The UK economy grew by 0.2% in the second quarter of 2023, up slightly from growth of 0.1% in the previous quarter, according to the latest official figures from the Office for National Statistics (ONS). Monthly data suggests even more encouraging results; the UK economy grew by 0.5% in June, up from the contraction of 0.1% in May, thanks to stronger manufacturing and construction sector output. However, the strong bounce back in GDP in June more likely reflects the reversal of the squeeze on output from the extra bank holiday in May rather than a meaningful improvement in the UK’s growth trajectory.

Business investment booming?

Business investment in the UK increased by 3.4% in Q2 2023, the biggest increase since Q1 2022 and follows strong growth of 3.3% in the previous quarter. Investment in air transport was the main contributor to the Q2 increase, rising by 23%, amid an increase in imports from the United States in April. However, such spending can distort the overall investment picture because of the high value of this type of transport equipment. Information and communication technology equipment and other machinery and equipment fell by 9.8% as the super-deduction incentive came to an end.

Productivity remains anaemic

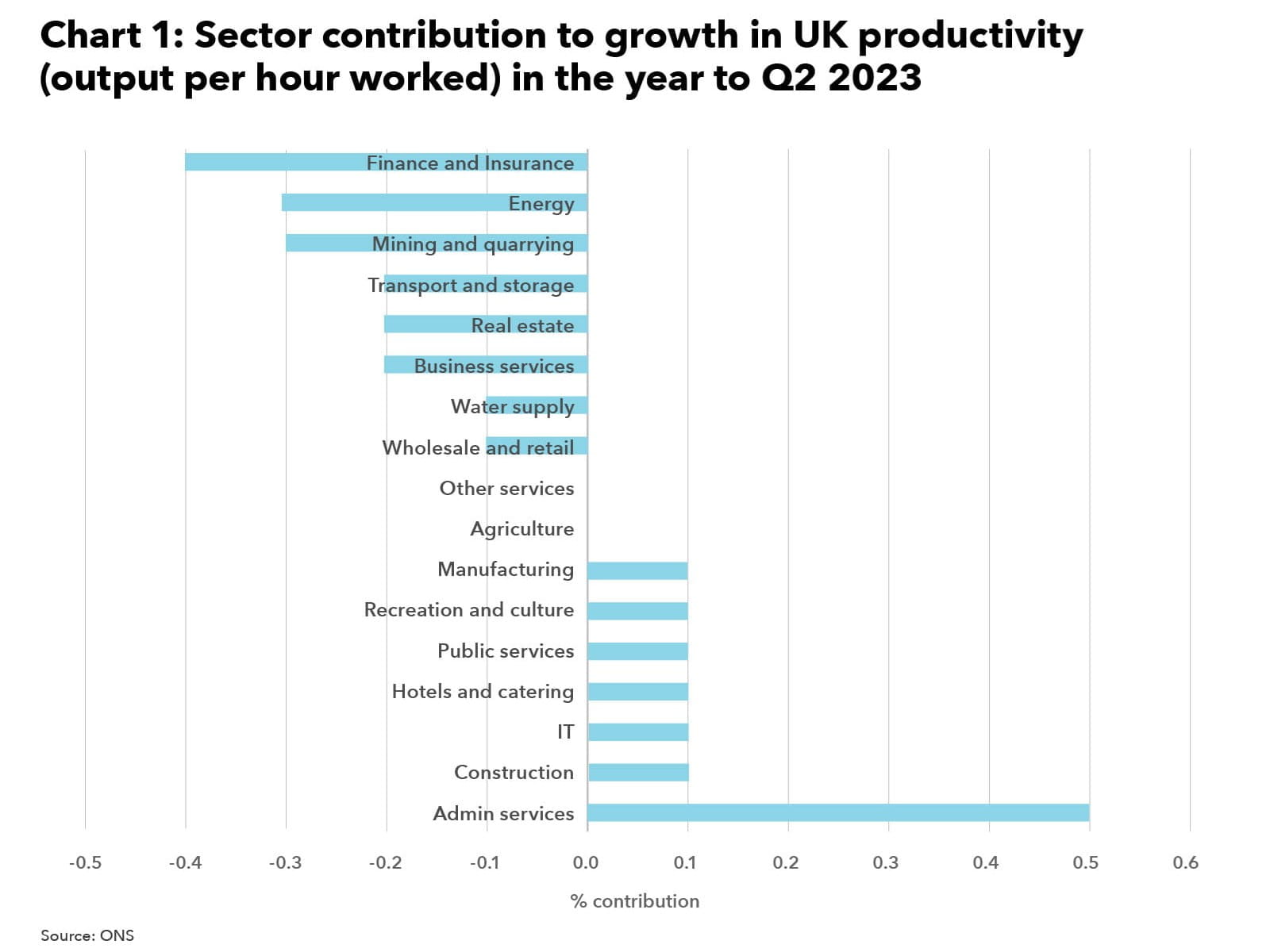

Productivity in the UK – as measured by UK output per hour worked – rose by 0.1% in Q2 2023 on the same quarter a year ago and is now 1.4% above its pre-pandemic level. The administrative services industry made the biggest positive industry contribution to productivity growth in the second quarter (see Chart 1).

By contrast, the finance and insurance, energy, and mining and quarrying industries made the biggest negative contributions to annual productivity growth. Productivity may be an abstract concept for many, but its consequences are real because increasing productivity over time can raise living standards, wages and economic growth. Historically, UK productivity has grown by around 2% a year but since the global financial crisis growth has been much weaker.

Hefty inflation fall provides little comfort

UK Consumer Price Index (CPI) inflation stood at 6.8% in July 2023, the lowest rate since February 2022 and down sharply from 7.9% in June. Although these figures provide reassurance that the inflation tide has turned, this latest drop owes more to lower energy bills in July, following the reduction in Ofgem’s energy price cap, than to a broader easing of price pressures. For example, core CPI, a better gauge of the underlying trend because it excludes volatile items such as energy, food, alcohol and tobacco, remained unchanged at 6.9% in July and is now higher than the headline rate.

