New data reveals that the UK slipped into a technical recession at the end of last year, marked by a modest economic downturn in Q4 2023. Despite challenges, signs of recovery are emerging though, with business investment seeing a modest rise. However, inflation stands at 4.0% and economic inactivity, particularly due to long-term sickness, has reached a record high. Businesses look towards the Spring Budget and the interest rate decision in March to dictate how the UK can return to growth.

UK slipped into recession at the end of 2023

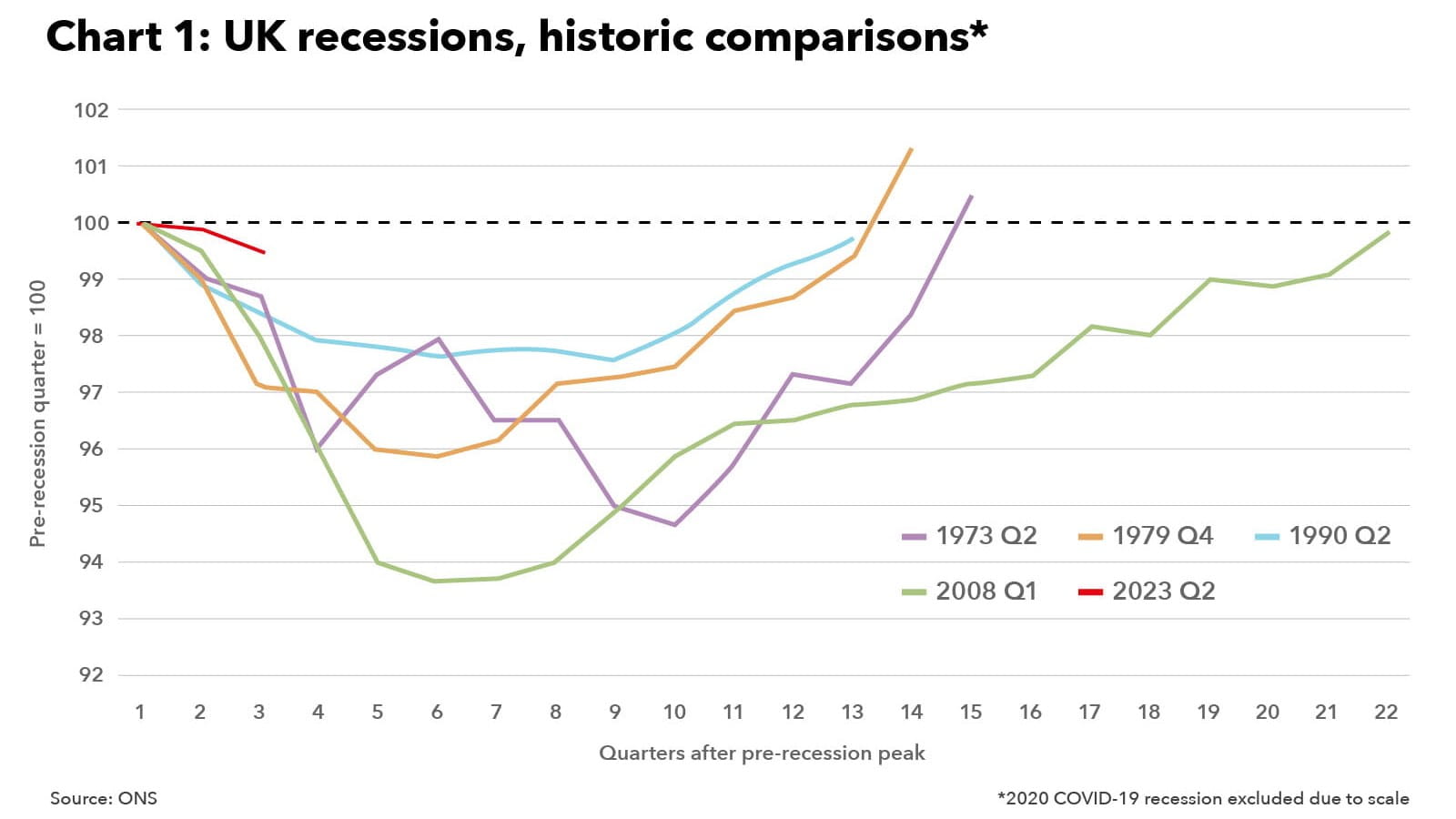

The UK economy met the definition of a technical recession (two successive quarters of falling output) by contracting by 0.3% in the fourth quarter of 2023 and recording a 0.1% decline in the third quarter. However, compared with previous downturns, this one is very shallow (see Chart 1) and without the sort of economic pain (e.g, high unemployment) typically associated with previous technical downturns. For 2023, the UK economy grew by just 0.1%, down from growth of 4.3% in 2022 and below the 2023 outturns for the US (2.5%) and the eurozone (0.5%).

