Dismal end to 2025 for the UK economy

Official figures revealed that the UK economy contracted by 0.1% in October, following the 0.1% drop in September and means that the UK economy has recorded no growth since June.

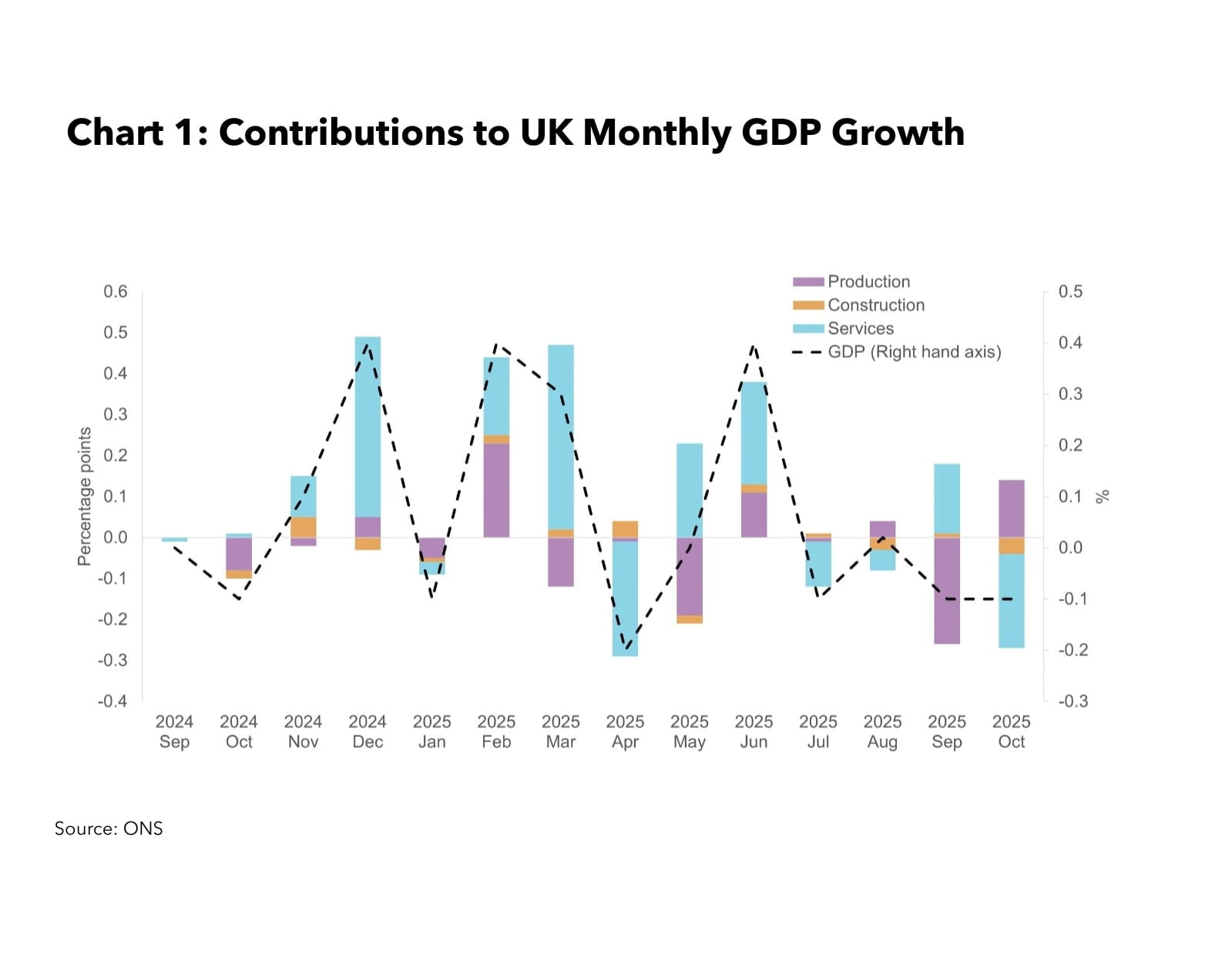

October’s decline was driven by falling services (-0.3%) and construction sector (-0.6%) output, more than offsetting a boost to industrial production from Jaguar Land Rover’s return to production following the cyber-attack (see Chart 1).