Record wage growth masks significant disparities

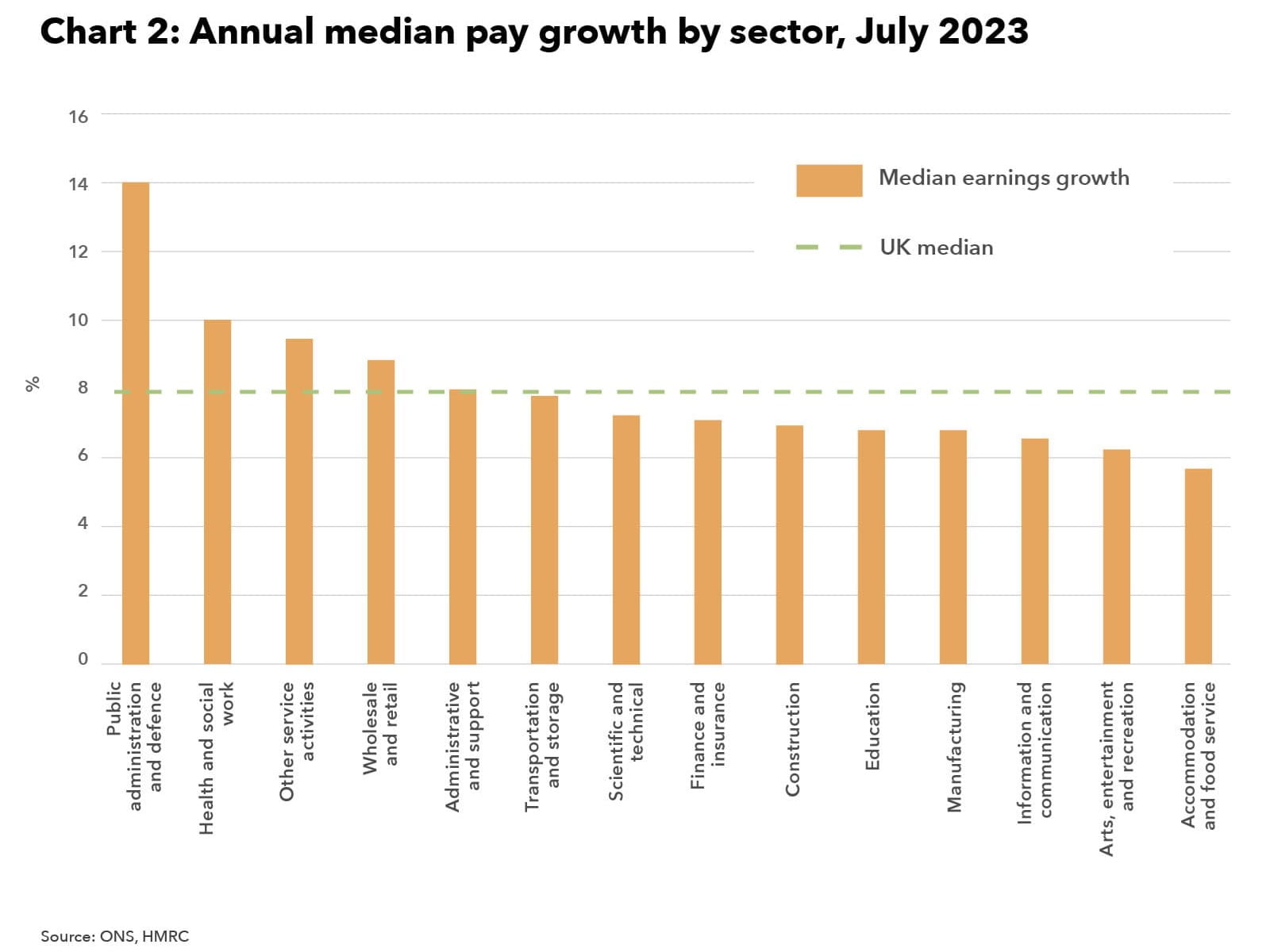

HMRC data reveals that monthly pay increased by 7.8% in July 2023, higher than the rise in inflation over the same period. However, HMRC figures also show a significant disparity in wage growth with the strong headline wage growth outturn driven by a huge wage rises in a few sectors (see chart 2).

Annual pay growth was highest in public administration, where wages rose by 14%, reflecting a one-off cost-of-living payment of £1,500 to civil servants that month. In contrast, nine out of the 14 sectors recorded below-median wage growth with accommodation and food service activities firms seeing the weakest wage growth (5.6%).

