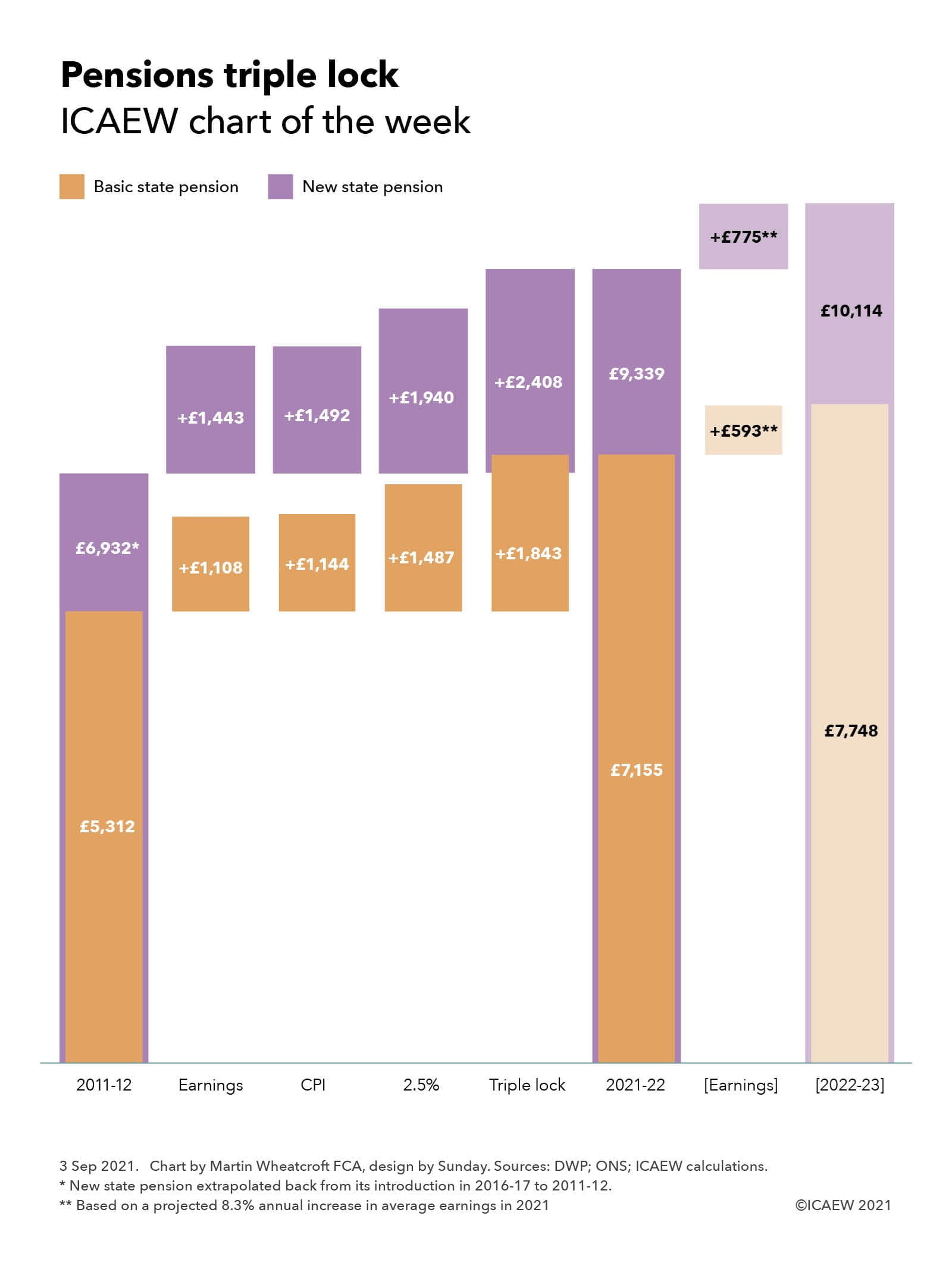

ICAEW’s chart of the week illustrates just how much of a boost the triple lock has been to the state pension since its introduction a decade ago compared with what would have happened if it had risen in line with one of the components of the triple lock formula alone.

