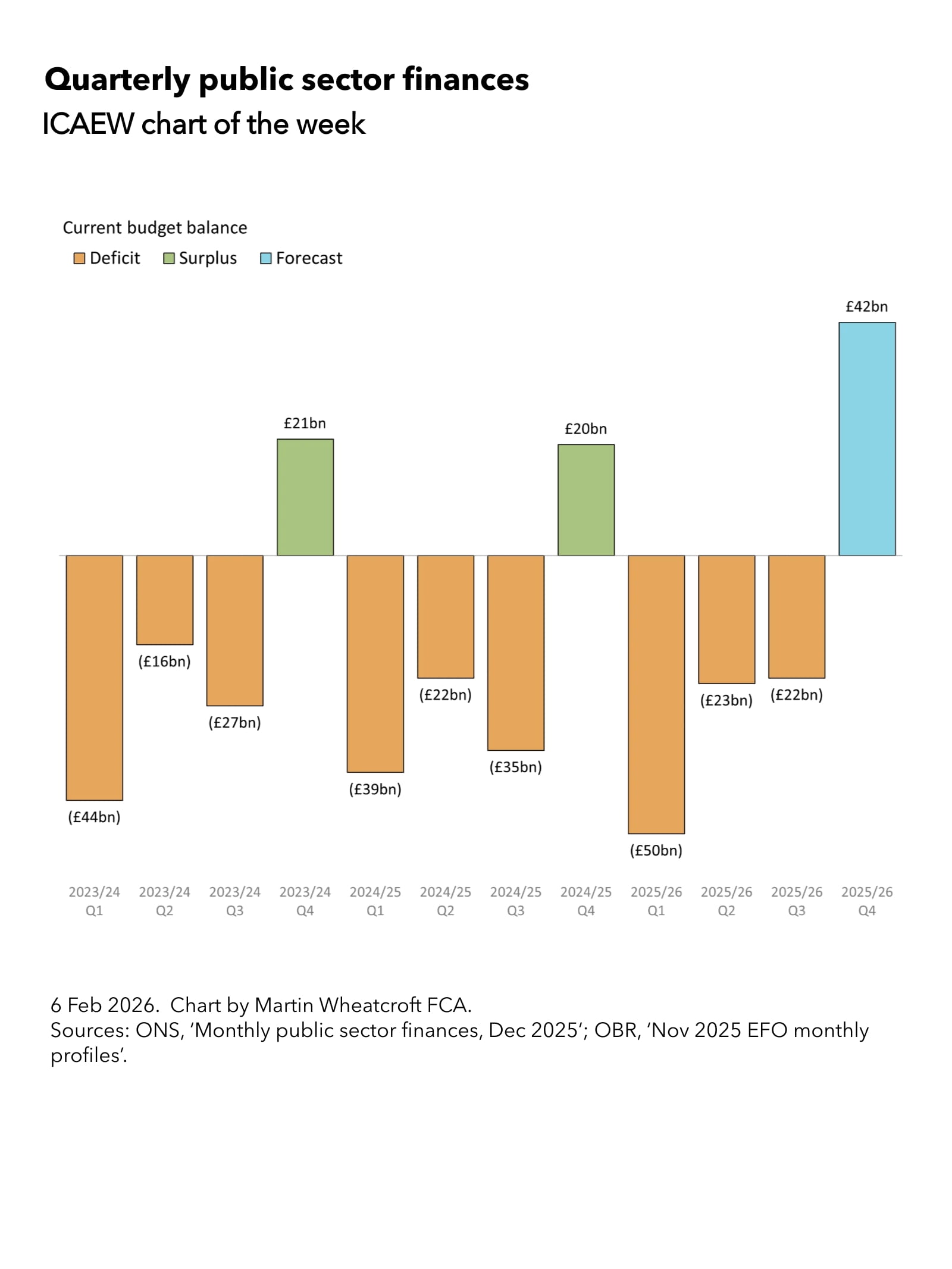

Our chart this week illustrates the financial results for the UK public sector before net investment expenditure over the twelve quarters to March 2026, including the latest Office for Budget Responsibility (OBR) forecast for the final quarter.

According to the Office for National Statistics (ONS), the full-year current budget deficit – current receipts less current spending including depreciation – was £66bn in 2023/24 and £76bn in 2024/25, while the latest OBR forecast is for a current budget deficit of £52bn for 2025/26.

The current budget balance is different to the headline deficits of £135bn, £152bn and the OBR forecast of £138bn for 2023/24, 2024/25 and 2025/26 as deficits also include net investment spending of £69bn, £76bn and £86bn respectively.

Our chart breaks the current budget balance down by quarter, showing how there were current budget deficits of £44bn, £16bn and £27bn in the first three quarters of 2023/24 and a surplus of £21bn in the fourth quarter of 2023/24. This was followed by current budget deficits of £39bn, £22bn and £35bn and a current budget surplus of £20bn in 2024/25.

Current budget deficits of £50bn, £23bn and £22bn were reported for the first three quarters of the current financial year, with the OBR forecasting a current budget surplus of £42bn in the final quarter. This would bring the total current budget deficit to £53bn, £1bn more than the OBR’s November 2025 full-year forecast of £52bn because of variances in the third quarter.

As the chart illustrates, there is a £64bn swing between a current budget deficit of £22bn in the third quarter of 2025/26 to a current budget surplus of £42bn in the fourth quarter.

This quarter-on-quarter swing can be analysed between:

- a £46bn contribution from 2024/25 self-assessment tax returns, most of which were submitted in January 2026 (£28bn income tax and £18bn capital gains tax);

- £20bn from higher PAYE income tax and national insurance receipts (principally driven by employee bonuses and first calendar quarter pay rises);

- £5bn from lower interest charges (as interest rates and inflation have fallen); less

- a net £7bn swing in all other receipts and expenditures across central and local government and public corporations.

The £64bn swing this year is higher than the £55bn swing between the third and fourth quarters of 2024/25. The difference is mainly due to an anticipated £7bn extra from capital gains taxes, principally driven by the rate increases that took effect in October 2024, half-way through the self-assessment tax return period.

The lower current budget deficit in the third quarter compared with a year previously is primarily because of the employer national insurance tax rise from 1 April 2025. This rise also benefited the first quarter of 2025/26 but that was offset by much higher interest charges (principally on inflation-linked debt) amongst other drivers.

Some of the benefit of the swing in the current budget balance in the fourth quarter of the current financial year will be offset by higher net investment spending in the typical end-of-year ‘capital rush’. However, the achievement of the £138bn revised deficit forecast for the current year is primarily in the hands of the taxpayers who submitted their tax returns in January and how well employers operating on a calendar performance year basis did in 2025 and hence the bonuses that they will pay out by the end of March.

We will hope to get a sense of the position in self-assessment tax returns when the January public sector finances are published by the ONS later this month, but we will likely need to wait until April (when the March public sector finances are published) to fully understand what is happening with bonuses.