October’s dismal GDP may have been followed by a similarly downbeat November with the damage to business and consumer confidence from the frenzied speculation ahead of the Budget likely to have frozen wider economic activity.

Against this backdrop, labour market conditions continued to weaken with UK’s unemployment rate rising to 5.1% in the three months to October 2025, the highest rate since the end of 2020 and up sharply from 4.3% in 2024.

UK interest rates cut following notable inflation drop

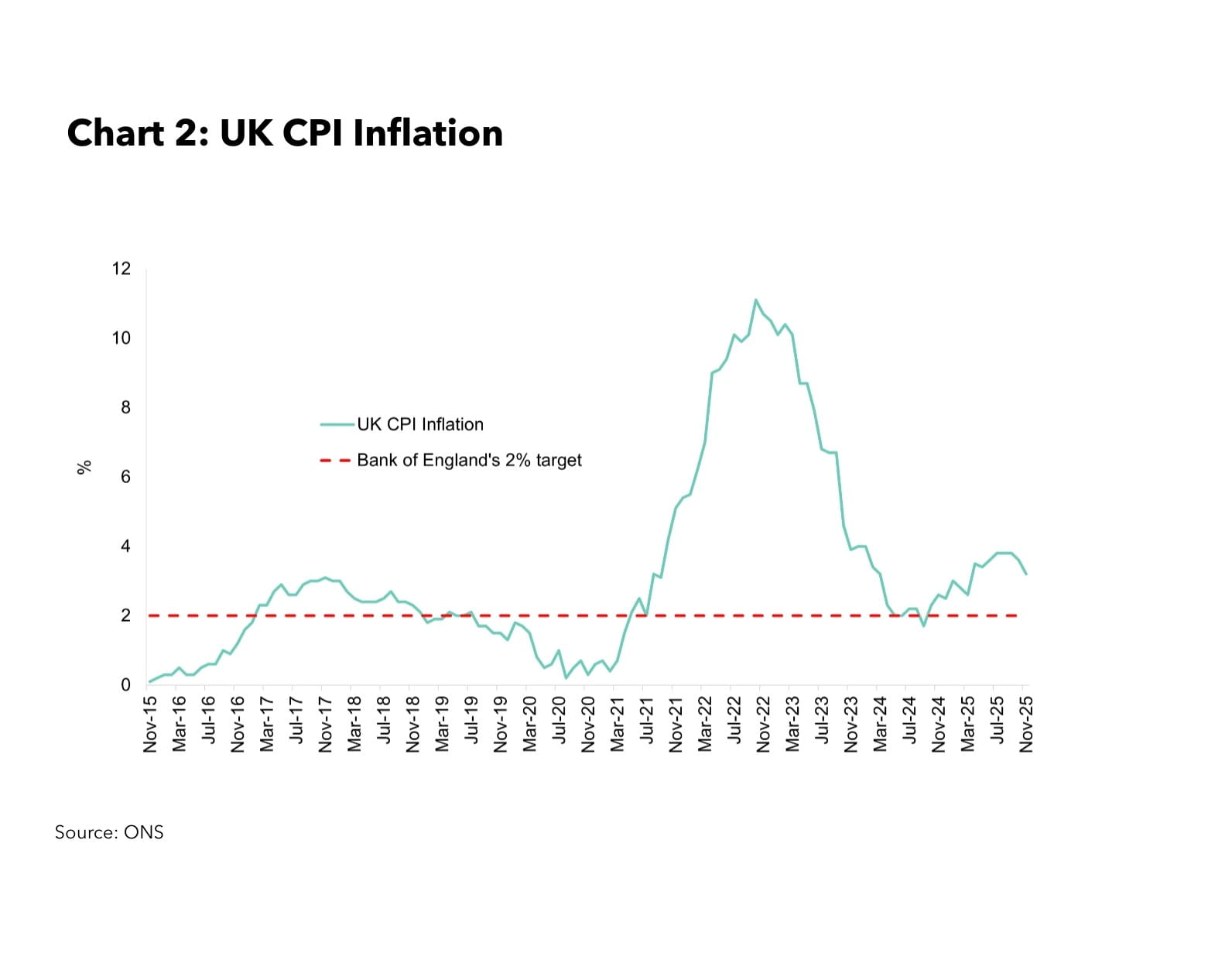

UK Consumer Price Index (CPI) inflation fell to 3.2% in November 2025, the lowest rate since March and down from 3.6% in October (see Chart 2). The main downward pressure on the headline rate came lower food prices. Between October and November, food prices fell by 0.2%, slowing annual growth to 4.2% in November, from 4.9% in October.

