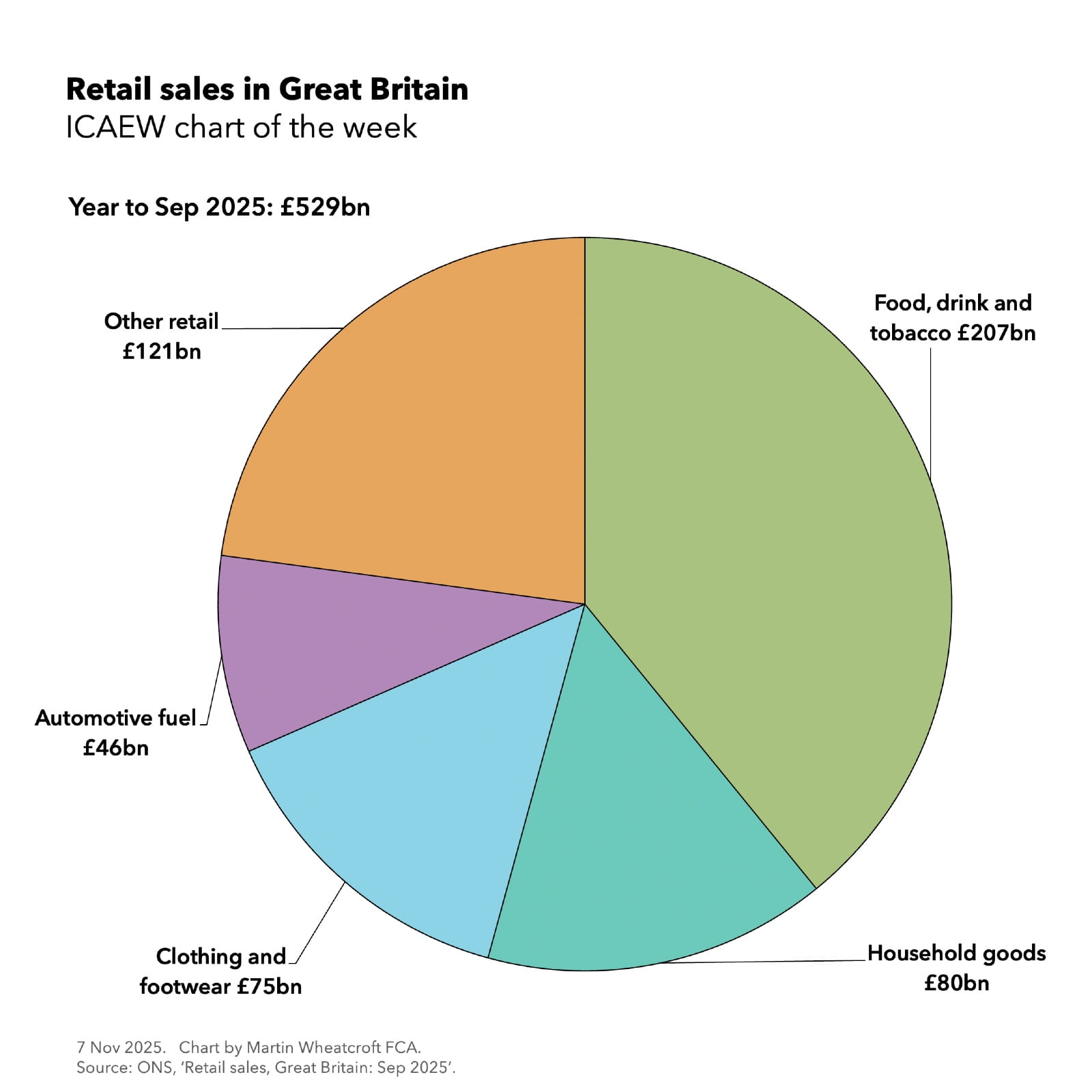

Retail sales are a core component of the economy, and our chart this week takes a look at the total amount of sales made by retailers over the past year.

According to the Office for National Statistics (ONS), total sales of £529bn in Great Britain between October 2024 and September 2025 comprised £207bn (39%) of food, drinks and tobacco, £80bn (15%) of household goods, £75bn (14%) of clothing and footwear, £46bn (9%) in automotive fuel, and £121bn (23%) in other retail categories.

This £529bn in sales is equivalent to around £10bn a week on average and represents around 18% of overall economic activity in England, Wales and Scotland by value.

The ONS also analyses the data by type of store, with £410bn and £119bn generated in sales by large (100 employees or more) and small (99 employees or fewer) retail businesses respectively, while around £132bn or 25% of retail sales are now transacted online.

Supermarkets and other ‘predominately’ food stores made sales of £209bn last year (of which £20bn or 10% was online), while textile, clothing and footwear stores recorded £57bn (£16bn or 28% online), household goods stores recorded £37bn (£9bn or 24% online), department and other non-specialised stores recorded £39bn (£10bn or 26% online) and all other stores generated £70bn (£15bn or 21% online). Internet, mail order, and other ‘non-store’ retailers (such as market stalls) made £70bn (£62bn online). None of the £46bn in petrol and diesel sales were reported as being online.

According to the ONS, seasonally adjusted retail sales volumes in September 2025 are at their highest level since 2022 but 1.6% lower than in February 2020 prior to the pandemic.

This decline in the amount of ‘stuff’ being bought by British consumers despite a growing population is primarily a reflection of the squeeze on household budgets from the cost-of-living crisis combined with relatively weak growth in household incomes over the last few years.

The concern for many retailers in the next few weeks will therefore be not only what business tax measures might be announced in the Budget, but also the effect that other tax measures might have on household disposable incomes and, hence, the ability and willingness of consumers to spend their money in the shops and online.

ICAEW on the Budget