UK economy returned to growth in November

Official figures revealed that the UK economy grew by 0.3% in November 2025, following a contraction of -0.1% in October. Economic growth was mainly driven by a 2.1% rise in manufacturing output, amid a 25.5% increase in car production following Jaguar Land Rover’s return to full capacity after a cyber-attack.

The services sector, which accounts for around three-quarters of UK economic output, grew by 0.3% in November. In contrast, construction shrank by 1.3% in November, with builders reporting a drop in new work, and repair and maintenance.

November’s uptick in GDP means it’s inevitable that the UK economy grew modestly across the final quarter of 2025 with easing uncertainty post-Budget likely to have supported growth in December, despite the ‘super flu’ disrupting activity in sectors like education.

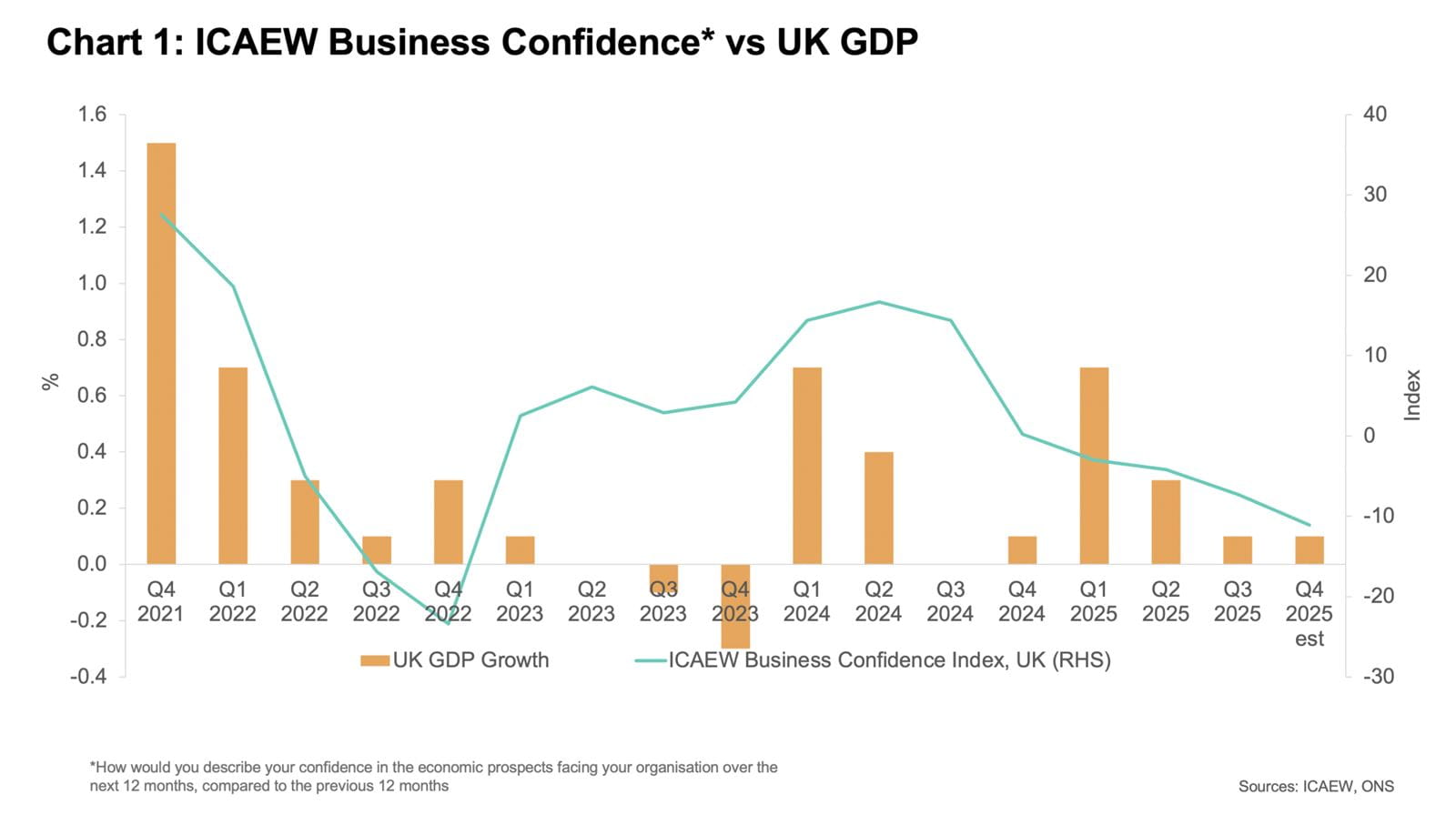

Business confidence drops into negative double-digit territory

Sentiment in Q4 2025 stood at -11.1 on ICAEW’s Business Confidence Monitor its lowest point since Q4 2022, having dropped from -7.3 in the previous quarter. Confidence has now fallen for six quarters in a row.

Confidence generally weakened across the fourth quarter with the index declining to -10.7 pre-Budget, before falling slightly further in its aftermath to -11.1 by the end of the fieldwork period.

Business confidence among non-exporters was especially downbeat, dropping dramatically from -10.0 in Q3 to -20.8 in Q4, while among exporters sentiment rose from -5.5 to -2.5.This likely reflected that domestic challenges, such as higher taxes, are more negatively impacting businesses than wider global volatility.

By sector, sentiment was most negative among property businesses (-23.4), while only the IT and communications sector registered a positive confidence score (+0.3).

