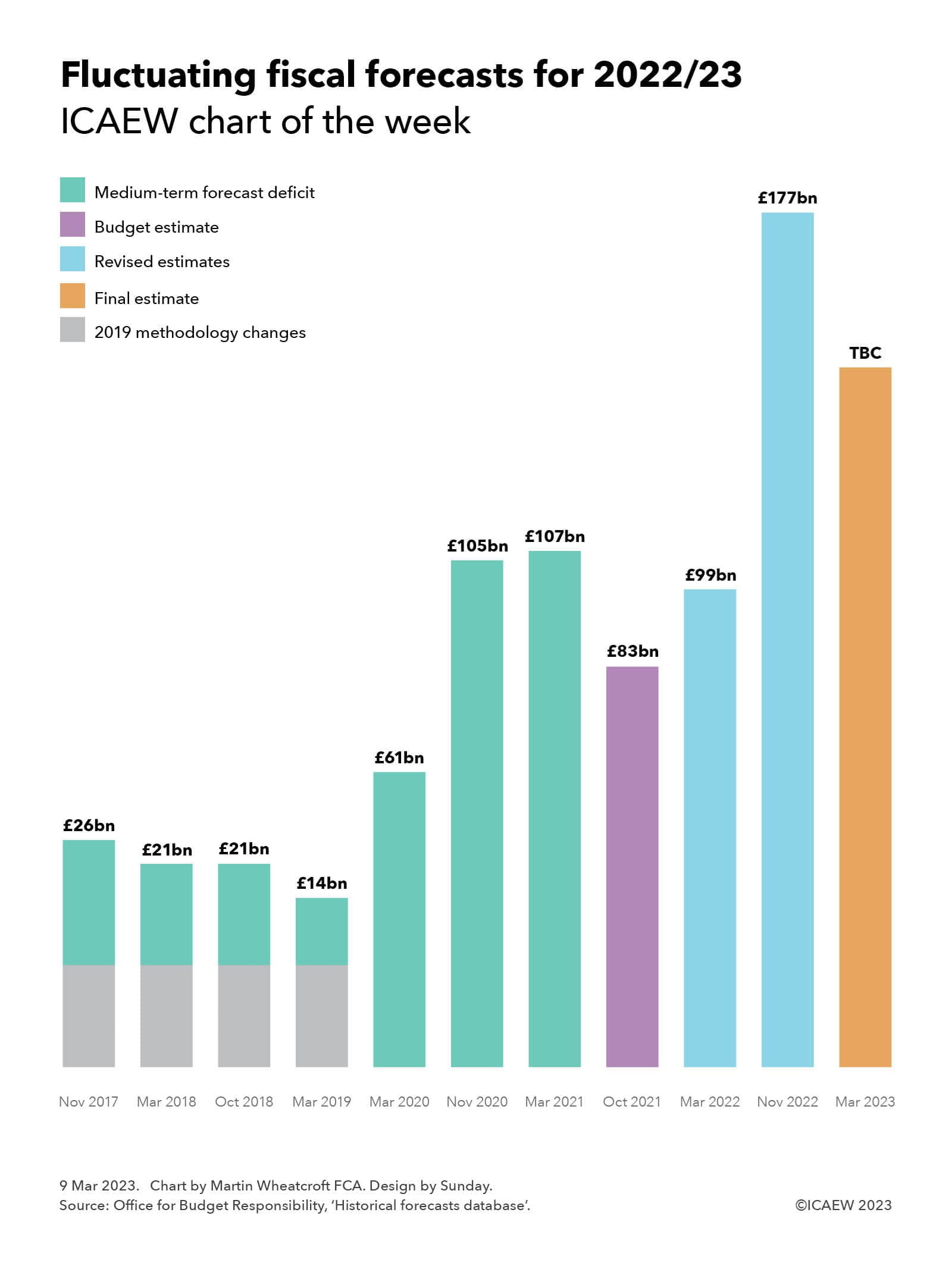

Our chart this week is on the topic of fiscal forecasting, and how the forecast deficit for the UK government’s financial year ending 31 March 2023 (2022/23) has changed over the course of five or so years of official forecasts.