Corporate insolvencies hit 14-year high

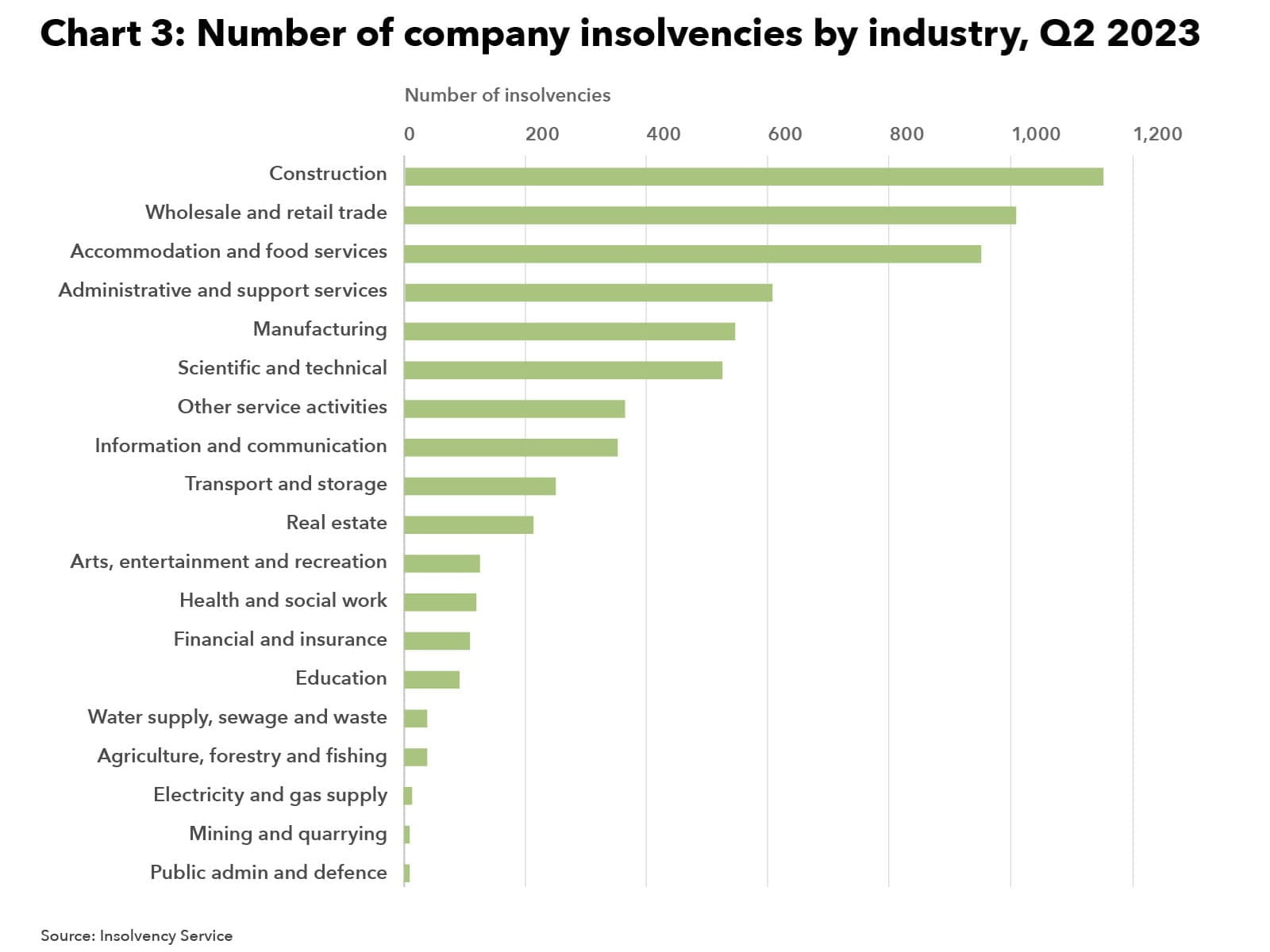

Insolvency Service data shows that 6,342 companies were registered as insolvent in Q2 2023, the highest number since Q2 2009, amid high inflation, rising interest rates and a weak economy. The large number of insolvencies over the past year has been driven primarily by increases in the construction, wholesale and retail trade and accommodation and food service sectors (see Chart 3). The number of creditors’ voluntary liquidations was the highest since records started in 1960.

Implications for accountants, business owners and the economy

August’s economic data suggests that the UK is entering a more challenging period where stubbornly high inflation and soaring interest rates mean GDP may weaken considerably in the third quarter, despite a boost from lower energy bills. The UK’s weak productivity performance underscores the lack of progress in tackling deep-rooted problems in our economy, from skills shortages to creaking physical and digital infrastructure.

UK economy – what to watch for this month

- The next UK GDP data to be published on 13 September could show that the UK economy contracted in July as inflation, interest rates and unseasonably wet weather constrained output.

- Next official figures, due out on 20 September, may see inflation rise for the first time since February due to increases in the price of clothing and wages. However, this should be a one-off with inflation still set to drop sharply over the rest of the year.

- On 21 September, UK interest rates are likely to increase for the 15th successive time. Rates will probably rise by 25 basis points to 5.50%.

Further reading

For more insights, analysis and resources for organisations facing rising costs of doing business – visit ICAEW’s Cost of doing business hub.

ICAEW works with CABA to promote the mental health of chartered accountants and their families with a range of resources to provide support during these difficult times.