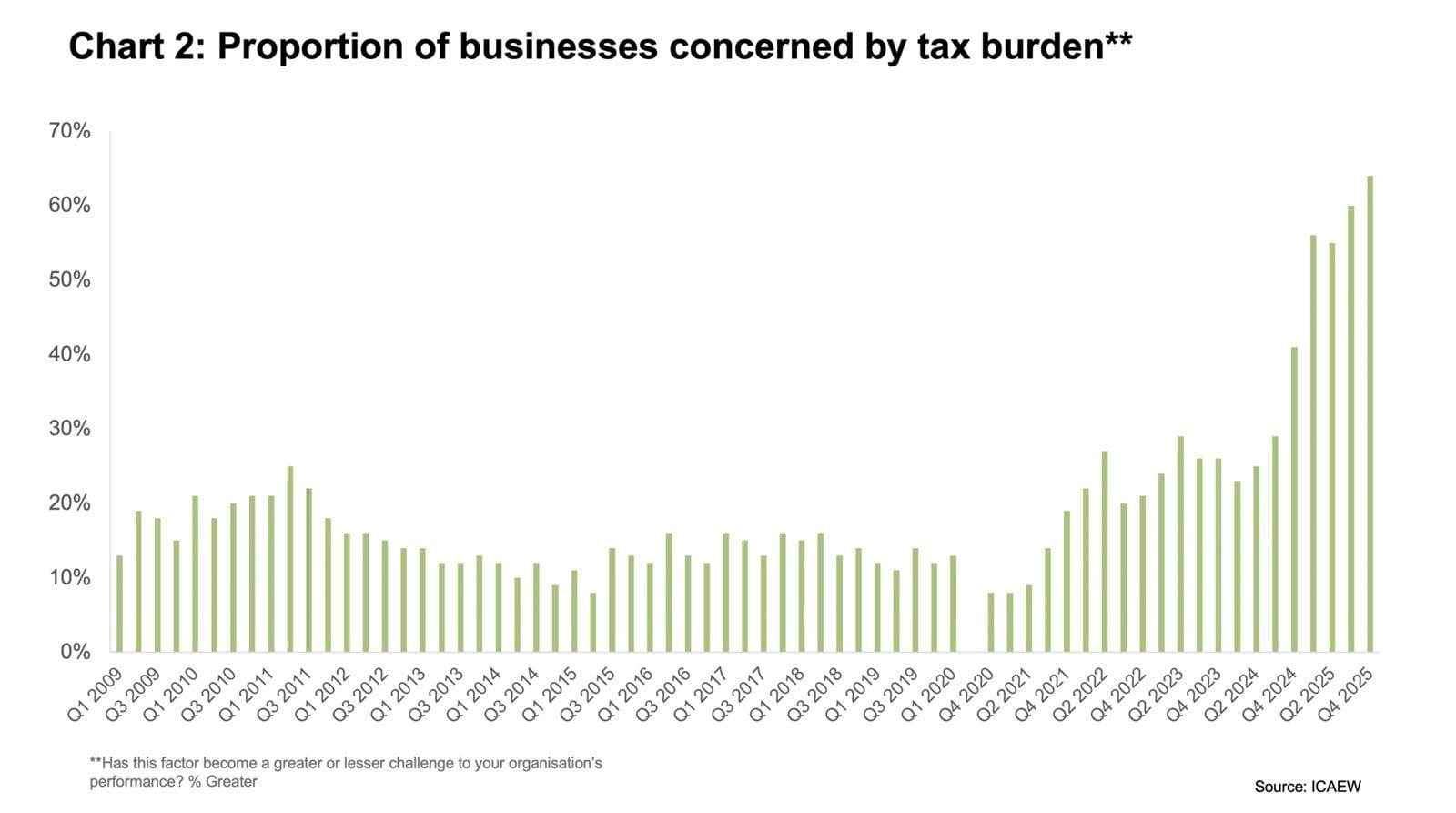

Tax and regulation key concern for businesses

ICAEW’s BCM also found that A record 64% of firms said the tax burden was a growing challenge in the quarter (up from 60% in Q3), more than double the proportion (29%) since the last General Election in Q3 2024 and an eleven-fold increase from a reading of just 6% in Q3 2020. This mostly reflects both the impact of pre-Budget speculation and continued financial squeeze from recent tax hikes, including higher national insurance.

Regulation is the second biggest barrier to performance, with half of businesses (51%) hampered by this issue, the highest proportion for more than seven years. ICAEW said this increase is partly a reflection of concerns over the impact of the Employment Rights Bill. Worries over financial related challenges – bank charges, late payments, access to capital –all collectively ticked up for the first time since Q3 2023.

Labour market conditions to weaken

The number of employees on payrolls in December showed a 184,000 fall on the year and a 43,000-decline month-on-month. The largest increase was in the health and social work sector, with a rise of 37,000 employees; the largest decrease was in the wholesale and retail sector, with a fall of 72,000 employees. The UK jobs market is in a more problematic phase with spiralling labour costs likely to mean notably higher unemployment, with entry level roles most vulnerable given their greater exposure to increased automation and the looming minimum wage rise.

