents, software developers and HMRC itself.”

“The survey reflects what our members tell us, that MTD ITSA will not benefit their clients and will push up costs. Ahead of the Budget on 30 October we have urged the government to take this on board and remove the quarterly reporting requirements. ICAEW fully supports the digitialisation of record keeping and tax administration, but considers that quarterly reporting is an unnecessary burden.”

Engagement with HMRC

The survey suggests that there is a growing sense of frustration with some of the core channels of engagement with HMRC. The percentage of respondents rating HMRC’s webchat and telephony services as poor has increased to 56.7% from 39.8% for 2023, and to 63% from 41.3% for 2023 for helpline response times.

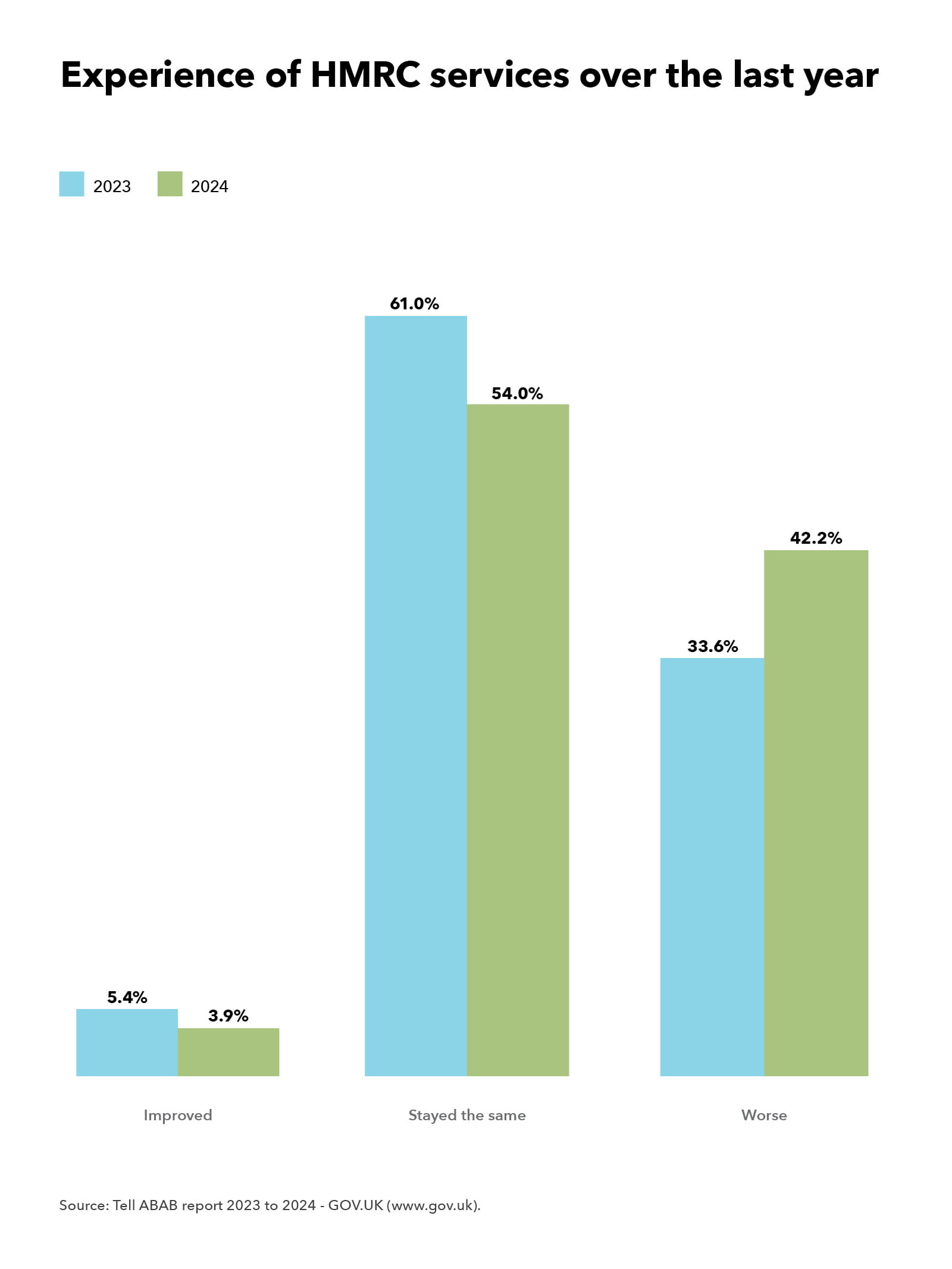

This is reflected in the fact that, when asked about their experience of dealing with HMRC in the last 12 months, 42.2% of respondents said it was ‘worse’, compared with 33.6% for 2023.

Caroline Miskin, Senior Technical Manager, ICAEW, said: “Sadly, it comes as no surprise that businesses and agents are losing faith in HMRC. HMRC’s service levels have fallen far below what is needed for a modern tax system – politicians have told us that, the National Audit Office has told us that, and our members continue to voice their frustrations. This simply can’t be allowed to continue. Tax collection is suffering and there are huge inefficiency costs for taxpayers, agents and HMRC”.

Next steps

ABAB has shared its findings with the Exchequer Secretary to the Treasury (XST), the government minister responsible for HMRC. In December 2024, ABAB will submit its annual report for 2024 to the XST, reviewing HMRC’s progress and performance against the priorities set in 2023.

Other areas, including AI

Survey recipients were asked for their views on a number of other areas including time to pay, basis period reform and off-payroll working.

2024 was the first year in which agents and businesses were asked if they had used generative AI to answer a tax question. 11.8% said they had, and of those the majority (51.9%) did not feel that they got an answer that resolved their query.

The Tax Faculty

ICAEW's Tax Faculty is recognised internationally as a leading authority and source of expertise on taxation. The faculty is the voice of tax for ICAEW, responsible for all submissions to the tax authorities. Join the Faculty for expert guidance and support enabling you to provide the best advice on tax to your clients or business.