Most areas of UK economy weakened in final quarter

Detailed official data shows that the drop in UK GDP in the fourth quarter of 2023 reflected declines across most drivers of economic activity. In output terms, there were falls in all three main sectors, with declines in services (-0.2%), industrial production (-1%), and construction (-1.3%). In expenditure terms, there was a weakening in net trade (including a 2.9% fall in exports), household spending (-0.1%) and government consumption (-0.3%) in the fourth quarter. In better news, business investment rose 1.5% in Q4 2023. Across 2023, business investment increased by 6.1%, partly driven by firms bringing forward activity in response to the super-deduction allowance expiring on 31 March 2023.

UK close to winning inflation battle

UK CPI inflation stood at 4.0% in January 2024, unchanged from December’s outturn. The upward pressure on inflation from higher energy bills, following January’s increase in Ofgem’s energy price cap, was offset by slower price rises in furniture and household goods as retailers offered big discounts, as well as the first monthly fall in food prices in more than two years. Inflation’s journey back to the Bank of England’s 2% target should now accelerate, with Ofgem confirming that the typical annual energy bill will fall by £238 to £1,690 from April (the lowest for two years), expected to drag the headline rate noticeably lower by the Spring.

Record number out of work due to long-term sickness

.ashx?cx=0.5&cy=0.5&cw=1600&ch=900)

The UK economic inactivity rate – the proportion of people who are neither working nor looking for work – was estimated at 21.9% in the three months to December 2023, unchanged from the previous quarter. However, compared with a year ago, economic inactivity was 0.2 percentage points higher, largely driven by those aged 16 to 34 years (see Chart 2), while inactivity among those aged 35 to 49 years decreased. The increase compared with a year ago was mainly driven by those inactive because they were long-term sick. The number of people inactive for health reasons was 2.8 million by the end of 2023, a record high, compounding recruitment difficulties faced by businesses and limiting the UK’s growth potential.

When will the UK exit recession?

