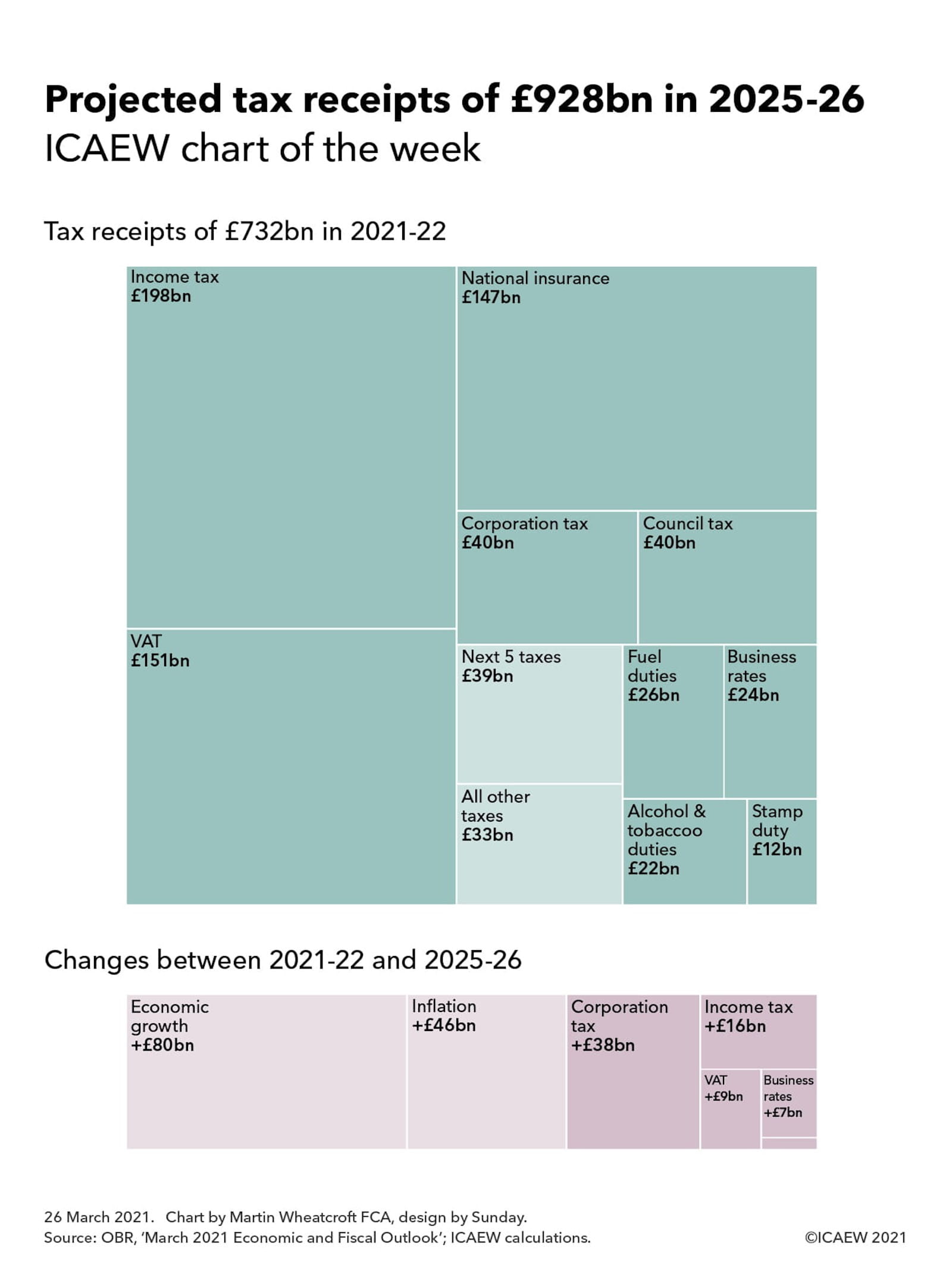

The #icaewchartoftheweek starts with the Spring Budget forecast tax receipts of £732bn for the coming financial year from 1 April 2021 and how these are expected to increase to £928bn in 2025-26 through a combination of economic growth, inflation and higher receipts principally from corporation tax, income tax, VAT and business rates.

The chart illustrates how the ‘big three’: income tax (£198bn in 2021-22), VAT (£151bn) and national insurance (£147bn) together comprise 67.8% of the total tax take, with corporation tax (£40bn), council tax (£40bn), fuel duties (£26bn), business rates (£24bn), alcohol & tobacco duties (£22bn), stamp duty (£12bn) generating a further 22.4%. The next 5 taxes - environmental levies (£10bn), capital gains tax (£9bn), insurance premium tax (£7bn), vehicle excise duties (£7bn) and inheritance tax (£6bn) - generate 5.3%, while all other taxes (£33bn) comprise the balance of 4.5%.

With the Chancellor constrained by a commitment not to raise the main rates of income tax, VAT and national insurance, the principal focus of both the Spring Budget and Tax Day has been on improving the tax take from existing taxes, for example by looking at tax reliefs and tackling tax avoidance, and on raising more money from smaller taxes.

This is reflected in the Office for Budget Responsibility projections for tax receipts that accompanied the Spring Budget, which indicate that receipts from most taxes are expected to rise broadly in line with economic growth (generating £80bn in higher tax receipts) and inflation (£46bn) between 2021-22 and 2056-26. This reflects anticipated economic recovery from the pandemic as well as a boost from stimulus measures announced by the Chancellor in addition to existing plans to increase public investment.

The biggest incremental change is an expected increase in corporation tax receipts of £38bn over and above economic growth and inflation. Some of this rise is recovery to a more normal level, as businesses will be able to reduce their tax bills in the coming year by offsetting losses incurred during the pandemic and using the temporary ‘super deduction’ of 130% of qualifying capital expenditure, but the principal driver is an increase in the corporation tax rate on larger businesses from 19% to 25% in 2023.

The next highest increases are from income tax (+£16bn) and VAT (+£9bn) where a combination of fiscal drag from freezing tax allowances (income tax) and registration thresholds (VAT) will bring more transactions into the scope of both taxes and hence generate more revenue. Both taxes are also the focus of efforts to make taxes easier to pay and to tackle tax avoidance as addressed in several of the Tax Day consultations.

The other significant increase is in business rates (+£7bn), although this mostly reflects pandemic related reliefs in the coming financial year that are not expected to continue into subsequent financial years. In practice, there are some questions as to whether this increase will be deliverable, with the Tax Day consultation on business rates suggesting that levels are too high and a reduction could help bricks and mortar businesses survive against online competition and so ‘save the high street’. The dilemma for the Chancellor is that if he were to cut business rates as some hope, then what tax lever he would need to pull to make up for that lost revenue?

Much of the focus of this first Tax Day has been on the efficiency and effectiveness of the tax system and how it can be made to work better. Perhaps future Tax Days will tackle some of the bigger questions surrounding the role of taxation in the long-term sustainability and resilience of the public finances – and whether some bigger tax levers might need to be pulled at some point in the future?