It also illustrates how much pensioners might get in April next year if the government continues with the current formula and doesn’t adjust for the distortions in the official statistics caused by the pandemic. With average earnings for the three months to July 2021 projected to be in the order of 8.3% higher than a year previously, the incremental cost would be significant given that the state pension is the second biggest line item in the government’s spending bill at over £105bn a year.

With the statistic distorted by effects of the pandemic, the Chancellor may decide to adopt an ‘adjusted’ percentage to eliminate the effects of the furlough scheme and lockdowns, likely to be somewhere in region of 3.5% to 5%, or potentially he could opt to use the annualised average rise over two years that is expected to be closer to 3.5%. Or he could abandon the triple lock completely and choose another basis for determining how much pensioners will have to live on next year.

| Avg. Earnings | CPI | 2.5% | |

| 2012-13 | 2.8% | 5.2% | 2.5% |

| 2013-14 | 1.6% | 2.2% | 2.5% |

| 2014-15 | 1.2% | 2.7% | 2.5% |

| 2015-16 | 0.6% | 1.2% | 2.5% |

| 2016-17 | 2.9% | -0.1% | 2.5% |

| 2017-18 | 2.4% | 1.0% | 2.5% |

| 2018-19 | 2.2% | 3.0% | 2.5% |

| 2019-20 | 2.6% | 2.4% | 2.5% |

| 2020-21 | 3.9% | 1.7% | 2.5% |

| 2021-22 | -1.0% | 0.5% | 2.5% |

The basic state pension, payable in full to those with 30 years of national insurance credits, increased from £5,312 (£102.15 per week) in 2011-12 to £7,155 (£137.60 per week) in 2021-22, an increase of £1,843 (£35.45 a week). This contrasts with the increases that would have been seen if pensions had been uprated over that period in line with average earnings (£1,108 or £21.30 per week), CPI (£1,144 or £22.00 per week) or 2.5% (£1,487 or £28.60 per week). By selecting the highest of the average earnings or inflation and with a floor of 2.5%, the result has been to uplift the basic state pension above the legally required increase in line with earnings.

This does not mean that pensioners have received this level of increase for the whole of their pension, as many of those who retired before 2016 are entitled to an additional state pension linked to their national insurance contributions (also known as the state earnings related pension or SERPs) that has been uprated each year over the last decade in line with CPI.

Since 6 April 2016, the basic and additional pensions have been replaced for those retiring after that date by the new state pension, which requires 35 years of national insurance credits to receive the full amount. This provides a higher income for most pensioners than the basic plus additional state pension system but less for those with higher career earnings who – the theory goes – should also have company or private pensions to support them in retirement.

The chart illustrates the effect of the triple lock on the new state pension as if it had been in place since 2011-12, with the triple lock increase of £2,408 (£46.35 per week) to reach the current level of £9,339 (£179.60 per week) contrasting with average earnings (£1,443 or £27.75 per week), CPI (£1,492 or £28.70 per week) or 2.5% (£1,940 or £37.30 per week).

The ratchet effect of the triple lock will be put to the test for the coming state pension rise, as the statistic used to measure the rise in average earnings stood at 8.8% as at June 2021 and is expected to be somewhere in the region of 8.3% (plus or minus) when July 2021 statistic is announced later this month. As the chart indicates this would result in a £593 (£11.40 per week) increase in the basic state pension to £7,748 (£149.00 per week) and a £775 (£14.90 per week) increase in the new state pension to £10,114 (£194.50 per week).

The distortion in the average earnings statistic is because of the combination of fewer lower paid employees in the workforce a year ago altering the make-up of the working population used to measure pay rises and the furlough scheme where many employees received a temporary pay cut of 20% if their employers didn’t make up the difference. However, there is some genuine wage inflation going on, with the ONS estimating that the ‘underlying’ annual rise in average earnings for the three months to June 2021 was somewhere between 3.5% and 4.9%.

The Chancellor is expected to announce his decision on the triple lock at the fiscal event on 27 October, although there is a chance that he might make an announcement later this month in order to avoid getting pensioners’ hopes up when the average earnings rise is released on 14 September – only to then dash them a few weeks later.