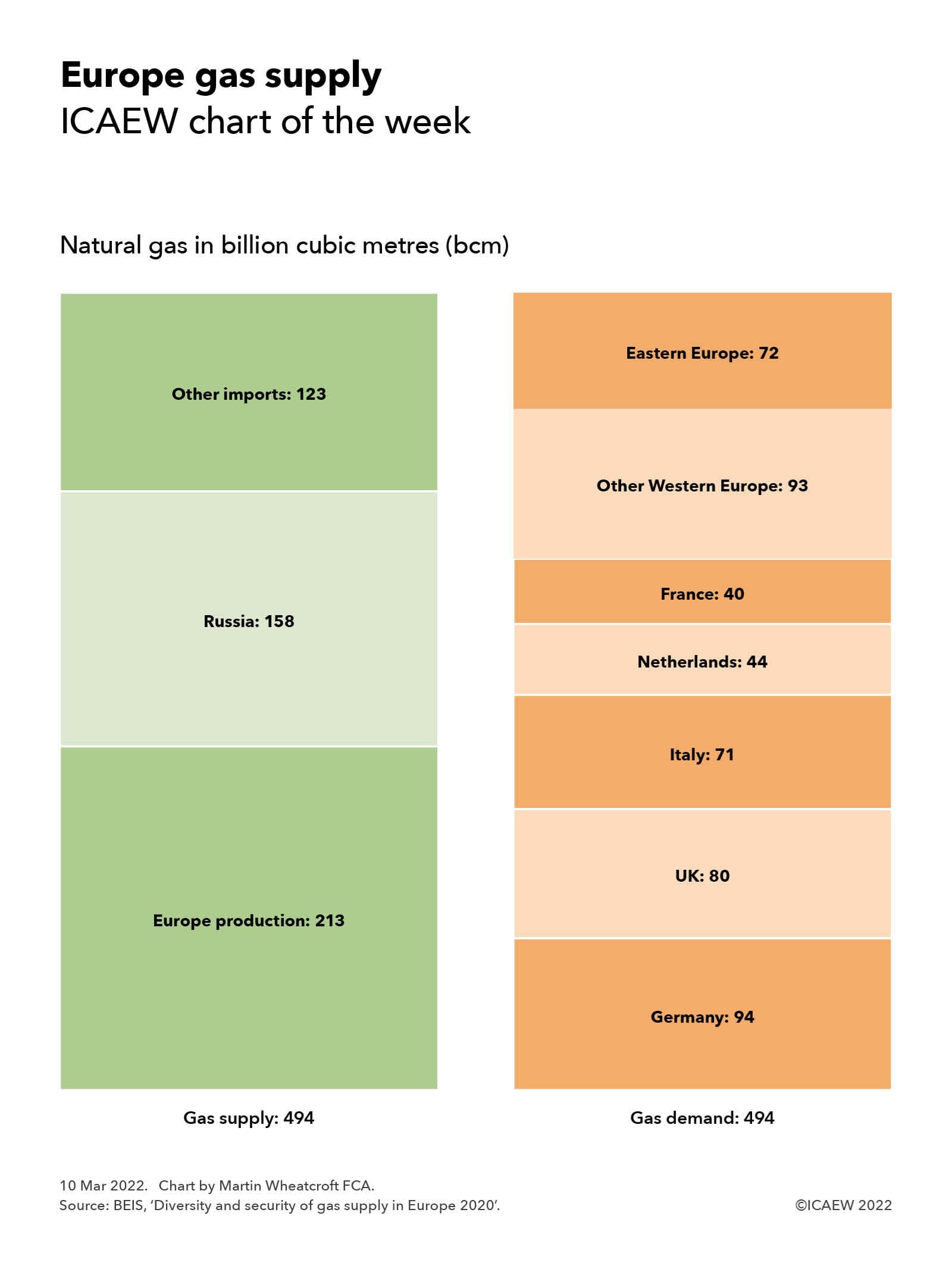

Europe’s gas supply in 2020 amounted to 494 billion cubic metres (bcm) of natural gas, comprising 213bcm (43%) of domestic production (principally from the North Sea), 158bcm (32%) imported from Russia, and 123bcm (25%) imported from other sources.

For this purpose, Europe excludes Russia, Belarus and Ukraine and these numbers also don’t take account of movements into and out of gas storage. For reference, 1bc) = 38.2 petajoules (PJ) = 10.6 terawatt hours (TWh) = 36.2trn British Thermal Units (BTU).

The biggest users of gas are Germany, the UK, Italy, Netherlands and France, which consumed approximately 94bcm, 80bcm, 71bcm, 44bcm and 40bcm respectively, together adding up to 329bcm or 67% of the total. Other western European countries consumed 93bcm of gas in 2020, including Spain (32bcm), Belgium (18bcm), Austria (9bcm), Portugal (6bcm), Greece (6bcm), Ireland (5bcm), Norway (5bcm), Switzerland (4bcm) and Denmark (3bcm).

Eastern European countries consumed 72bcm, including Poland (22bcm), Romania (12bcm), Hungary (11bcm), Czechia (9bcm), Slovakia (5bcm) and Bulgaria (3bcm). The Baltic states together consumed 4bcm.

Domestic production of 213bcm includes 116bcm from Norway, 41bcm from the UK and 24bcm from the Netherlands, almost all of which was supplied through a network of pipelines starting under the North Sea. The next largest producer was Romania with 9bcm.

The majority of Russia’s supply (around 140bcm) was sent through pipelines into eastern Europe, Germany and Italy, and from there onto western European countries. The balance of around 18bcm was supplied by tankers filled with liquefied natural gas (LNG).

Some of the remaining imports were also supplied by pipelines, in particular from Algeria, Libya and Turkey, but the majority was purchased as LNG on the world market from suppliers including the USA, Qatar, Kuwait, UAE, Nigeria and Trinidad & Tobago among others.

Removing Russia from the gas supply chain will not be easy, especially as the largest consumer of gas – Germany – has no LNG terminals and currently relies on pipelines for almost all of its gas supply.

Despite that, European leaders are working on plans to do so, with the International Energy Agency (IEA) recently publishing a 10-point plan to reduce Europe’s reliance on Russian gas.