As the economy has battled with the pandemic, M&A has proved more crucial than ever for businesses looking to acquire technology, or to pivot to adapt to the fundamental changes that have been accelerated in the wake of the crisis.

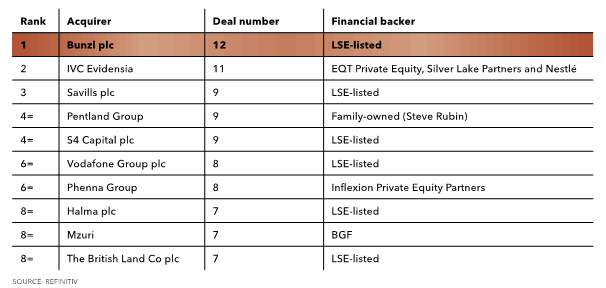

The top 10 is a mix of companies from different sectors – logistics, retail, media, healthcare – as well as through different types of funding – private equity-backed, family-owned and public companies. The level of activity of listed companies has seen an upturn since our previous review (see Corporate Financier, February 2020).

1. Bunzel plc

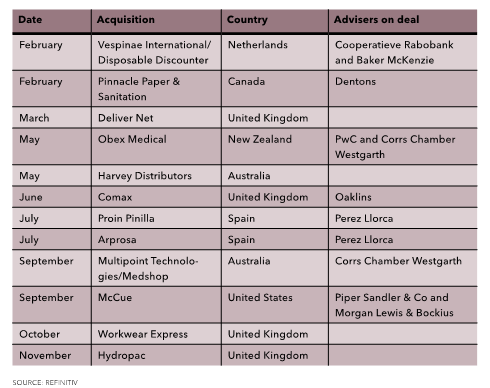

In the year to the end of December 2020, Bunzl, a global specialist distribution and services group, delivered £778m profit off £10.1bn turnover. To Q3 2021, underlying revenue growth was 2.5%, with acquisitions generating a further 4.3% of revenue growth.

Bunzl has been listed on the London Stock Exchange since 1957. Acquisitions have been a key part of the company’s expansion over the past two decades. Since 2004, when after a series of sell-offs it had become mainly a distribution business, the company has invested more than £4.3bn in more than 180 acquisitions.

In October 2021, it acquired Workwear Express, a Durham-based, £29m-revenue business specialising in personalised and promotional clothing, which has a strong e-commerce focus.

In early November 2021, Bunzl completed the acquisition of Hydropac, a £7m-revenue distributor of insulated packaging solutions, which is based in Buckinghamshire.

Frank van Zanten, who has been Bunzl’s CEO since 2016, said: “[These two acquisitions] further highlight the continued success of our compounding strategy, with our committed spend year to date higher than our spend in 2020, making it one of the most acquisitive years in our history.”

In March 2020 – as the pandemic took hold – Bunzl’s share price fell to 1422p, the lowest under van Zanten’s stewardship. By the end of the year it had recovered the lost value and was trading at 2443p. In 2021, the acquisitions contributed to a further 18% uplift in the company’s share price – 2876p (as at December 17, 2021).

2. IVC Evidensia

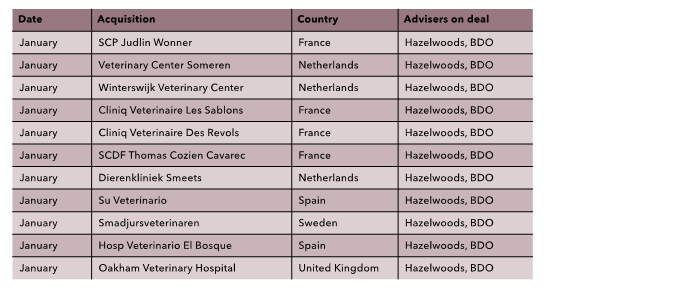

IVC Evidensia was founded in Bristol a decade ago, as Independent Vetcare (IVC), when mid-market private equity firm August Equity saw an opportunity to grow a business in a niche sector and acquired three vet clinics in Bath, Hertfordshire and Bristol.