Our story starts with the Autumn Budget in November 2017, when the Office for Budget Responsibility (OBR) first published a medium-term fiscal forecast that extended to 2022/23. After plugging economic assumptions into its model and combining it with the government’s plans for public spending, it came up with a forecast of £26bn for the 2022/23 fiscal deficit, the shortfall between receipts and public spending calculated in accordance with statistical rules.

Then Chancellor Philip Hammond was at that time pretty positive about the economic prospects for the UK, despite weak productivity causing him to abandon the government’s medium-term plan to completely eliminate the budget deficit. Instead, he settled for a more modest objective of a balanced current budget and a falling debt-to-GDP ratio, extending austerity policies to cut public spending.

The next few fiscal events saw the OBR revise down its forecast for the 2022/23 deficit in the light of moderately better economic data each time. This saw the forecast for the 2022/23 deficit reduce to £21bn in the March 2018 forecast, stay at £21bn in October 2018 and fall to £14bn in the March 2019 forecast.

The forecasts up to this point were before methodology changes announced in 2019 relating to the treatment of student loans and other items. According to the OBR these had the effect of increasing the forecast for the fiscal deficit in 2022/23 by an estimated £21bn.

The calling of a general election in December 2019 prevented Chancellor Sajid Javid from presenting a Budget in November 2019, so the OBR had to wait until March 2020 to publish its next forecast. At this point, 2022/23 was in the middle of the forecast period and Rishi Sunak’s first fiscal event as Chancellor saw a £26bn increase in the 2022/23 deficit to £61bn in an ‘end-to-austerity’ Budget that saw £46bn in extra planned spending compared with previous forecasts.

Frustratingly for the OBR, its forecasts that day were immediately out of date, as initial emergency pandemic measures were decided too late to be incorporated into its calculations. While these and subsequent temporary measures to support households and businesses through the pandemic primarily affected the 2020/21 and 2021/22 financial years, the economic hit caused by COVID-19 was the primary reason for the OBR increasing its forecast for the 2022/23 fiscal deficit to £105bn in November 2020.

March 2021 saw a small tweak to the forecast to £107bn, but the Autumn Budget and Spending Review in November 2021 saw an improvement to £83bn as the economy emerged from the lockdown phases of the pandemic in a slightly better place than was previously anticipated, with higher spending funded by planned tax rises.

This positive move went into reverse in March 2022 as the OBR revised its Budget estimate upwards to £99bn, reflecting rising interest rates on government debt and the government’s initial response to an emerging cost-of-living crisis.

The OBR was not asked to produce an official forecast to accompany short-lived Chancellor Kwasi Kwarteng’s tax-cutting ‘mini-Budget’ in September. At £177bn the OBR forecast for the 2022/23 fiscal deficit in November 2022 was eye-watering enough, and that was after current Chancellor Jeremy Hunt’s Budget had reversed most of his predecessor’s tax cuts.

Lower than anticipated wholesale energy prices have led several commentators to suggest that the OBR’s final estimate for the fiscal deficit could be revised down by £30bn or more when it presents its medium-term forecasts up to 2027/28 to accompany the Spring Budget on 15 March 2023. As the chart suggests, this is not a ‘windfall’ as some commentators have claimed. Even if the gap between receipts and spending narrows, the deficit will still be significantly higher than the £83bn official estimate included in the Budget for 2022/23 presented to Parliament.

Fiscal forecasting is of course a very difficult task even in normal times. The deficit is the difference between two very large numbers – receipts of just over a trillion pounds and public spending of nearly £1.2trn – that can each move up or down significantly as economic conditions change, and policy choices are made. Add to that a global pandemic, a cost-of-living crisis and an uncertain policy outlook, and it is perhaps unsurprising that the forecasts have changed so much over the past five years.

In an uncertain world, fiscal forecasts fluctuate.