Easing inflation and concerns over a deteriorating economy helped push the Bank of England to cut interest rates to 3.75% at their December meeting.

Five things to watch out for in 2026

Against the backdrop of a struggling economy, wilting jobs market and falling inflation, what can we expect in the year ahead?

1. Weaker consumer spending to mean weaker GDP growth in 2026

2026 is shaping up to be another dismally anaemic year for the UK economy with weaker consumer spending amid a growing tax burden and a loosening labour market likely to mean that economic growth is notably slower this year compared to 2025 and also undershoot the OBR’s (Office for Budget Responsibility) current forecast for GDP growth for 2026 of 1.4%.

Sectors such as retail and hospitality face a particularly testing year, given their direct exposure to higher business costs, including April’s minimum wage rise.

Business investment is likely to remain subdued with falling confidence and skyrocketing cost pressures likely to push more firms to mothball new projects.

International trade’s contribution to UK growth is likely to remain muted with weaker global economic output, persistent geopolitical volatility and growing protectionism likely to limit demand for UK goods and services in key markets.

This year may be the low point for UK economic growth for this parliament, with prospects for 2027 currently looking moderately brighter.

2. Only two interest rate cuts expected, despite inflation’s likely return to target

The UK will no longer be an international inflation outlier this year with lower, energy bills, food and fuel costs likely to pull the headline rate back to the Bank of England’s 2% target by the summer.

The pace of decline will accelerate from April once the energy bill changes announced in the Budget come into effect and favourable base effects from April 2025’s tax and duty hikes increasingly drags down on the headline rate.

Despite softer inflation, the pace of interest rate cuts is likely to slow to a crawl this year. The Monetary Policy Committee is likely to press the pause button on the rate cuts once they reach what they consider as close to the neutral rate (estimated rate at which monetary policy is neither stimulating nor restricting economic growth). This may mean a further two interest rate cuts to 3.25% by the Autumn.

3. Younger workers likely to bear the brunt of a weakening jobs market

The UK’s labour market will face more adverse turbulence this year with surging business costs and weaker customer demand, amid a growing tax burden, likely to lift unemployment uncomfortably higher from here.

Younger workers are facing a particularly traumatic year given that they are the most vulnerable to the increased financial squeeze on businesses from a higher minimum wage and greater automation of entry level roles.

Wage growth is likely to moderate further as the downward pressure from an ailing economy, elevated staffing costs and more job losses increasingly restrain pay awards.

4. Taxes could rise again this year

While the welcome news from last November’s Budget was that the chancellor increased the headroom against her fiscal rules to £22bn, this doesn’t significantly increase the margin for error, given the average revision to an OBR forecast is around £20bn.

With much of the planned fiscal pain backloaded and considerable uncertainty over the amount of revenue that can be raised from freezing thresholds and a mishmash of new taxes, the door remains open for further rises, particularly if economic growth is materially weaker than the OBR expects.

5. High public debt and political volatility among the key risks to the UK economy

Any fallout from a financial market correction, such as a bursting of the AI bubble, could feed through into the broader weakening of the financial system and trigger a marked tightening in access to finance, stifling the wider economy.

Against a backdrop of high public debt levels and elevated interest costs, further political shocks could spark more troubling turbulence in the bond markets, tightening in financial conditions, which in turn weighs on economic growth and adds to concerns over the public finances. A material resurgence in inflation cannot be ruled out given the sustained supply side constraints facing the economy and upside risks to global food and fuel prices. This could mean that interest rates stay higher for longer.

UK economy – what to watch for in January:

- ICAEW's Business Confidence Monitor covering the fourth quarter of 2025 will be released on 14 January.

- November 2025 UK GDP, to be released on 15 January, may show that the economy continued to contract.

- The December inflation figures due out on 21 January could reveal a slight drop in the headline rate.

Prepare for 2026