The idea was that IVC would provide marketing and administrative support services to enable smaller vets to retain autonomy, but have greater purchasing power for drugs and equipment. By 2014, when Summit Partners acquired the group, it had 40 vet businesses and owned 100 clinics. By 2016, it had 310 sites and revenue of £184m. It was acquired by Scandinavian buy-out firm EQT and merged with Swedish pet-care business Evidensia.

Despite completing 11 transactions in January 2021, the biggest deal involving IVC Evidensia was the sale, in February, of a significant minority stake in the business to Silver Lake Partners and Nestlé, which had taken a minority stake in 2019, but increased its shareholding. The investment of €3.5bn valued the European veterinary services provider at €12.3bn.

Goldman Sachs and Jefferies acted as sell-side advisers; JPMorgan and Numis acted for Silver Lake.

Silver Lake’s USP is its expertise in technology. It will help “unlock growth from digital and technology opportunities”, as well as support further digitalisation of the business. Nestlé’s interest is in cross-selling its Nestlé Purina PetCare nutrition products.

Another big deal came just over six months later, when IVC crossed the Atlantic to ‘merge’ with leading Canadian veterinary care provider VetStrategy, creating a business with almost 30,000 employees and 2,000 clinics and hospitals across 17 countries. VetStrategy operates more than 270 pet hospitals across nine Canadian provinces. The terms of that transaction were not disclosed.

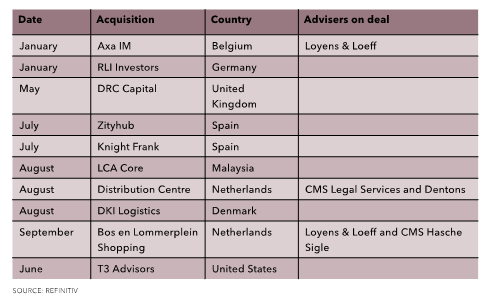

3. Savills plc

Perhaps Savills’ acquisition in June of New York-based T3 Advisors was the most interesting, even if it wasn’t the biggest deal of 2021. T3 has a tech focus, advising in the tech and life sciences sectors.

Mark Ridley, global CEO of Savills, said: “Life science and technology industry advisory services are key growth sectors for us and are integral to our continued strategic expansion across North America.”

4. Pentland Group

Pentland Group is a private company owned by the family of the company’s chair, Stephen Rubin OBE. The group, which he inherited as a Liverpool shoe company from his parents in 1969, has been transformed. It owns the brands Speedo, Berghaus, Canterbury of New Zealand, Ellesse, Endura, SeaVees, KangaROOS, Mitre and Red or Dead, and has a 52% stake in LSE-listed sports retailer JD Sports.

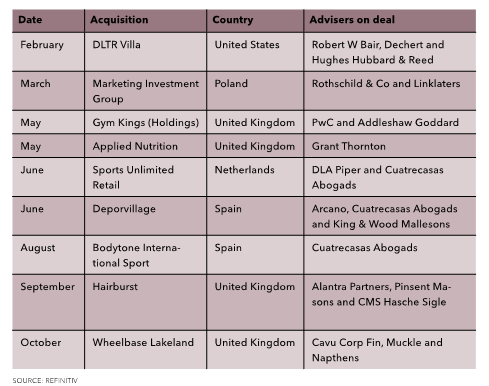

The biggest deal completed last year was JD Sports’ $500m acquisition of US sports retailer DLTR Villa, which operates 247 stores across the north and east coast of the US.

5. S4 Capital plc

S4 Capital was founded by Sir Martin Sorrell after his acrimonious departure from WPP in 2018. That same year, S4 paid £350m for MediaMonks and $150m for MightyHive. The business has been built through acquisition and has a market cap of more than £3.2bn. Its share price dipped in the latter half of 2021, but it’s still 17% up on the start of 2021. Throughout the year it made acquisitions across the globe and shows no signs of letting up. Sorrell said: “With a strong, liquid balance sheet and significant combination firepower, we’re in a great financial place to expand through further combinations, which will add to our data, content, digital media and, potentially, technology services capabilities.”