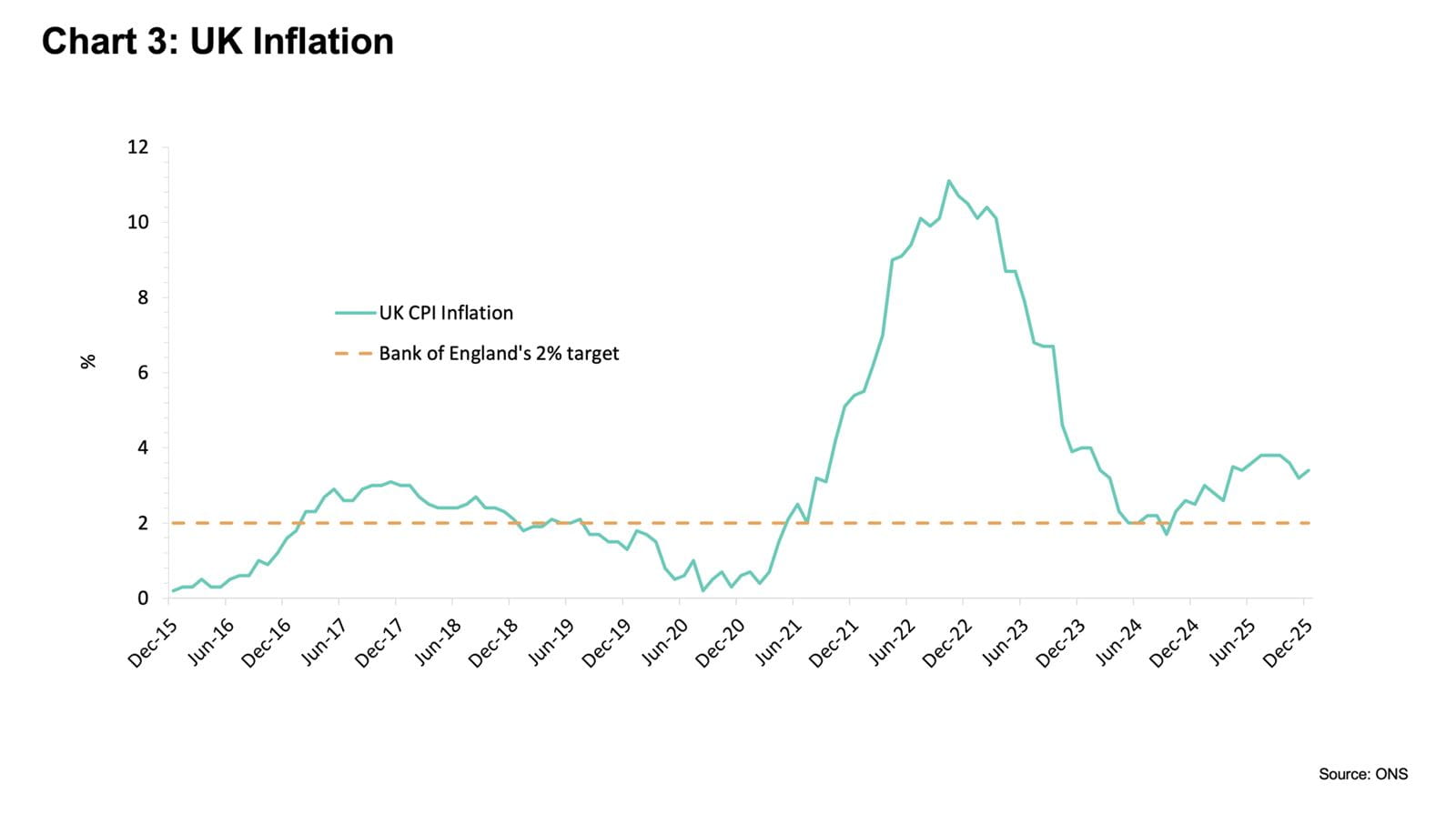

December inflation rise a temporary blip

UK CPI inflation rose to 3.4% in December 2025, the first increase in five months and up from 3.2% in November (see Chart 3). This increase largely reflected several one-off factors which drove higher airfares, food and tobacco costs. Prices in the alcohol and tobacco division rose by 5.2% in December, from 4.0% in November, driven by the rise in tobacco duty announced in the Autumn Budget. Air fares, rose by 28.6% due to timing of return flights over the Christmas and New Year period. December’s increase is a temporary blip with the near-term trajectory for UK inflation largely locked in, as lower energy bills from April coupled with falling fuel and food costs should pull it back to 2% by the summer.

Implications for accountants, business owners and the economy

This month’s figures will do little to ease concerns over the health of the UK economy. November’s return to growth probably won’t trigger a sustained economic revival with softer consumer spending amid an intensifying tax burden and higher unemployment likely to mean noticeably weaker growth for 2026, despite a boost from lower inflation. The chances of a February interest rate cut look also unlikely.

UK economy – what to watch for in February:

- On 5 February, the Bank of England’s Monetary Policy Committee are expected to keep interest rates on hold at 3.75%. Alongside their February policy decision, the bank will publish its latest economic forecasts for the UK economy.

- The quarterly GDP data to be released on 12 February, confirm that UK GDP grew slightly in the final quarter of 2025, following 0.1% growth in Q3 2025.

- The inflation figures for January 2026 due out on 18 February should see a small fall in the headline rate from 3.4% in December.

Read the full BCM results

Read the full report which looks at how tax concerns have hit a five-year high as business confidence continues to fall.