Any transformation programme requires a clear focus on the final destination. As the programme manager, you need to keep the ultimate business outcomes and benefits in mind, be it revenue growth, cost efficiencies or improved compliance.

Unlike other areas of programme management, this should be well within your comfort zone as an accountant. Accountancy is built on targets and an understanding of return on investment, which is what this is all about. However, in the context of a transformation programme, it can be tricky to know where to start.

Gaining project buy-in and alignment

Change programmes can be difficult and political to pull off. At times, they can also test our patience. To get it right, you need to have clarity and alignment across the board when it comes to why you’re running the programme in the first place, and what benefits you ultimately want to achieve.

The benefits you are aiming to achieve by the last day of your programme need to be clearly defined at the beginning. You will have determined this by completing your GAP analysis, which you can read about in a previous article that also describes the GAME PLAN framework.

You will need buy-in and alignment from the project board and executive sponsors on the ‘why’ and ‘what’ of your project for it to move forward effectively. MIT-Sloan and London Business School lecturer Elsbeth Johnson talks about how important it is for executives to step up in these early phases.

“Leaders need to do more than they typically do in the early stages of change,” she told the Extraordinary Business Book Club podcast. “That’s where they need to step up in specific ways. And at specific times, … having laid the foundations by that stepping up work, they can then – and indeed, should – then step back and do less than they typically do in the later stages of change… so that the people whom they’ve charged with delivering the change can get on with it.”

Finance people are used to setting a business plan and operationalising it into an annual budget, split into months and quarters. Any major reporting is done quarterly to investors.

When looking at a budget, finance professionals actually know the business pretty well. Even if it's going through a high growth phase, we can make some pretty good assumptions with a medium to high level of confidence.

With a project or programme, we often start with low-to-almost zero confidence in our assumptions. Managing those assumptions and benefits and trying to turn them into fact is a really difficult thing.