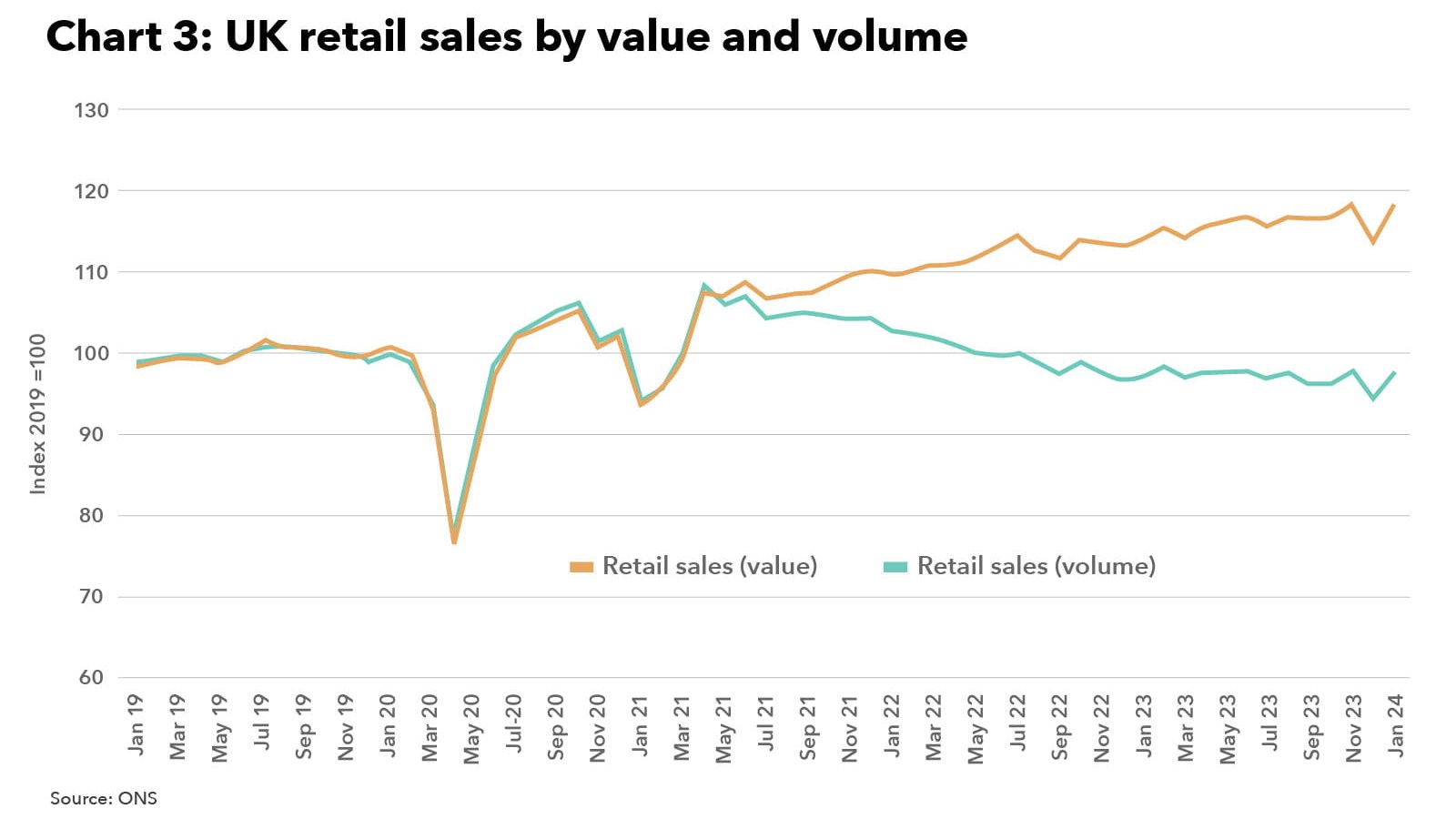

Most recent indicators of economic activity suggest that the UK will probably exit recession in the first quarter of 2024. For example, the pickup in the indicators of domestic and export activity for the next 12 months in ICAEW’s latest Business Confidence Monitor suggests that the return to growth should be pretty quick. Similarly, retail sales grew by 3.4% in January 2024, the fastest increase since April 2021’s post-Covid reopening (see Chart 3). Sales volumes in all subsectors except clothing stores increased over the month, with food stores such as supermarkets contributing most to the increase.

If the economy does return to growth this quarter, the UK will have exited recession in the shortest possible time frame and would rival the 1956's decline as the smallest technical downturn on record. The earliest date an official exit from recession can be confirmed is 10 May, when the GDP figures for Q1 2024 are published.

Implications for accountants, business owners and the economy

The latest figures suggest that while the shallowness of this recession should provide some comfort, our economy remains locked in a cycle of persistent stagnation as myriad headwinds, including high interest rates, continue to weigh heavily on activity.

UK economy – what to watch for this month

- Alongside the Spring Budget on 6 March, the Chancellor will present the Office for Budget Responsibility’s (OBR) updated economic forecasts. While the OBR is likely to project that the economy will continue stagnating, its new forecasts may also show that inflation will fall more quickly, and GDP growth will be slightly stronger in the near term, than it predicted in November.

- The next GDP data, to be released on 13 March, is likely to show that the economy returned to growth in January, paving the way for the UK to exit recession this quarter.

- While the next interest rate decision on 21 March is expected to confirm that rates will remain on hold once again, a shift in the vote split between rate setters towards loosening policy would indicate that rates could fall sooner rather than later.

Further support

For more insights, analysis and resources for organisations facing rising costs of doing business visit ICAEW’s Cost of doing business hub.

ICAEW also works with caba to promote the mental health of chartered accountants and their families by producing articles, guides, webinars, videos and events that can provide support during difficult times.

ICAEW launched a campaign, Resilience and Renewal, to explore some of the most serious systemic challenges facing the UK economy and brings together government ministers, leading academics, economists and thought leaders to look at how to build a better, more resilient future economy and the vital role UK business and chartered accountants play.

Advice for government

ICAEW sets out its vision for a renewed and resilient UK, drawing on insights and expertise from its members.