The publication of the Office for Budget Responsibility (OBR) of its combined fiscal risks and sustainability report on Thursday 7 July 2022 was overshadowed by events in Westminster, which is unfortunate given just how important the state of the public finances is to the success of future government administrations and to the country as a whole.

Setting out long-term fiscal forecasts for the next 50 years, the OBR has analysed threats posed by rising geopolitical tensions, higher energy prices, the pressures of an ageing population and the loss of motoring taxes, as well as risks such as cyber attacks, future economic shocks, higher defence spending, and global protectionism adversely affecting international trade.

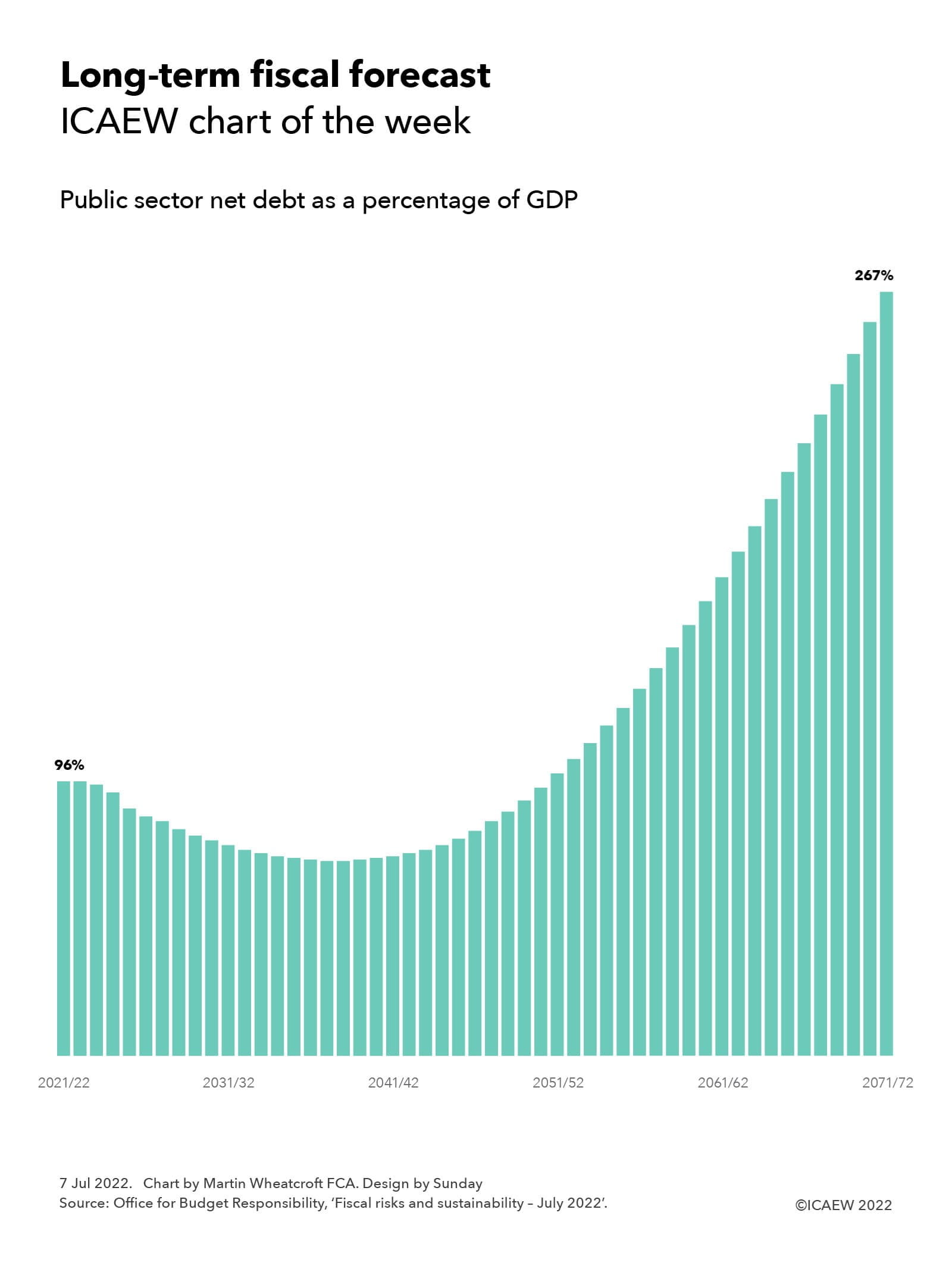

The chart illustrates the baseline projections prepared by the OBR, which show public sector net debt as a share of GDP rising from 96% of GDP to 267% in 50 years’ time in 2071/72. This primarily reflects more people living longer with the consequent effect that has on public spending, in particular pensions, health and social care, combined with a declining proportion of working age adults who pay the most in taxes. The report also highlights the fiscal gap created by the loss of fuel duty and vehicle excise duty as petrol and diesel cars are replaced with electric vehicles.

The OBR’s Chair, Richard Hughes, commented how 20 years ago, “Government debt stood at 28% of GDP, the deficit was about 0.5% of GDP, the economy was growing at an average rate of 2.75%, and inflation was running at 1.3% – and the Treasury’s pioneering 50-year fiscal projections predicted that government debt this year, 2022, would stay just below 40% of GDP – consistent with the fiscal rules in place at the time.

“As we now know, debt this year is expected to be more than twice that, at 96% of GDP,” Hughes continued, highlighting how over the past two decades the UK economy has been buffeted by an unprecedented series of global shocks including a financial crisis, a pandemic, a major war on the European continent, and an energy crisis.

Hughes commented: “Working away in the background as this series of crises unfolded were a set of longer-term pressures on the public finances and the number of people aged 65 and over rose by 3.5 million from 9.5 to 13 million people; we learned that global temperatures had already risen by 1°C and were on track to rise by 4°C by the end of this century; and having fallen from over 5% in 2002 to less than 0.5% in 2020, interest rates on government debt are now back up to 2%.”

One of the key drivers of the projection is the old-age dependency ratio, the number of those aged 65 and over to those aged 16 to 64, which is expected to rise from 0.31 in 2022 to 0.52 in 2072, with a low birth rate and inward migration insufficient to offset the increasing number of people living longer in retirement.

The report has stress tested the projections with a range of potential events that could make the financial position much worse, with different unpalatable scenarios seeing the ratio of debt to GDP rising to 288%, 304%, 317% or 437% in 2071/72, depending on the assumptions made. In the other direction, the OBR notes that 76,000 additional net inward migrants a year over 50 years would reduce the baseline projection for debt to GDP of 267% to 217% in 2071/72.

The next prime minister will inevitably focus on the many short-term challenges facing the government and the country, but the OBR report makes clear just how much a long-term fiscal strategy is needed to put the public finances onto a sustainable path.

Read more on the OBR website: July 2022 Fiscal risks and sustainability