Creating a process to manage business benefits

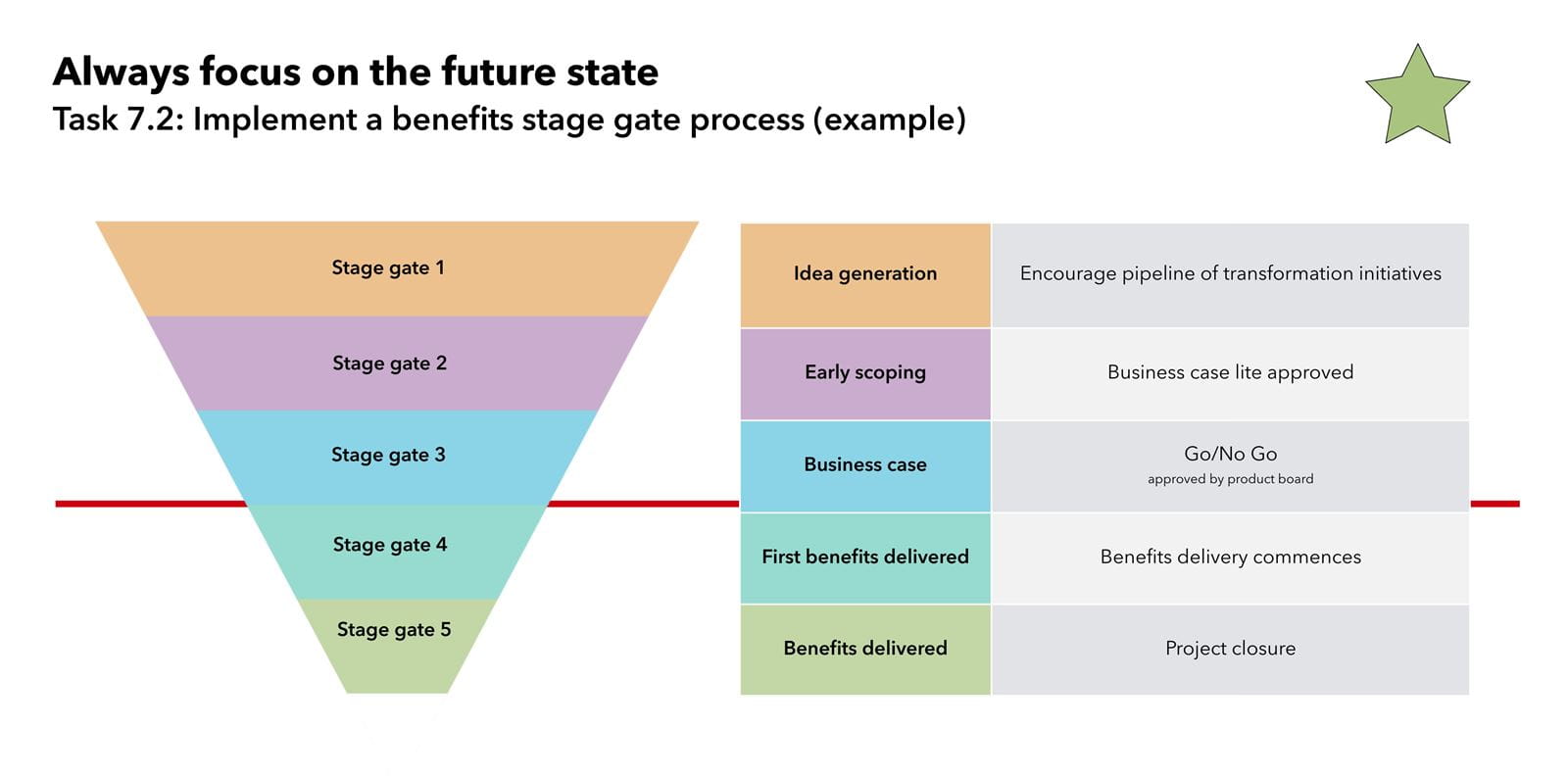

To help maintain the focus on the business benefits your transformation programme aims to provide, it’s helpful to implement a process to manage the various benefits of each project within the programme. It is not dissimilar to a sales cycle or product development cycle.

This funnel diagram is a way of managing this difficult process.

Stage gate one: the idea

Let’s say you want to set up a shared service centre in Newcastle. It would give you access to good talent and would help save costs compared to a base in London.

Stage gate two: validation

You get some stakeholders involved, you flesh out the plan and put it into a detailed and convincing business proposal that outlines the potential business benefits.

Stage gate three: committing to delivery

This is the critical stage, the equivalent of finalising a budget or signing a contract with a client. You are committing to deliver those benefits, and the company is committing the money to spend on that delivery.

Stage gate four: benefits realised

We start seeing the benefits of the project. In our Newcastle scenario, we’ve started recruiting in the area and start to see some EBITDA efficiencies. We’ve got everyone working in one place, so our control failure starts decreasing.

Stage gate five: project finish

It's come to the end of the project, the door closes, and we're in the new world.

Stage gates one, two and three are like our sales process: you have an idea, you sell it, and sign the contract. You commit to deliver the benefits in the future and you need commitment for the money.

Then you get to stage gates four or five. After stage gate three, it moves from a sales cycle. It’s locked into a budget in the business plan. You can then follow it like a budget and forecast, though it operates over different time periods. You’ll do some variance analysis on month and project to date versus your forecast. Use traffic light reporting to make sure you’re on track.

If you discover that things are off track, you need to work with your project board, the project manager or programme management office, and your executive sponsors, to figure out what’s going wrong and how you might need help.

There’s an escalation path that you can take for this. We look at a project from both a tactical and strategic point of view. First, we try to solve an issue tactically. If that doesn’t work, we need more help. For example, you might have naysayers blocking progress on the project. That’s when we pull the strategic trigger and bring in executive support.

That escalation chain and command structure becomes really important the further you get into the project. When you have problems (or hit barriers), you need to have a plan for how to respond.

The finance function is used to helping the sales team review the sales pipeline. If we apply those sales gate processes to our forecast processes, then we apply a percentage of how much we're likely to win to each stage gate, and that becomes the basis of our project benefits forecast. This is not a million miles away from what we’re used to doing as an accountant; it’s just applying the pipeline methodology in a different way.

Support on growth

ICAEW offers practical support for organisations looking to grow, as well as a series of recommendations to the UK government to support its plans to kickstart economic growth.