UK Finance, the industry body for the banking and finance industry, released its latest data on UK card transactions on 20 April 2023. This provides an insight into UK debit and credit card transactions between January 2022 and 2023, and our chart this week takes a look at the year-on-year change in transaction amounts.

The monthly total value of transactions on UK-issued debit and credit cards increased from £73.9m in January 2022 to £83.5bn in January 2023, putting card transactions on course to exceed £1trn over the course of 2023. This includes online and telephone purchases, as well as in-person retail transactions and spending overseas.

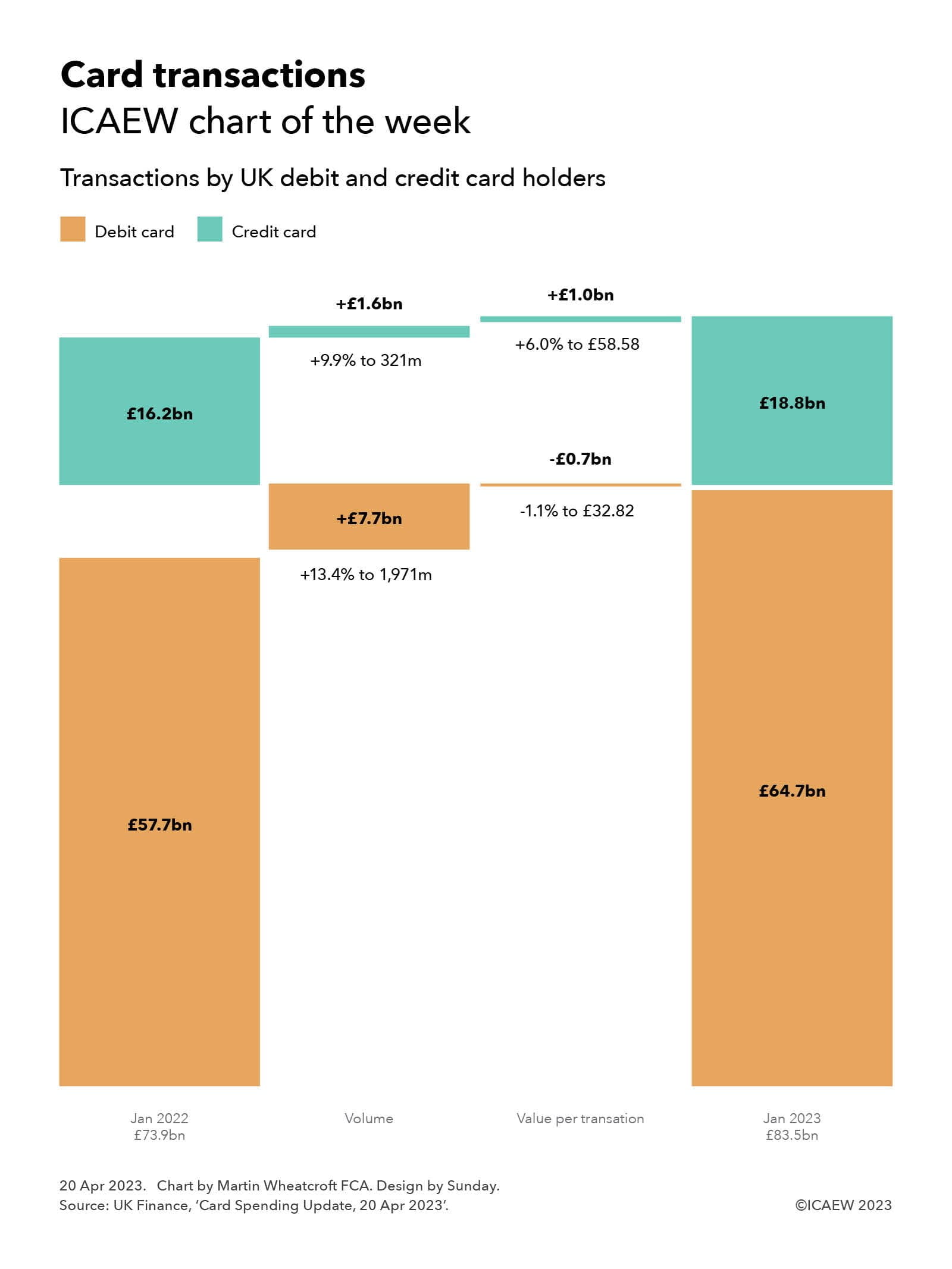

Our chart illustrates how the value of debit card transactions increased from £57.7bn in January 2022 to £64.7bn, analysed between £7.7bn from a 13.4% increase in the volume of transactions to 1,971m, less £0.7bn from a 1.1% fall in the average value of each debit card purchase to £32.82.

In the context of inflation in excess of 10%, a decline in the average value of debit transactions may seem counterintuitive. This is partly because of the continued displacement of cash as a method of payment, especially for low value purchases – contributing to growth in the volume of transactions, but a decline in average purchase amounts. Consumers scaling back their spending in response to the cost-of-living crisis is also likely to be a factor.

The value of credit card transactions rose from £16.2bn to £18.8bn, reflecting £1.6bn from a 9.9% increase in the number of transactions to 321m plus £1.0bn from a 6.0% increase in the average value of each transaction to £58.58.

The largest component of credit card transactions were purchases, which increased from £14.6bn to £17.1bn, up £1.4bn from a 9.9% increase in the volume of purchases to 319m, and £1.1bn from a 6.7% increase in the average value of each purchase to £53.60. Cash advances increased from £187m to £207m (from a 6.6% increase in the number of cash advances to 1.5m and a 3.6% increase in average advance to £135), while balance transfers increased from £1.4bn to £1.5bn (from a 4.0% increase in the number of balance transfers to 0.7m and a 4.9% increase in average transfer to £2,133).

Similar to debit cards, the decline in the average value of each credit card purchase after inflation is likely to be affected by the ongoing switch from cards to cash, as well as a scaling back of purchases by some consumers. There may also have been a shift in purchasing patterns for some households, from fewer larger purchases to more frequent smaller ones.

Not shown in the chart is the amount owed by credit card holders, which was 9.1% higher at £60bn at the end of January 2023 compared with £55bn a year previously. This is lower than the £61.3bn owed at the end of December 2022 as the £20.1bn repaid (just under a third of the total) exceeded the £18.8bn added. According to UK Finance, 51.3% of credit card balances attract interest, with the remainder primarily comprising those who pay their balances in full each month and those on interest-free balance transfers.

Debit and card usage is expected to continue to rise, with UK Finance previously forecasting that cash usage will fall from around 15% of all retail purchases in 2021 to around 6% by 2030. Others have suggested that physical cash could be eliminated altogether, saving the exchequer and businesses from the costs of creating, handling and disposing of cash.

For many, transitioning to a cashless society will be welcome – heralding the end of the need of jingling coins and purses and wallets bulging with banknotes. For others, including the million or so consumers who prefer or are reliant on cash for most of their day-to-day shopping, this may not be so positive.