According to the Office for National Statistics (ONS), the number of businesses on the Inter-Departmental Business Register (IDBR) grew by 28,470 in 2025, comprising 313,715 business births less 285,245 business deaths.

The IDBR is a database of 2.76m businesses in the UK that are registered for VAT or PAYE or which report turnover in their company filings, business credit reports or are otherwise identified as actively trading.

On 31 March 2025, when it stood at 2.73m, the register comprised 2,096,600 active companies, 380,520 sole proprietor enterprises, 160,865 partnerships, 84,000 charities and other not for profit organisations, and 12,630 public sector organisations.

Business births arise when businesses are added to the register, while deaths occur when businesses are dissolved, their turnover or employment falls to zero for several periods, or the ONS is otherwise notified that they are no longer trading.

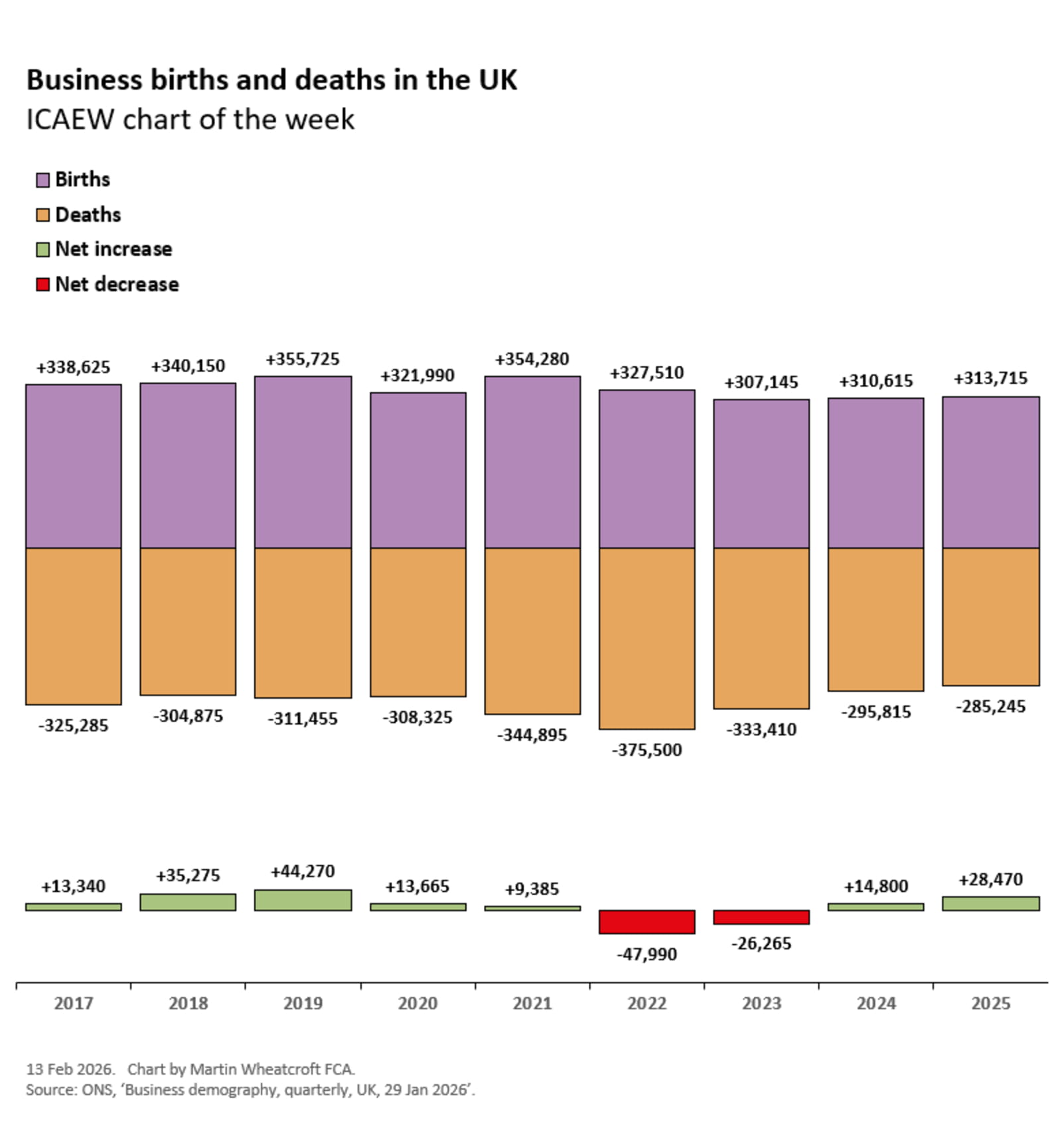

As our chart this week illustrates there were a net 13,340 business creations in 2017 (338,625 business births - 325,285 business deaths), 35,275 in 2018 (340,150 - 304,875), 44,270 in 2019 (355,725 - 311,455), 13,665 in 2020 (321,990 - 308,325) and 9,385 (354,280 – 344,895) in 2021. There were a net 47,990 business destructions in 2022 (327,510 - 375,500) and 26,265 in 2023 (307,145 - 333,410), followed by net additions to the IDBR of 14,800 in 2024 (310,615 – 295,815) and 28,470 in 2025 (313,715 – 285,245).

These are equivalent to net changes of +0.5%, +1.3%, +1.6%, 0.5%, 0.3%, -1.7%, -1.0%, +0.5% and +1.0% in 2017 through to 2025 respectively. In 2025, this was made up of an increase of 11.5% less a decrease of 10.5% compared with the start of the year, highlighting the level of churn in the business register.

The net increase of 28,470 in 2025 comprised net increases of 5,035 professional, scientific and technical businesses, 4,400 in the real estate sector, 4,270 in accommodation and food services, 3,355 in retail, 3,000 in construction, 2,785 in transportation and storage, 2,615 in health and social care, 2,515 in arts, entertainment, recreation and other services, 1,645 in education, 1,420 in motor trades, 1,145 in business administration and support services, and 615 in finance and insurance. There were net reductions of 10 in wholesale businesses, 440 in information and communication, 790 in production, and 3,090 in agriculture, forestry and fishing.

The good news is that the number of UK businesses is starting to grow again, which may be a small spark of hope for the UK economy as we enter the second quarter of the 21st century.

Economy hub

Expert analysis on the latest national and international economic issues and trends, and interviews with prominent voices across the finance industry, alongside data on the state of the economy.